Another potential war heating up with Azerbaijan and Armenia.

Significant potential of a railroad strike as soon as Friday. As if we need more supply chain disruptions to the economy. The Administration doesn’t care it still has a baby formula crisis swept under the rug by the media.

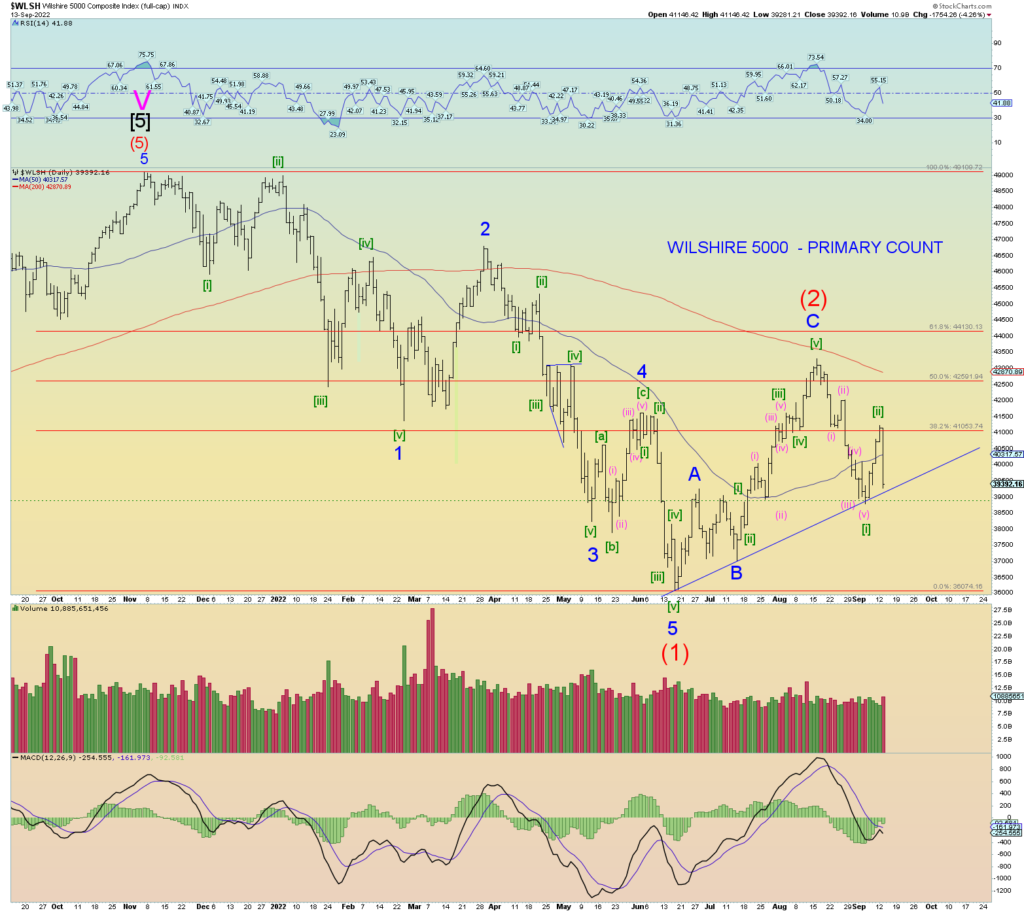

Well, that face-ripper occurred just at the spot where it makes sense – the beginning of the primary wave count of [iii] of 1 of (3) down. Things really don’t get heated up until [iii] of 3 of (3) down, so we still have some counting to do. For context, here is the 2008 impulse wave down and where we compare. It’s not a perfect compare, but you get the idea. 2022 is running a bit hotter and more violent on a daily basis. But I’m just guessing on that.

A continuation-type head and shoulder pattern? A break of the neckline would make the target of the pattern beneath the price low of (1).

5 waves down today. Due for a bounce wave (ii).

