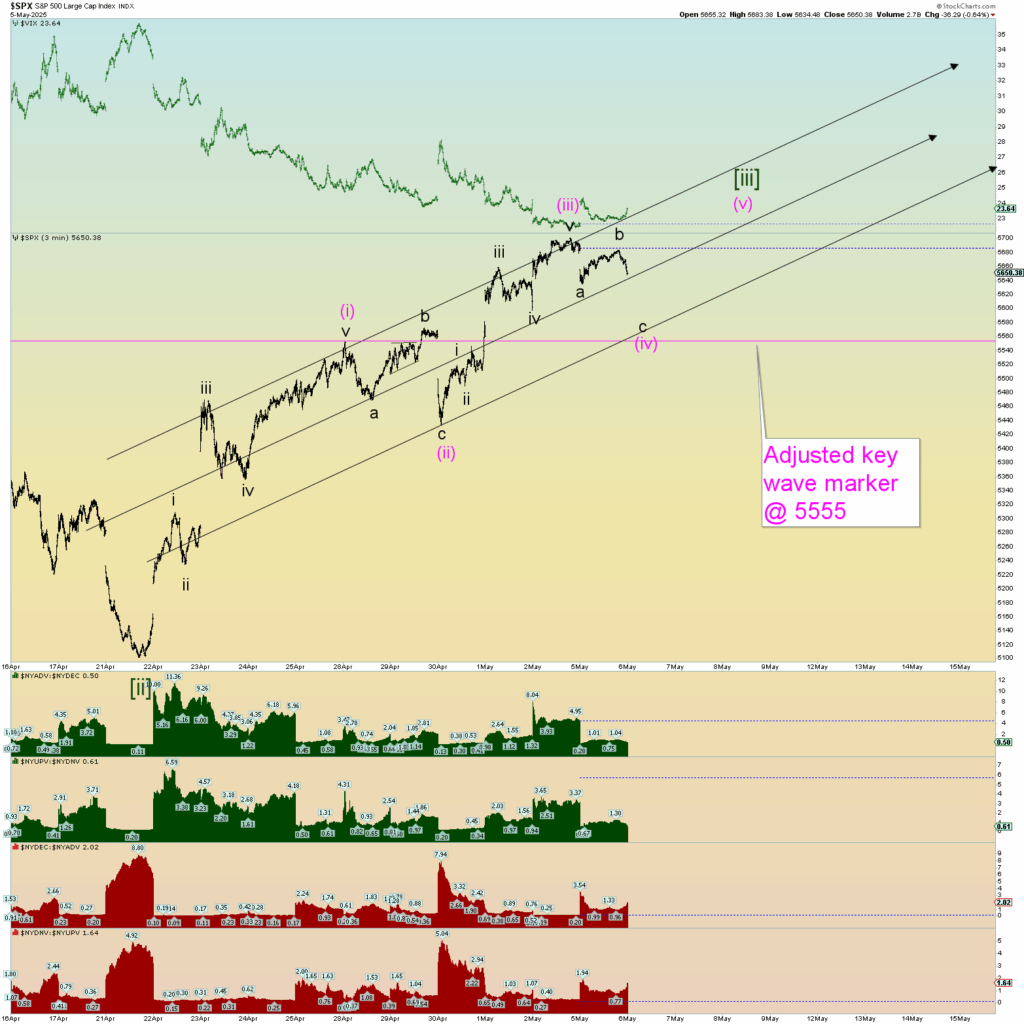

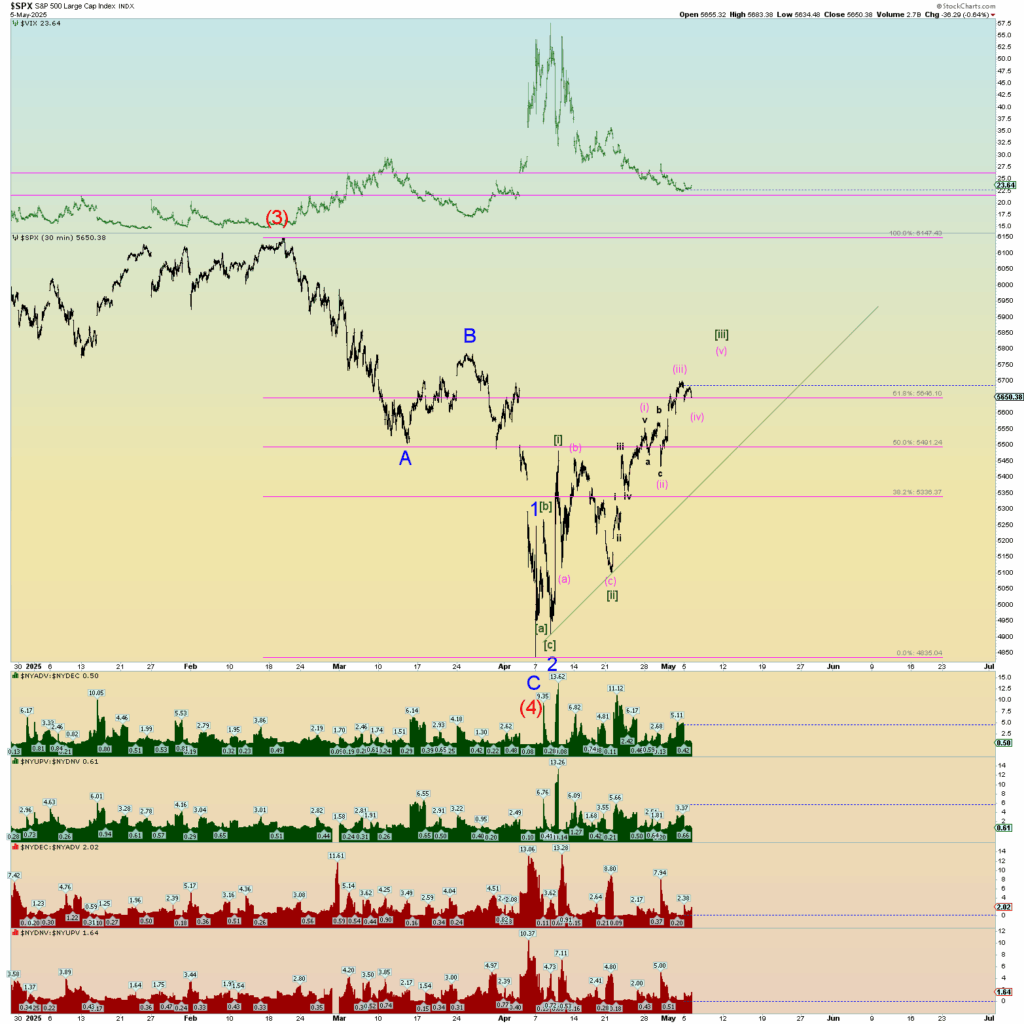

Today was pretty much expected. As noted on Friday, after 9 days up in a row for the SPX, it was due for some consolidation. The count is wave (iv) of [iii] of 3 of (5) up. An expected alternate corrective would be a wave (iv) zigzag down versus the wave (ii) flat. The count cannot go below