Update:

Another good potential squiggle count is presented below. Basically, finishing the quarter on or near a rebound high, start April with a down move (perhaps opening gap down) and then move higher to meet the underside of the long-term upper channel line as shown on the weekly.

This count has us finishing up wave [a] of Y of (2).

Remember, the Wilshire has what appears as a misprint on stockcharts. I tried to cover it up. Basically, where wave ii of (iii) is.

Original Post:

I’ might have updates as the day goes on, if so, I’ll post here at the top of the post.

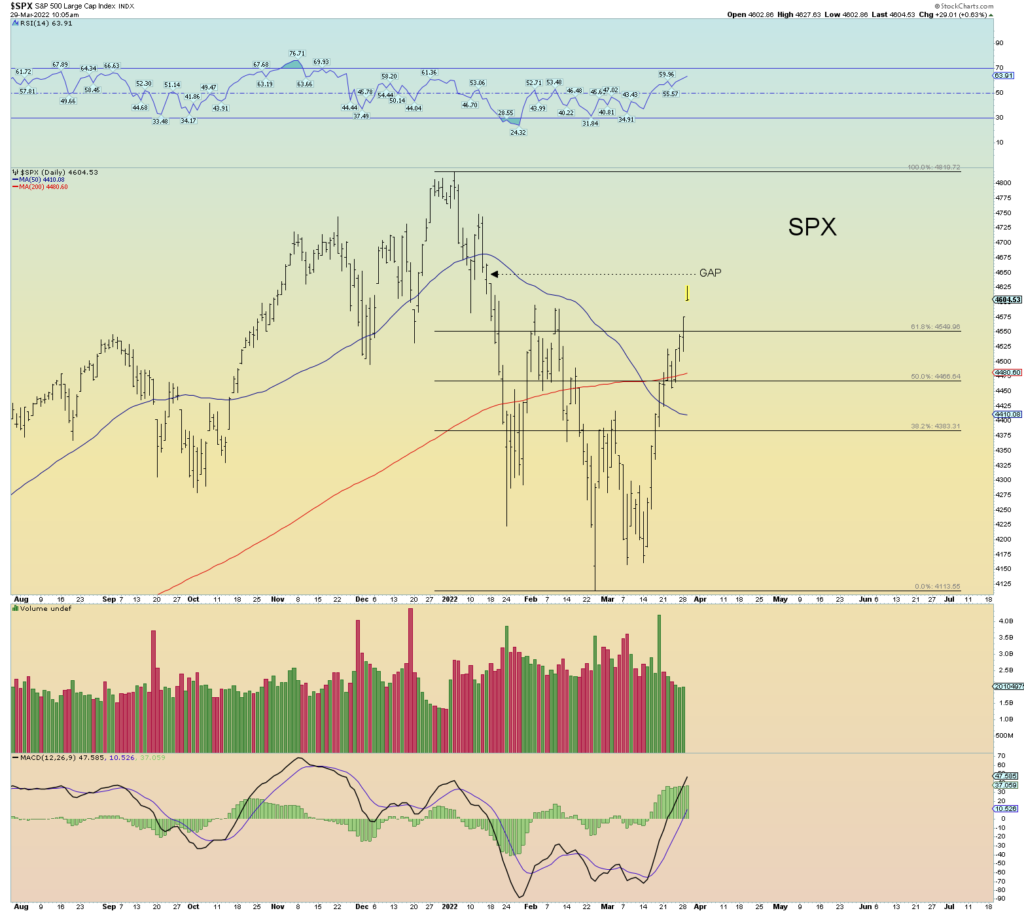

Wave (2) continues on without pause. In this over-leveraged market would we expect anything different?

The ultimate target could be a backtest of the broken long term upper channel line. At the top, prices overthrew this line for quite many months. Then it finally broke under. For the bull market to continue, prices need to get back above this channel line. It’s that simple, I guess. So here we are.

Definitely in the wave (2) target zone I described a few posts ago.