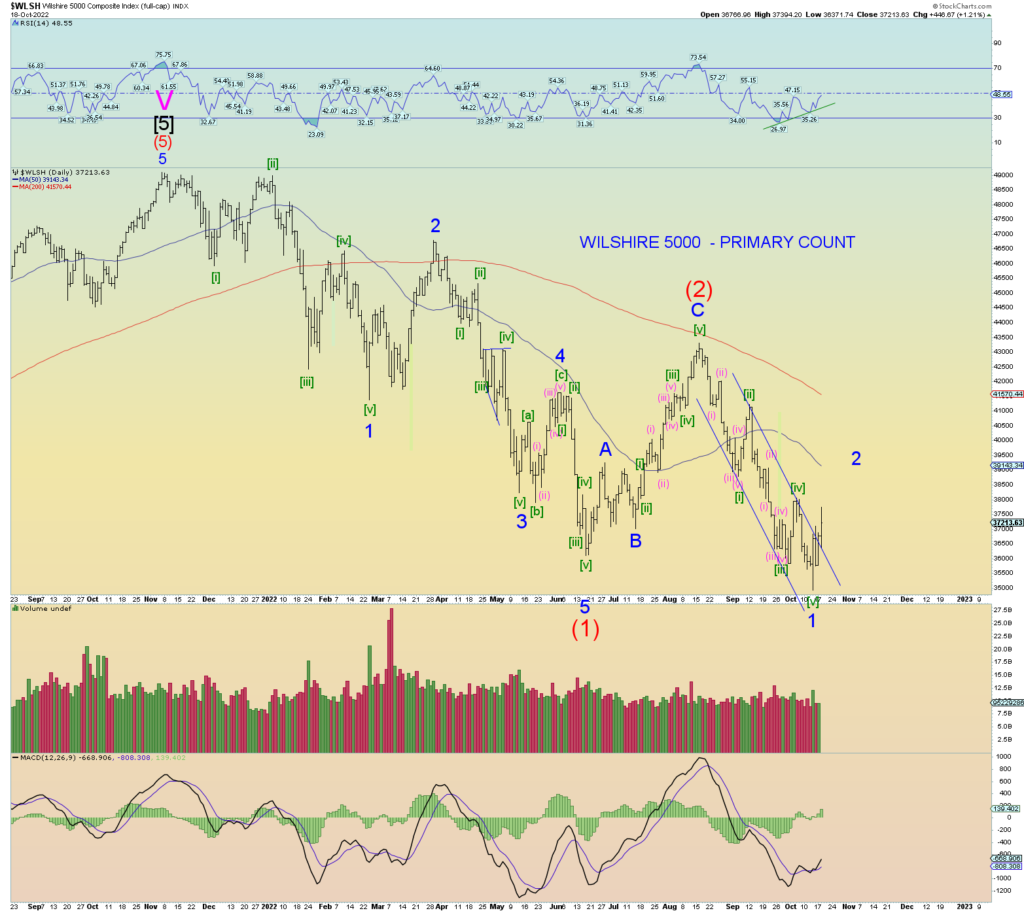

The Wilshire 5000 has corrupted data again on Stockcharts. I had to add to the top of today’s candle.

