UPDATE:

The Wilshire 5000 is in a tighter and tighter contracting triangle pattern where even wave (e) makes its own mini triangle. It can also be viewed as a bearish head and shoulder pattern. We shall see, we probably won’t have an answer until next week.

The primary count is Minute wave [iv] because we do not have a 5-wave structure down from peak.

UPDATE:

The top squiggle count may be unfolding:

UPDATE:

Interesting thing of note by Zero Hedge in that the number of people holding 2 jobs is at an all-time high. Here are my off-the-cuff observations of what is going on in the US labor market at the moment in no particular order:

1) The overall economy has yet to truly contract via bankruptcies and voluntary closures. This is a reflection of sentiment refusing to “let go” of the old bull market business cycle. Businesses remain intact by taking on more and more debt. And that was of course very easily done with interest rates, of even junk debt, at all-time lows for quite a length of time. But that dynamic is changing as short-term rates have shot up quicker than anyone imagined.

2) As far as the labor market, people need 2 jobs to survive this inflationary environment. And the businesses struggling to stay alive are paying for that labor. Overall customer service has taken quite a hit as a result. No longer is the customer always pandered to. Except the uber rich of course.

3) The covid “vaccine” has taken an obvious toll on people. Excess deaths and serious injuries as a result of the vaccine of prime working age people are evident everywhere that reflects both in hard statistics and anecdotally. With businesses trying to stay afloat, many in serious debt, and labor in short supply due to vaccine injuries and death, we have a serious divergence occurring. Eventually this serious divergence will resolve itself with businesses closing due to bankruptcy or lack of experienced, reliable labor.

4) Today’s youth – what is it gen Z? (I lost track) are not equipped for the vigors of the working life. There are millions of young 20-year old’s whose brains have been permanently injured by SSRIs such as Prozac. They forever live with their aging parents (many who now work 2 jobs) living an unproductive life relying on government handouts. Even the ones who have dutifully gone to college are overloaded with massive student loan debt and have started life in the hole. Thus, the entire Ponzi system is primed for collapse.

5) So, there is not up and coming generation to rescue Babylon USA. The birth rate is plunging. We are a dying empire and aging baby-boomer septuagenarians, and octogenarians know that their time is running out on the dream of the New World Order. They hate Jesus Christ and why would they care if they wreck the world? That was the plan all along.

In conclusion, it has all been supported by going against God and piling up massive Ponzi scheme debt to support it all. Having sucked every last soul on earth into the global system, the power-in-charge are in perfect position to pull the rug out and let it all collapse. This will be done by purposeful warfare resulting in global financial collapse. And global collapse will result in great famines occurring.

The bible promises it. God promises the end will not be a utopia, quite the opposite. The end will be a 7th Babylon New World Order, a one world religion not based on Jesus Christ, but of the Antichrist and the Devil, and a one world currency (mark of the beast) to weed out and kill the people that are hated the most: bible-believing Christians.

The fake Christians, all the ones who teach a “repent of sins” “works” based salvation (which is most denominations) – who are not saved – many will take the mark including a plethora of Catholics, Orthodox, Protestants, all Mormons and other such cults. Even a lot of unsaved Baptists. And make no mistake, the bible clearly teaches that taking the mark damns you to hell.

UPDATE:

The NYSE. This backs up the idea that Minute [iv] has occurred or is occurring. The “Big Board” index is diverging from the overall market.