the wave (i) peak or else this is not an impulse wave up as labeled.

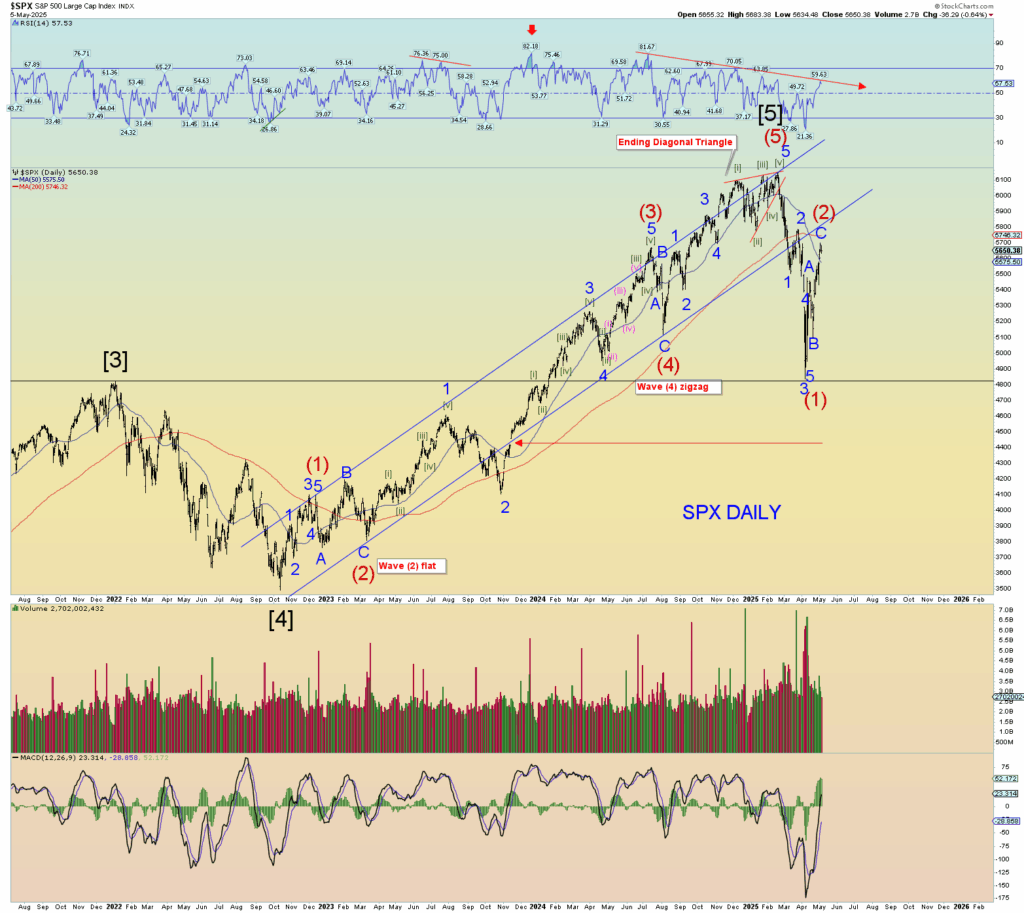

The best bear count is simplistic (1) – (2) …I haven’t ignored this count at all, it’s just on the back burner until and unless a price drop below key levels would demand that this count gets primary attention. In theory, wave twos can go as high as they require.