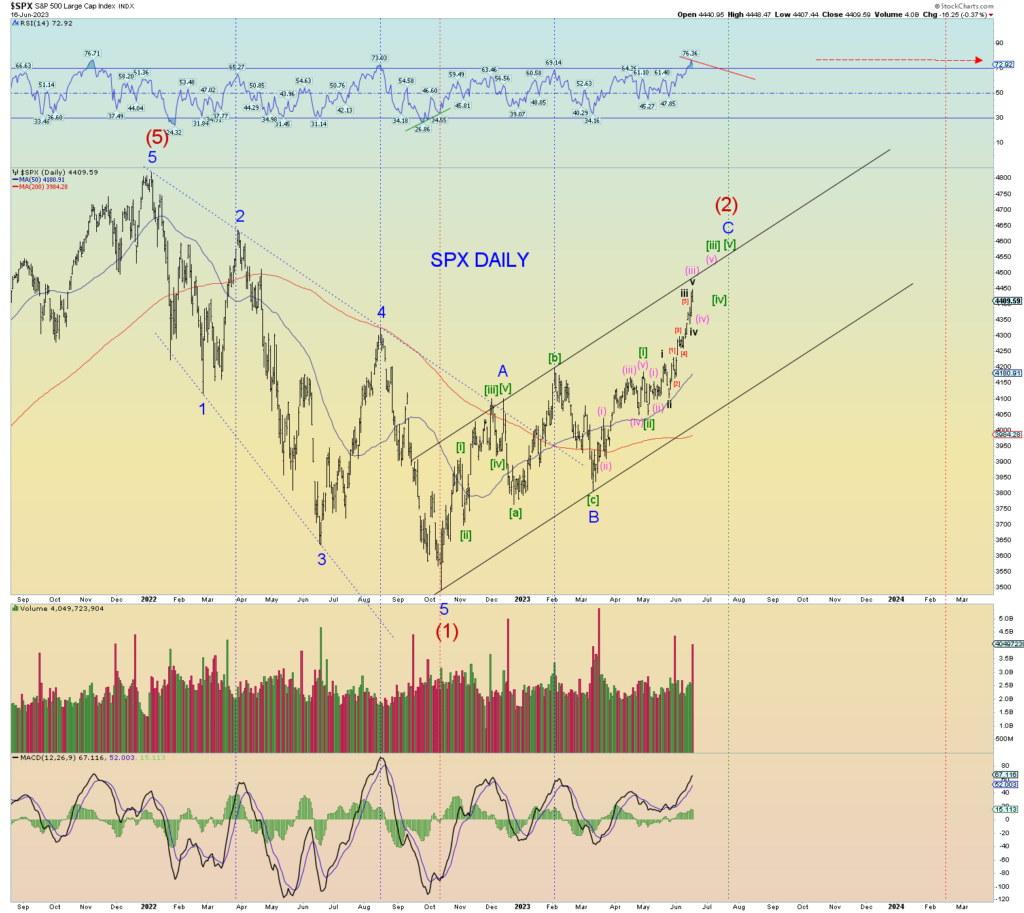

Technically, we are looking for a peak RSI to mark the top of subwave (iii) of [iii]. Today may have been that day. Note that the previous peaks all ended at the peak RSI in the bear market downturn. I don’t expect that to happen here, I expect a negative divergence situation.

It will be curious to see Monday’s opening. An ideal wave structure calls for a gap down then eventual fill and power higher sometime next week to mark the proper end of Minute [iii] of C of (2). Thats the primary count.

Happy days are here again for the markets. Well, I think not. The damage has been done. The Titanic has been gashed. The Ponzi is taking on water and no one notices too much just yet.

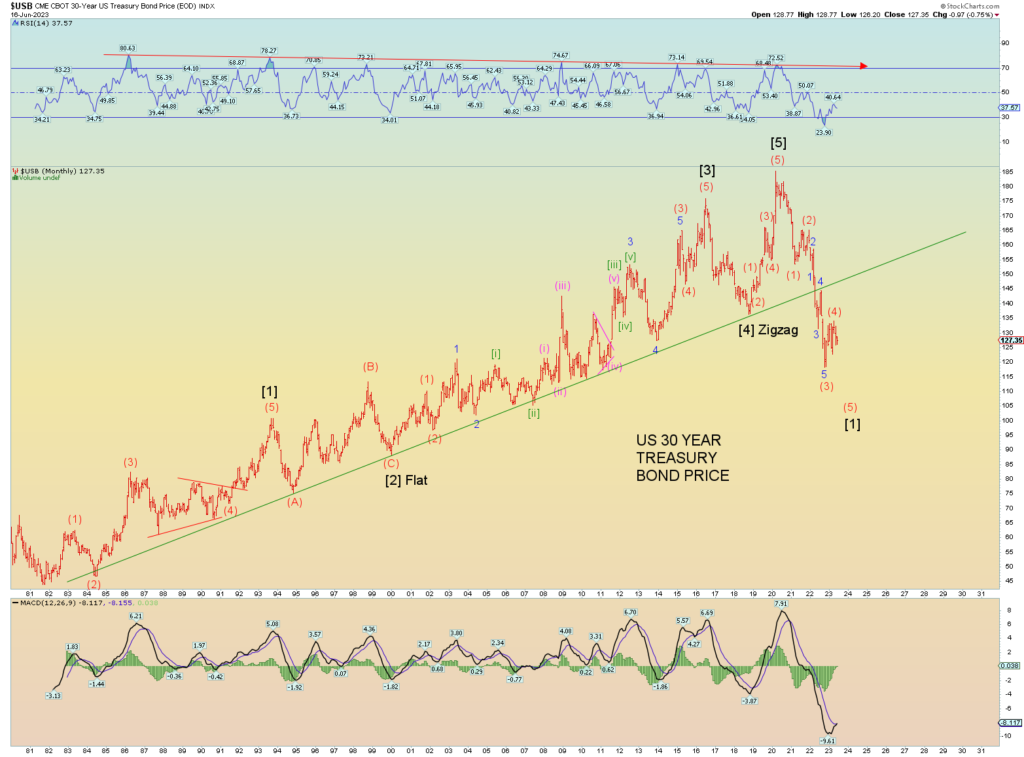

Ideally, we have another leg coming in both the 10- and 30-year yield. Both seem to have been consolidating. Another leg here would be a “surprise” I suppose. Duration risk is why all the banks are bankrupt. They kept buying bonds as if interest rates would never go up. Actually, I don’t think the people running banks actually care a piss about anything. They get their money and if things go bad, they all get a golden parachute. But almost everyone to a person will wind up burning in hell because it is easier for a camel to go through an eye of a needle than for a rich person to trust alone on Jesus and go to heaven.