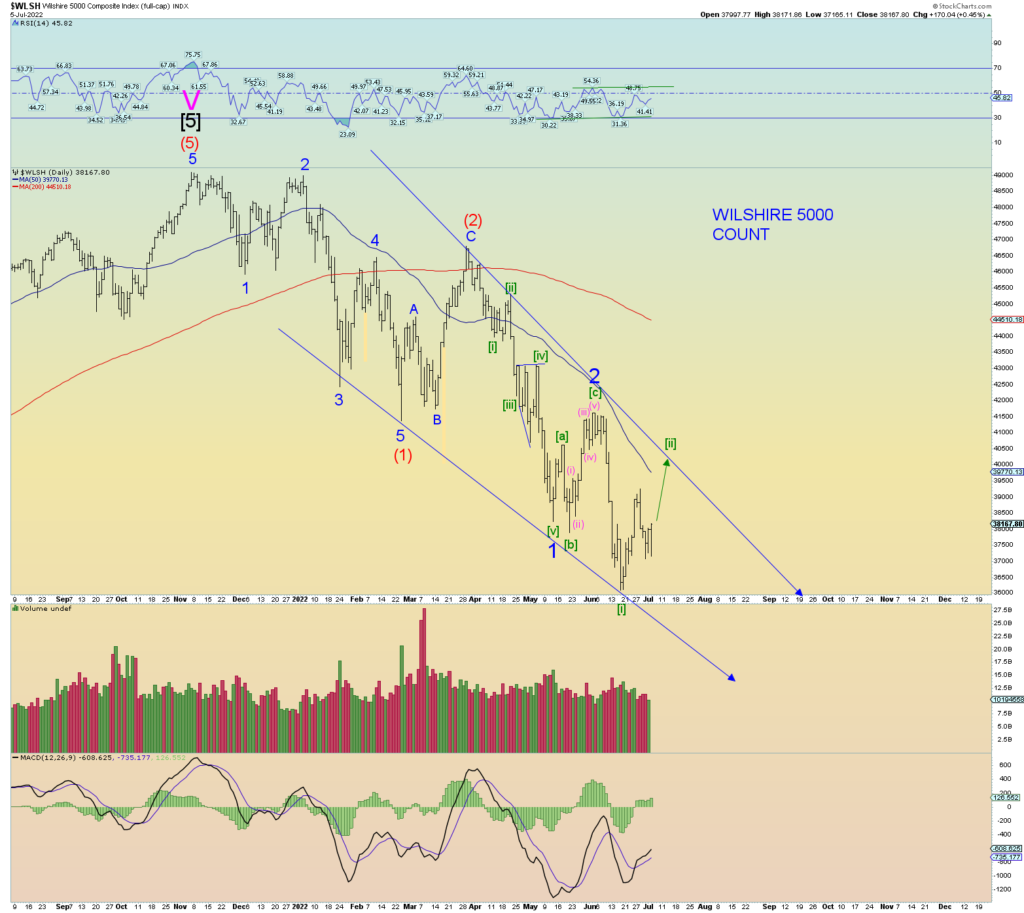

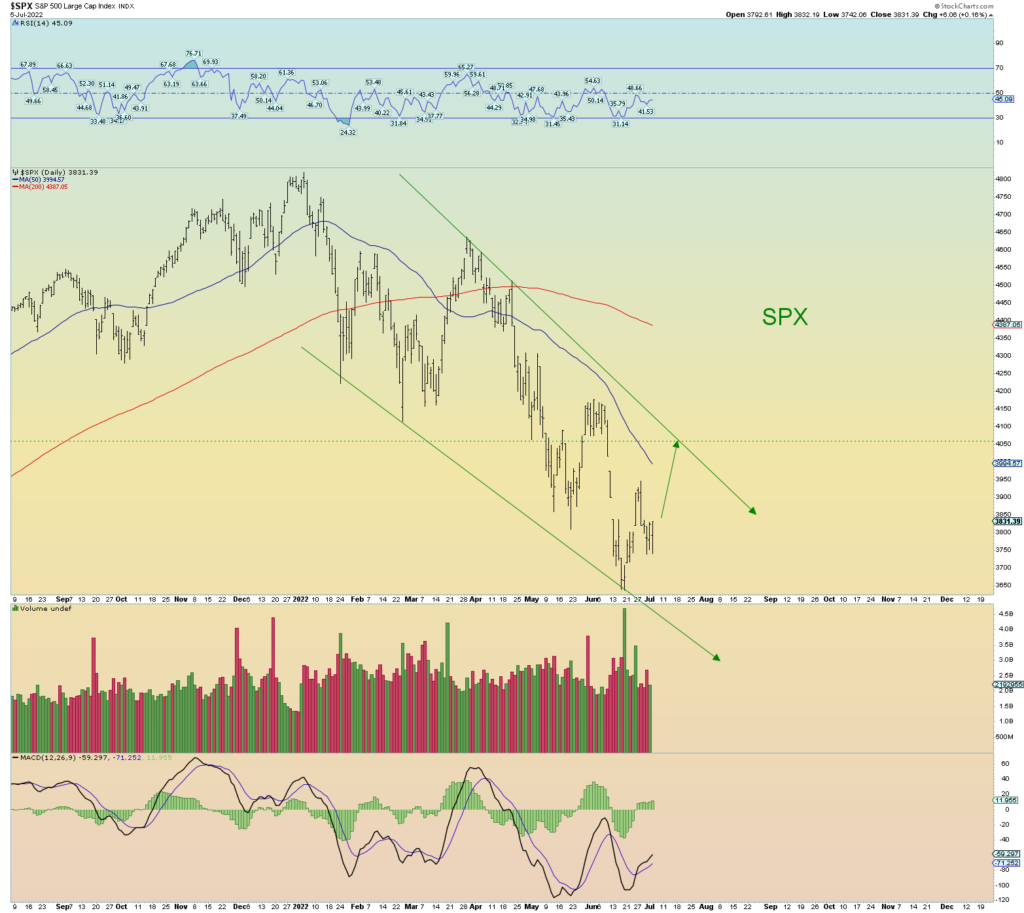

A notable drop off in daily volume which reflects the summer vacation season. We had the same setup in the summer of 2008. After sharply rising in early July 2008, prices meandered in a general sideways fashion never regaining previous pivots.

