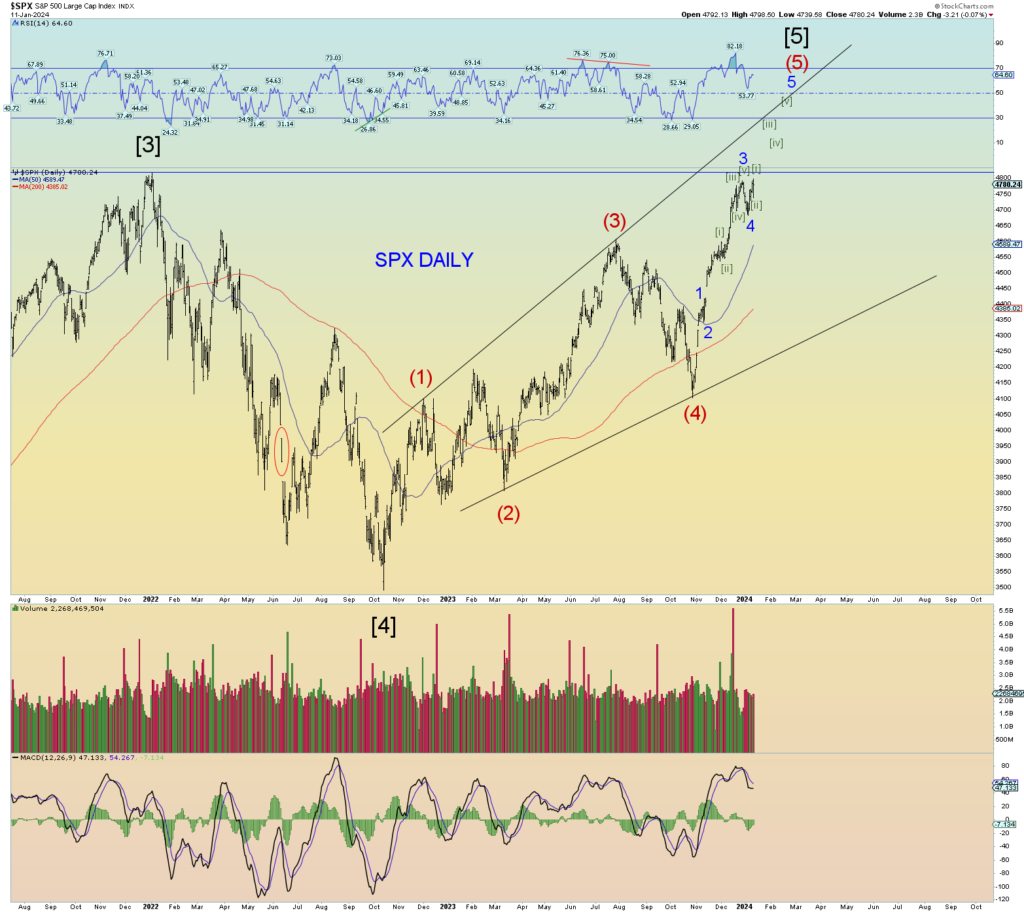

The system has been setup for collapse. Satan’s grand plan. I have been saying the bubble has already popped via the sharp interest rate rise. I’m certainly not the only one who sees what is going on underneath and behind the scenes:

The Great Taking – Documentary (rumble.com)

