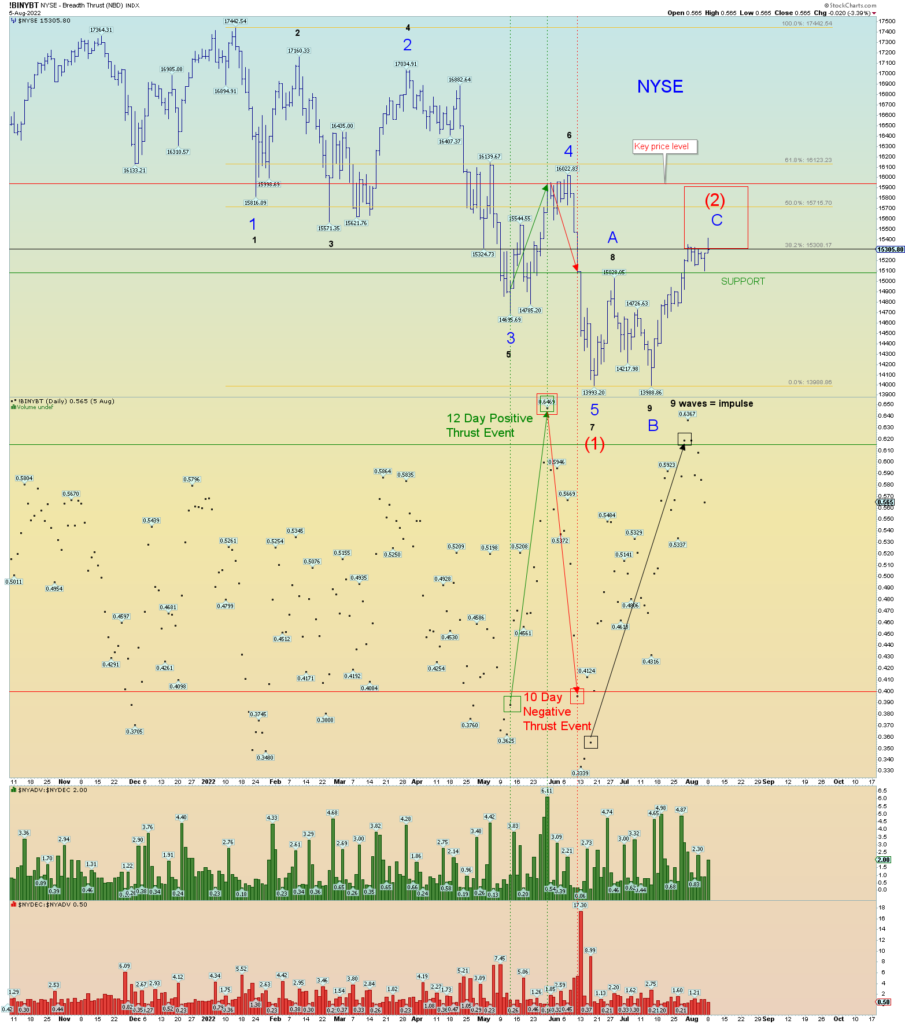

NYSE poke above and beaten down. I still have respect in the negative Zweig breadth thrust event that had previously occurred at these levels. It can be postulated that this negative rush out of stocks at these prices (see red arrow down) is still in effect sentiment-wise.

