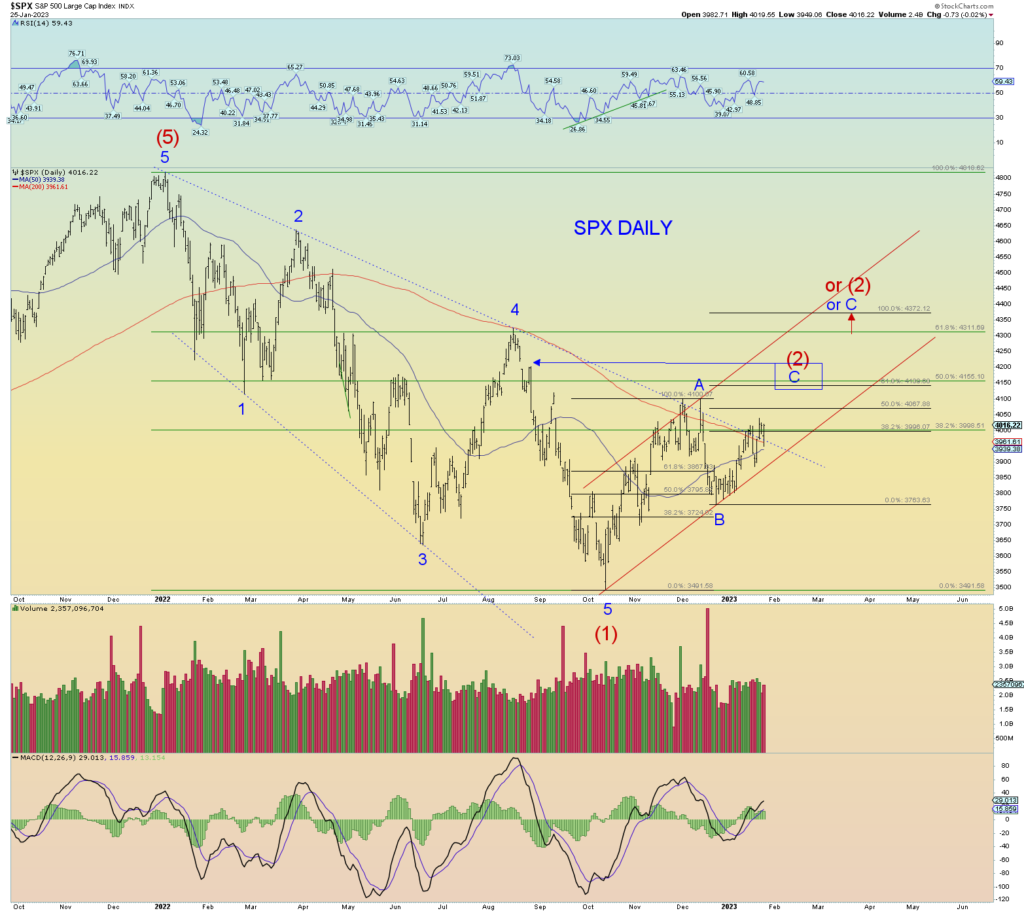

Ok, the primary count is shown below in the form of a simple 5 – 3 – 5 zigzag. [Note: Wave A could be counted as zigzag itself but for simplicity’s sake I think this works better especially since the SPX has a different peak].

The Wilshire is shown but the SPX is practically the same count. The best count has that minute [i] of wave C of (2) has completed. Today may have been all or some of Minute [ii]. Perhaps a bit more consolidation for Minute [ii].

The rule for wave C of (2), being a zigzag, is that wave C must finish higher than wave A in price. Therefore, wave C is represented by the blue target box. As the waves trace out, we will be able to tighten the count and the box itself.

The convergence of channel lines and trendlines helps determine where we are in the structure. The black Fibonacci scale is to indicate how much wave C relates to wave A. For instance, wave C would be .618 times wave A just above the peak price of A. This is sometimes a common ratio relationship between waves C and A.

The SPX is the same chart as above. I show this because it is easier to relate the wave relationships. Wave C = .618 x A @ SPX 4139.

The SPX daily shows the overall big picture count. Between 4139 and 4155 there is 50% overall retrace resistance and wave C would be about .62% x wave A. This is less than 4% above today’s close.

The more stretched out target is where wave C = wave A which is very common, and it is a full 9% above today’s close and would take much more time.

With all that said, it is good to be mentally prepared for the “upside surprise” bullish short-term scenario (s). However, the most bearish scenario remains valid but as I keep saying, prices need to turn down hard and fast soon. There is still room for the bearish count that has been shown for over a month.

I’ll call this the “global war goes hot” scenario. It is quite bizarre to me, having lived through the some of the cold war and remembering “The Day After” movie of the early 1980’s and the real fear people had of nuclear war. Now it’s like a farcical chess match to be pondered.

I guess decades of fake video games will do that to a generation of people. I’ll remind the casual reader that 2 superpowers openly fighting in an open proxy war is not actually the best time to be buying the stock market hand over fist.

There is no “contrarian” play when there is no longer worldwide deliveries of foods and goods due to sudden global war and an overnight collapse of the globalist supply system. And we all know that is their goal.