The NY Stock Exchange internal data is the worst selling since the November Wilshire 5000 high. This is a good clue that wave 3 of (3) down has kicked off in earnest.

Decliners vs advancers ended the day at 90.9% to the downside. Downside volume ended the day at 87.1%. Almost across-the-board 90% down day.

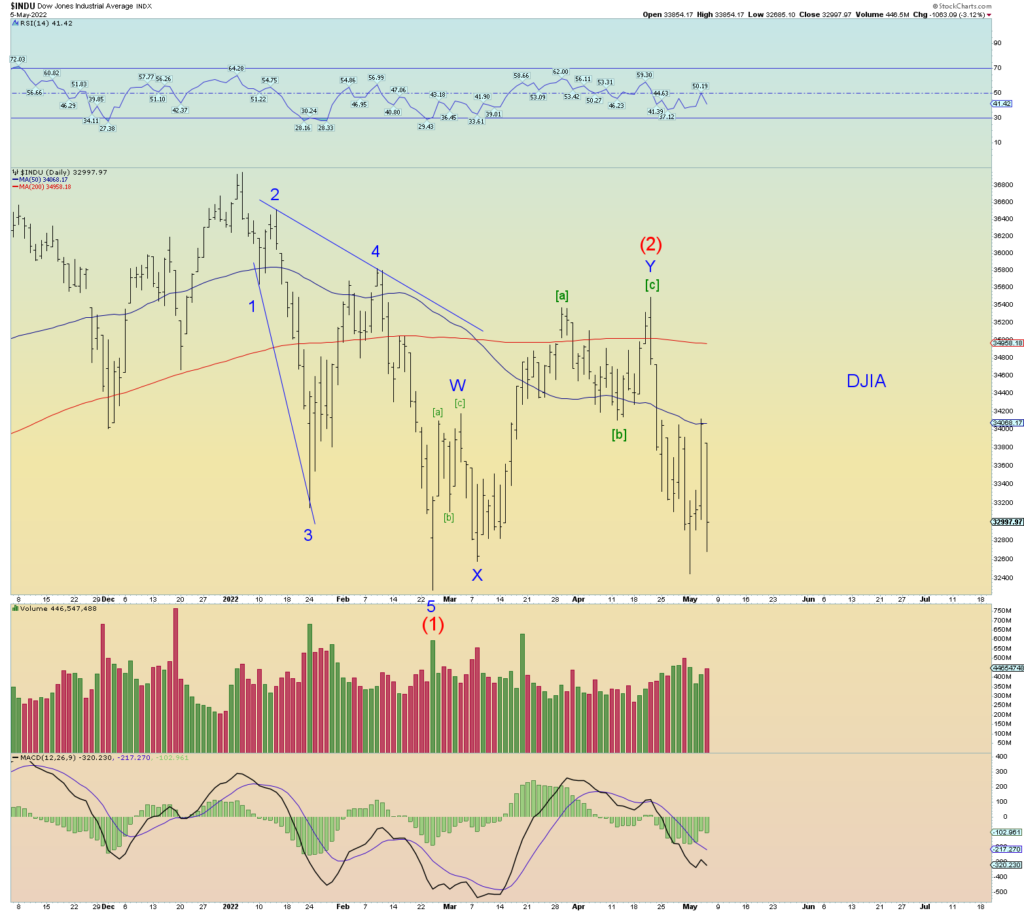

Primary count allows for a small pop tomorrow in (ii) and then prices should be taken lower than Minor wave 1. As Intermediate wave (3) unfolds, selling pressure and market internals should get very ugly indeed.

The downside leader – the NASDAQ Composite – advanced prices lower thereby maintaining its downside leadership position.

Another downside leader – junk debt – also broke lower in prices.

On the daily, we are not even near an oversold condition on the RSI. Technically the market is primed for a collapse.

The market’s “general” – the DJIA – has yet to submit to lower prices under (1). But the wave count suggests it will sooner or later.