THE COUNTS

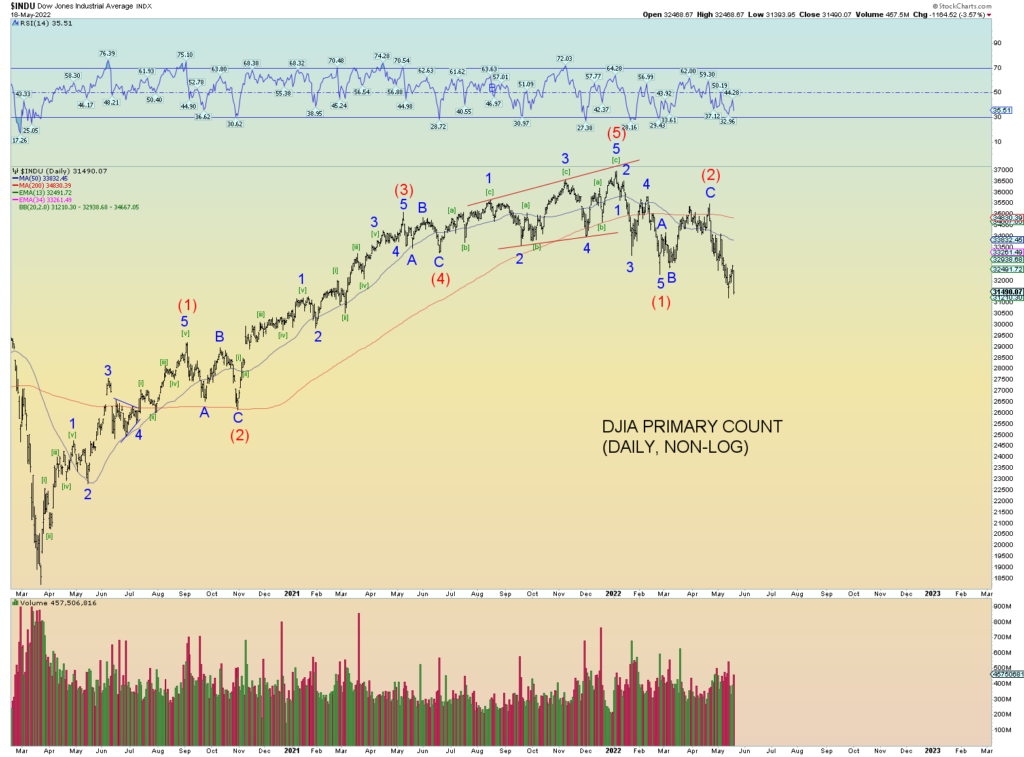

Well, after one day of contemplating a downward market pause of more than a few days, today’s price action and wave structures quickly jumped me back on the exact squiggle count that I have been going with for the last few months. As I said before, trying to guess the biggest bounces in an Intermediate wave (3) down is a fool’s game.

Regardless, it doesn’t matter. This blog is not a “day trader” blog, this blog is now all about the end of the world as we know it and teaching and preaching about it according to the bible, The King James bible only. And a 200-point SPX bounce would never change that underlying belief. Neither would a 500-point bounce for that matter!

Yet I do believe the collapsing social mood as reflected in stock market price levels are a clue to us. As is the deadly “vaccine” campaign and the Ukraine/Russia war and the possible rise of the REAL Antichrist – Zelenskyy.

So, we will keep going with what makes the most sense: That the market is impulsing down in 5 waves in both large structures and small and thus let’s just keep counting it for what it is showing.

Today we confirmed that yesterday’s high was a 3 wave move making it corrective to the downward impulsive trend.

Again, the long-term view is that the market will collapse to (3).

The truly amazing thing is that real economic hardship is upon us already yet look at the market on the monthly. Have we really collapsed to anything of ruin just yet? My take is that we will collapse all the way beneath wave IV – a cycle-sized wave – and then we can talk. We are just getting started folks.

CPCE perfectly positioned. Not yet even a sniff of true panic and collapse just yet.

