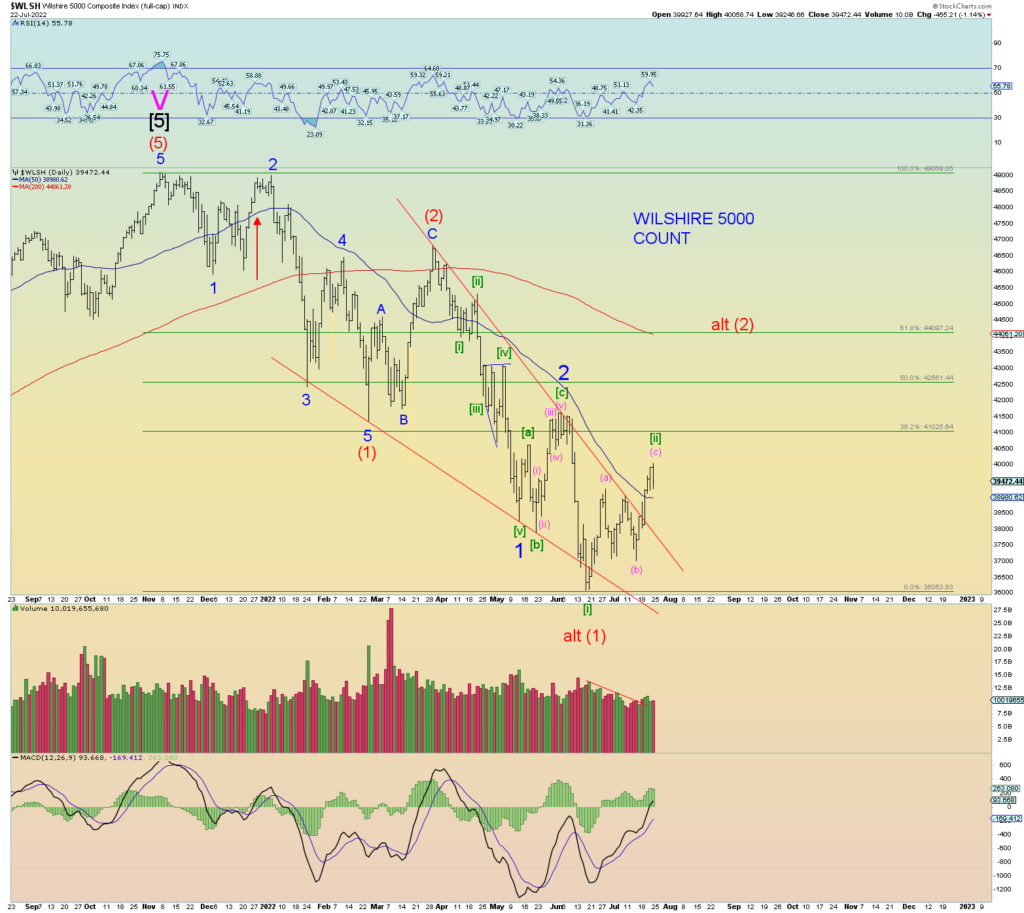

Well, we have reached our wave [ii] target in a most excellent wave structure. The major gap down is not quite closed (5 SPX points).

The alternate count is that the 17 June low is actually an Intermediate (1) wave low – a leading diagonal triangle falling wedge pattern. This would imply a significant advance in price over the next month or so culminating in Intermediate (2). A price rise above blue Minor 2 would be a confirmation.

