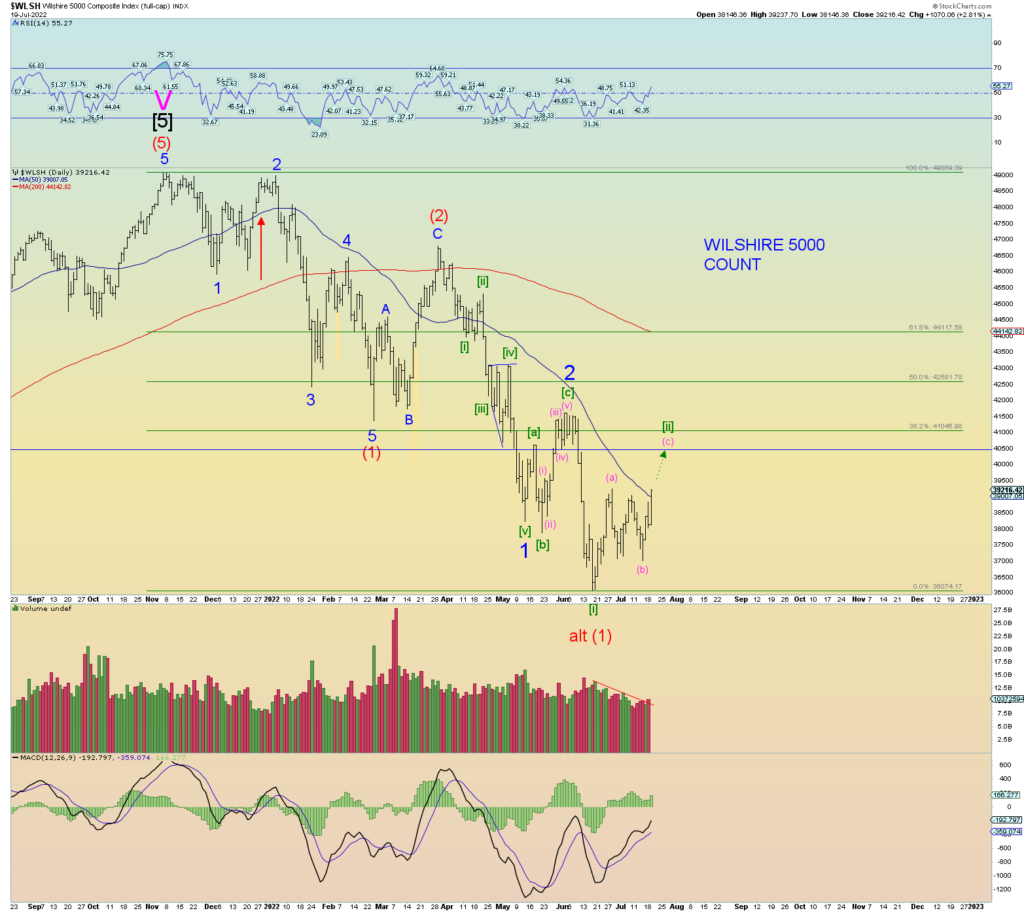

Has this rally surprised you? No, Elliott Wave Theory allowed for it or even predicted it. When we had a clear 3 waves down from (a) to “a of (b)” is when we realized that a more complex Minute [ii] or even a higher wave degree Intermediate (2) may be tracing out.

This was a very good reason to be cautious on “rushing” the bear collapse. But the bear collapse is indeed likely coming, this is the last hurrah whether or not the gap gets closed or not.

This blog said almost a month ago, that if that big fat open gap down was to be ever closed, Minute [ii] – at the least – would have to do the job. So, it seems to be panning out.

And finally, the 50 DMA has been reached.