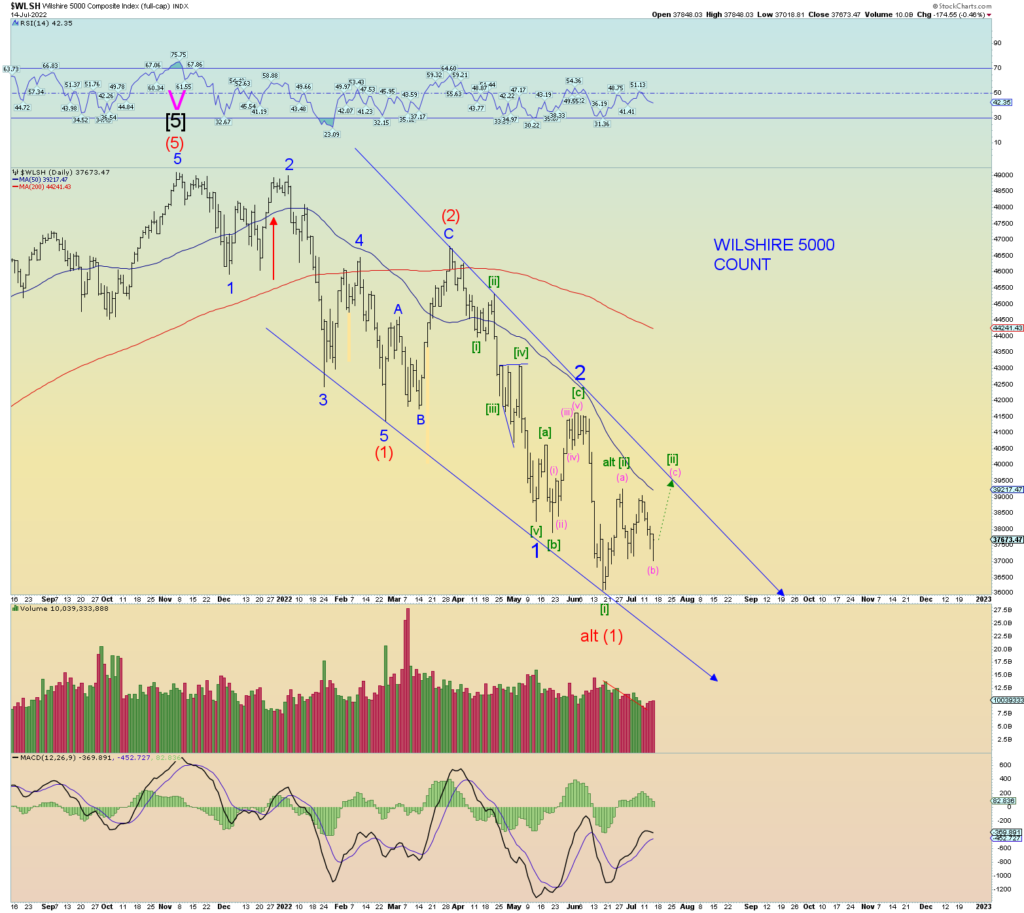

We have a 5-wave impulse down ending at today’s low which could wave c of a 3-3-5 flat situation. Let’s go with it for now and assume the lazy summer trading will continue to be held in this 5% trading range or so.

A break beneath today’s low would be a very bearish sign and likely result in a test of the 17 June lows.

Let’s throw this up and see if it sticks. But in my heart, I’m rooting for a total market crash. The subwave count of [ii] of 3 of (3) implies we are close to that point.

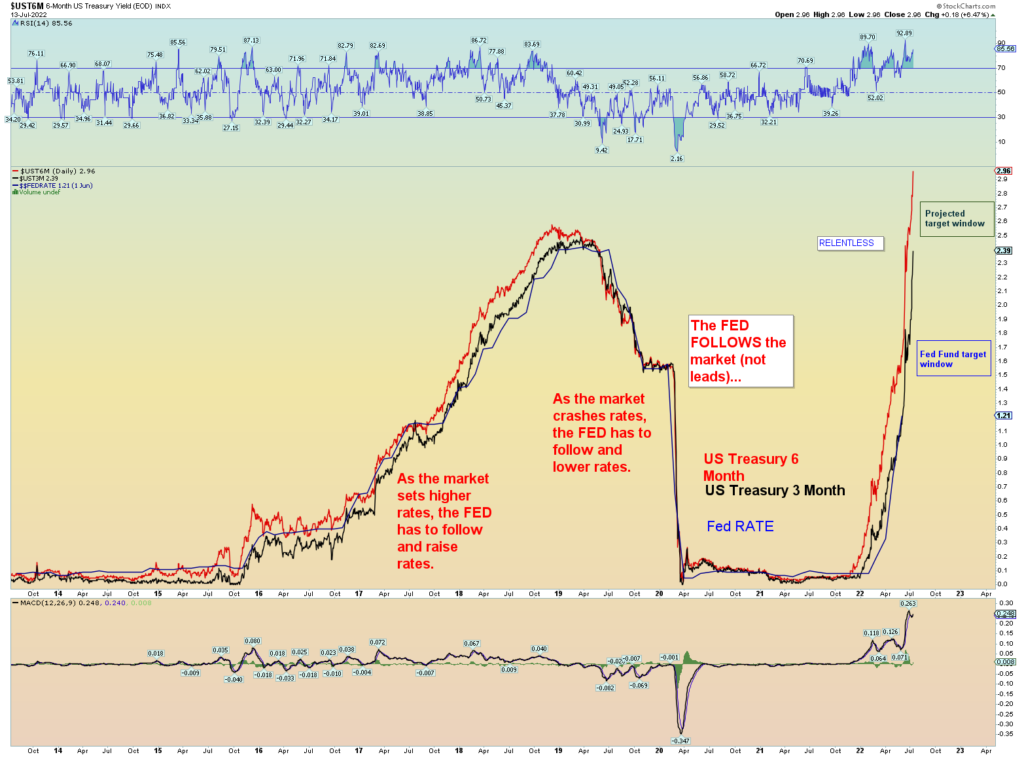

Short term rates. The market is at least .75 points behind the market. The green box projects a 1 point raise.

