Both the Wilshire 5000 – the total market – and the Nasdaq Composite quietly have now closed today at their lowest since Oct 13th, over 3 months ago.

The most bearish count is below. The market is perhaps at critical spot on the verge of “surprise” downside prices – i.e., “3rd of a 3rd” down. Just think of the Wilshire 5000 as a head and shoulder pattern and the neckline is in danger of breaking.

NYSE counts nicely as “finished”.

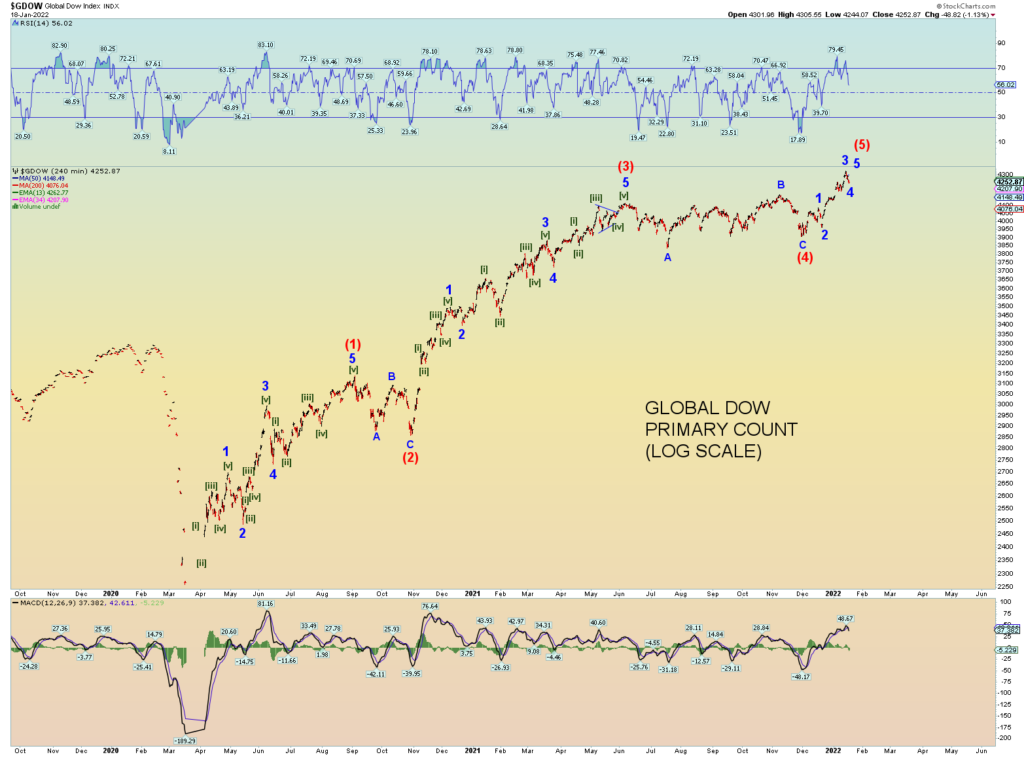

GDOW count. One more blip?

Long term upper channel line on the Wilshire was closed under today.

Well, channel lines can be finicky.

