Well, last Spring in 2023, I was predicting a July 27th high based on a possible backup date for the 2nd seal of Revelation – global war. Obviously global war did not occur (although who can argue any longer that they are not trying their best to do so?). Yet the market topped on July 27th, and it held for a few months before being taken out recently. Then I pondered if the market would hold up until mid-February 2024 and it has.

My preferred date, here or about, was and is February 15th. 2024 and lo and behold the market has indeed held up until this time. Having peaked yesterday with a decent pullback today, we shall see.

The subwave count is still a best guess. But if we use simple peak RSI and assume (for now) that it represents the [iii] of 3 and we have a double negative divergence since then, the wave count is sufficient. There are enough waves in place and the upper trendline has been solidly touched and retreated.

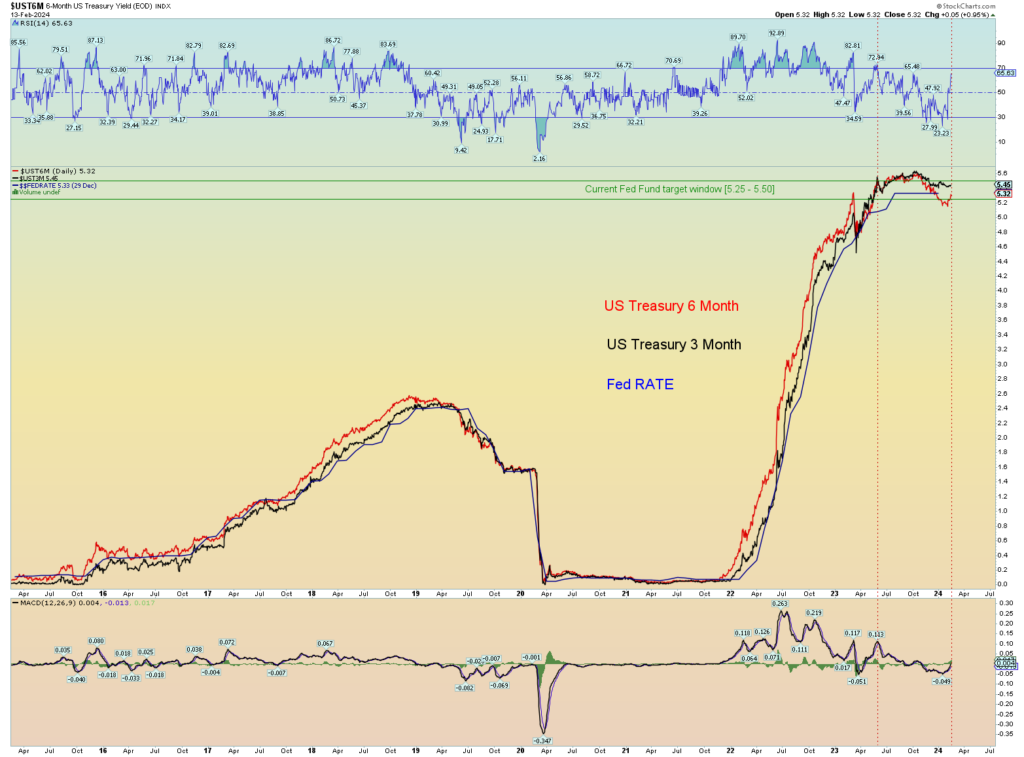

The 3/6 month yield chart. One forgets that the meteor rise in rates occurred over a year ago and these levels were first entered in May/June 2023. If for example one posited that the CRE market was $1.2 Trillion unrealized losses hiding in the banks in the summer of 2023, well, that hasn’t changed. One could make the case; yields have been consolidating. The 3- and 6-month yields remain inverted to each other but if and when they un-invert, it could be a trigger for a greater market panic.

Remember, this is what controls whether the Fed cuts rates or raises them. When they say they are “watching” multiple sources and conflicting signals, what they really mean to say is they are watching this chart to tell them where to set rates. The market sets the rates not the Fed, the Fed follows, and it has always been so.

The reason the Fed has to keep the Fed short term lending rate in alignment with the short-term yield debt of the 3/6-month yields is simply because the Fed would create mass distortions across the quadrillion $$ interest rate derivative markets and besides the massive imbalances of arbitrages created would cause them to lose money beyond what the market is doing. Therefore, you are not going to see the Fed “all of a sudden” drop rates to near zero unless the market panics first. Yes, the market panicked in 2020 but the rates were already back down to 1.6% when the panic came, not the current 5.3%.

