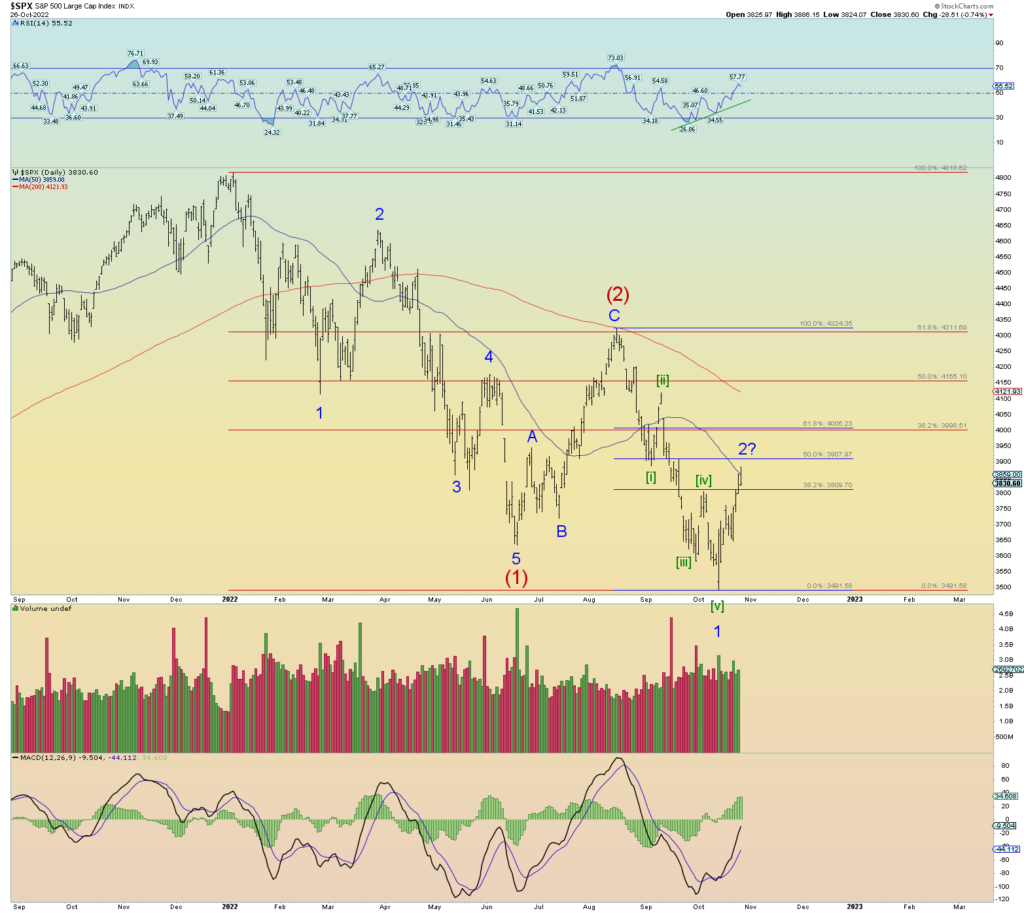

The SPX peaked at 3886+ and I was looking for 3888 or so where wave [c] = [a] of 2. Close enough. Perhaps Minor wave 2 has peaked. The pattern looks good and the time and price of the retrace is more than adequate. On the DJIA the retrace is quite deep.

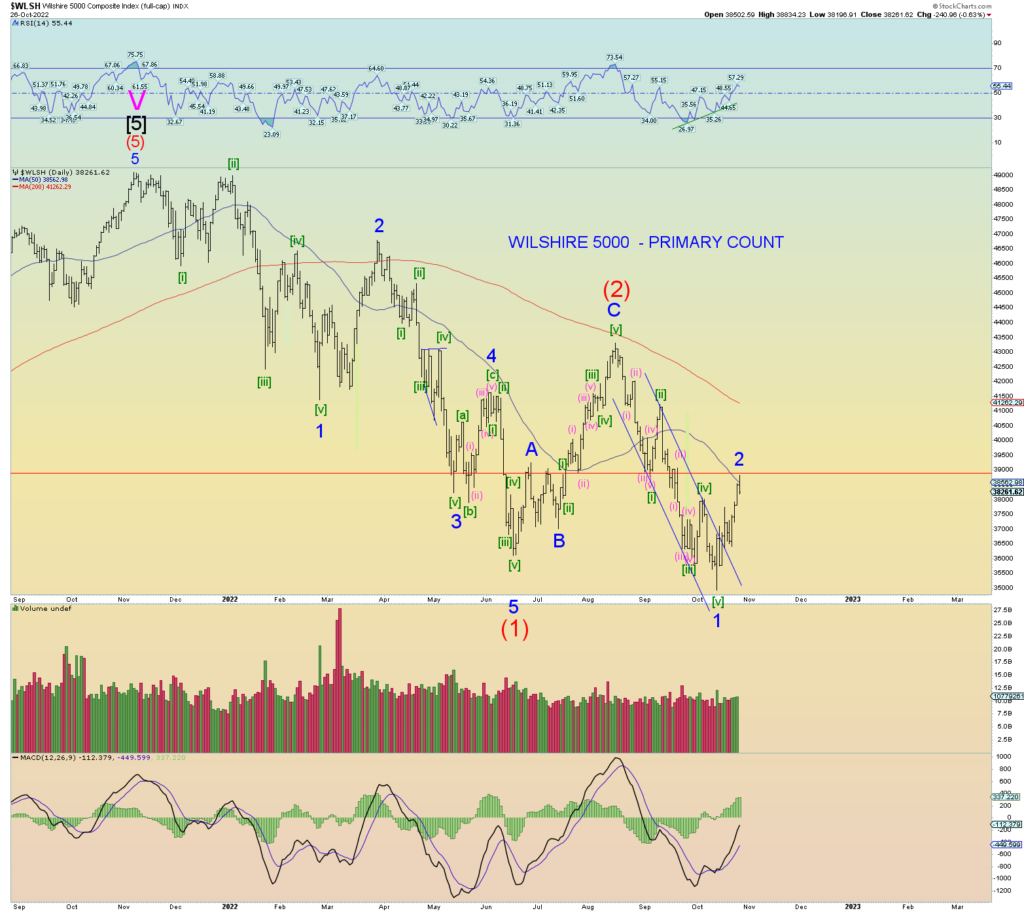

Wilshire daily shows prices have met horizontal resistance. Remember, a few weeks ago, everyone wanted out of this market. Now that prices are back toward 3900 today, many took the opportunity to do just that.

A major bond rally would not be surprising. Does that mean equities rally also? Not necessarily. I expect any positive correlation between equities and bonds to break. Hard down in stocks, panic-selling in a Minor wave 3 of (3) sending buyers into the “safe haven” of bonds. Just a thought.