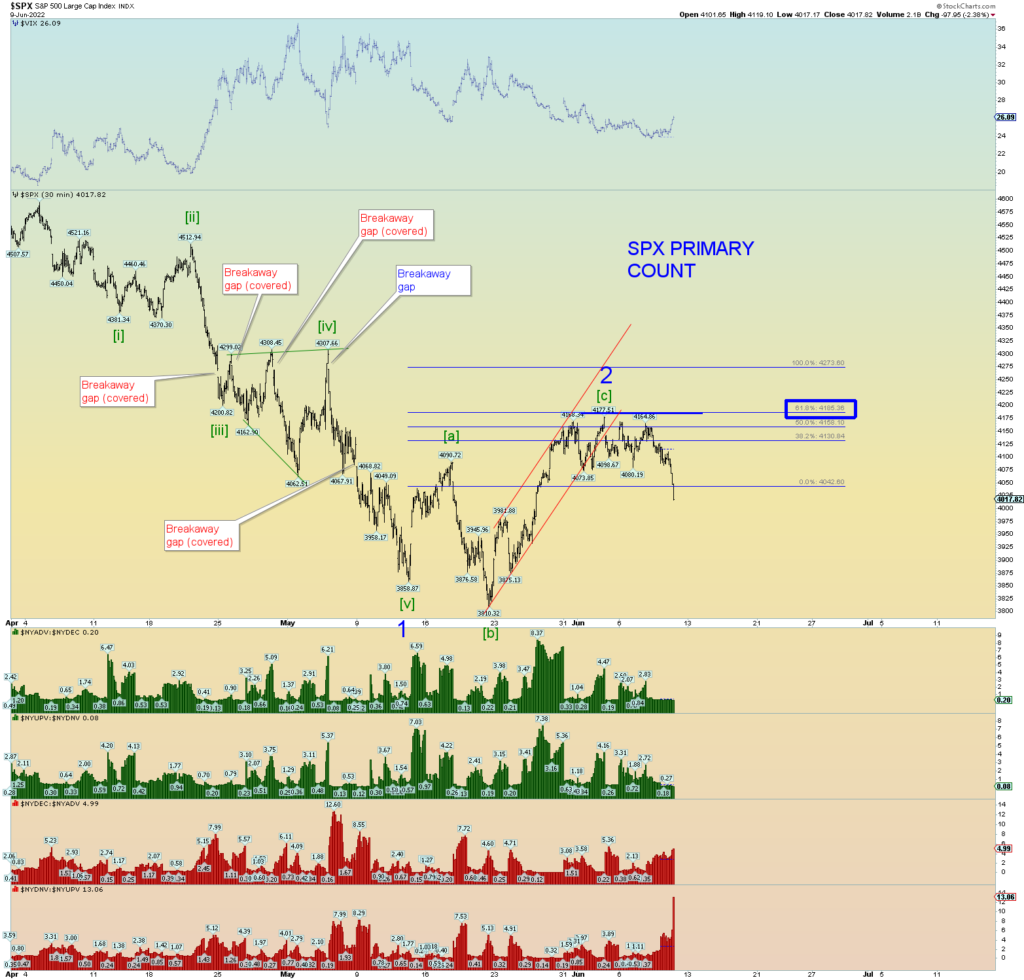

The overall primary count of the past week(s) has been that Minor 2 of Intermediate (3) has to play out and then after the peak of Minor 2 is “in”, the market will collapse in the power of a Minor 3 of (3) down. Perhaps today’s bearish close was the opening “salvo” of the next wave down. Note the final 30-minute bar of the NYSE histogram down volume ratio at the end of day. It finished well above a 90% ratio, the biggest negative 30-minute volume bar of the past 2 months.

The Wilshire 5000 again has a suspect data point in its opening surge and quick plunge back but it’s a minor nuisance so no need to make a big deal of it.

And although I had this count yesterday where prices plunged and recovered in a minuette (iv), that scenario was mostly based on a beginning day opening gap down and cover + (which didn’t happen) and instead we got a bearish late day plunge. But regardless, here is the chart if today turns out to be a small headfake on the path to the true Minor 2 peak. But again, the end of day price action was quite bearish.

The weekly shows the potential longer-term count. If Minor 2 has found its peak, then total market carnage is about to unleash. The plunge of Minor 3 would take prices, at a minimum, back to beneath the February 2020 high of (D).

The sary thing is that the Chinese markets may be “aligned” social-mood wise with the global markets. In other words, once Intermediate (2) finds its peak, the Chinese market will collapse also in spectacular fashion in alignment with the rest oif the world markets. the results could spur and bring about global war.

China attacking Tawain this summer with the U.S.A. Babylon instigating.

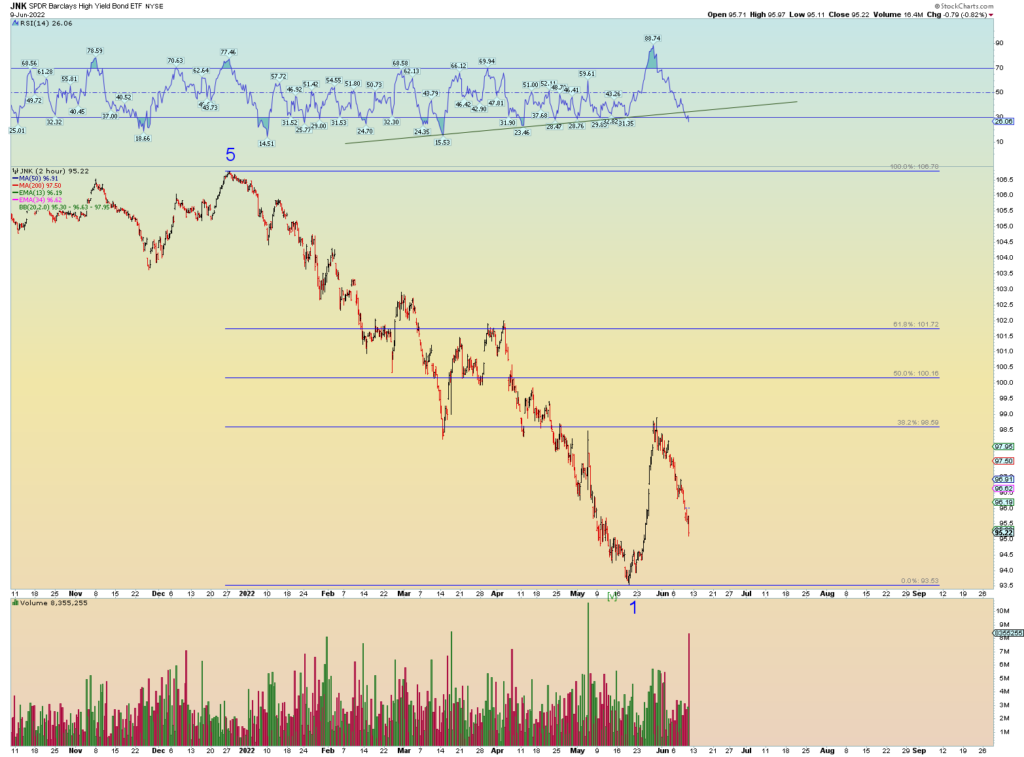

Junk is confirming the bearish move and is Transports.