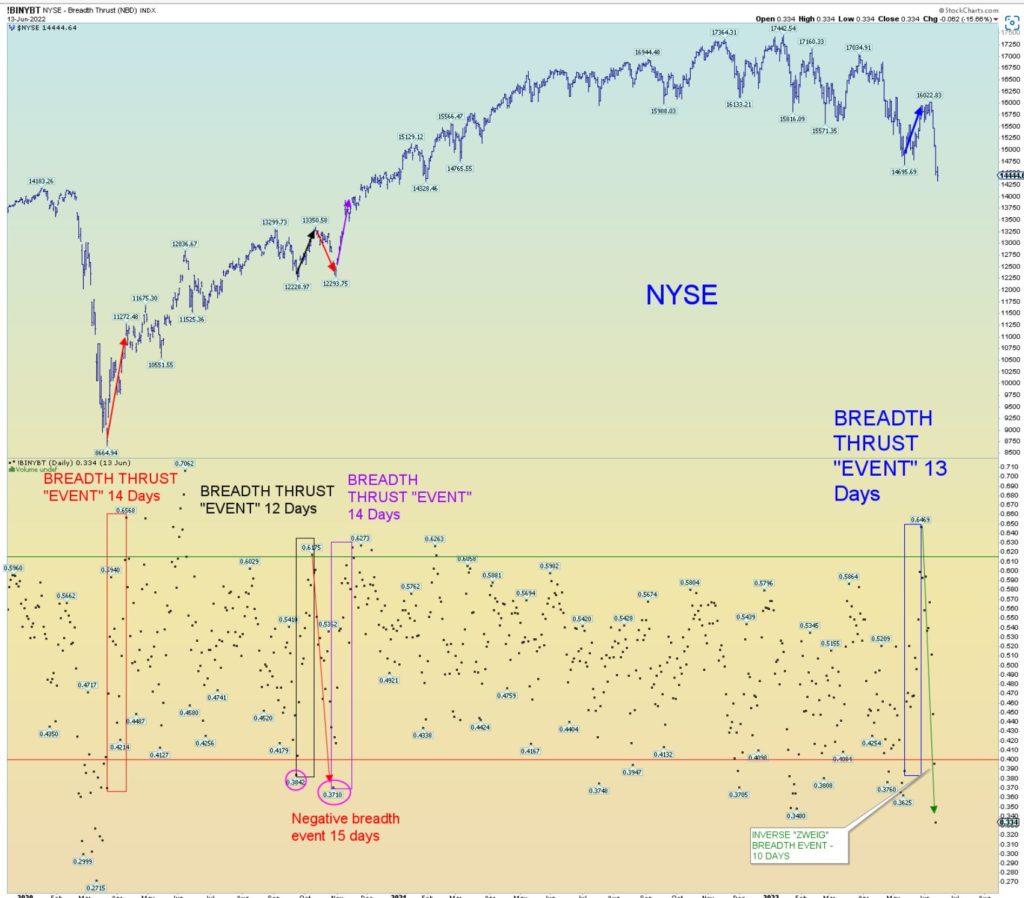

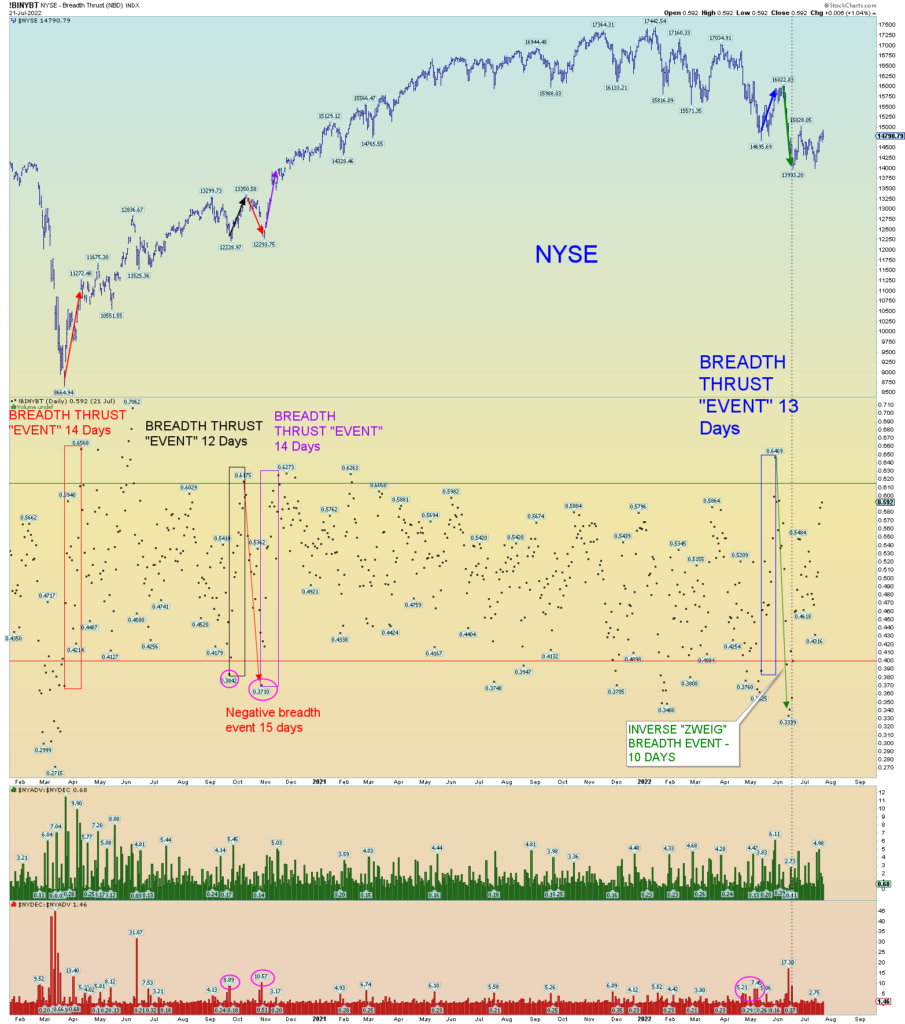

But do not disregard the “negative” Zweig breadth thrust event that has occurred and has not been “overridden”. Recall this chart from 13 June:

The updated chart through yesterday’s data. A decent poke higher yet the time frame is not significant, nor has it reached above 61.5. So, one must assume the market is still in enthralled by the negative 10-day event. The NYSE has diverged from the overall market. It has not risen above its previous pivot of 15,028.

We shall see. For example, a price move thrust higher Monday to resulting in a reading above 61.5 would be an upside “surprise” that would be very concerning for the overall bearish count.

Therefore, the market is at a major crossroads.

The weekly shows a very slight positive divergence in the RSI but it is a weak signal and considering the negative breadth thrust event as discussed above, we have no reason to change our count to the alternate at this time.

So, we are at a major crossroads for the overall market. Regardless if it rallies in a surprise (2) it is still doomed overall.