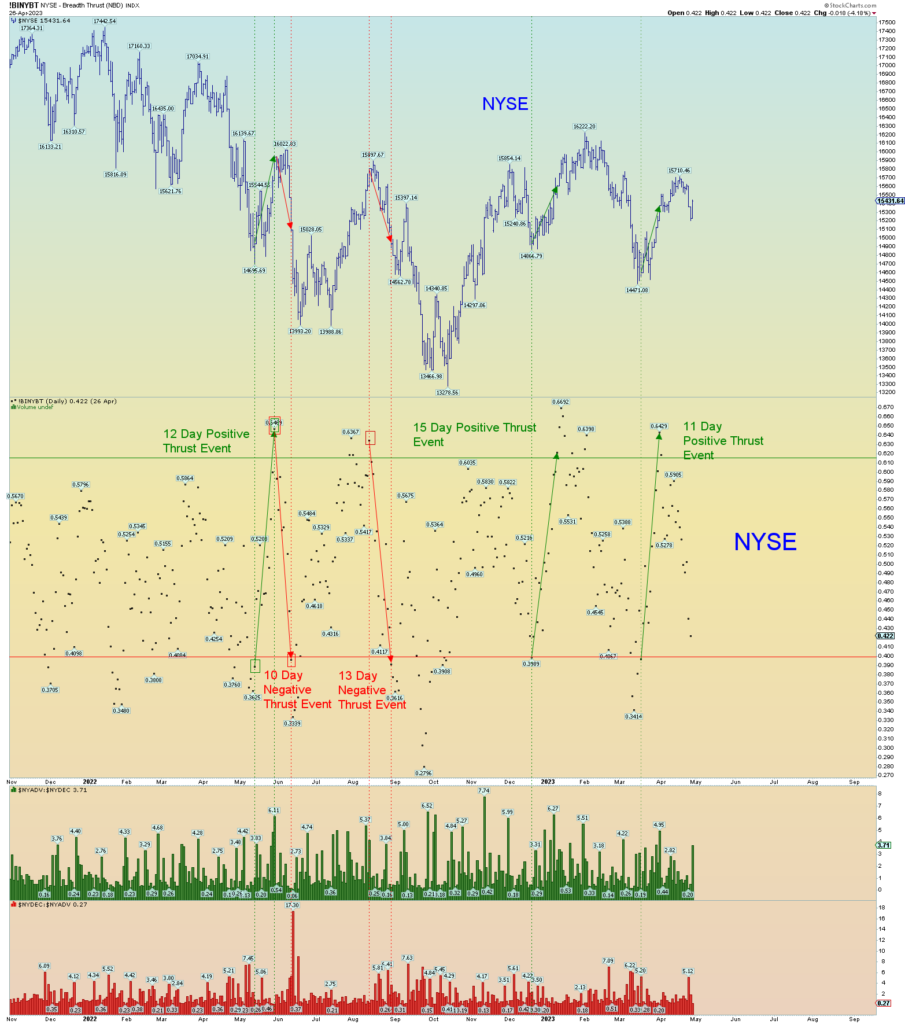

I had posted the NYSE chart a few weeks ago showing a very significant positive breadth thrust event. This is the reason the count is still Intermediate wave (2) in progress. The past many sessions, although prices dropped a bit, did not negate this positive event.

Based on the positive breadth thrust event still being intact and valid, yesterday’s low could be Minute [ii] of wave C of (2) and not wave [iv]. If this is the case, expect “upside surprise”. If wave C of (2) = wave A of (2), expect the August 2022 highs to be eclipsed. It’ll be the most hated rally ever in the history of the stock market. Why? Because the underlying Ponzi has popped, and the market “shouldn’t” be rallying based on what man thinks should happen. But the market is emotional, not logical. The world is still ignorant and blissful. Only global war will snap them out of it. The second horse of the Apocalypse. But it is not yet here. Until then, party like its 1999.

It would be perfect if wave C = A. This implies that the August 2022 high will be eclipsed, even if only just a bit.

The Minute [iv] count is now on the backburner because the pullback was deep and looks more like a wave [ii] instead. We shall see. Again, I base all this on the very positive breadth thrust event that was not nullified by a negative event. Thus, the positive event still holds sway over the market.