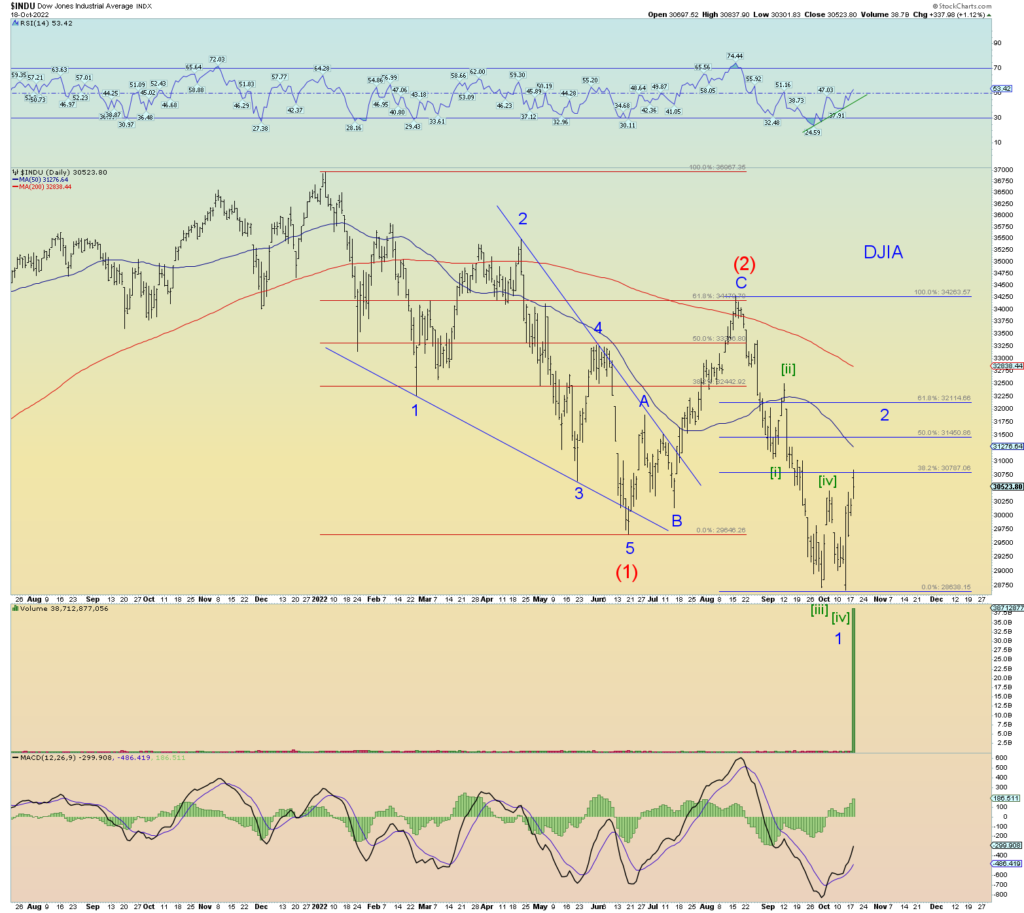

The market has now bounced higher than at any other time since the wave (2) peak of August. Prices have broken out of the down channel, and the wave pattern so far from the low is a 3-wave pattern. All these things collectively signal that we are on the correct count of Minor 2 of Intermediate (3) down.

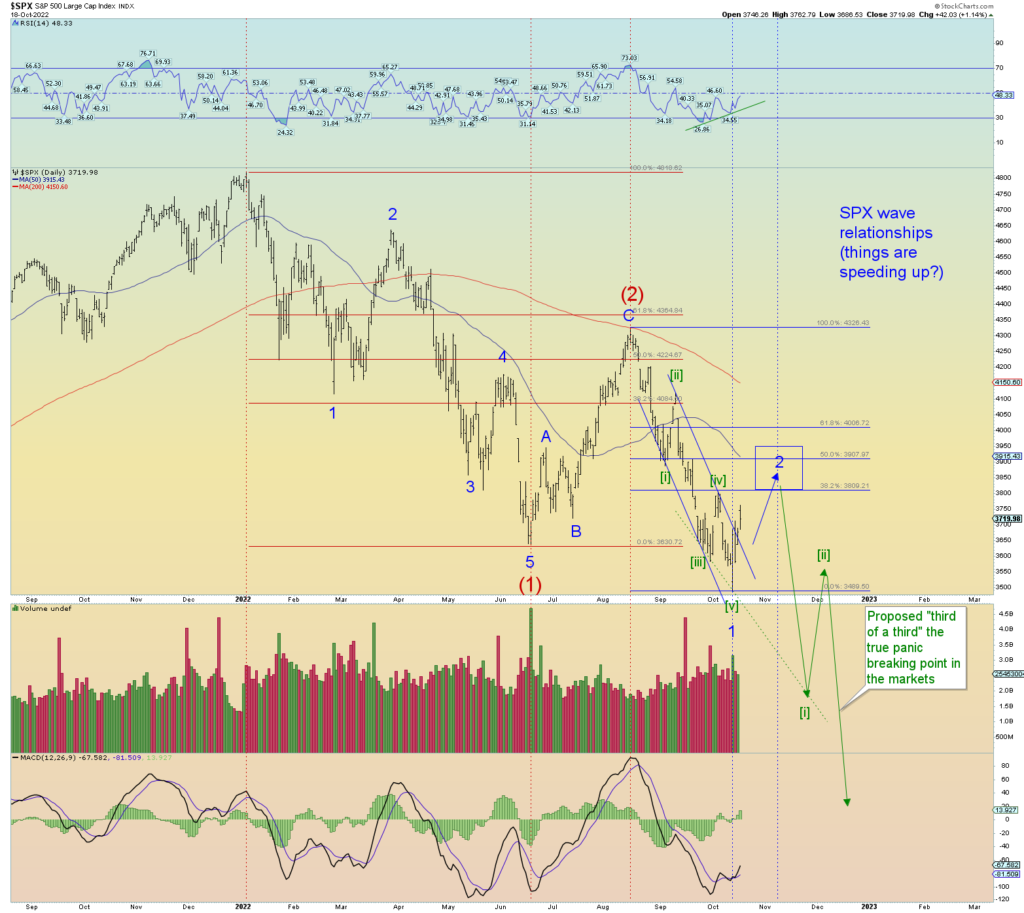

The following charts show ideal Elliott Wave relationships within the context of a series of (1)-(2), 1 – 2, [i] – [ii]. In an ideal EW pattern as the wave hierarchy gets smaller, the speed of the market should speed up and volatility steepen. So far that has been the case. We can estimate Minor 2’s target range. Intermediate (2) did not retrace 61.8, perhaps Minor 2 only makes it to 50% or even less.