And if Satan is truly in control of his current wicked global financial kingdom (he is), the entire world is being set up for a massive collapse of his timing. The clues and signs are all around us. When one is trapped inside the bubble for so long, they no longer realize just how dangerous it has become.

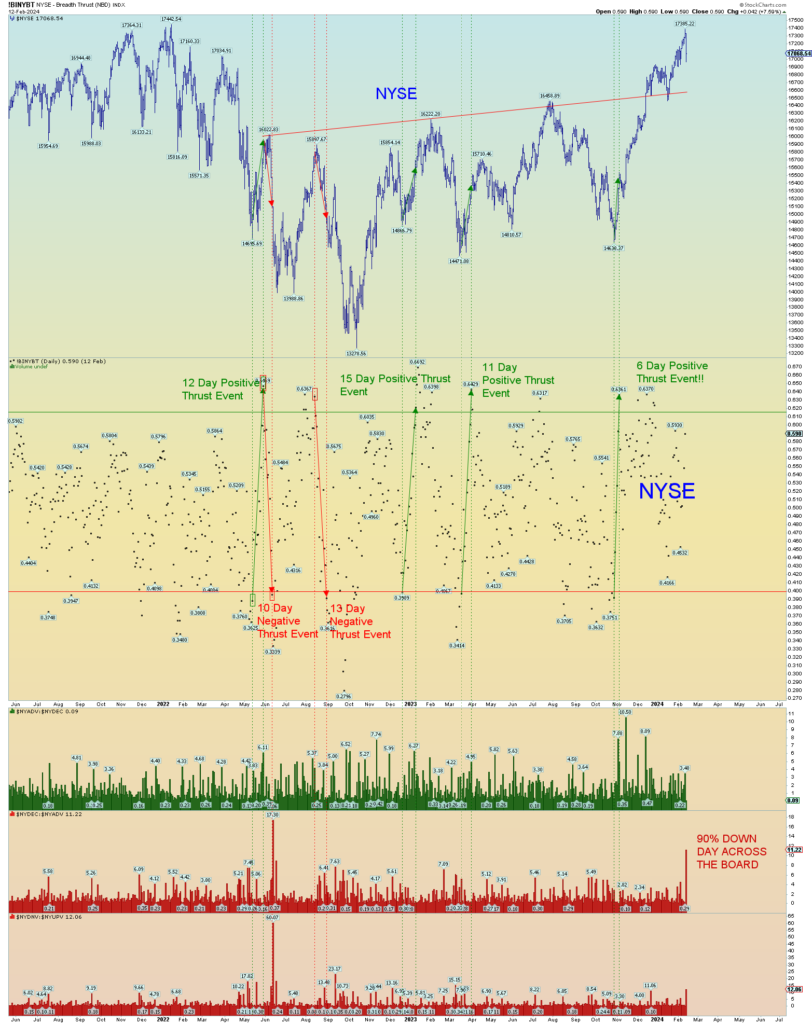

Composite. Not yet a new all-time high. Twin peaks!

Possible long-term count on the DJIA:

The Chinese are not in a good mood. But there really hasn’t been a panic yet. More like a sharp second wave subwave bounce. Looking for prices to test the underside of the broken neckline(s). So far the 2018/2019 level has been support.

Officially the NYSE has also come short so far of a new All-time high. More market fractures. Today was a solid 90%+ down day across the board both declining stocks and in declining volume verses advancing stocks and volume. This is significant, this hasn’t happened since the big down day in June 2022. And this comes at a market high versus in June 2022 when the market had already been working its way down for 6 months.

CONCLUSION:

I think the Ponzi bubble has already popped due to the rapid rise in interest rates which occurred a year ago. And the rates did not yet go down and may be consolidating for upside surprise. The wave count and pattern are sufficient to consider it complete and the upper trendline has been hit. Today’s market internals were bloody red just off a fresh all-time high even though the headline number of only a 1.37% market day loss seems tame, it may be more deceiving than not. I am not trying to make a big deal about one measly down day but for all the reasons (and more) mentioned above, I’m paying attention.