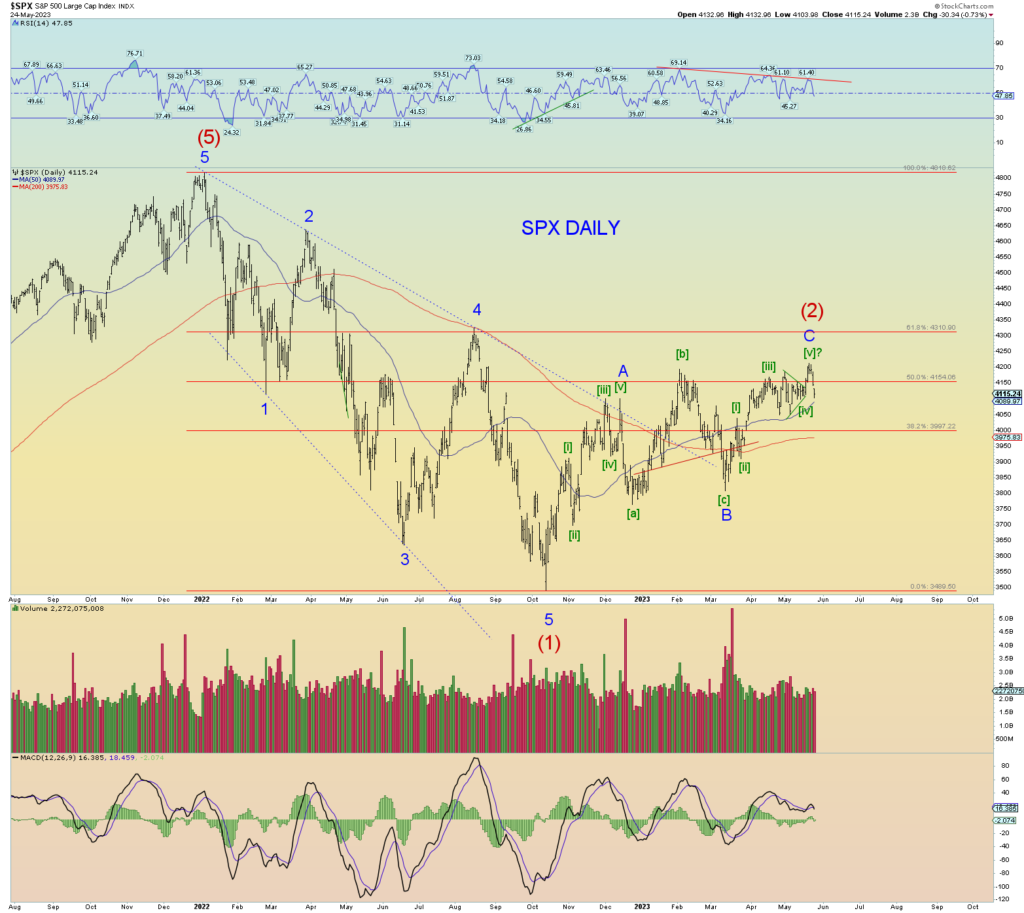

I have been neglecting over the past week or so in not pointing out that the S&P 500 did indeed make a new Intermediate wave (2) high, and I was fully expecting the Wilshire to follow suit, yet it has not. In fact, the recent falling away is kind of a bearish move in that the Wilshire 5000 did not yet “confirm” its sister index the S&P500. These subtle non-confirmations can sometimes be key clues that market direction is about to turn again. (In this case down).

So, if it seems the daily sentiment of this blog goes back and forth from slightly bullish to bearish and playing around with the squiggle counts, it is because that is where we are. Ultimately, I am extremely bearish in fact I will remind the casual reader I am predicting global World War III and the eventual revealing of the Antichrist and False Prophet. So yes, probably not a good time to be in the markets based on this projection LOL!

But yes, the SPX has squeaked out a higher high of early February, but the Wilshire has not. And now that prices have fallen back a bit, this non-confirmation is bearish.

A count that is a blast from the past. I keep these charts because they are still valid although my other counts make more sense overall. I had predicted the gap would be met and but it is not yet closed.