Once the market rolls over Minor 2, this is when things should really fall apart. Eventually the market should panic break at the ideal “third of a third” wave panic point. Sometimes time speeds up also. So even though this chart shows ideal pathing, it’s just a best-case scenario.

Too early to tell what is going on with the pattern since the low, but so far it charts best as a double zigzag. That could be just wave [w] of a complex [w]-[x]-[y] corrective pattern, or in theory, it could be all of Minor 2 itself. However it seems a bit short in price and time so we assume not just yet.

Or we could have a Minor 2 pattern going on like this below and we are only seeing the very few first days of many.

The DJIA has been more stubborn in giving up prices since the January peak and more persistent in its retraces. The positive RSI divergence has already been fulfilled with prices soaring over Minute [iv] of 1 of (3) whereas the other indices are lagging in that regard.

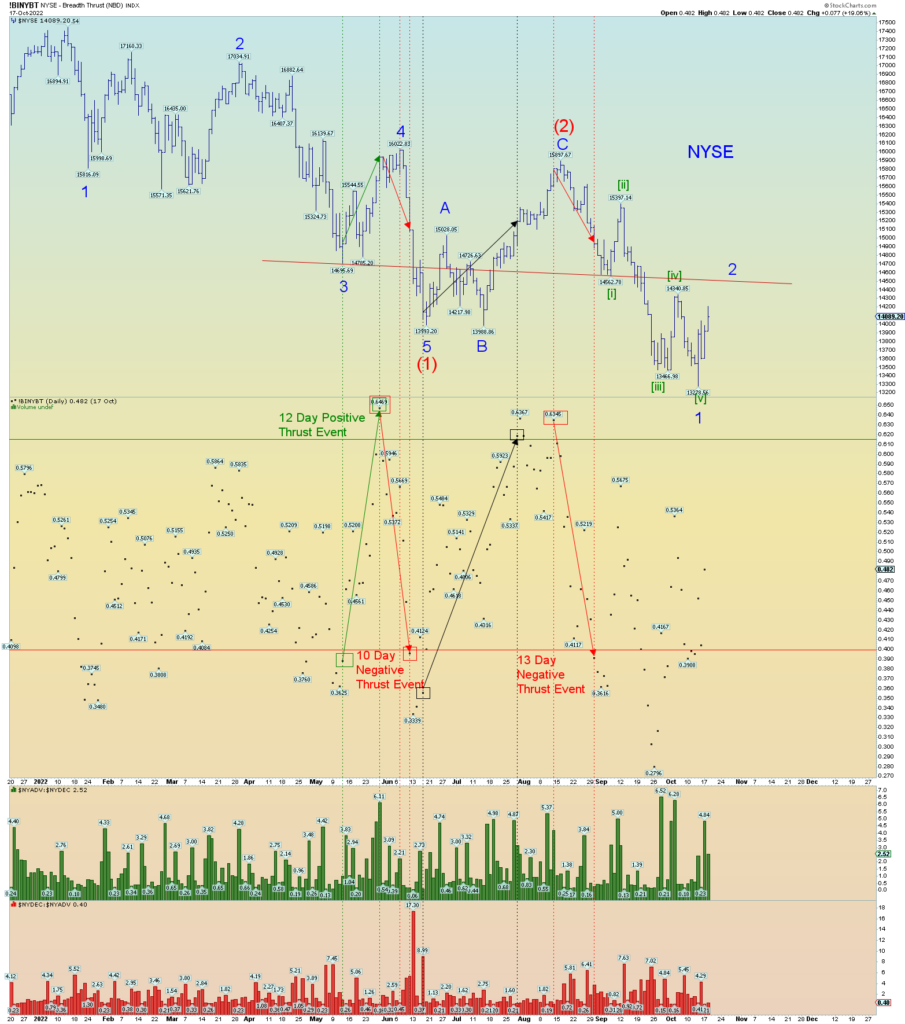

NYSE. Today’s advance/decline ratio was only 2.5 to 1.