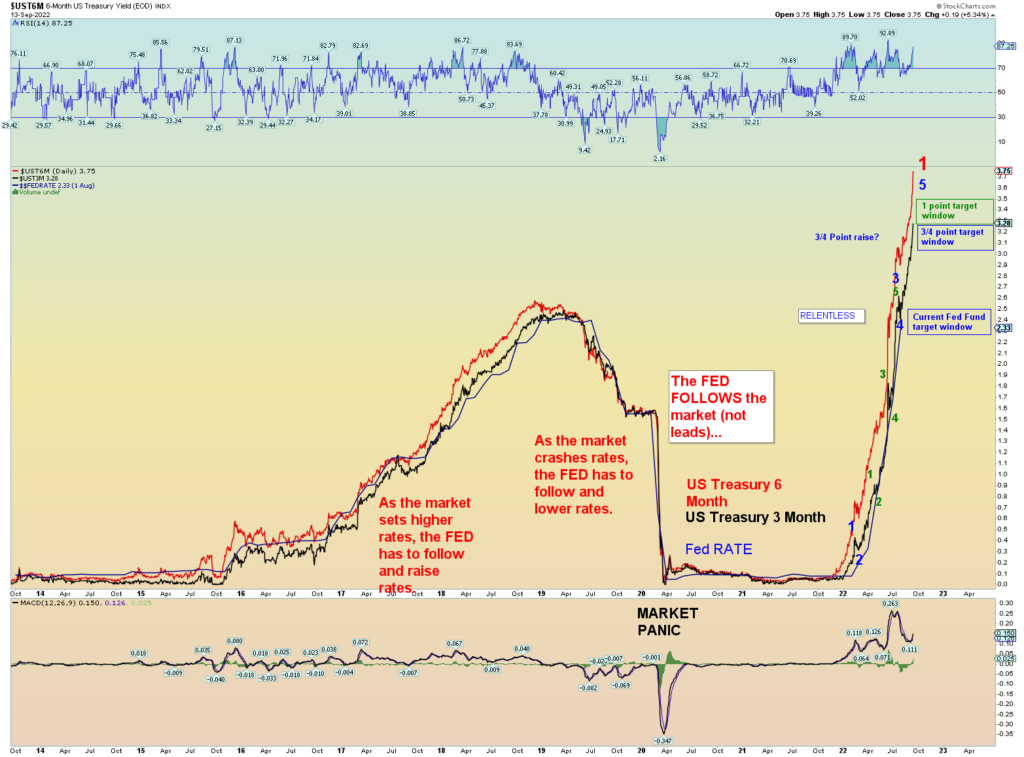

Yields. A 3/4 hike is certainly baked in if rates were to be set tomorrow. 1 point if the 3-month rate rises a bit higher. There is a probability that the 3 month/ 10-year yield inverts.

Heck, it would be quite a feat if the entire curve inverts from 3 month all the way to the 30-year yield.

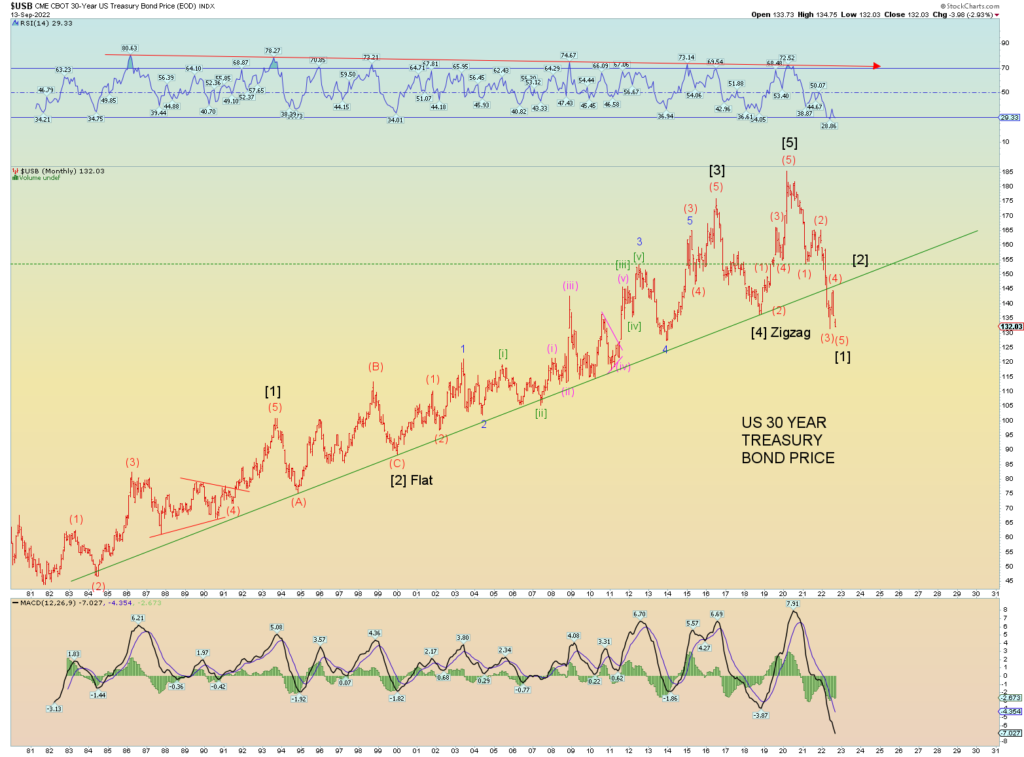

10-year price new lower low target almost reached.

And 30-year prices are nearing minimum wave (5) target.

What would it take for a rush back into bonds both long term and short term? The entire curve is due for the biggest bounce since the bond peak.

A stock market crash perhaps would spark a rush back into bonds and stocks/bond “asset” correlation disconnects for a while? Just a thought.

Of course, it’s all a big Ponzi scheme don’t forget! There is a “Ponzi-type” sentiment that exists, and it is this: Once a Ponzi scheme is recognized for what it is, it can drop to zero despite extreme negative sentiment readings.

In other words, a Ponzi scheme doesn’t have “BTFD” due to overly bearish sentiment readings. It pretty much unravels quite quickly.

Kind of like our 100-1 leveraged bond market where a ‘liability” can be counted as an “asset” depending on what side of the ledger you put it on. But if the counterparty can’t pay, the “asset” becomes liability on both sides of the ledger.

And don’t forget the gargantuan derivative market, particularly interest rate derivatives.

Everyone thinks the Fed will be forced to “act” eventually and “pivot” as if they can control the markets. (They cannot). But the real question to ask at this stage of the coming New World Order, do they want to act or have any authority left to act even if they wanted?

Satan is in control and has so conditioned the masses into thinking the Fed will rescue the markets that people will ride it all the way to the bottom to their doom. I cannot think of a better lie that has been told over and over for decades. Condition the people into thinking the system can and will be “rescued” in time of trouble when the multi-decade devilish trap has been actually sprung on the unsuspecting middle classes and their 401K’s.

Everyone has a sell point. Everyone. But if the masses have been conditioned to “hold on”, again, it’s the perfect trap to wreck the last of the middle classes in this world.

You cannot have a “New” world order if the “Old” world order is still functioning and constantly “rescued”. Powell is under the control of bigger Satanic forces at play. They must collapse the old system to be able to usher in the new once the global financial collapse triggers a global economic typhoon the likes that have never before seen unleashing supply chain halts, wars, and famine. The world is only ever 10 meals away from life threatening hunger.