Babylon USA keeps poking the Chinese Pooh-Bear in the eye. But that was the intent all along. Just like we poked the Russian bear until it reacted. It will not be any different with the Chinese. Eventually they will respond with war sooner rather than later. The deteriorating social mood trends of the last many years predicts it.

Ok, let’s put aside end times theology and bible prophecy for just a minute and look at things through the “lens” of social mood wave theory. The “true” social mood peak was in the year 2000. The biggest wave degrees – Millennial, Grand Supercycle, Supercycle peaked and have “rolled over” for some 22 years now.

It’s been quite a while since I have shown this chart. This is my representation of the hierarchy of social mood waves and its overall effect. The biggest waves at Grand Supercycle degree have been rolling over for some 22 years and counting. And each lesser wave degree has also rolled over in mood. This explains why the 1990’s were truly an ascension of overall social mood peaking at about the year 2000. But even then, the 2007 rebound was certainly better than what is going on today.

Today there is nothing but negative mood “rot” underneath. And eventually once every wave degree rolls over and they all align in agreement to the negative, the collapse will be historic. Cannot you feel what’s happening underneath??

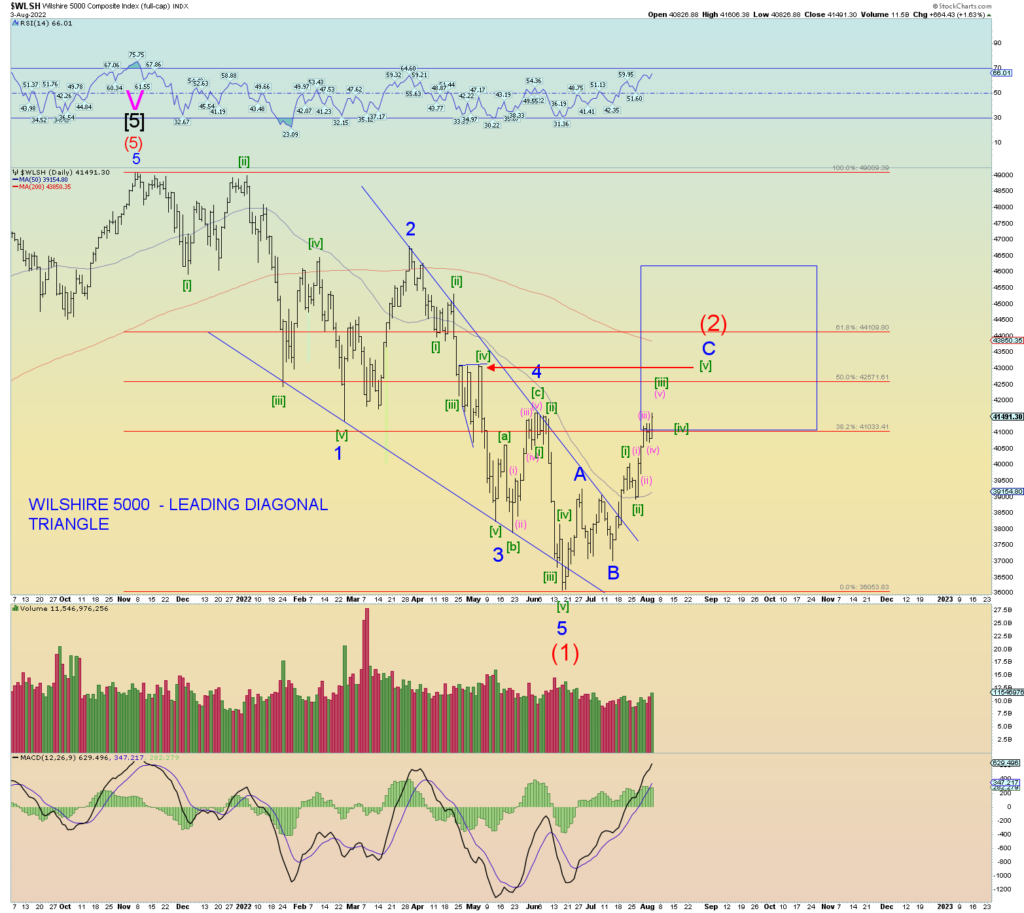

There are enough waves in place to consider the count “complete”. I may be saying this over the course of the next 2 weeks if we continue to melt up on summer light volume with no cares in the world.

August is the final month of peace in this world. And yet tell that to the Ukrainians and Russians they will severely disagree. Or for that matter any of the other various small wars going on in the world at the moment.

One such possible count:

