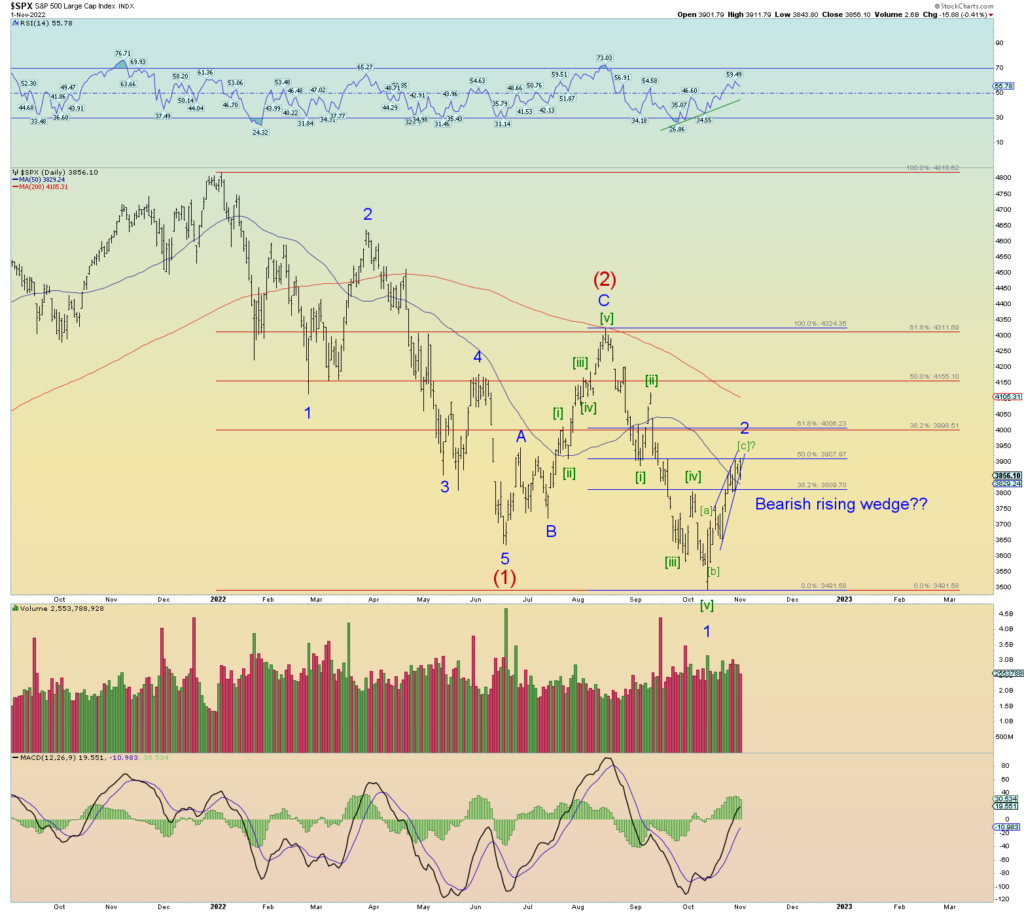

I’ve changed my tune somewhat tonight based on the last 2 trading days (which have gone sideways). The price action looks like “distribution” from strong hands to weak. All the “fever” of media news articles to come out since Friday’s ramp predicting higher prices now seem suspect. And we have a wave count to back it all up.

