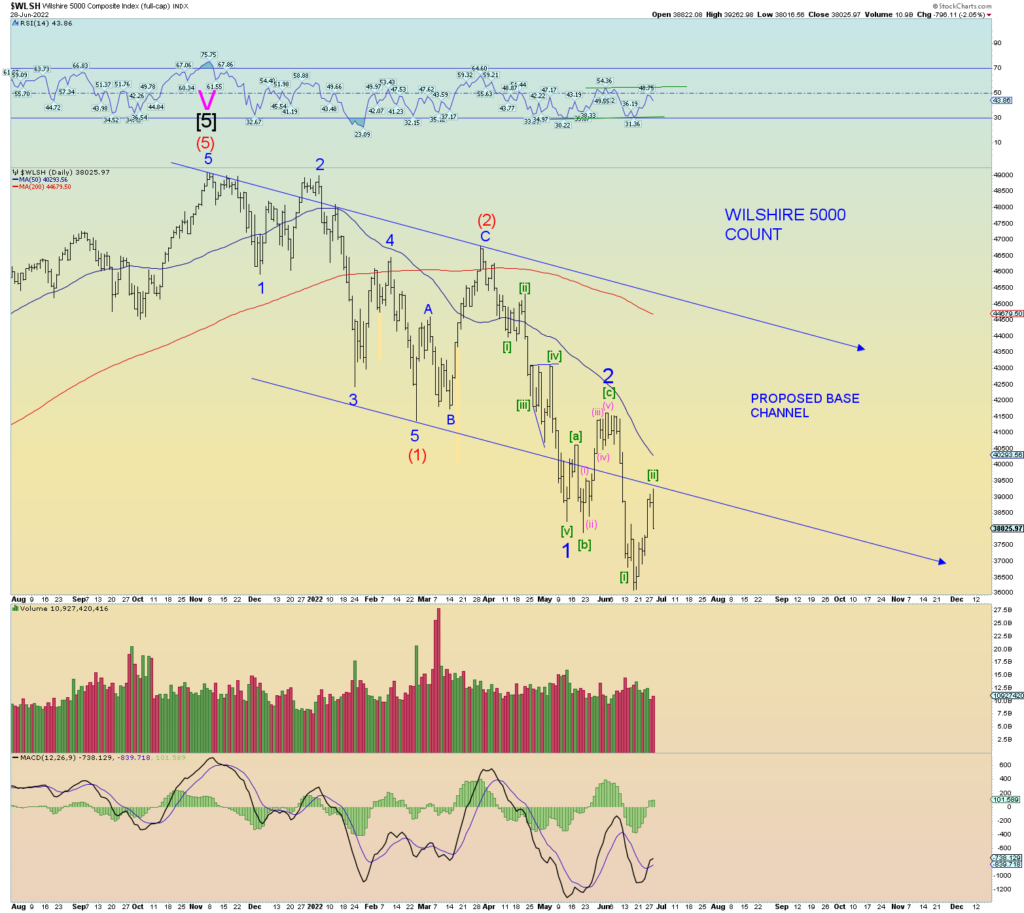

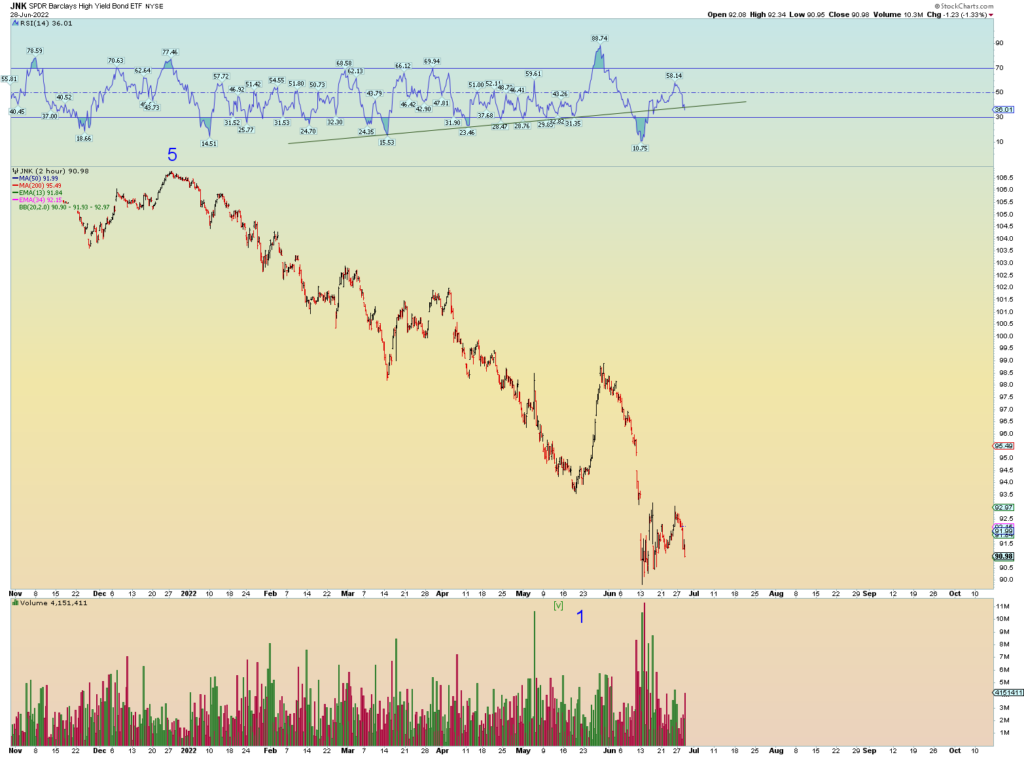

The primary count is that Minute [ii] of 3 of (3) topped in price today. This implies [iii] of 3 of (3) down has begun and should draw prices well below the previous low.

The DJIA fell 950 points after peaking early. The SPX fell 125 points intraday. This is a good start to the proposed wave [iii] of 3 of (3) down.

A pretty decent impulse wave lower. Perhaps due for an early wave ii bounce first thing tomorrow.

If Intermediate waves (1) and (2) formed a “base channel”, then Minute [ii] perfectly backtested this channel and was rejected. This implies that prices will accelerate downward in an acceleration channel.