The 233-year Grand Supercycle wave will not rollover easy. But rolling over is still the best count.

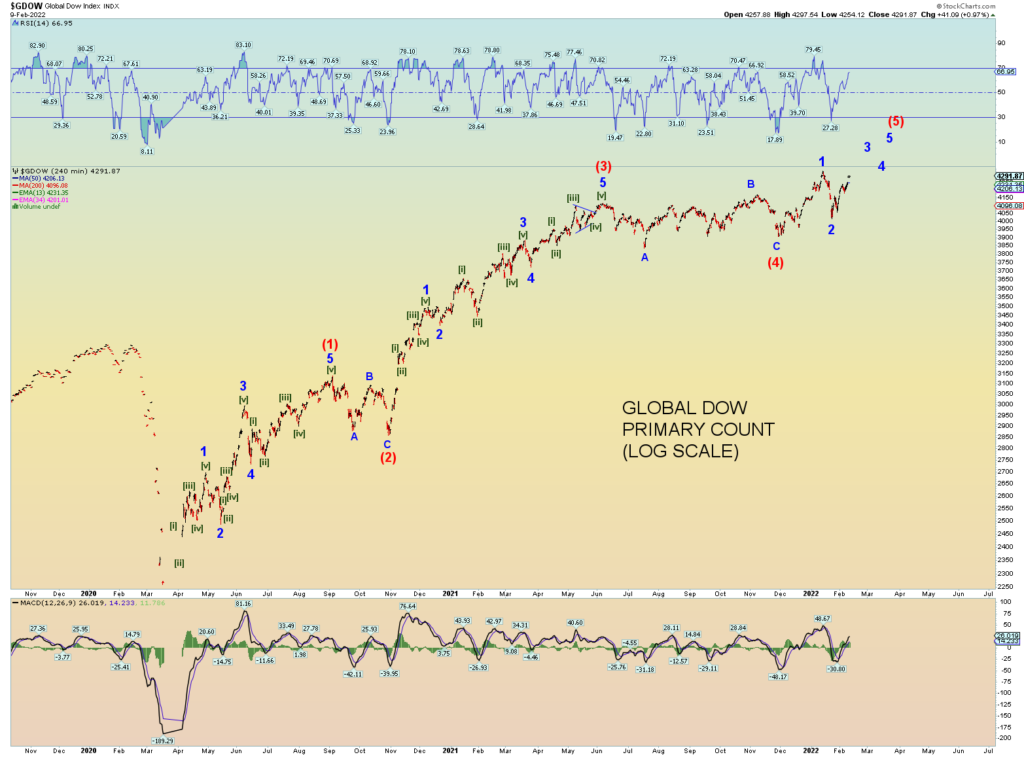

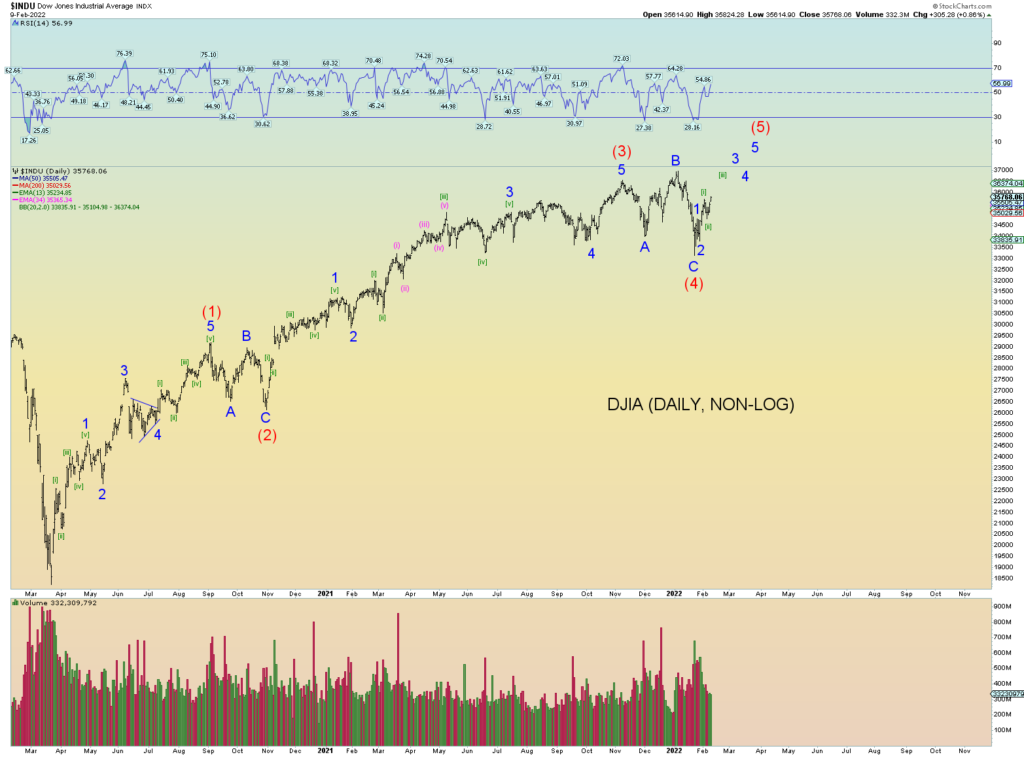

The NYSE and Global DOW is well positioned to make a possible new high. The DJIA is not looking too bad either.

The NASDAQ Composite is still about 10% from its peak. The S&P500 would come close to making a new all-time high if we continue to chug upwards.

I would think any new high in the DOW and or NYSE would result in a fractured topping process whereas the Composite and Wilshire 5000 do not make a new high. The S&P 500 would probably make it.

I am projecting ahead obviously since today was internally a strong up day on the NYSE. However, the Wilshire 5000’s pattern says it all. Prices could be merely backtesting the broken neckline as was talked about a few posts ago. So, we shall see.