It’s getting out of hand. Even only 3% rate will bankrupt the government. Its coming folks. That which cannot go on forever, won’t.

God is forever, this Ponzi market is not.

I haven’t talked much about the False Prophet of the bible because according to my timeline he won’t be pumping up and promoting the Antichrist until later in 2023. The False Prophet of Revelation is a person (possessed by a high-level demon) who promotes the Antichrist. I have proposed the Antichrist is Volodymyr Zelenskyy. Eventually the False Prophet will emerge that “promotes” the Antichrist to the world as being the Messiah to all of mankind.

Obviously, a lot of world leaders have actually been doing that very thing and I could conclude that one of them is the False Prophet. Yet, I don’t think that is how it will play out. Macron a False Prophet? Trudeau? Hardly. I think there may be a lot of people jockeying for that position, but the REAL False Prophet has yet to emerge.

Yet at the same time, obviously the False Prophet is already a living adult man. And that man would probably have great influence and perhaps actually be a billionaire who controls/owns the means of mass global communication to be able to carry out the plans of Satan of promoting the Antichrist to position of NWO world leader. Is there such a person today?

Yes. Elon Musk. My early frontrunner for False Prophet. A man who is neither hot nor cold, neither completely hated nor completely loved by all sides of the political spectrum. A truly weird man. He owns Starlink which will likely survive the coming God’s wrath period and now he bought Twitter, the means to communicate to the world. He is reprobate and not a Christian, is a WEF member, and he would agree in large part with the now demolished 10 Satanic commandments of the Georgia Guidestones.

This is where I will leave things. The proposed Antichrist (Zelenskyy) has yet even to defeat the first global nuclear armed power of 3 that the bible predicts. If Z man is not the Antichrist, then he will not win. It’s that simple. But going on 5 months, the Ukrainians have yet to experience a real loss of any of the big 3: Odessa, Kharkiv, or Kiev. Too many cheerleaders for Russia, but the bible predicts they will lose if Zelenskyy is the Antichrist. The bible prophesizes that the NWO will succeed.

Elon Musk is the frontrunner for the coming False Prophet. He is a transhumanist. He owns Neuralink. He owns Starlink and the means to launch the satellites in Space X. He owns an electric car company for when the global fuel supply collapses ala “Mad Max”. He is buying a global media communications company Twitter. He is not a Christian and I sense he is reprobate (rejected Jesus Christ) already. He is a WEF member. He is a globalist. A “New Age” prophet.

And he is the richest person in the world. He can make top bid and that might just buy him the title of False Prophet. Only time will tell…