Today’s low is actually a critical level for the continuing bull count of Intermediate (2)

UPDATE:

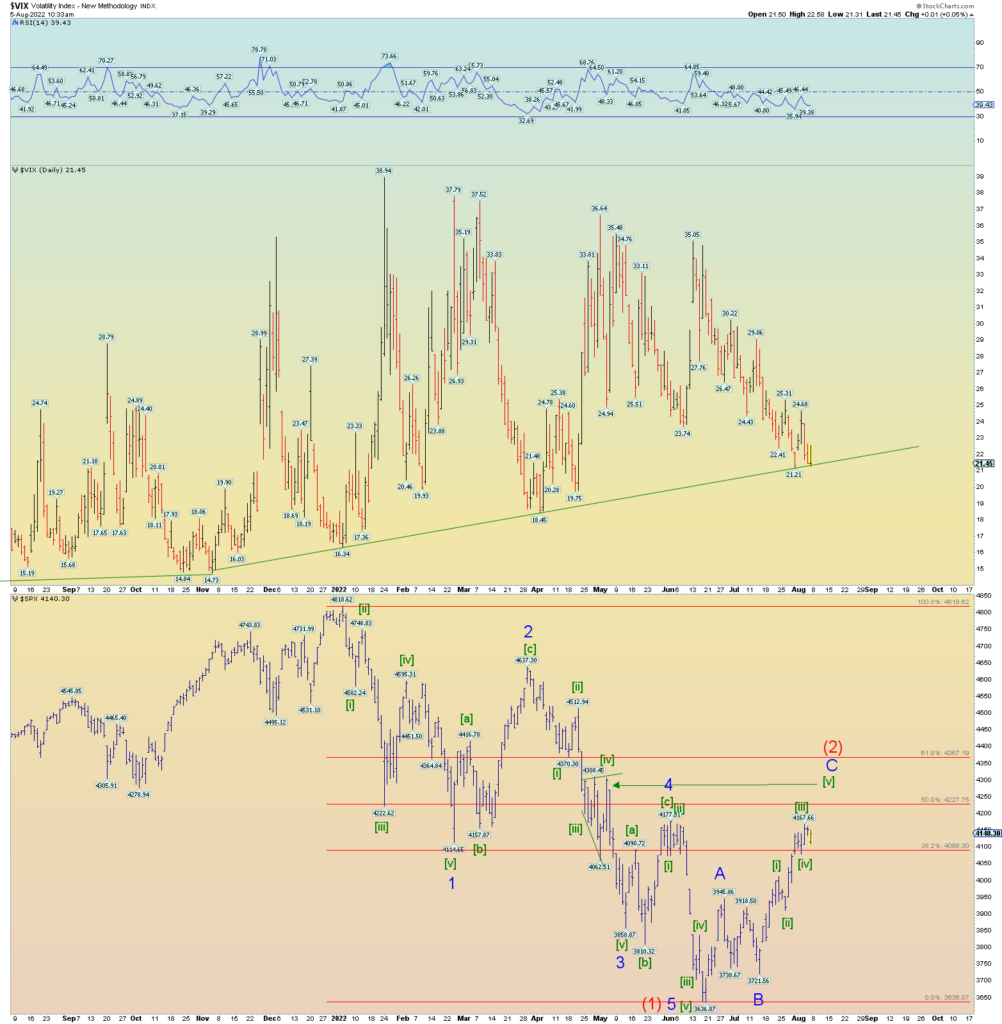

The VIX trendline is most interesting. It is under assault and if the trendline breaks down, the SPX will likely eventually reach SPX 4300 area and the still open gap at the top of the previous wave [iv] of 3 of (1).

UPDATE:

A couple of other squiggle options I’m looking at. It really is just parsing things to the “nth” degree which is half the fun of counting waves. The main idea is that Minute [iv] is in here somewhere….

We are at a good potential identifying spot in the wave structure. Futures indicate a hard open down, and this could be the final wave of Minute [iv] of wave C of (2).

So, this assumes today’s open will eventually bottom, perhaps even at the end of day, and a subsequent wave [v] rally will occur either starting today or next week.

The “key” wave marker is the price point of [i] of C of (2). Prices should not breach that peak if this count is correct. If they do, it is a bearish development.

A more detailed look at the squiggles. The entire pattern takes on the form of a sort of expanding triangle. However, I have it labeled here as an expanded 3-3-5 count.