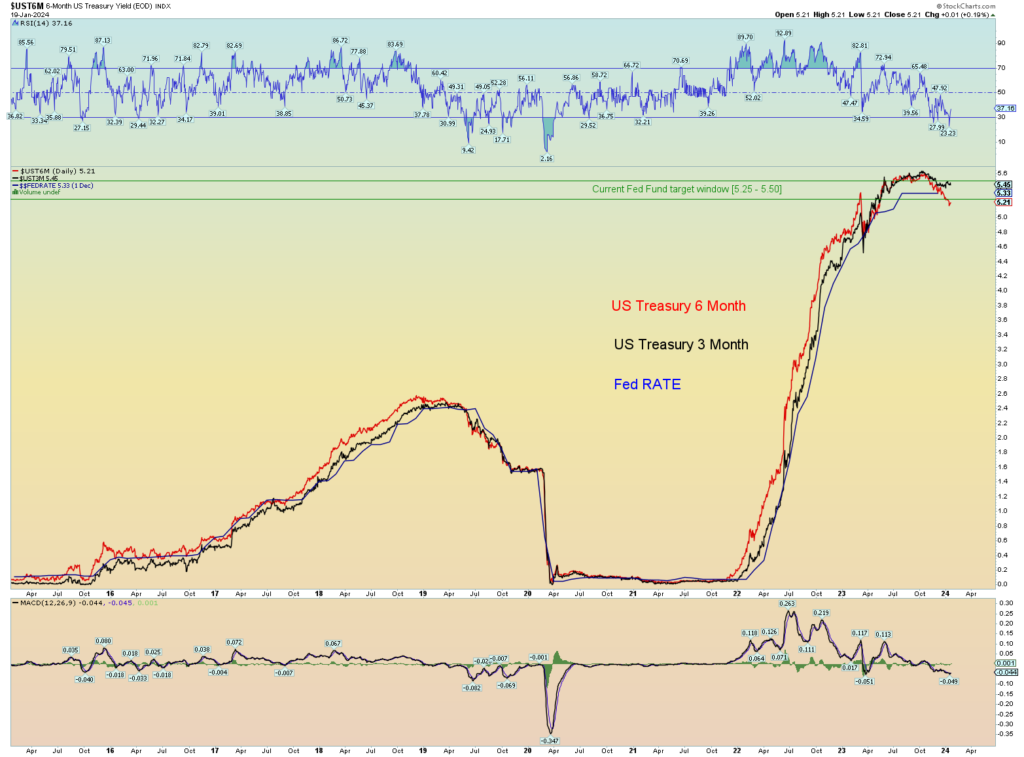

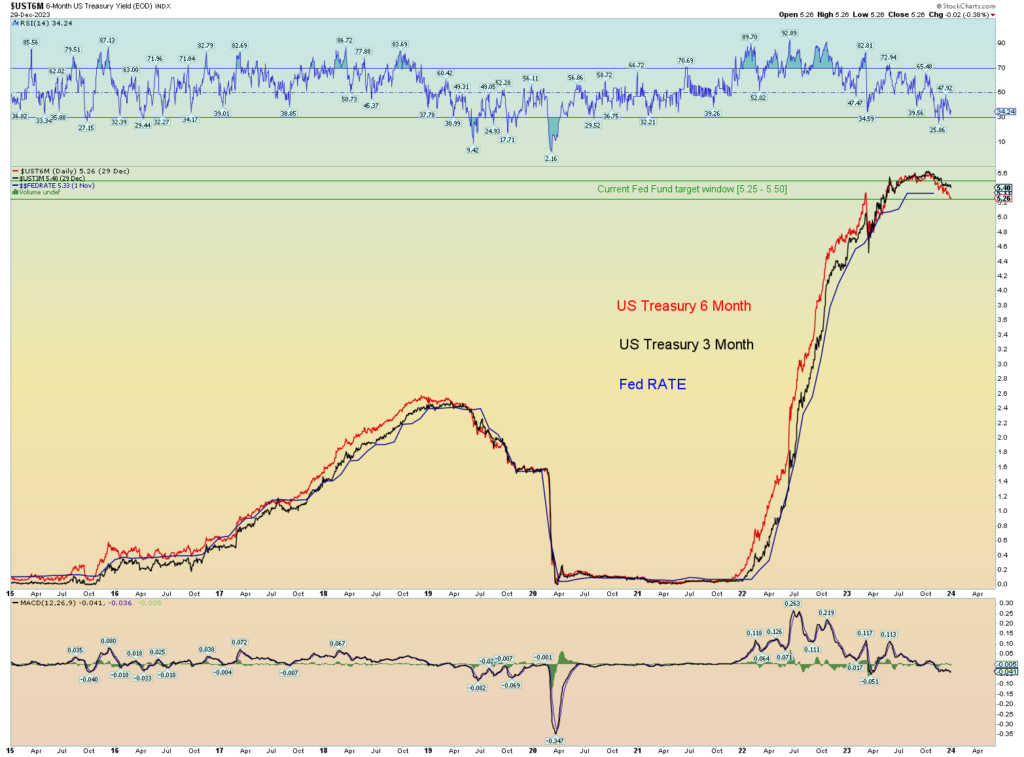

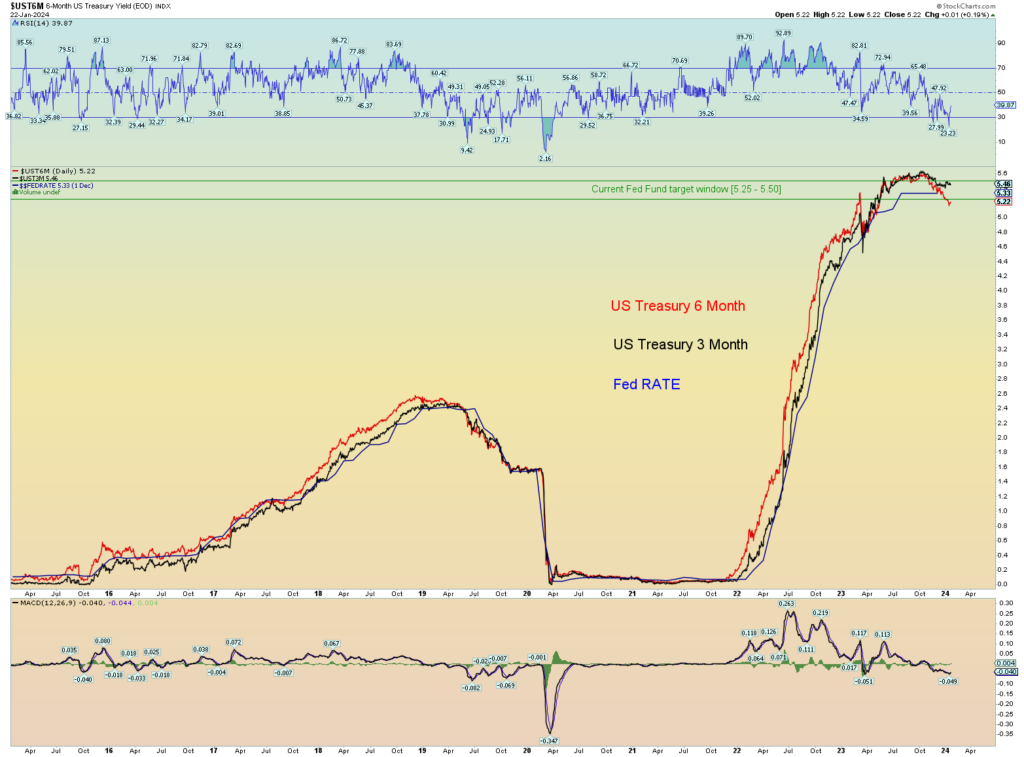

The 3 and 6 month yield. This has not moved low enough to justify any rate cuts. The