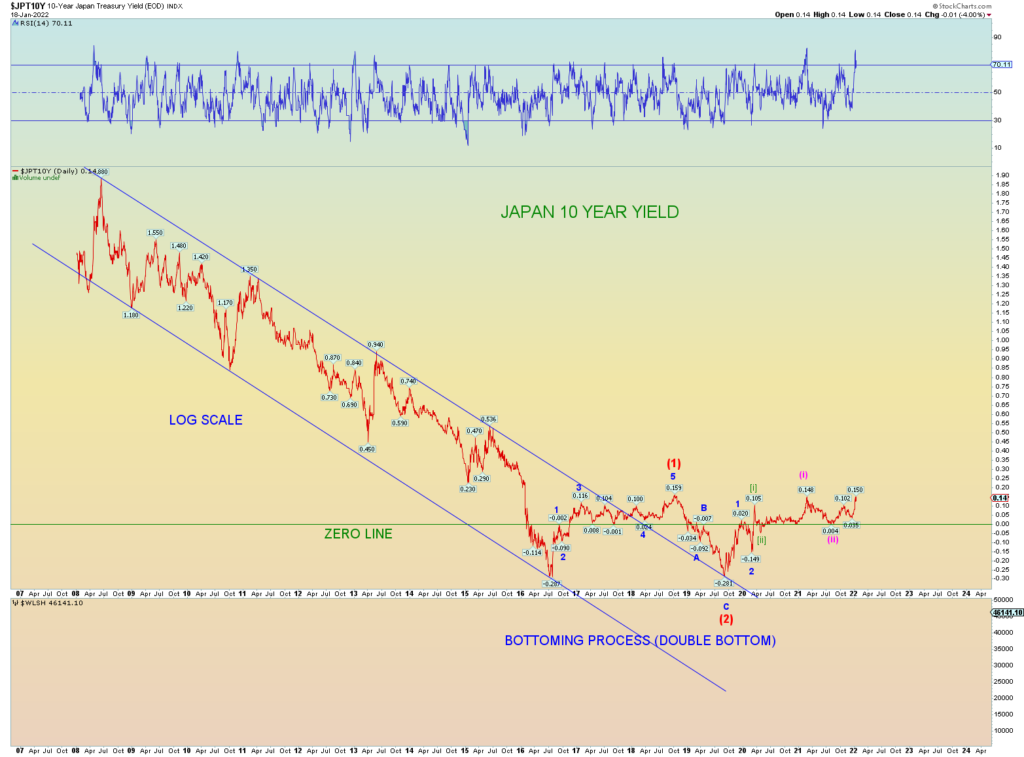

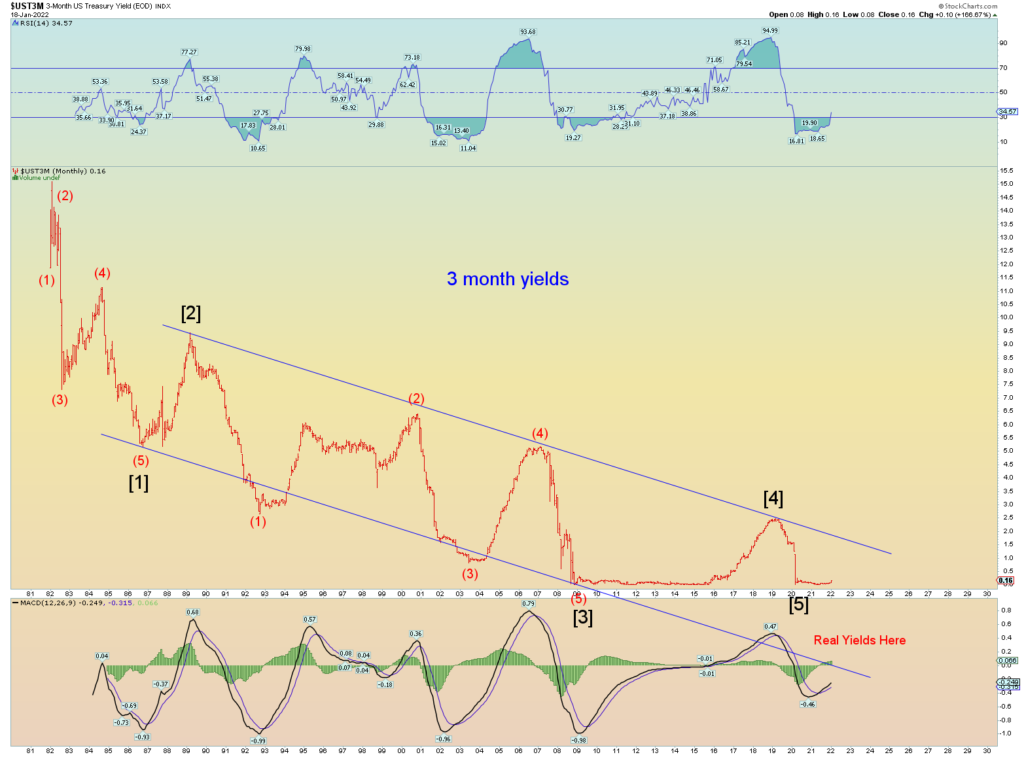

Isn’t it amazing that the entire world’s bond market moves in near unison (along with the stock markets). This is strong evidence of social mood theory aligned on a worldwide scale. And yields are finally on the move again – up.

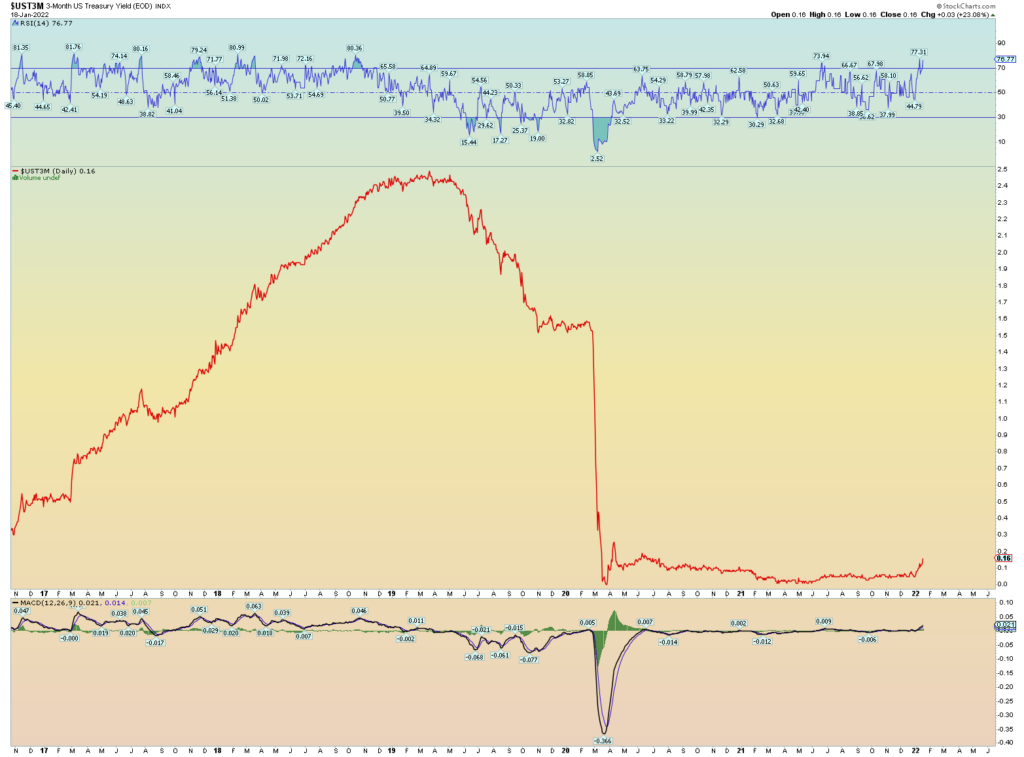

And the 3-month yields have ticked higher. This is the REAL chart that controls whether the FED will raise rates or not. The FED follows, not leads. They are NOT in control of anything.

Silver. It would look great if it finally broke higher into the $40’s. Solid support in the mid $20 range. With inflation roaring, I am surprised this hasn’t taken off yet.