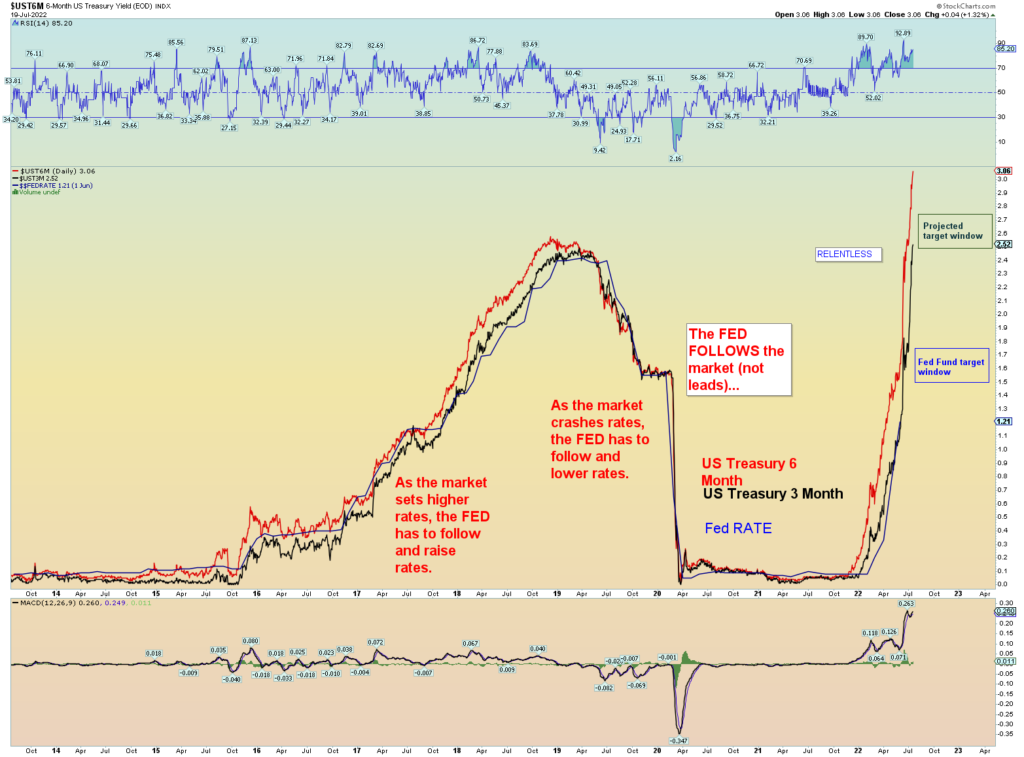

A big problem is that the market is pricing in, at the moment, at least a .75 rate hike later this month by The Fed. In fact, it is on the verge of signaling a full 1-point rate hike.

Higher interest rates bring about debt destruction, defaults, bankruptcies. At some point if interest rates get out of hand (they will) it will bring about a cascading default tsunami. Ultimately asset deflation of the higher end will occur (real estate, luxury goods, the markets). Yet at the same time due to constrained markets and broken “just in time” supply system (the effects of supply and demand) the world has depended upon, lower end rates will stay elevated just enough to bankrupt the poor people.

So, asset deflation hurts the rich, yet a continuing – and intentional – supply and demand disruption will continue to destroy the poor. $5 a gallon gas does not hurt the rich, but a massive high end asset inflation does. A collapsing Ponzi scheme worldwide market will bring about massive deflation. A broken supply system will ensure the poor do not “benefit” from a deflationary overall environment.

I have always called this a “rising interest rate inflationary depression”. A depression in which the high-end assets deflate but the low-end assets (food, energy, basic living needs) remain elevated thus destroying both ends of the spectrum at the same time. I am theorizing that the world is about to enter this phase if not already in it.

Inflation is not just a monetary effect, supply and demand is also a factor along with of course social mood trends.

I liken it to an analogy of a hot air balloon that is sent into the stratosphere flying so high that the human passengers perish due to the ascent into the thin oxygen “death” zone. And the sheer height of the balloon eventually brings about its own demise: ice, weight, and a lack of oxygen will bear upon it until it reverses and deflates at a rapid rate and at some point, rips apart on its descent.

And even if the occupants of the balloon survived the very peak ascent point, the resulting descent and crash and destruction of the hot air balloon will result in them dying, nonetheless.

I kind of see this grinding inflation in light of this high-flying balloon analogy. Slowing taking us up to 40,000 feet and we either die outright, or we die when we hit the ground because our very balloon gets ripped beyond repair on the way down.

What would 6% interest rates do? What would 10% do? What would 18% do? Certainly, no longer inflation, but hyper deflation.

It really doesn’t matter anymore; forces have already unleashed that are beyond anyone’s control and the inevitable is massive asset deflation and collapse of the system.

And if they printed money to try and reverse it, it would still result in collapse of the system. But that is the entire secret strategy of the elites in charge: to collapse the system one way or another so they can bring about another system in their image and liking. The Beast system to come that the bible predicts.