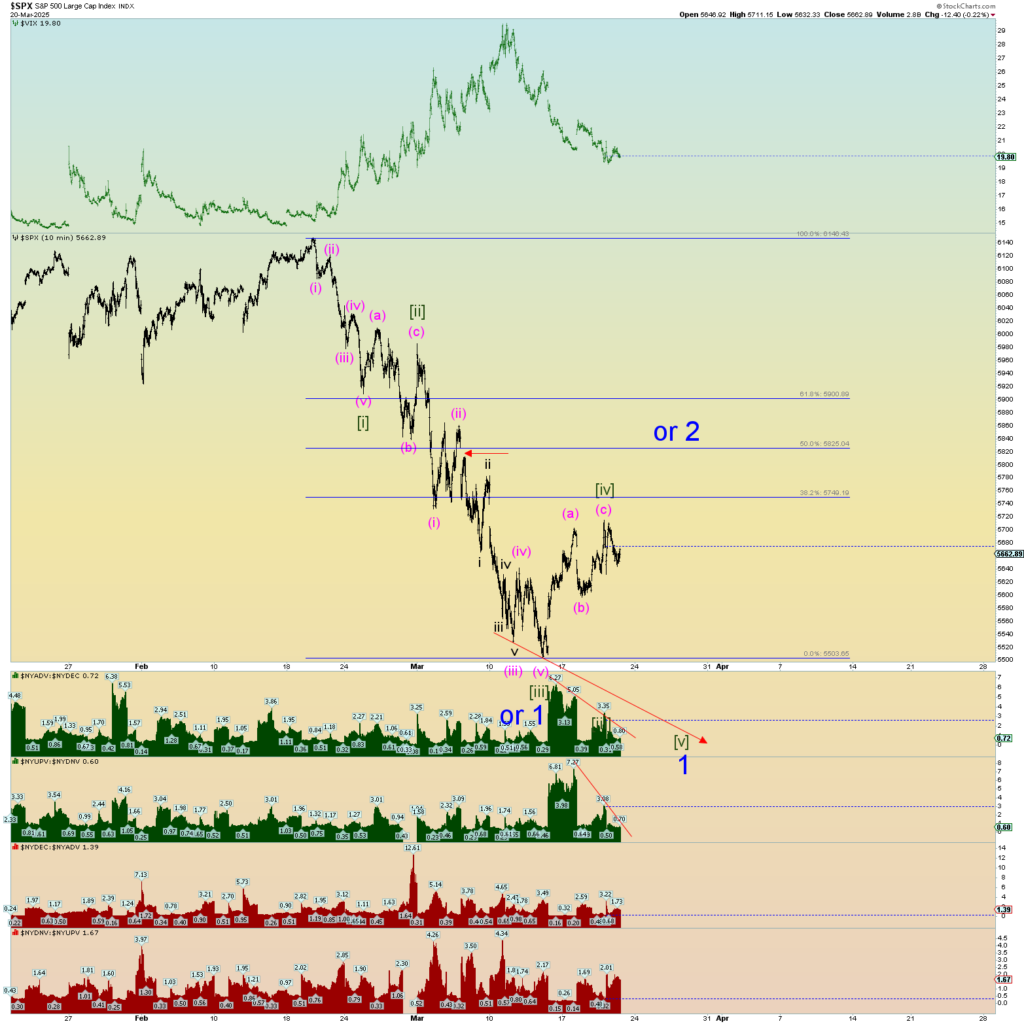

The SPX is at a crossroads. The primary count is wave [iv] of 1 down peaked today in a 3-wave pattern zigzag. This corrective wave contrasts with the proposed wave [ii] downward flat. Time-wise wave [iv] should have ended today. The next wave [v] of 1 should be down to a lower low to Minor 1.

Any immediate higher prices complicates the count and probably indicates that Minor wave 2 is tracing out. This is what makes the pattern interesting.

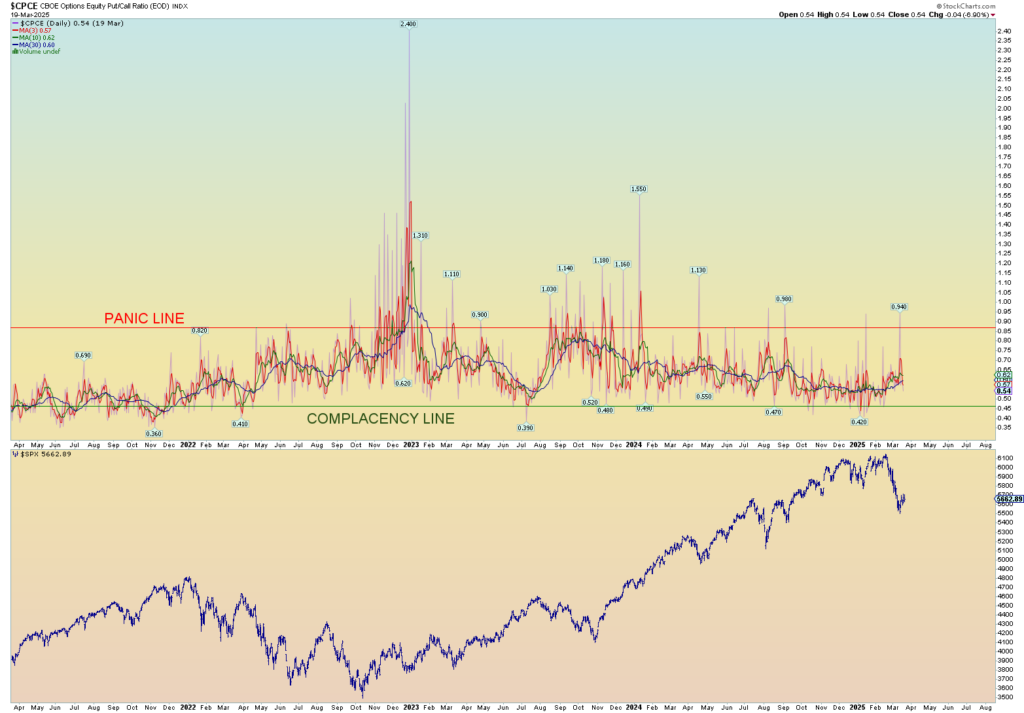

The CPCE does not show any panic. Only bullishness. The majority of the equity options market is bullish on higher prices from here. It’s not necessarily a short-term predictive chart but it does display a still overall sense of complacency within the overall market in general.