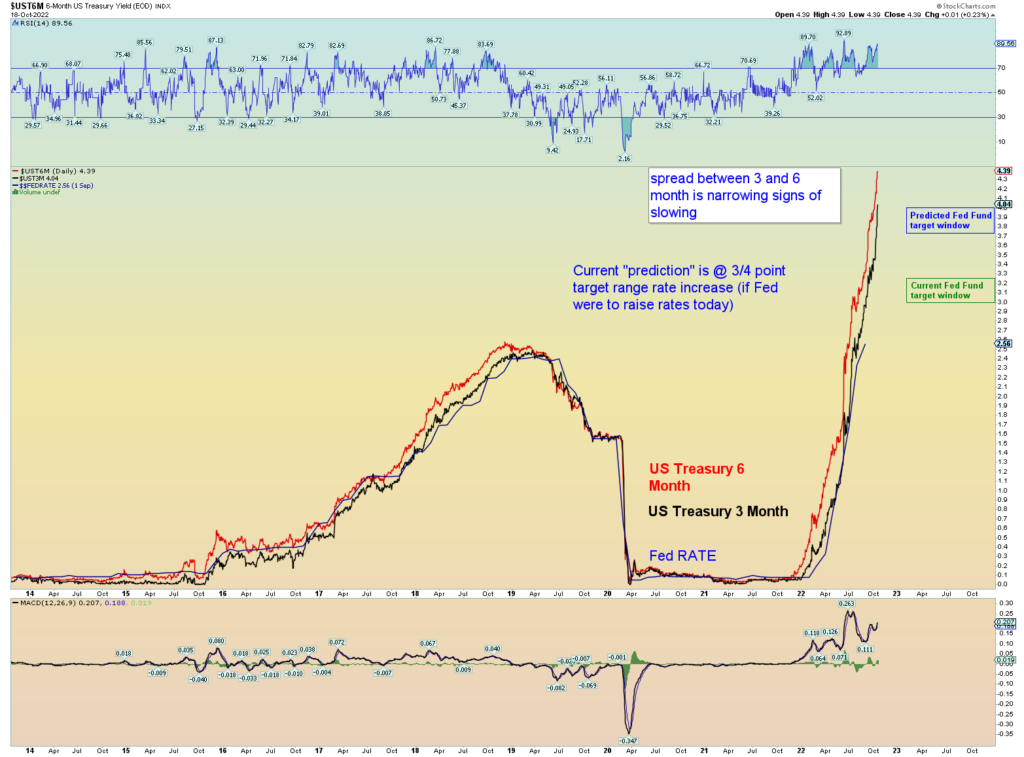

If the Fed were to raise rates today, it would be a 3/4-point raise. There are signs that the rise is slowing as the spread between the 3 and 6 month its narrowing.

What people don’t understand is that the Fed cannot lower rates with the 3- and 6-month short term rates at their present levels. It is the market that drives rates, not the Fed. And people will counter that the Fed controls the 3- and 6-month yields that is not true.

At any rate, the Fed funds has always stayed within market range or else there would be extreme distortions. Imagine if the Fed cut rates tonight by 1%. to a target window of 2 – 2.5%. With the 3- and 6-month rates being double that, what kind of distortions do you think that would create in the way the Primary Dealers handle the overnight paper markets and other short term market making funding schemes (of which there are too many to count)?

The Fed would lose money is the bottom line. And as much as people like to think the Fed serves “we the people” they are a private bank first and foremost.

So, the Fed follows the market, so they do not lose money. it’s that simple. Rates go up, they must follow. Rates go down, they must follow. This is the same way all Central Banks operate more or less. In Europe, real rates went negative, and the ECB decided to follow along and set a negative funding rate which was probably a mistake which presents tremendous duration risk.

The real rates in the U.S. also went negative, but the Fed set the floor at 0% as to avoid overly long-term complications of which the ECB is starting to experience. But alas, it won’t matter.

It’s all a Ponzi, make no mistake. Once debt/GDP ratio – which can be debated what the true number is – becomes greater than 100%, bankruptcy is sure to follow. We are 32 trillion in debt, and I think the GDP is more or less the same (and one could also argue that number is fudged beyond measure). It doesn’t take much of a GDP decline in combination of soaring interest rates to break the bank. This is where we are at.

That which cannot go on forever – won’t.

It is like a household that earns $100,000 and has $100,000 in credit card debt that is of course subject to prime + bankster robbery. A loss of income or lesser paying job will break that household very easily. An interest rate of 9% going to 14% and loss of income to now only $65,000 means it’s game over. And the interest compounds until one must declare bankruptcy which of course wipes out the debt and effects the banks that “funded” it. It’s a cascading situation. And interest (usury) is evil and ungodly and of course its run mostly by adherents to Judaism or Jewish offshoot Freemasons. Both groups are doing the work of the Satan to bring about the New World Order. Complete financial “reset” is part of that plan.

There will be no “Fed pivot” because it is all a lie, and they have setup the masses to think otherwise. 30 years of “market conditioning” will do that to you. But the rug is being pulled out all the same.

They just don’t want to be blamed too much. But they are to blame all the way since 1913 and the creation of the Fed monster to begin with.