market tells the Fed when to cut or raise.

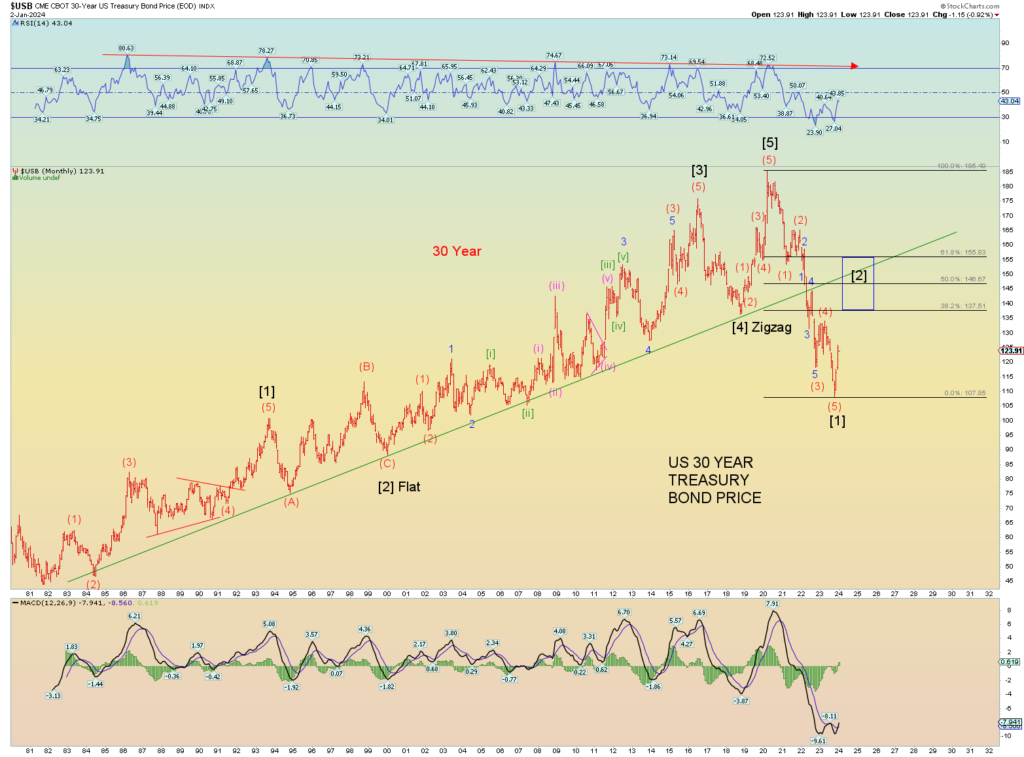

The Chinese are not very happy at the moment. This is the kind of price action that can spark wars. Keep a close eye on it.