He has already helped Zelenskyy via Starlink

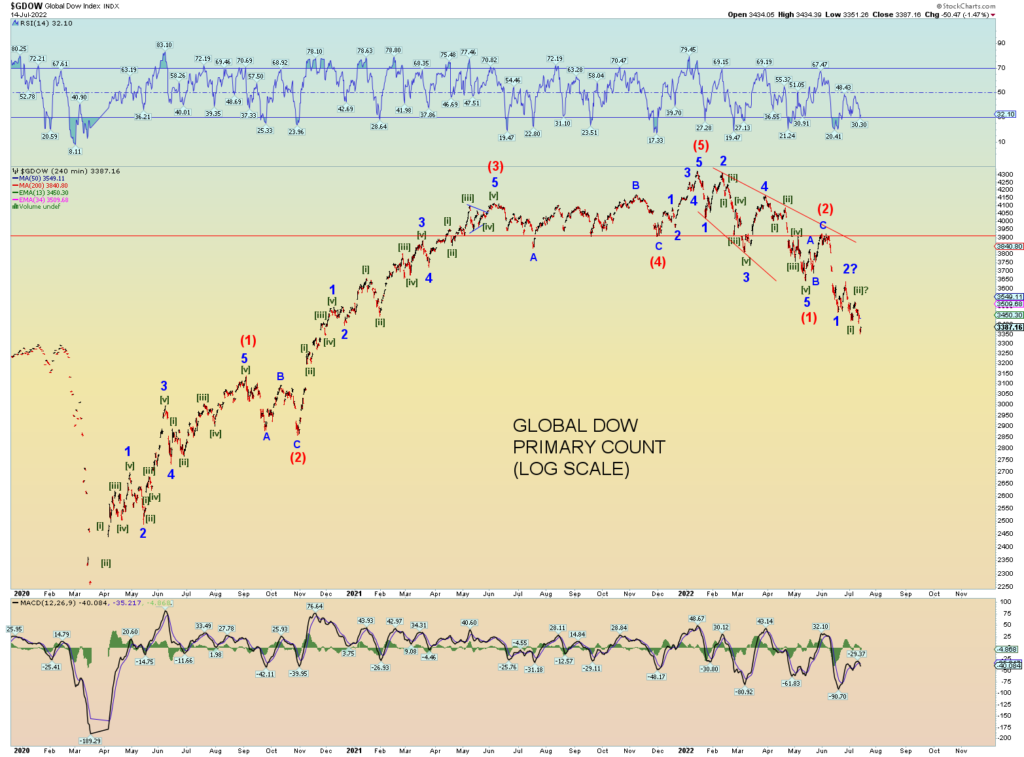

THE COUNT

Not going to mess with things, this chart is working like a charm,

MAJOR PROPHECY UPDATE

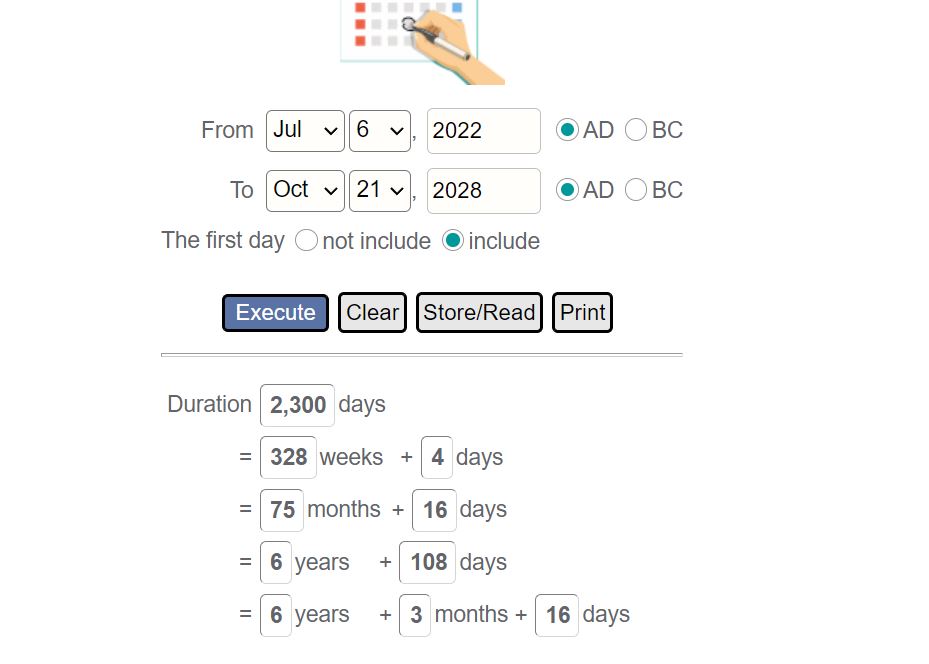

There is a significant prophecy in the Book of Daniel concerning the “2300 days”. I propose the blowing up of the Georgia Guidestones today marked the start of the 2300 days as outlined in Daniel Chapter 8.

