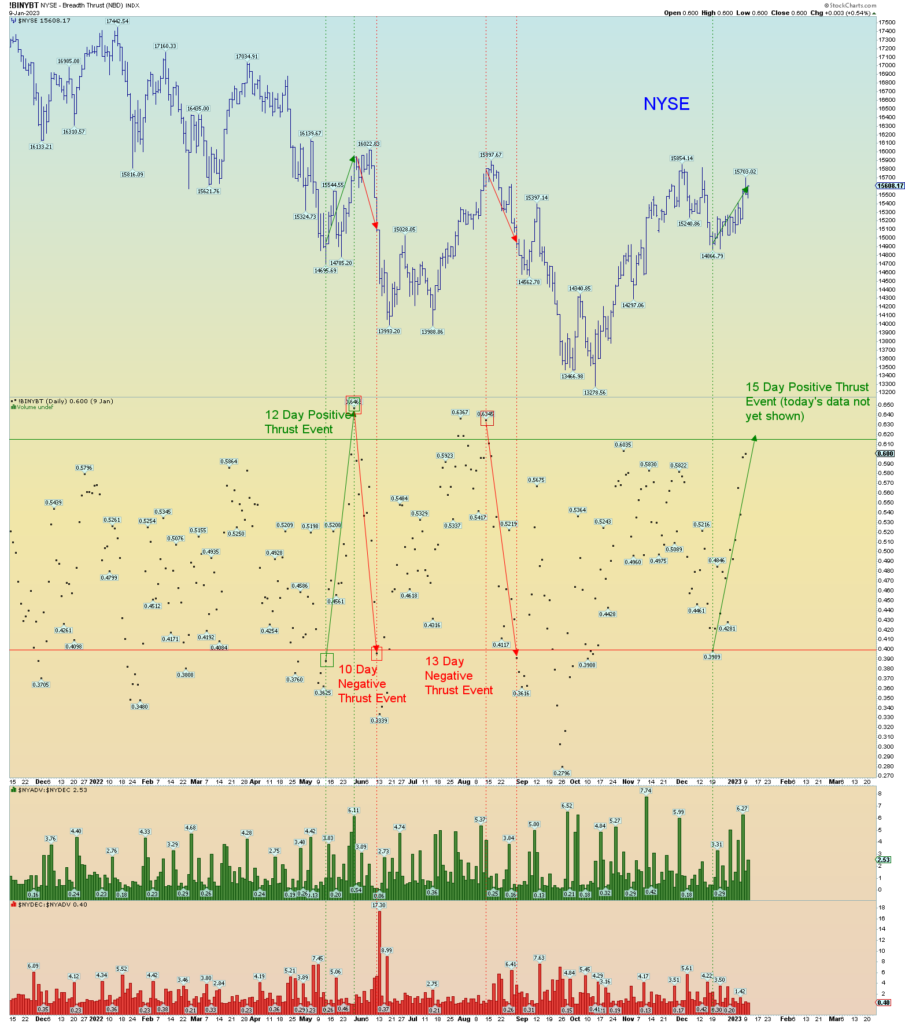

After a month of trying to regain SPX 3900, today the market did. And on the NYSE it likely resulted in a 15 day “breadth thrust event” is what I like to call it. The market needs to nullify this positive thrust event with a negative thrust event.

