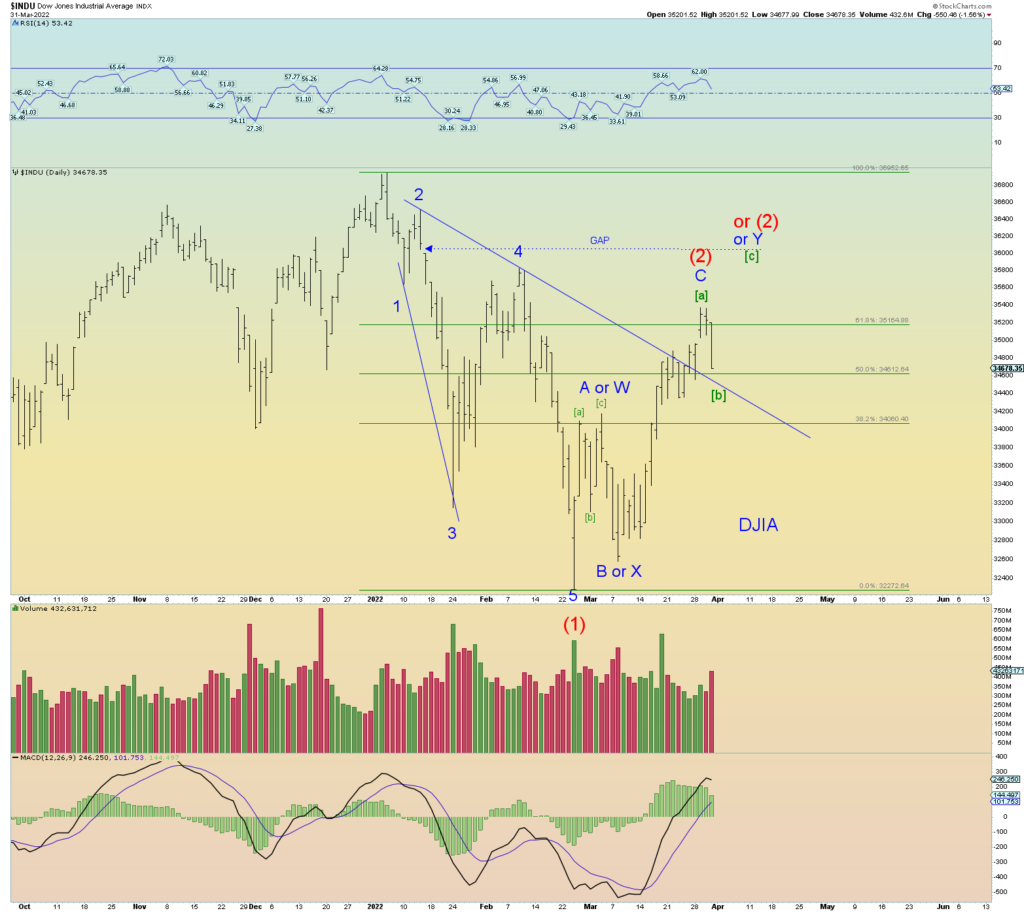

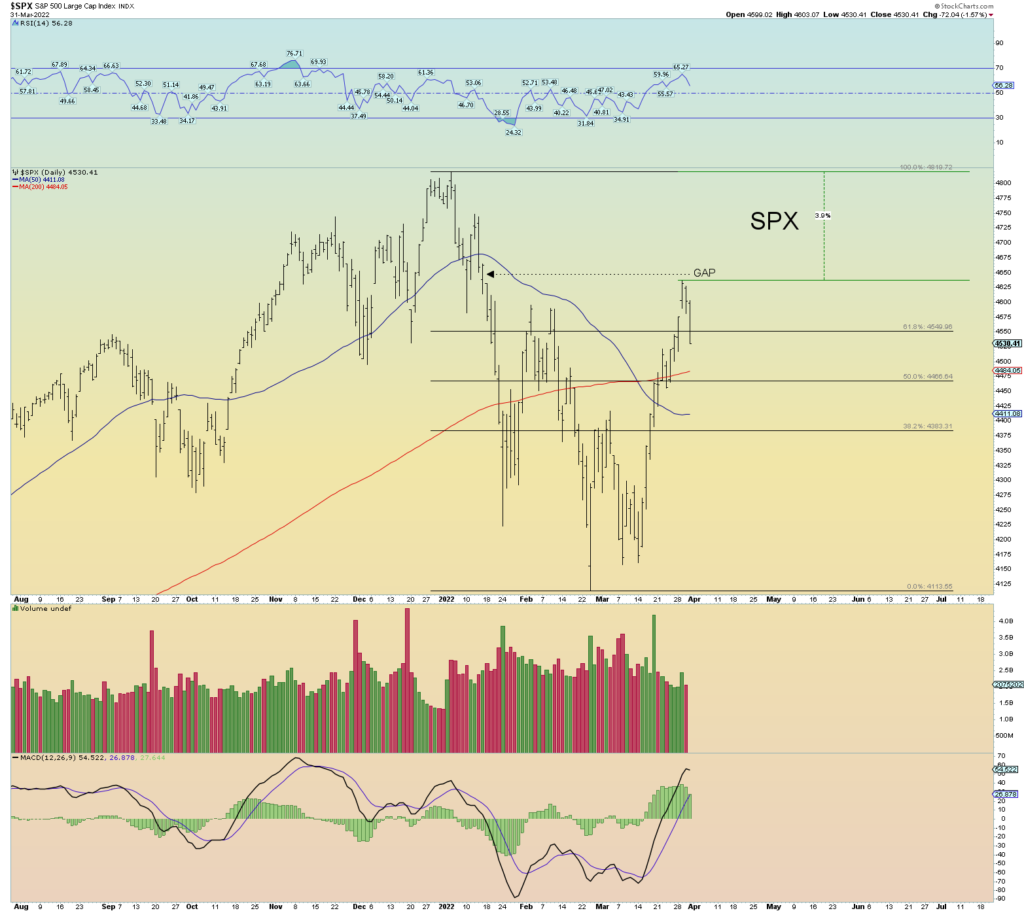

Wave (2) has retraced deep enough and long enough in time to be considered “over”. If it has another down-up “pop”, we have a count ready for it. We have 5 waves down forming a very satisfactory structure (despite the slight overlap of 1 and 4) and we have a solid 3 waves in the form of a sharp zigzag – normal for wave two – back up. Thus, no need to out-think things at this moment.

