I’m back. Had a nice Christmas break and nothing of too much note that happened in the markets anyway. The SPX still has not topped its intraday previous high.

The S&P total index is sort of equivalent to the Wilshire 5000 which is not available anymore on Stockcharts. It has overlapping waves.

And obviously the Composite has quite a bit of work left if it is to match its all-time high. So overall the market is fractured and that probably is not a good sign.

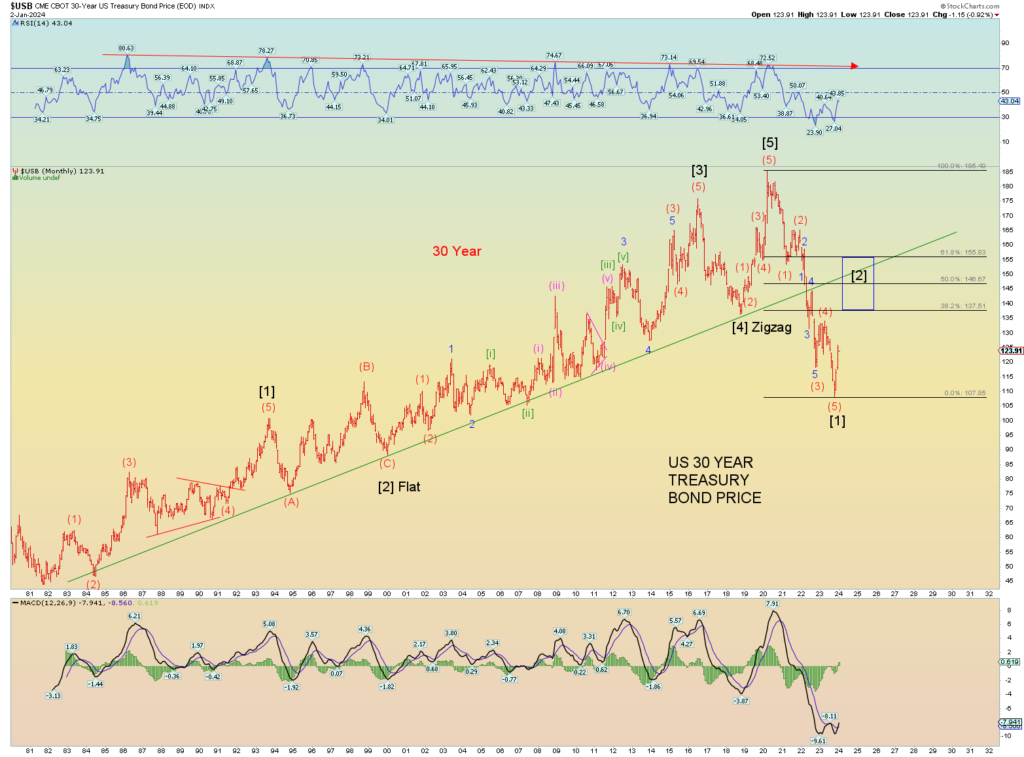

The 30-year bond count has been very nice and an expected bounce for wave [2] is in play.

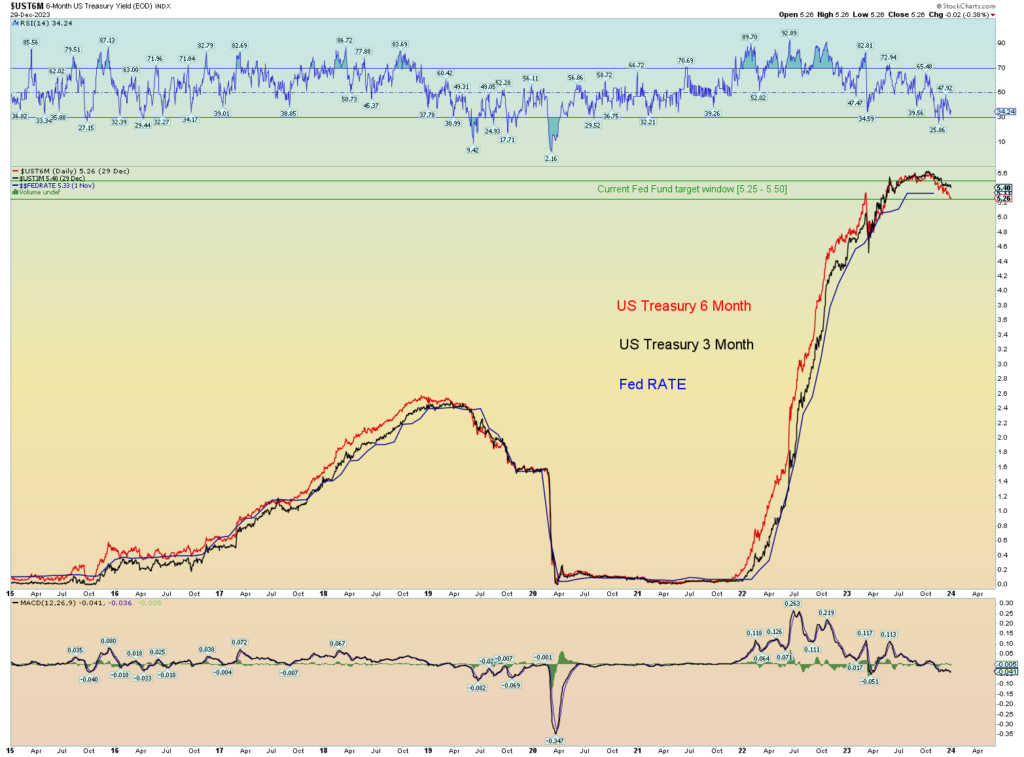

The Fed has yet to cut rates but when the 3/6 month yield will tell them when. At the moment not yet. The 3/6 month led the rates higher, it will lead rates lower if that is to happen.