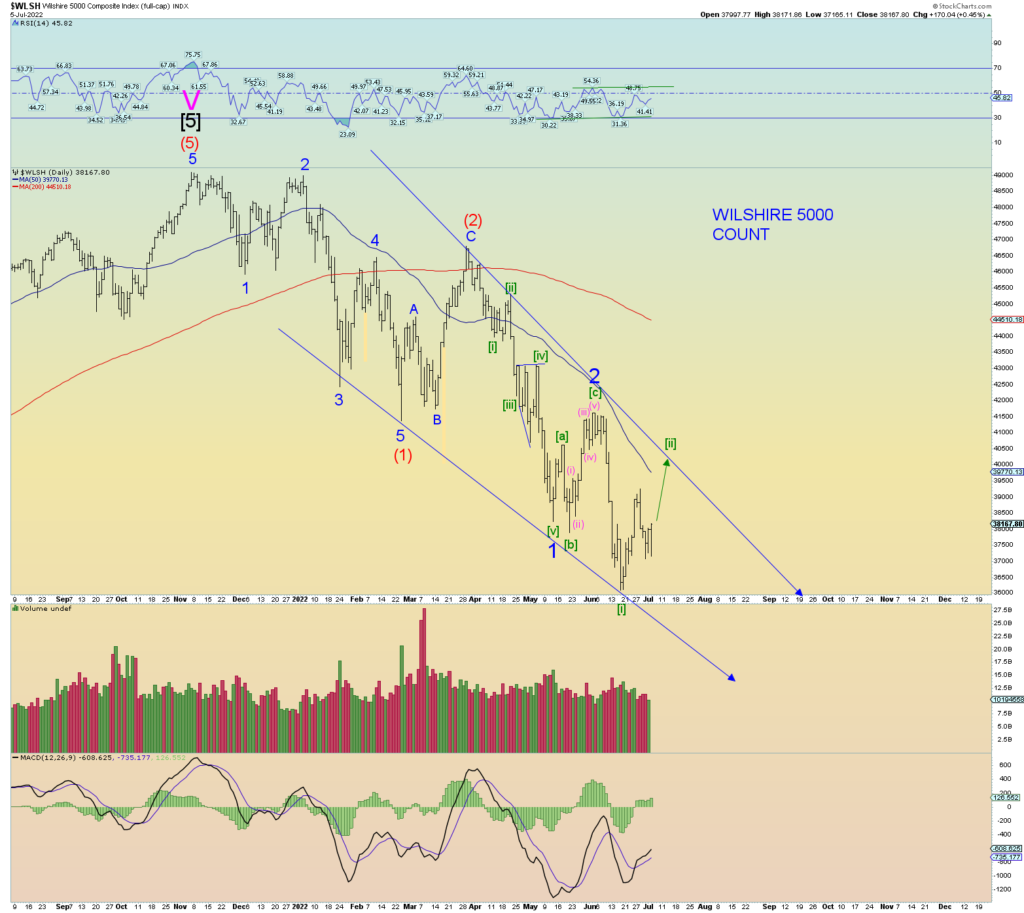

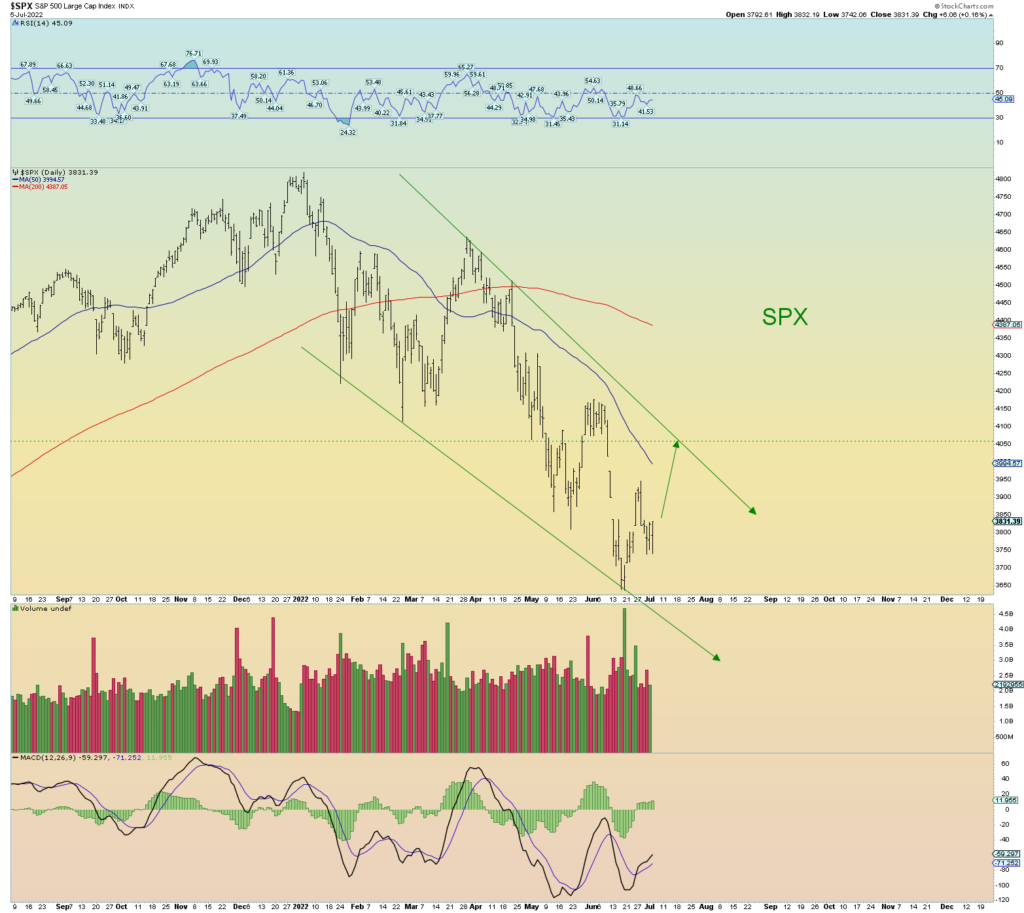

The primary count calls for some short-term upside surprise. The SPX gravitating toward closing the massive open gap down set back on 10 June. It might take a week or so to rally. Enough time and price to “reset” short-term market sentiment toward a more neutral/positive stance and prepare the way for the coming [iii] of 3 of (3) super bear market plunge.

One who gets too bullish here might want to look at it this way: If prices close the gap down on the SPX how many people will be using this opportunity to get the hell out of the market at a decent price with SPX above 4000 again?

I would think the entire market will be looking for that opportunity.

Meeting and then no doubt exceeding the 50 DMA (because the downslope of the 50DMA is very steep anyway).

The bearish count is something like this. But it doesn’t count well – nor have the correct “look” – since the peak of where we have [ii]. This is why it is the secondary count at the moment.

Believe me, I only pray for total market destruction because it is a big fat lie, a Ponzi scheme foisted on the world, and it needs to be exposed as such. However, the Bible teaches patience.