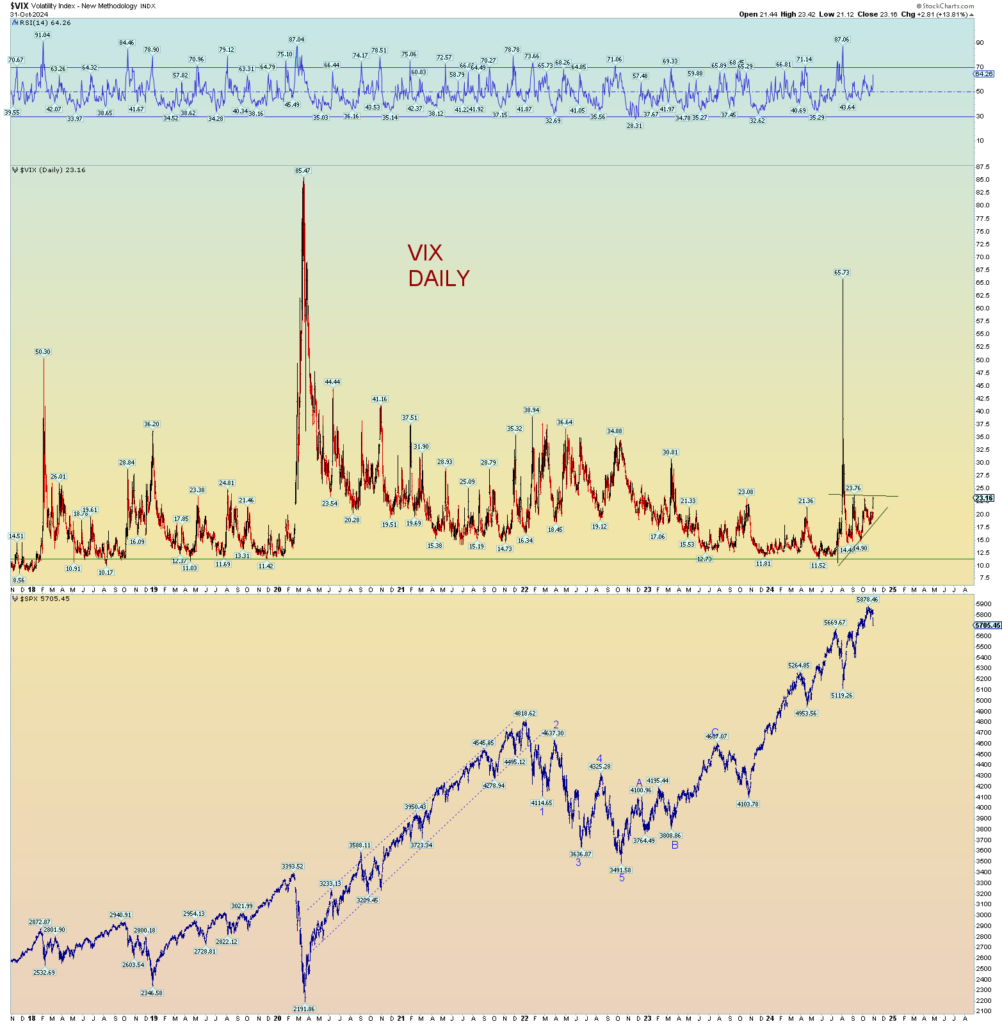

The count is mature either way. Election fireworks. VIX is elevated. I have no idea which way it goes but the 1st chart below has a rule that wave 4 cannot go into wave 1 which the green line horizontal line shows.

The DJIA aligns with this count

The VIX is in an ascending triangle pattern which suggests a breakout higher.

Short term interest rates are at a crossroads. If the 6 month yield crosses above the 3-month yield that may signal again a rise in interest rates as the 3 month would eventually follow. Again, this is the chart the Fed uses to determine interest rates overall. The market moves first, and the Fed follows.

(It is beyond the scope of this blog to explain why the Fed must follow the 3/6-month yield charts, but suffice it to say they would lose money – and the overall Ponzi market would break – if they did not follow what the market sets for these short-term lending yields)