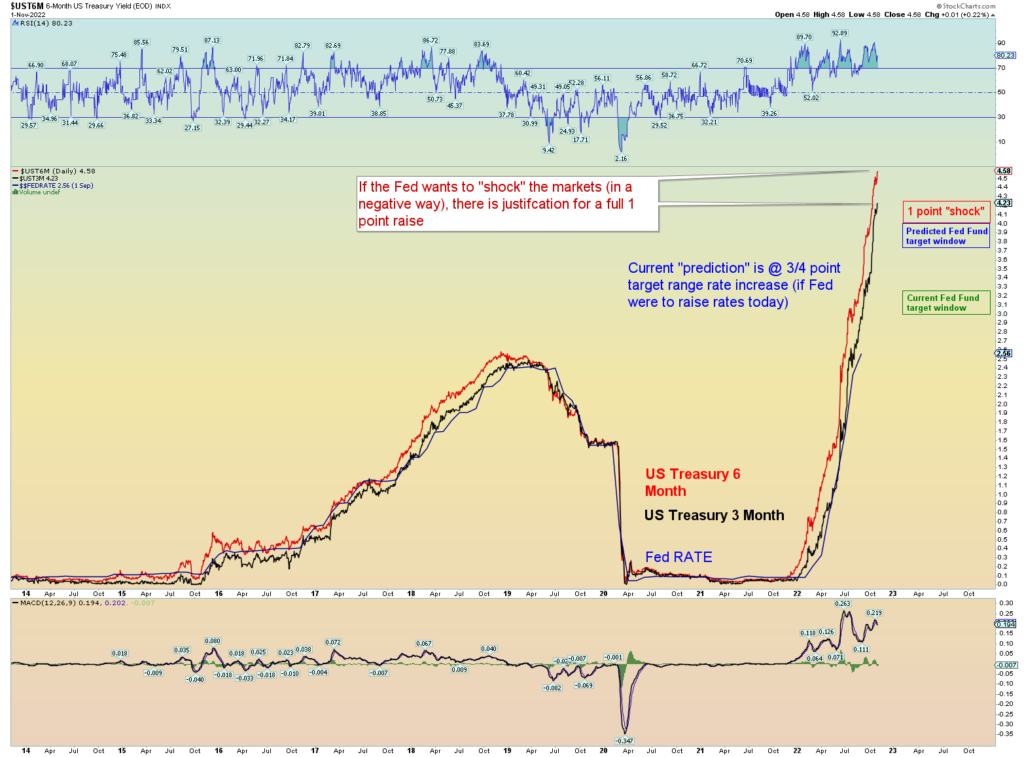

First things first. What will the Fed do tomorrow? Well, the 3/6-month yield chart suggests that 3/4-point raise is in the bag. However, if the Fed wants to “shock” the market in a truly negative way, a full 1-point rate hike is not off the table. In fact, had the 3-month yield been only a few ticks higher, that would be a done deal.

I have been saying the “marching orders” for the Fed (from Satan) for the past year is to not help the markets at all. And so, the odds of a full 1-point hike tomorrow resulting in the biggest market collapse in a long time is palpable. If not, nevermind.

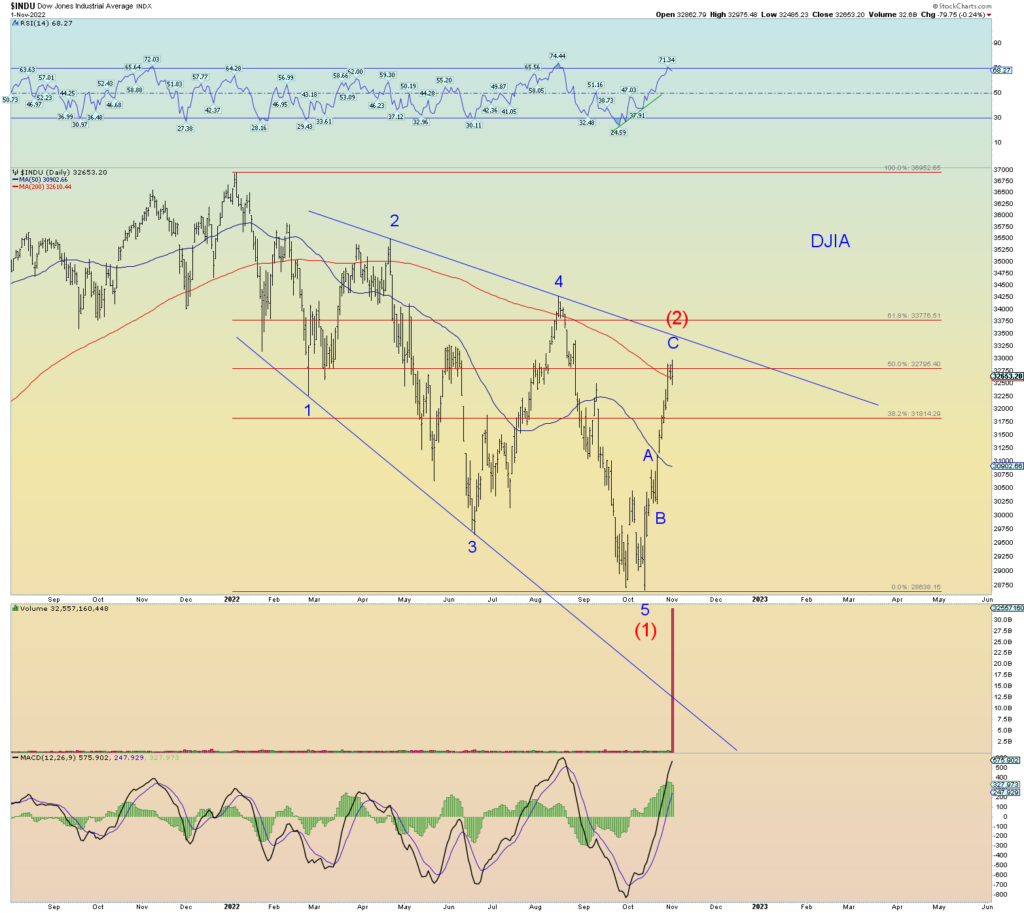

Do we have a “stealth” ending diagonal triangle that does not actually overlap waves one and four? Could be. Advancing in a-b-c formations. The disparity between the “generals” (DJIA) and the “troops” (Nasdaq and the rest of the market) is quite glaring.

Retarded DOW, which is why I, don’t use it for primary overall count. I hate this count but the rapid rise since the recent low has been historic. Over 50% of the entire decline since peak.

The overall primary count of wave 3 of (3) down is a powerfully negative predicted wave. We may on the verge of the “kickoff” of the greatest downdraft the markets have seen in many a decade.