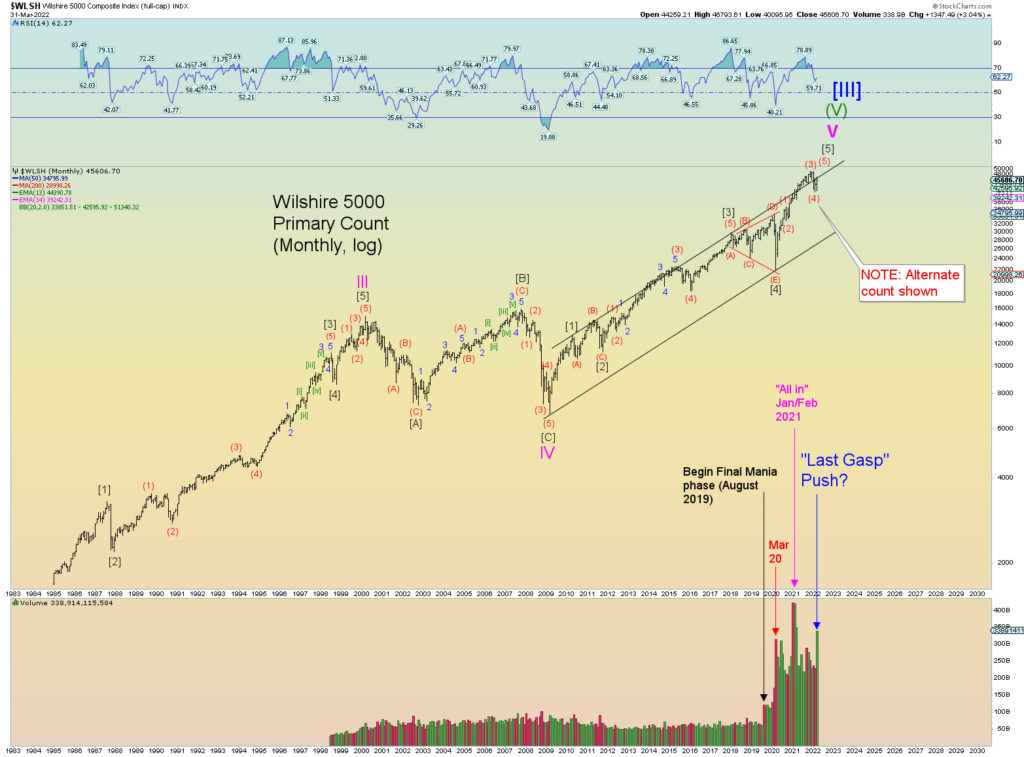

The long-term alternate count. The monthly volume bar doesn’t yet include today’s volume. Either the market is making a push toward a new all-time high as shown below in a wave (5) – this is the alternate count – or a lot of churn underneath with big money using this opportunity to sell into the pop. I believe it is the latter due to the wave structure.