Incidentally, I obviously think the attack on the Georgia Guidestones was an “inside job”. A “sacrifice” of their “holy” temple by the NWO members to initiate the end of times events. Naturally, no one has been implicated of this crime as of this post.

Here is what Daniel chapter 8 actually says:

13 Then I heard one saint speaking, and another saint said unto that certain saint which spake, How long shall be the vision concerning the daily sacrifice, and the transgression of desolation, to give both the sanctuary and the host to be trodden under foot?

14 And he said unto me, Unto two thousand and three hundred days; then shall the sanctuary be cleansed.

This is probably one of the most abused prophecies ever. The interpretation that I adhere to is that 2300 days is a subtraction from the day that Jesus actually declares the “temple” to be cleansed at the beginning of the Millennial Kingdom.

In other words, the followers of Satan start “sacrificing” at the end of days to bring about the satanic messiah, the Antichrist. Thus 2300 days represents the very day a significant “event” kicks off to mark this occasion, i.e., a “sacrifice”.

If we take 21 October 2028 as the day that Jesus’s Millennial Kingdom actually starts, then minus 2300 days using inclusive counting brings us to 6 July 2022.

Note the “duration” of 2300 days……

Thus, I made a slight adjustment of the calendar I have been using. “6 July 2022” is now the date that the “daily sacrifice” started.

What this means is that today Satan has once again imitated God by “breaking” the Satanic 10 Commandments (the Georgia Guidestones). This is a direct imitation of Moses breaking the tablets (10 commandments) when he came down from the mountain.

Additionally, only “one fourth” of the monument was broken. This is replica of Revelation 6 where Death has power over 1/4 of earth:

And I looked, and behold a pale horse: and his name that sat on him was Death, and Hell followed with him. And power was given unto them over the fourth part of the earth, to kill with sword, and with hunger, and with death, and with the beasts of the earth.

Therefore, we have our major event marking the beginning of the 2300 days and thus helping to confirm the eventual outcome of the overall end times timeline.

And if one cares to hear a REALLY freaky story, I happened to go in this morning VERY early to work; 3;30 A.M (which is rare). I had not much work, so I turned on You Tube, and a video caught my eye…. NEW WORLD ORDER.

This was the video I was watching at 4 AM at about the same time the police stated that the Georgia Guidestones blew up. (However, I had not learned of this event until 12 hours later)

America Unearthed: The New World Order (S2, E2) | Full Episode | History – Bing video

As God is my witness, I swear that is what I was watching at approximately 4 a.m. EST, the very same moments the police claimed the Georgia Guidestones blew up.

As a side note, the video “sucked” as far as I was concerned, and I played it in the background as I was working. Just a bunch of lame-stream mass-media “BS” yet it had an interesting interview of the banker who pledged fealty to “R.C. Christian” and swore to never tell the actual name(s) of those behind the Georgia Guidestones.

One other aspect of this show was the murals at the Denver airport which are clearly NWO satanic apocalpyse.

denver airport murals – Bing images

Which are more than freaky. And that video was from I think 2010,,,,,

TAKE IT ALL FOR WHAT IT IS WORTH

THE COUNTS

This seems to be working. See my comments yesterday.