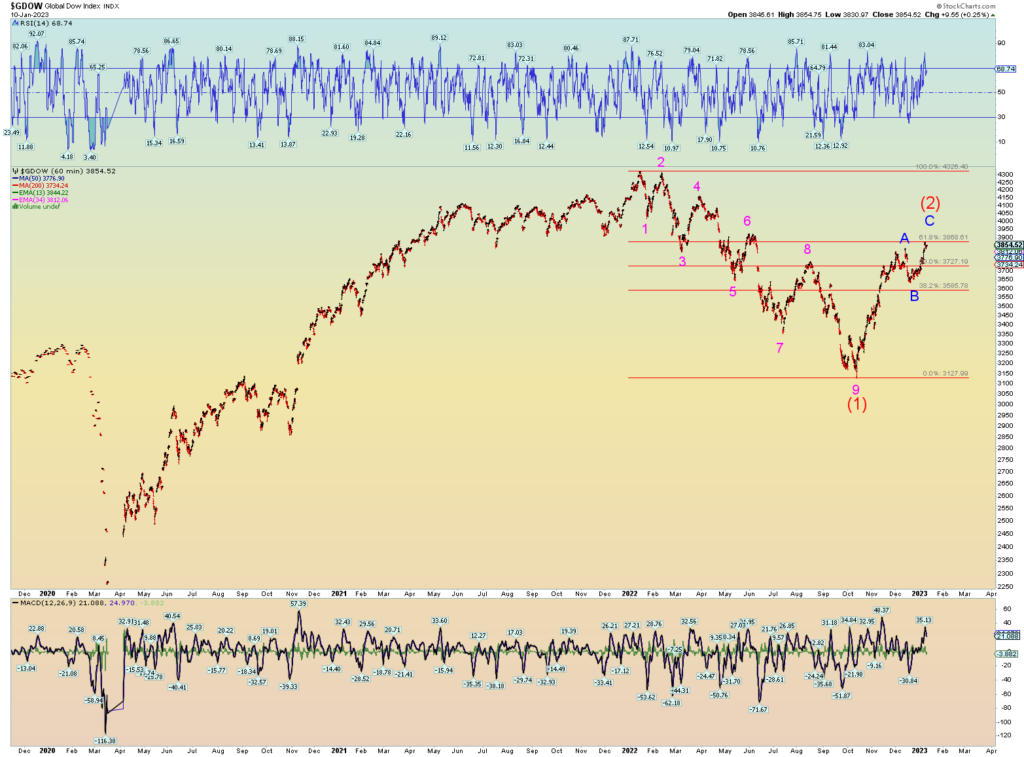

The SPX count is the preferred count, but to be honest, this ain’t behaving like a wave 3 of (3) down. Prices have gone back to about where I expected so we’ll see.

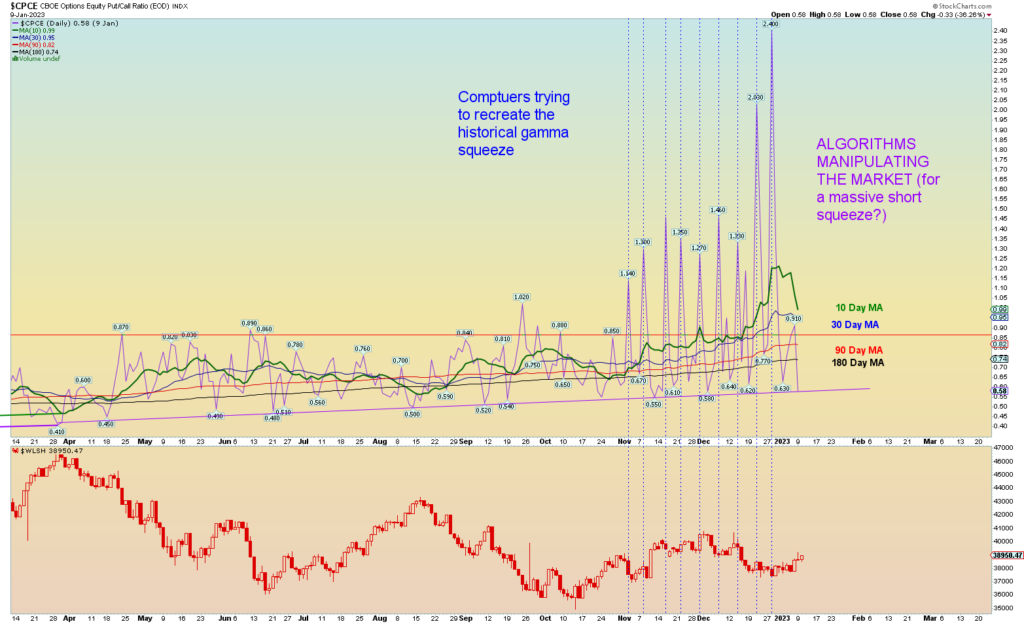

I don’t know what is going on with the CPCE data but it looks like algorithms are manipulating the market perhaps trying to artificially recreate the historic “gamma squeeze” we saw that drove the market to its November 2021 / January 2022 peak(s).

I’m not market internals expert but this is not normal. This makes me wonder if the market is in for surprise upside that surpasses the previous early December peak and starts to squeeze creating an artificial bandwagon that gets retail and hedge funds to reverse course and chase the market yet again.

This is probably what’s happening. The WEF New World Global Order Luciferians banking cartel are not yet quite ready to collapse the financial markets just yet. There is more preparatory work to be laid and then global war will be unleashed. The planned Taiwan invasion has probably been pushed back. I originally thought November/December, but obviously all the players involved including China needs more time. (Yes, the war is being planned between all parties) So, the markets must be maintained until then because when China finally attacks, the markets will collapse. There is no contrarian play when Apple iPhones stop production delivery altogether. And every other global product that supports humankind. It’ll make 2020 look like a Sunday picnic.

So, don’t get the wrong idea. Ol’ Dan isn’t getting bullish, things just (perhaps) require more patience. Once the whirlwind is unleashed there is no putting the genie back in the bottle again. That moment in time may be soon or may be 5 months from now. But it is coming regardless. The Luciferians are not playing games. Satan is running the global show and he don’t care about anyone’s 401K or Wealth Management Fund.

Here is the alternate medium term “bullish” count based on an artificially created short squeeze per the discussion above. But again, it’s still a bit too early to call for this count but it is always on the tip of my mind.

We can see the Global DOW has this actual count as is. And it seems the GDOW has met its 61.8% Fib retrace so this is a reason to stay bearish overall globally. Because in reality the rally has already happened.