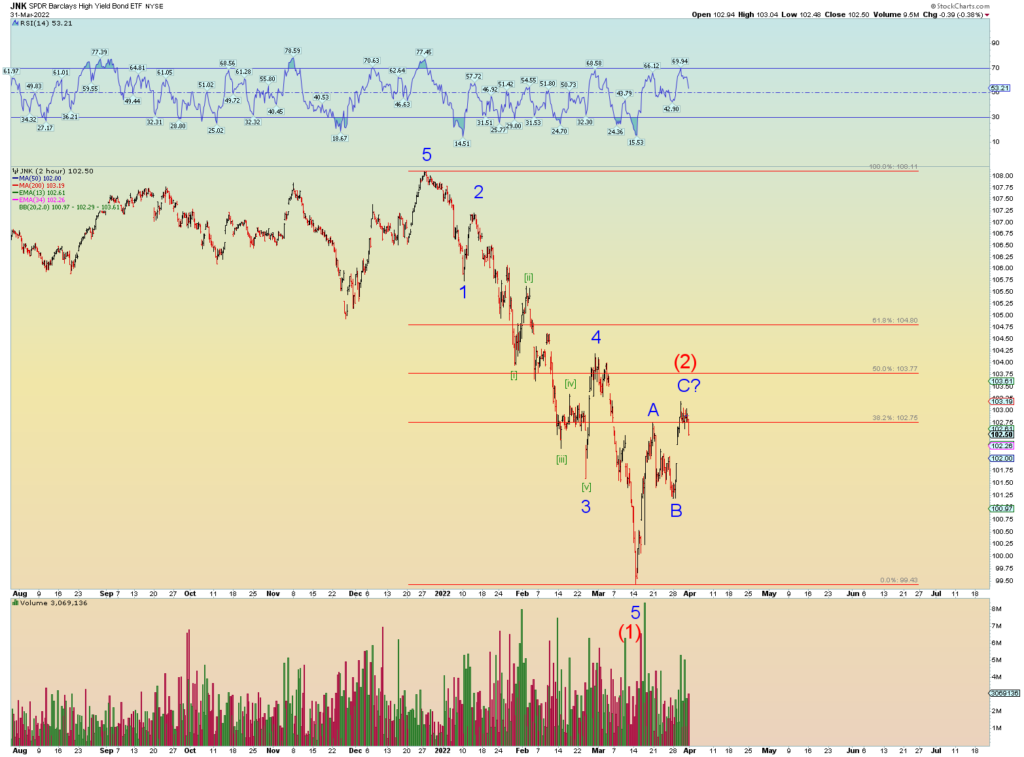

Junk is lagging which helps identify this is probably wave (2).

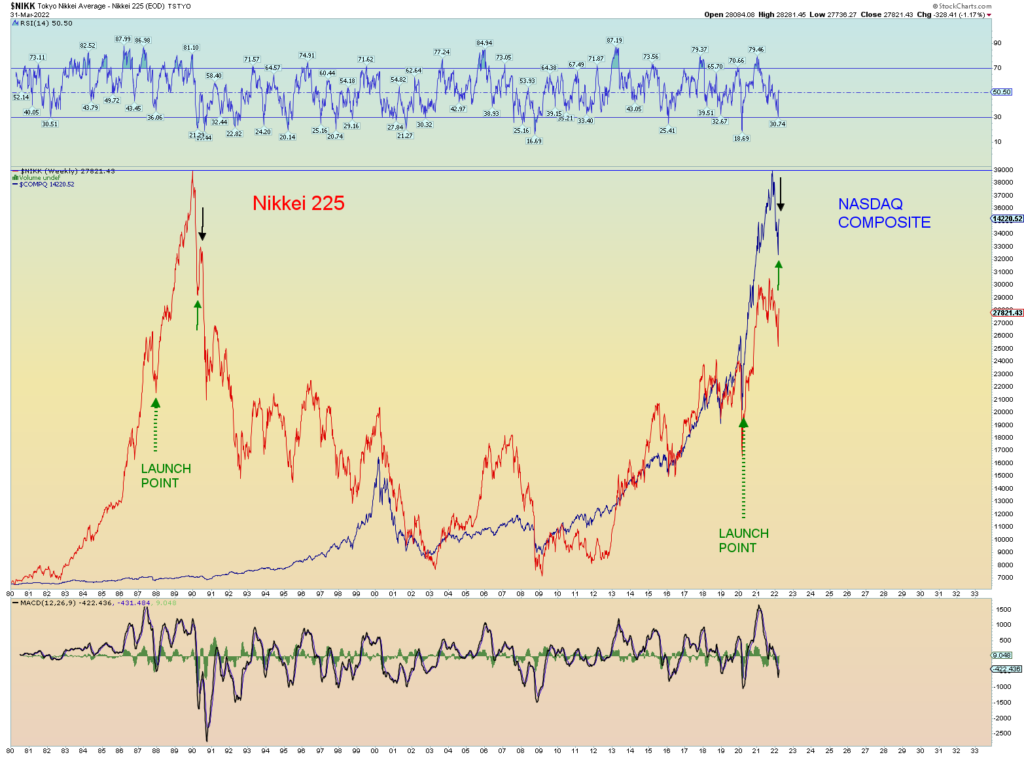

Comparison of the Nikkei of the last 1980’s and today’s NASDAQ Composite. Note teh comparison arrows and what happened to the Nikkei after the black arrow price point peaked. Prices basically dropped back to the final “Launch Point”. In today’s Composite, that would be the 2020 low.