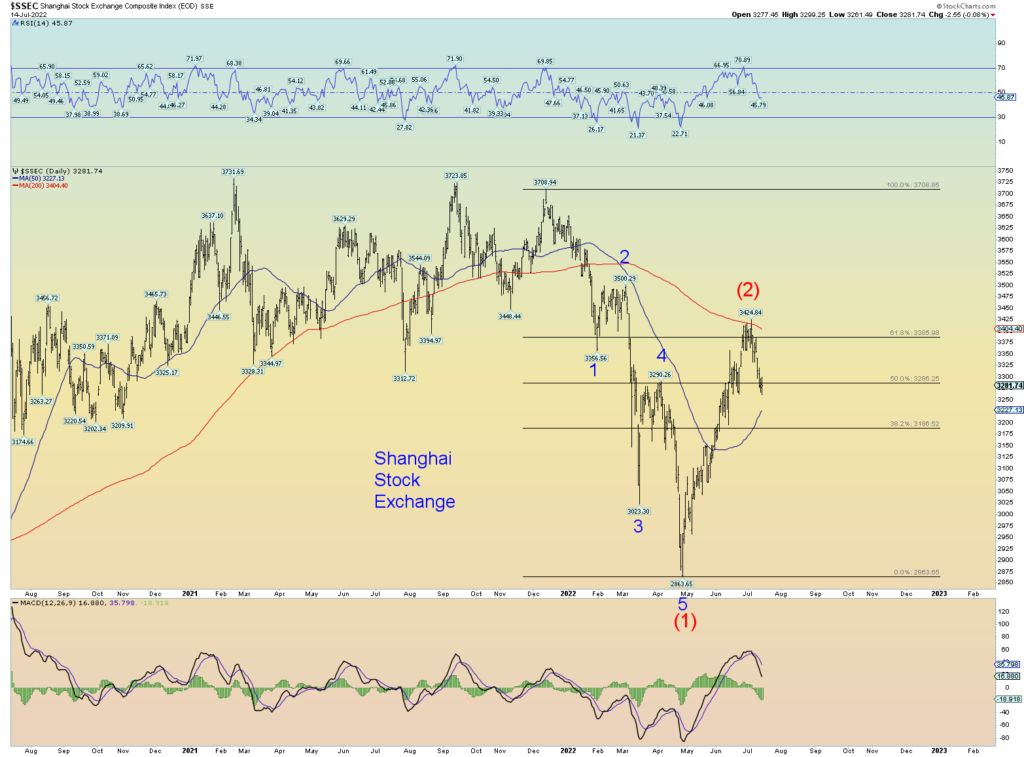

The primary count calls for some short-term upside surprise. The SPX gravitating toward closing the massive open gap down set back on 10 June. It might take a week or so to rally. Enough time and price to “reset” short-term market sentiment toward a more neutral/positive stance and prepare the way for the coming [iii] of 3 of (3) super bear market plunge.

One who gets too bullish here might want to look at it this way: If prices close the gap down on the SPX how many people will be using this opportunity to get the hell out of the market at a decent price with SPX above 4000 again?

I would think the entire market will be looking for that opportunity.

Meeting and then no doubt exceeding the 50 DMA (because the downslope of the 50DMA is very steep anyway).

The bearish count is something like this. But it doesn’t count well – nor have the correct “look” – since the peak of where we have [ii]. This is why it is the secondary count at the moment.

Believe me, I only pray for total market destruction because it is a big fat lie, a Ponzi scheme foisted on the world, and it needs to be exposed as such. However, the Bible teaches patience.

If the huge SPX open gap down is to be closed based on our overall count, then next week is the week probably to do so. A low volume shortened holiday week.

One reason for this count is the move from 3945 (a) to this week’s low of 3738 (b) counts best as a three wave move.

