The options are narrowing down about two main bearish counts on the Wilshire 5000, both are similar. The 3rd option is a new all-time high eventually takes place. But we have only just retraced a bit over 50% so far.

Backtest of the base channel.

Or we have a 1 – 2, [i] – [ii] situation. In this count, [ii] should ideally overlap in price within the prior wave 1’s price range.

If a 1 – 2, [i] – [ii] count, then a backtest of the long-term upper channel line will be a target.

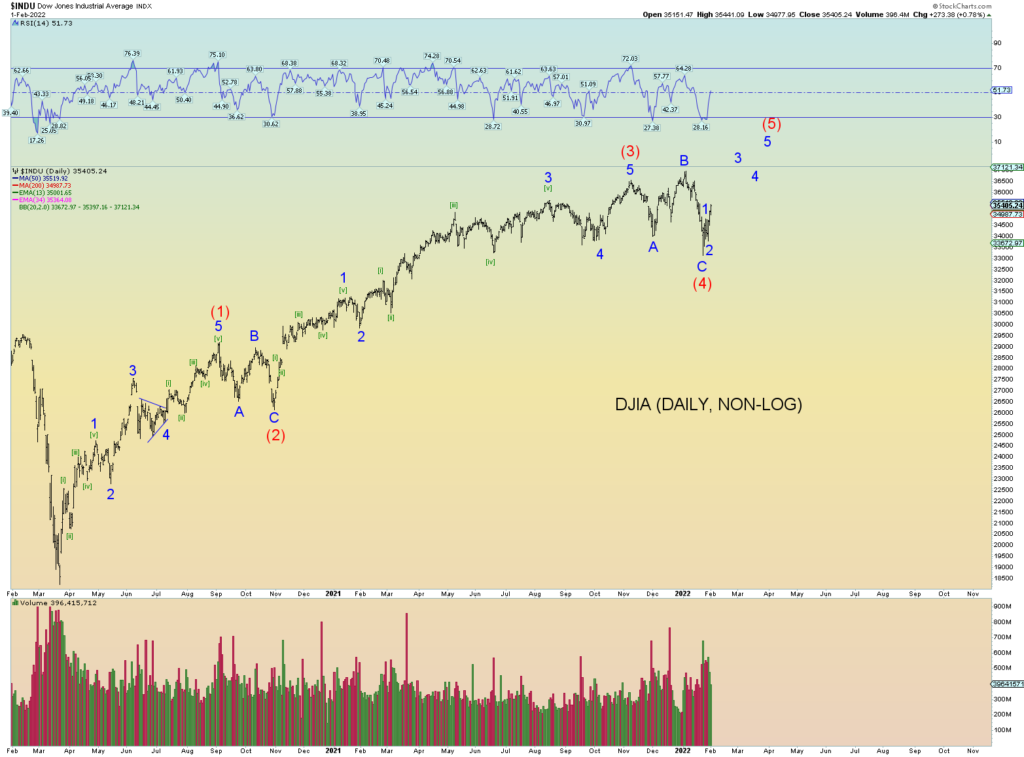

The bullish option count I mentioned is best shown using the DJIA as it has retraced almost a Fibonacci 61.8% from its peak. Again, I keep mentioning June 2022 is about when the world starts falling apart so maybe the market holds up a few more months as a result. We’ll see. But so far, we have not had a solid five wave down move and certainly internal market measures have not been extreme to the downside. We haven’t had a 90% downside volume day for instance. However, it’s not required.