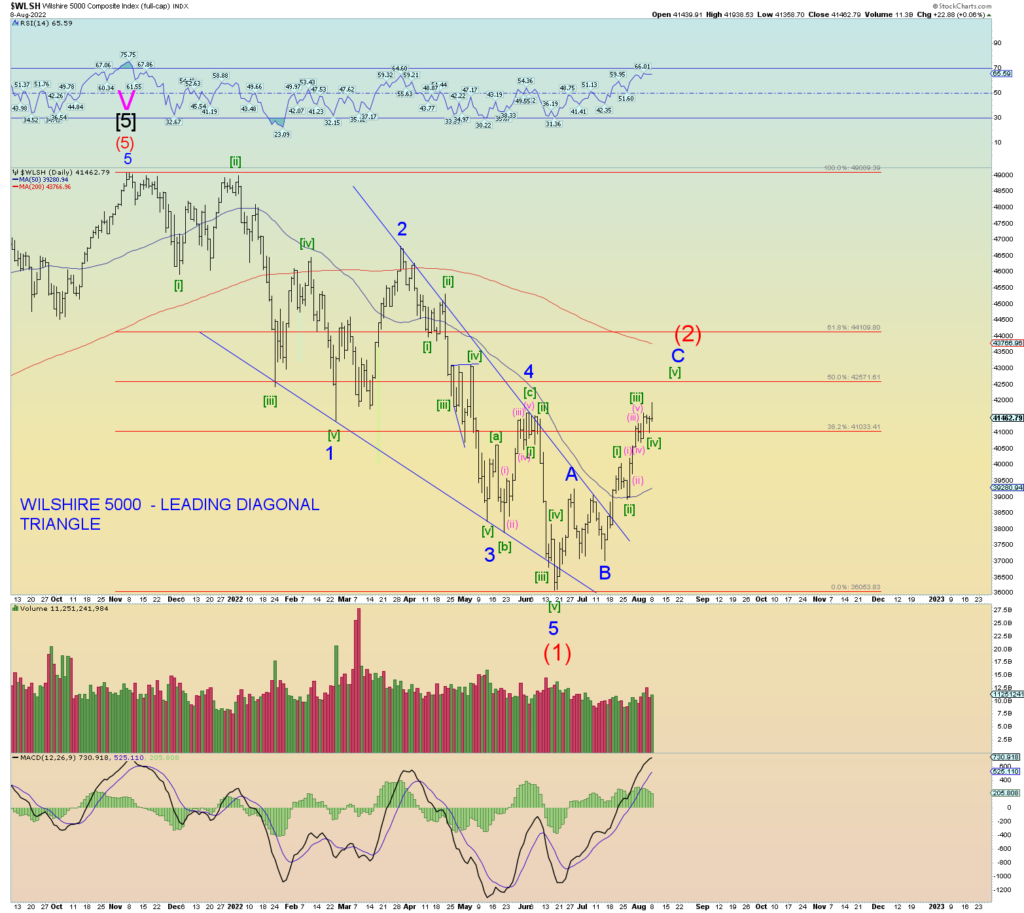

Today was a thrust out of our proposed triangle giving us enough waves in place to consider the count complete. However, if not presenting the squiggle count:

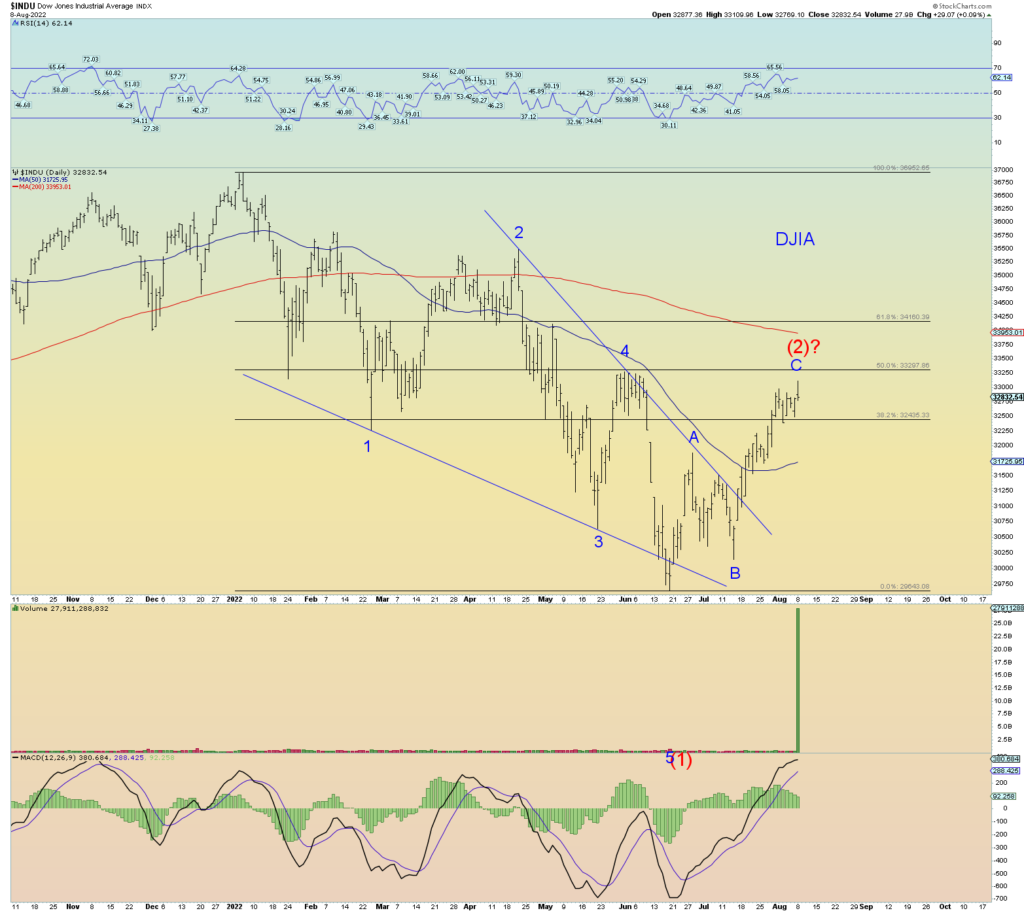

Everything has been choppy a-b-c “threes” even in the positive direction. It has an ending diagonal triangle “feel” about things.

Yet for a wave (2), the overall market has yet to rally to its 50% Fib retrace. Sentiment is starting to get perky bullish a bit again. More advances will strengthen this sentiment.