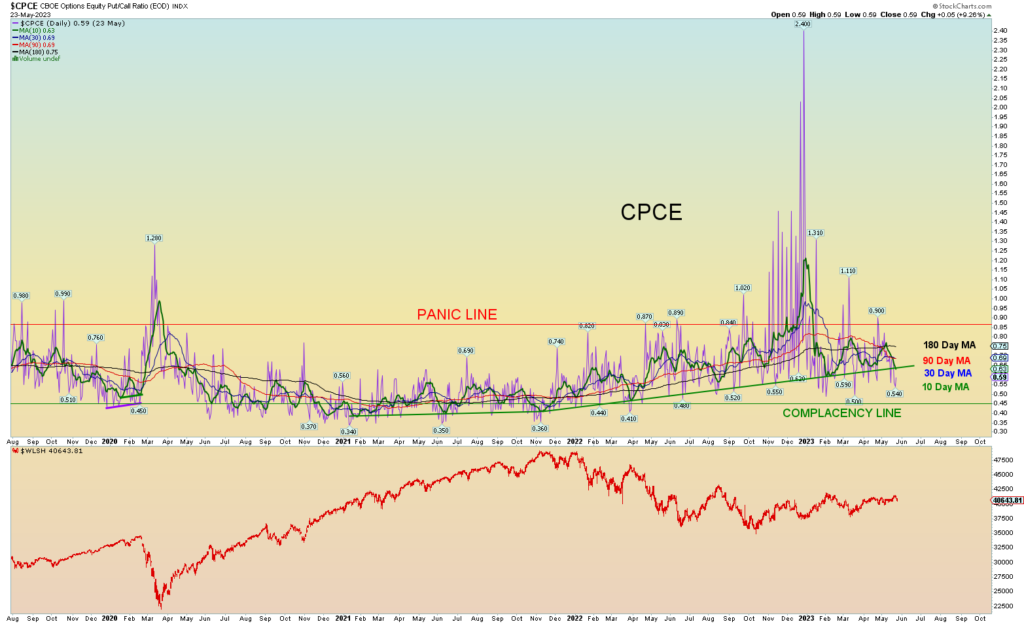

And don’t let anyone tell you that equity market is still too bearish because the CPCE is still rather frothy. Some insane numbers considering the short-term interest rates have already punctured the global Ponzi.

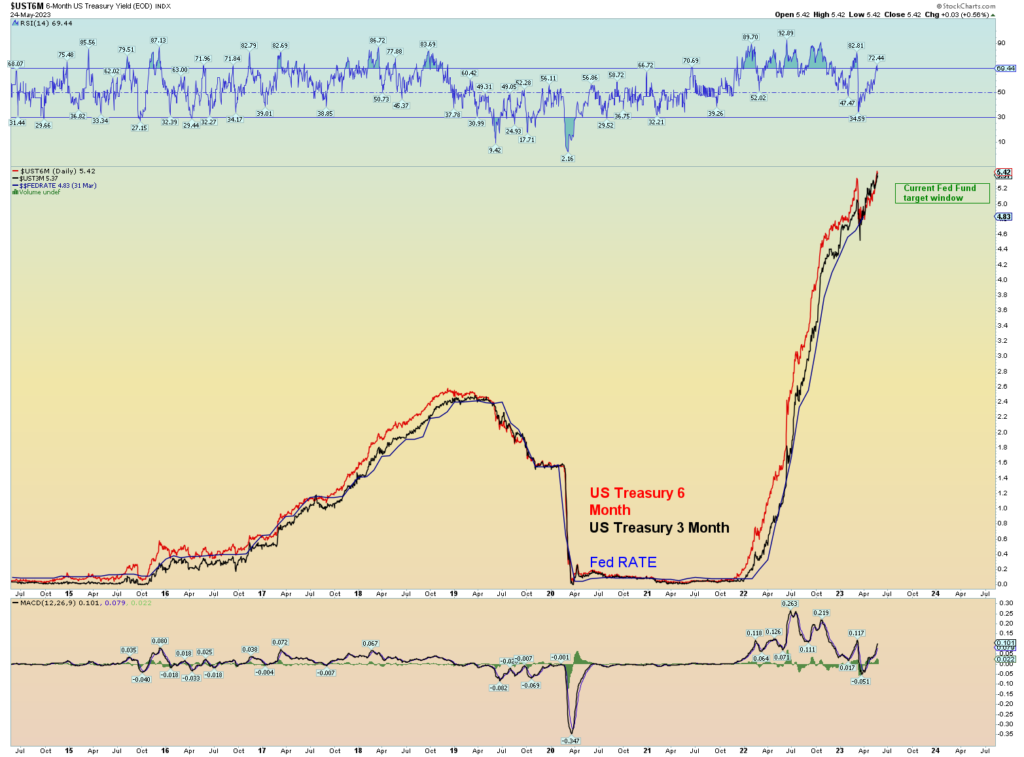

This is what is going to destroy the world. The fiat credit bubble has already popped!