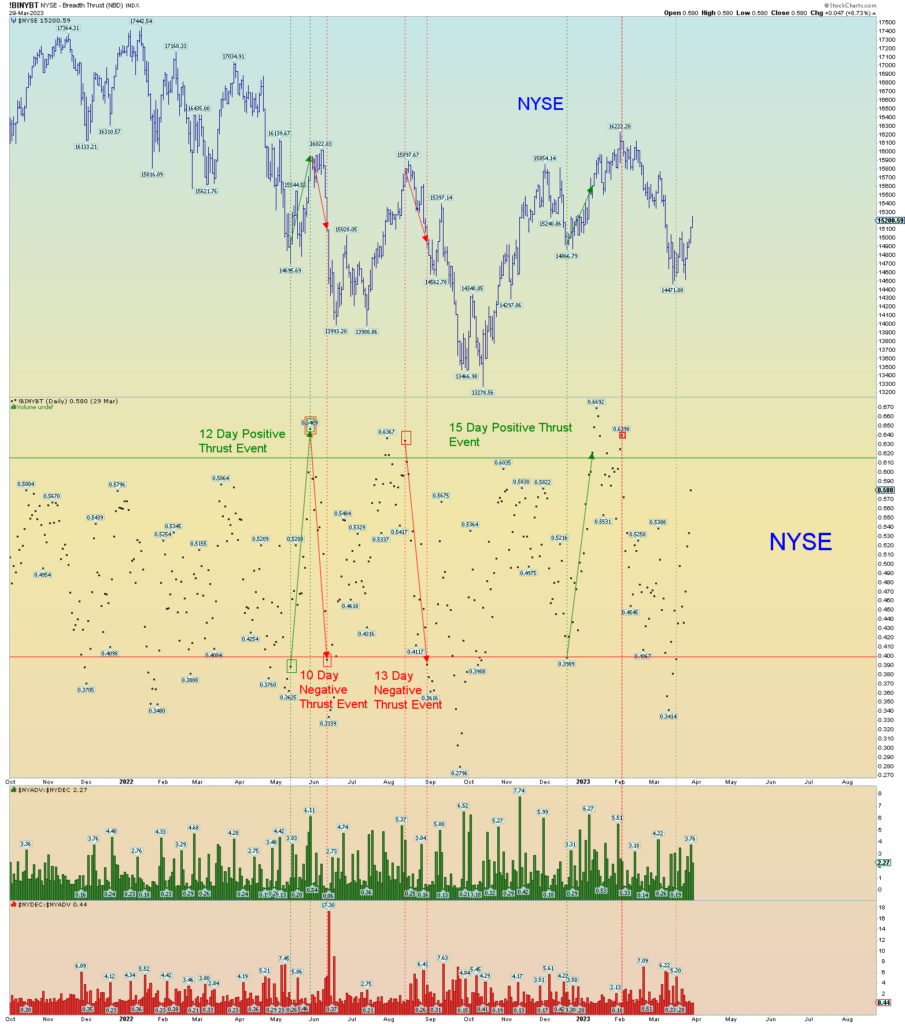

The market is coming close to a significant positive “breadth thrust” event. I don’t have today’s data plot until tomorrow.

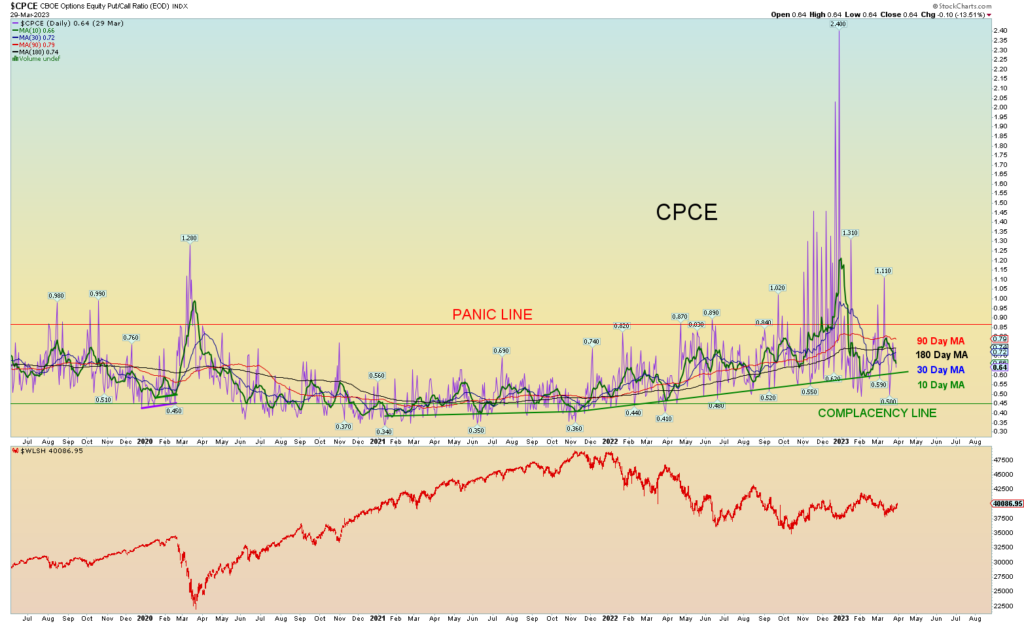

Additionally, despite the Jew-controlled media trying to panic everyone, clearly there has not really been any market panic just since the bank fiasco of the past many weeks. A panic occurred before but it looks artificially produced by computers.

And thus, the bull count would look something like this:

Yet even so, the count can be viewed still through a bearish lens.

But no matter what comes short term with the markets, here is the REAL problem. The 10-year yields, although pausing for weeks, seems to be consolidating for a further move upside.

And global debt is the problem, and ALL global debt is moving in the same direction. The 40-year debt bubble was sustainable as long as bond prices kept following the channel line, driving interest rates lower. The world has gorged on debt at every level. Corporate, personal, municipal, state, federal. It was done on purpose without regard. Historic greed that will be paid for dearly by 8 billion people on this planet.

Yield is higher than the last 12 years. All that constantly “flipped” debt for the past 12 years at lower and lower yields has now reversed and despite what they want you to believe, “debt” is not an asset. It is a promise that in this case cannot be kept, and they will all be broken.

Think of all the bloated governments at all levels that have gorged on debt for one marginal project or another. Or individuals. Or of course the corporate debt bubble.