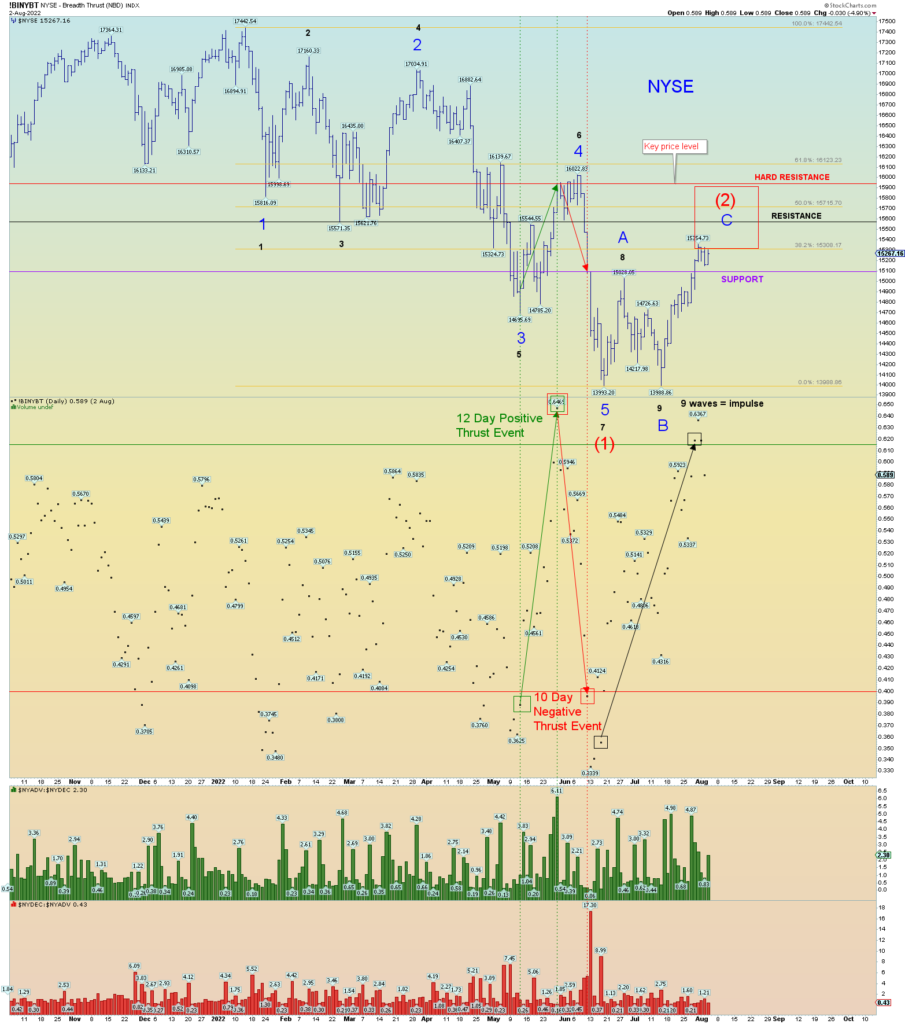

NYSE still diverging just as I suggested. I am still “betting” (although I have no dog in this market) that the 10-day negative “event” outweighs anything the market is attempting to overcome at the moment. We shall see!

It is actually “ideal” that Minor 2 overlaps Intermediate (1) in the wave count on the NASDAQ Composite. That is what it is supposed to do which is one reason why the Composite is an outlier at the moment. As compared to the NYSE above, it is not a broad-based rally by far. It is a squeeze on the most beat up index – the Composite – and the rally reflects as much.

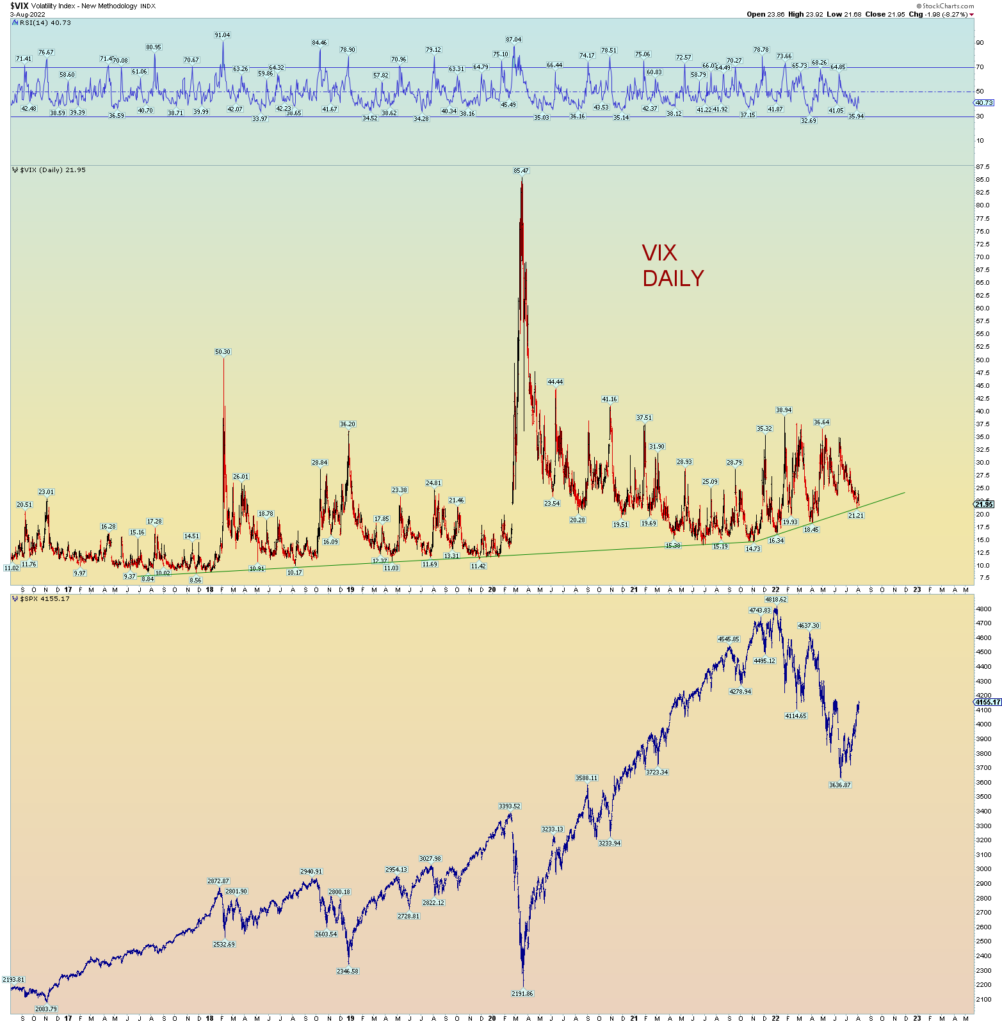

UPDATE: I forgot to post this. Probably the easiest chart will tell the eventual picture.