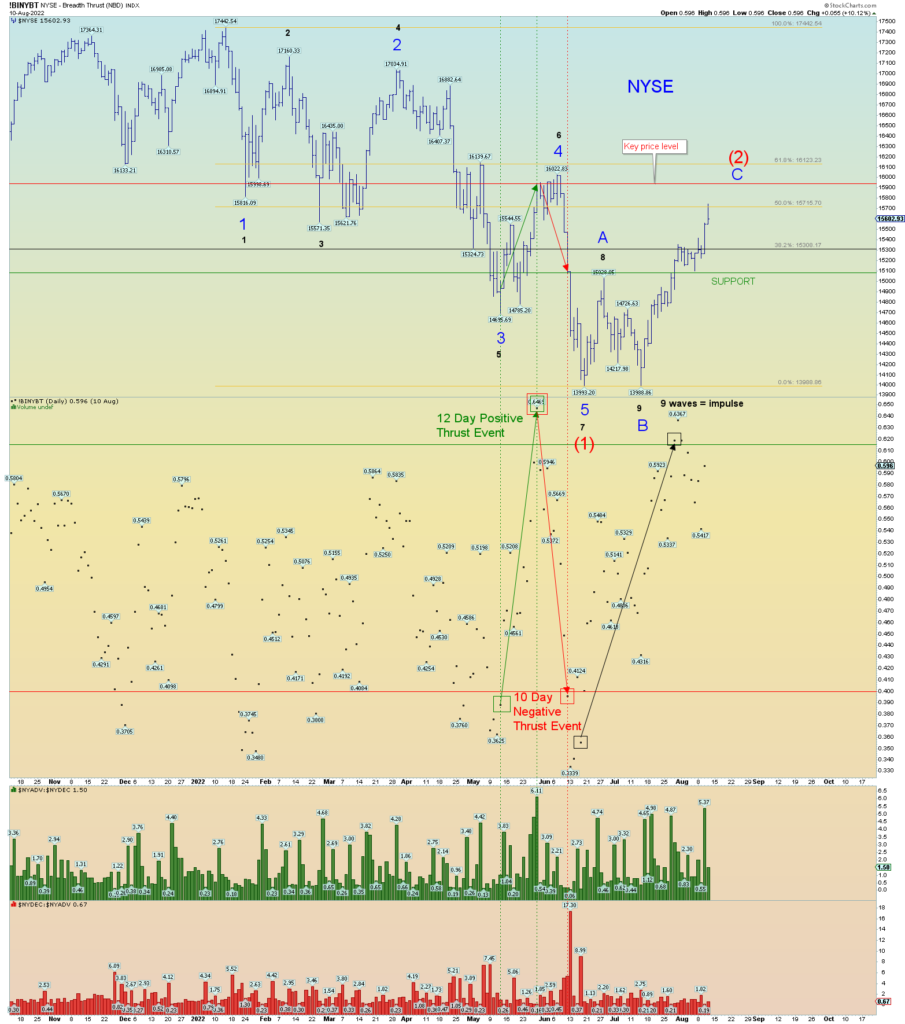

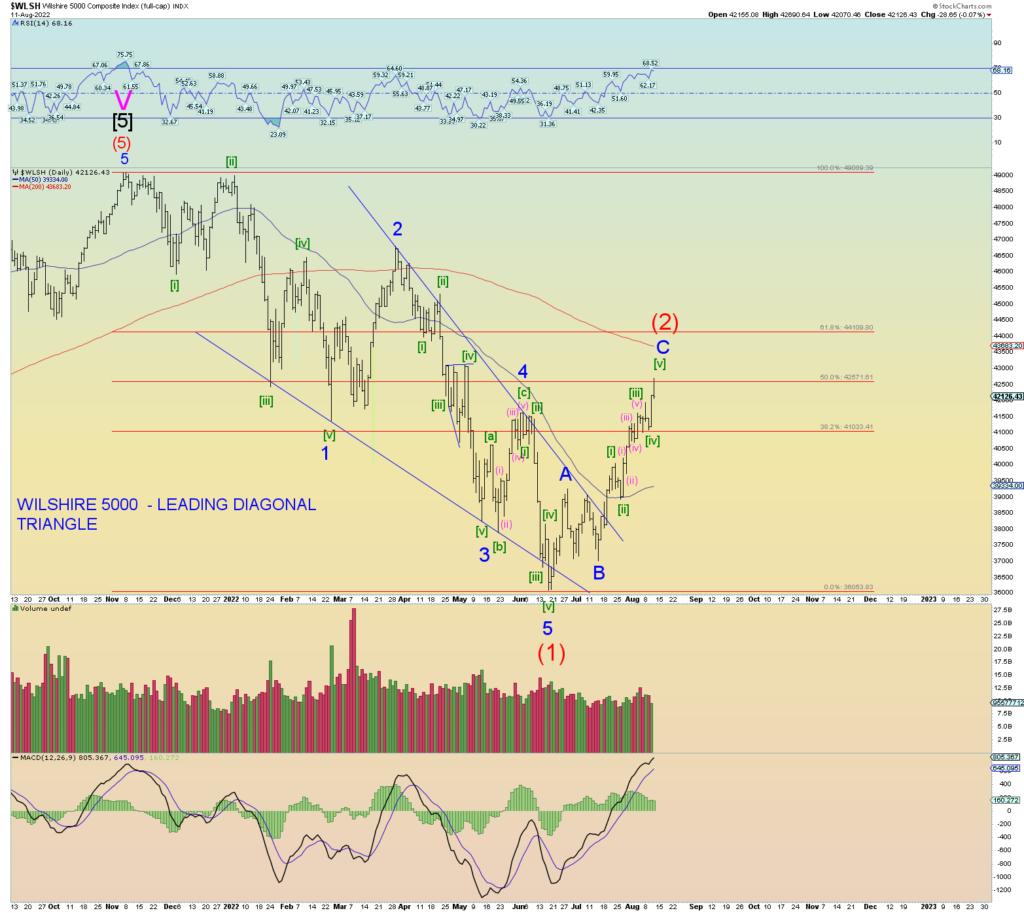

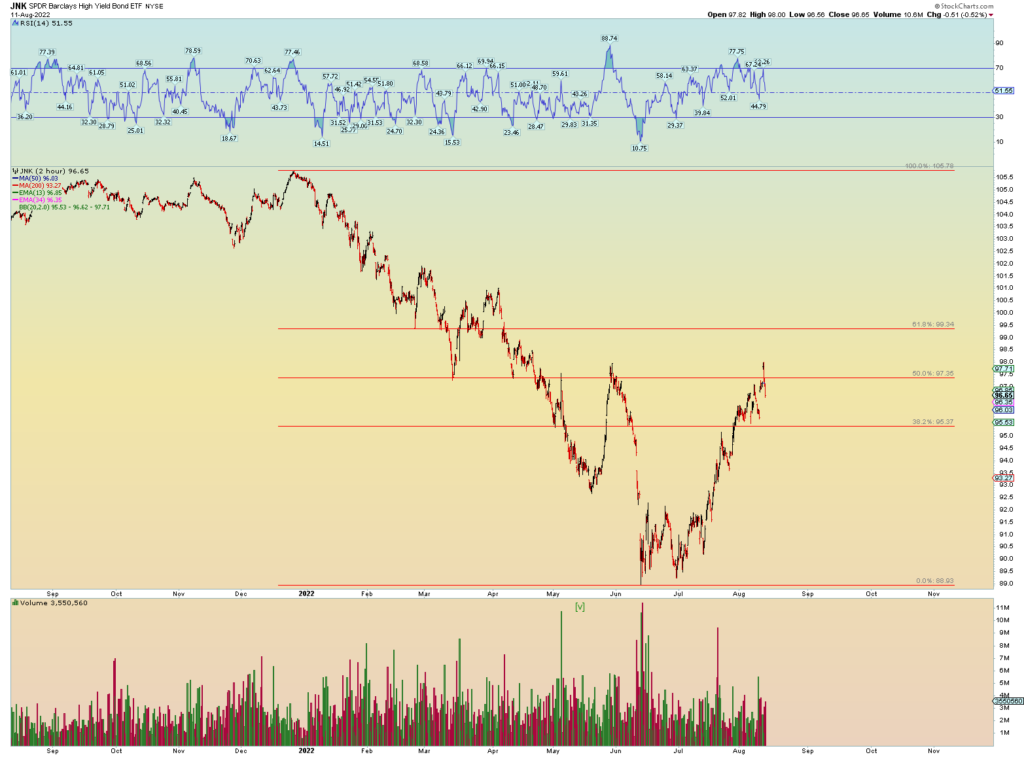

More “three” wave structures.

Or:

An example of bull market arrogance. Everyone wants to know if the bear market is “over” or if there is another “technical” price dip to test some magical support line. Or whatever. The entire thing is predicated on “the market always goes up”.

There is a complete disconnect with reality. The ironic part is that Elliott Wave theory has always taught that stock prices move not on any external event, but rather on social mood waves of either expanding good mood or contracting bad mood. Today’s market has again discounted valid EW theory and have embraced “market flow” theory. Or FOMO (fear of missing out).

How about fear of being trapped? Hardly. But that is where the market is eventually heading.

So, have stocks “bottomed”? That is not the relevant question. The relevant question is: Is the world ending as we know it?

Yes, it is, and stock prices will eventually reflect that reality.