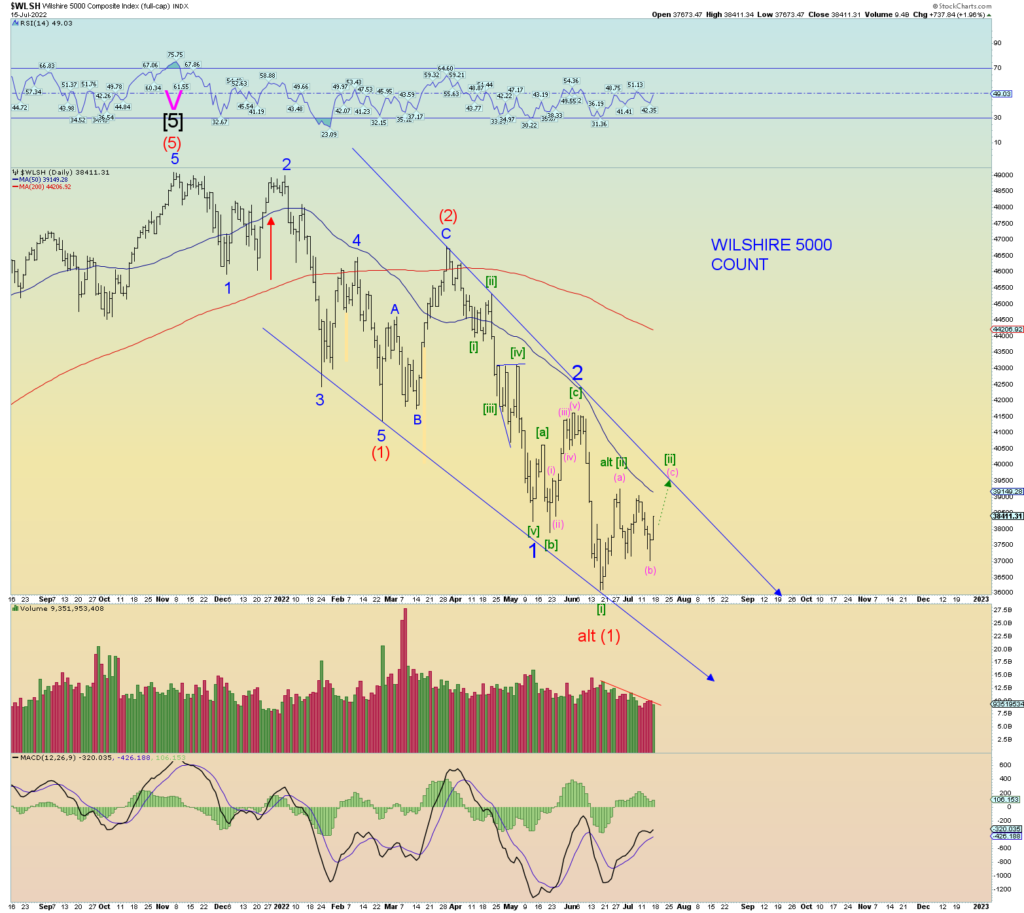

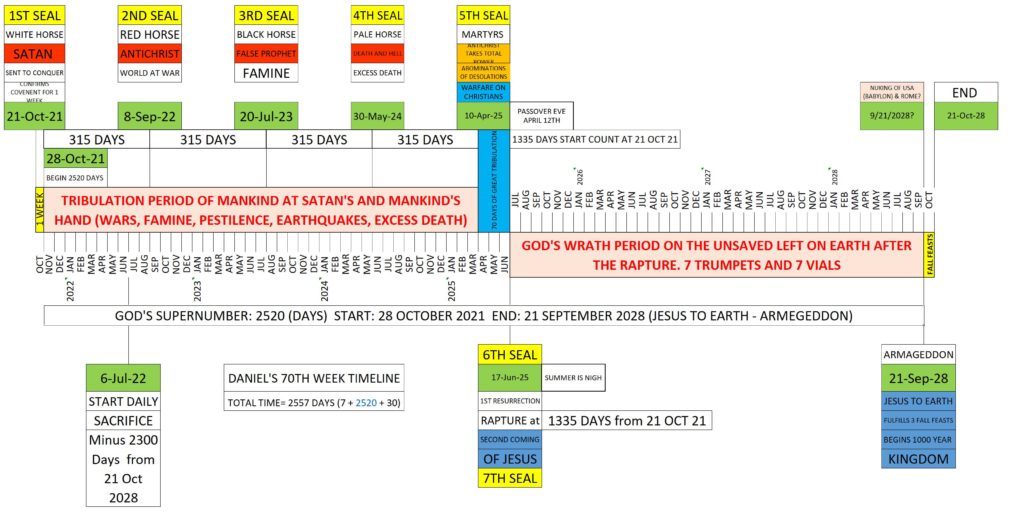

The Wilshire also with the same count

The most bearish squiggle count is shown below.