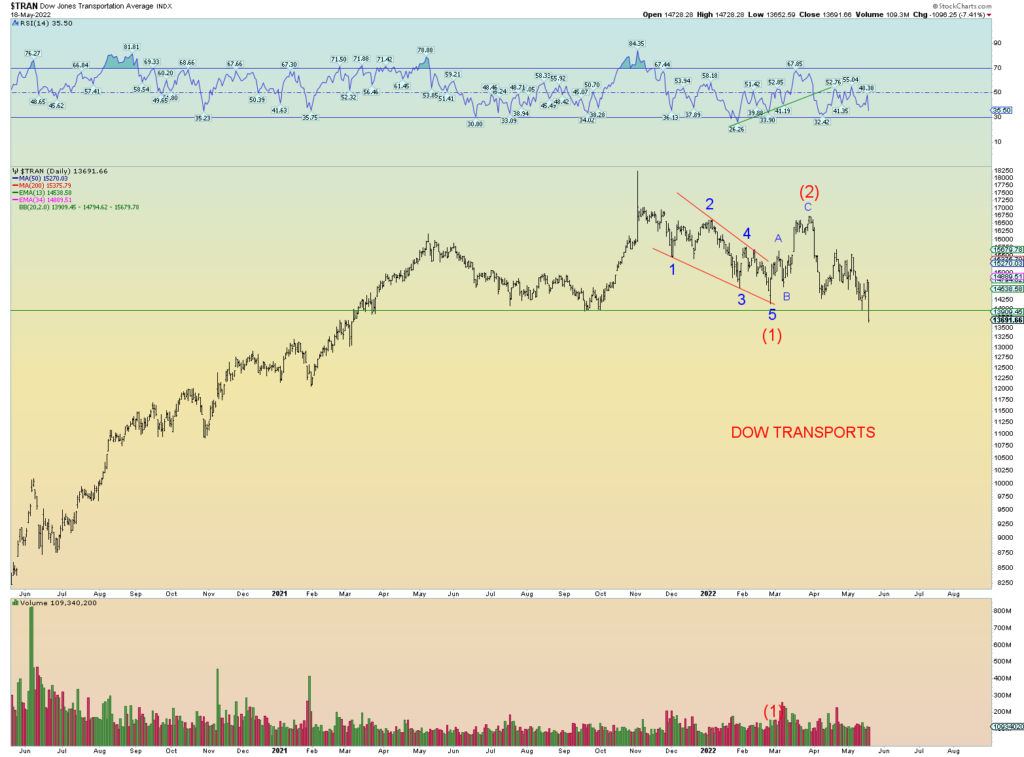

This is the main chart that caught my eye today/ Transports finally collapsed beneath long term support and confirming in full “DOW THEORY” in that it is following the Industrial average into a bear market, which by just breaking under today, is by definition just getting started.

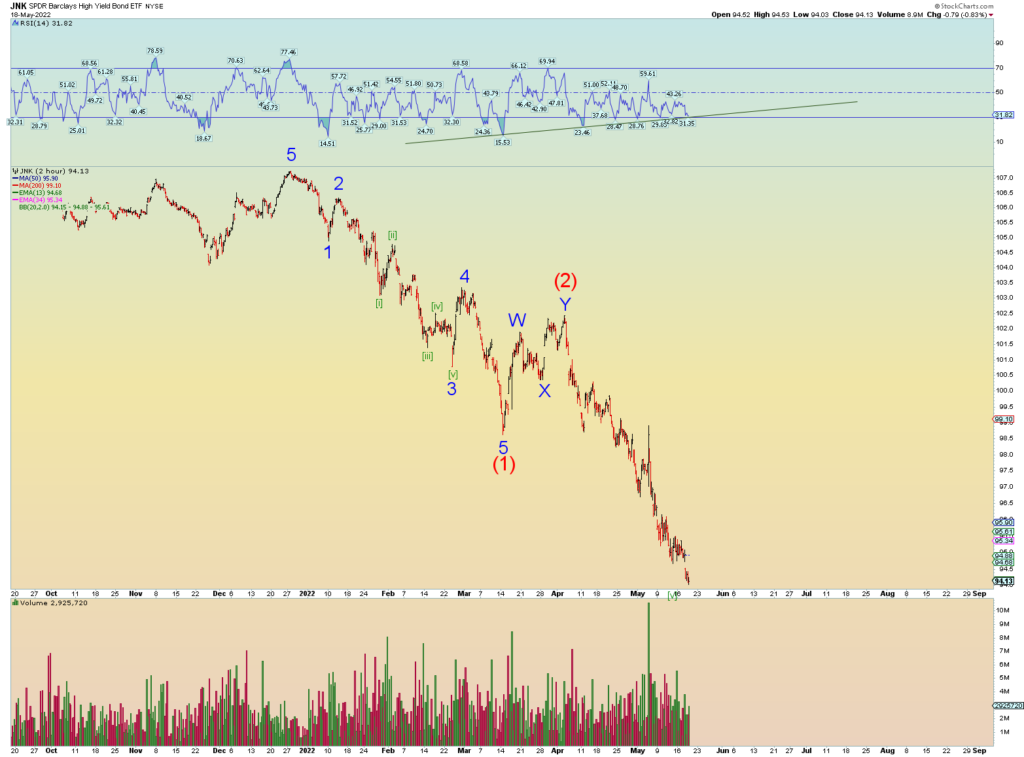

I don’t have a count for Junk. The trend is what is important. New lows today is what matters particularly since it has been a leading market indicator,