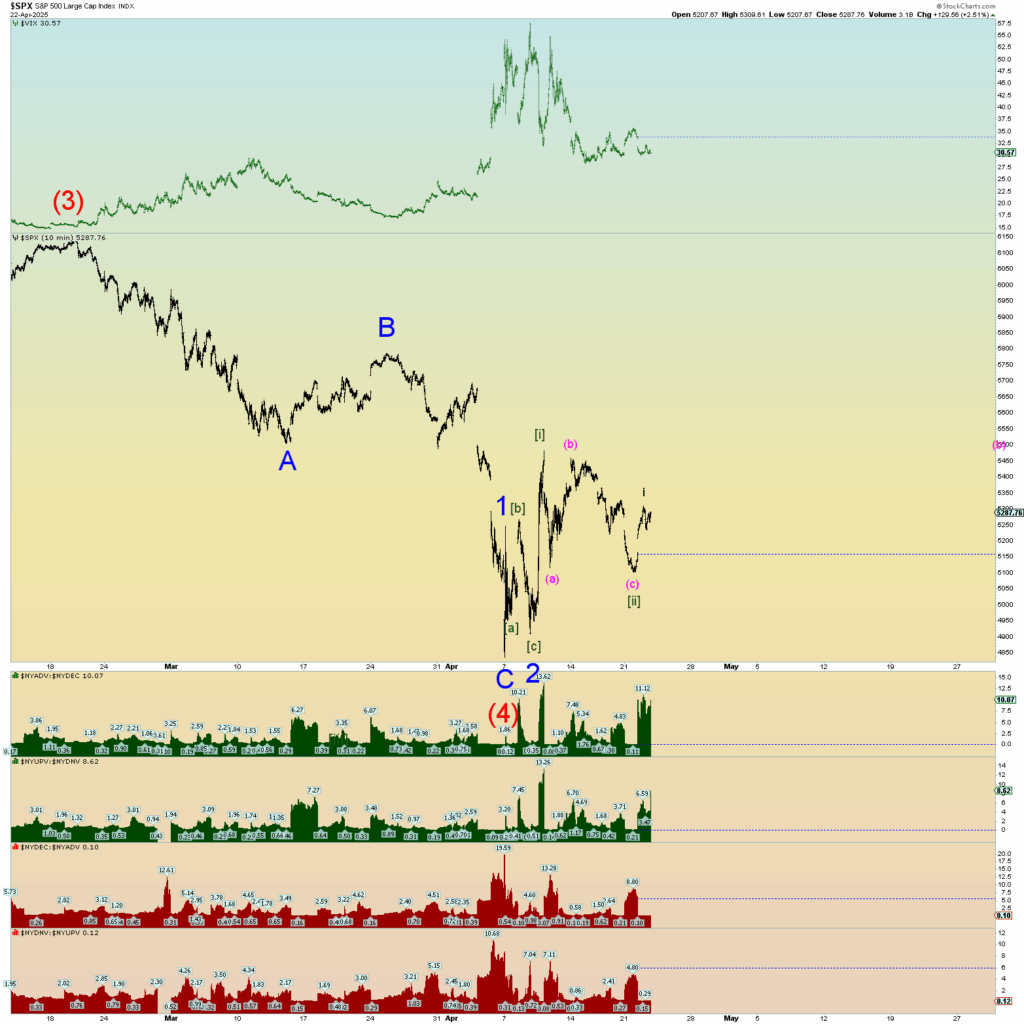

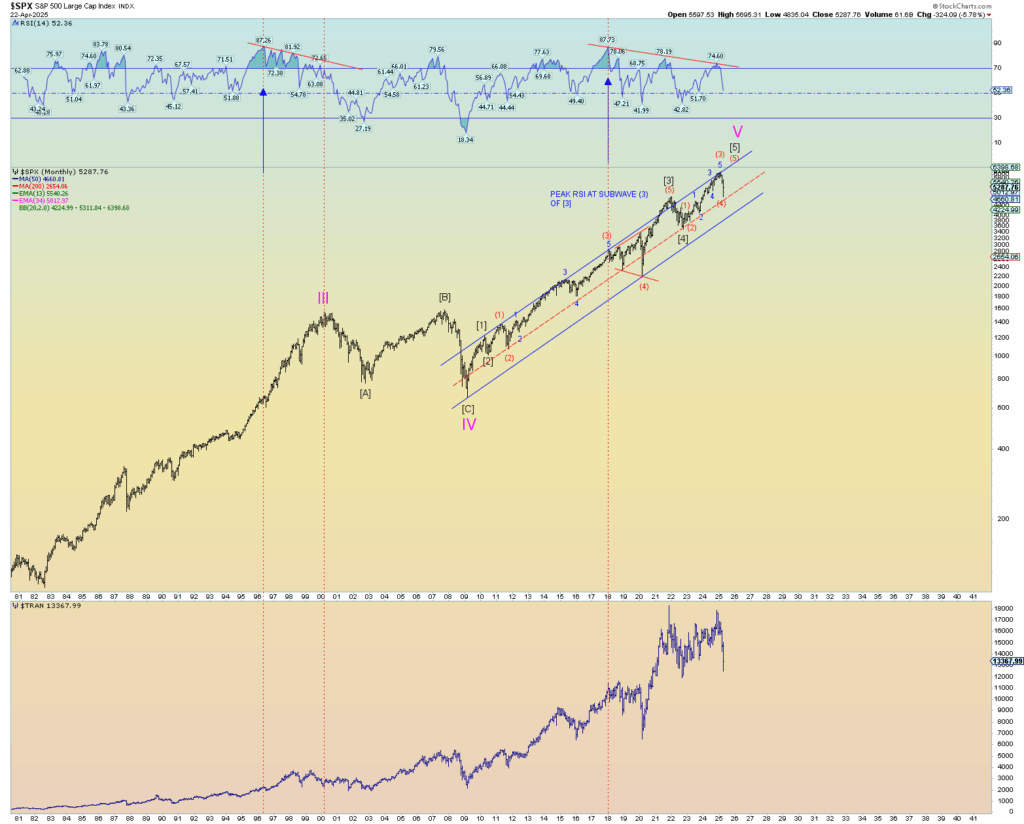

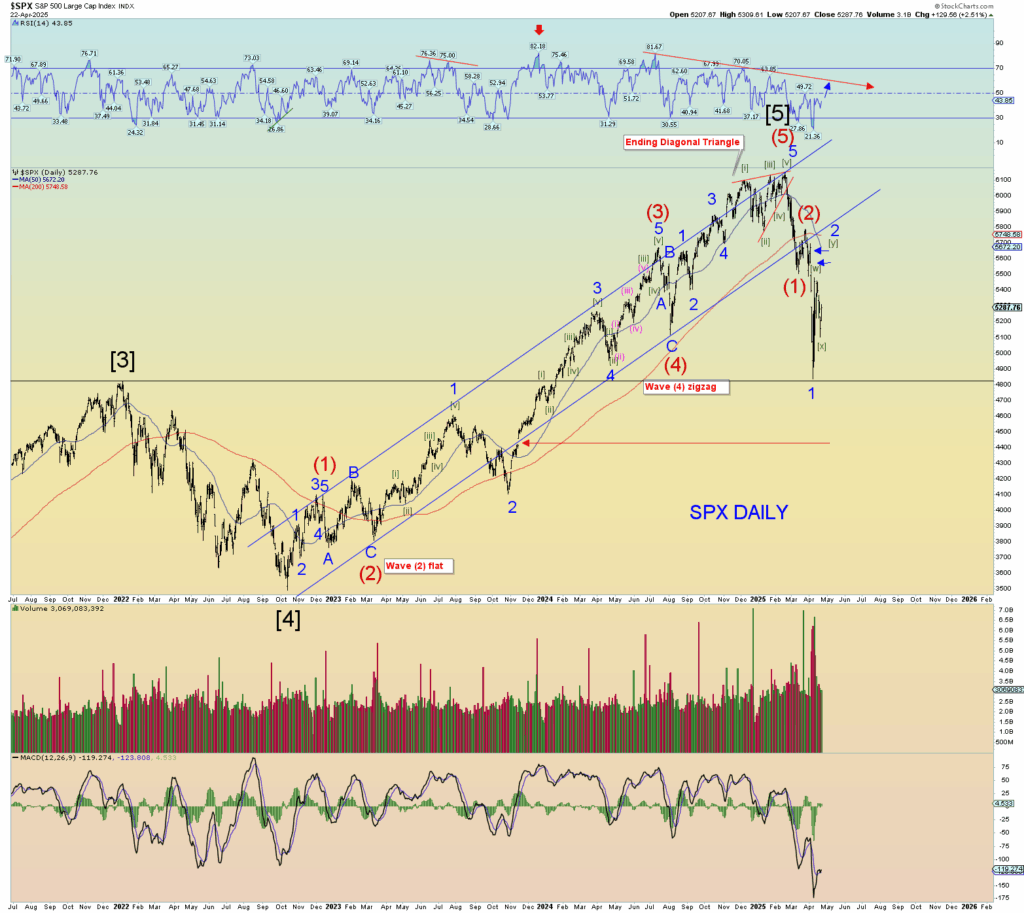

I’m posting a chart full bull retard here. A possible primary Elliott Wave count is that the SPX makes a new all-time high eventually within a few months or so. The caveat is that the DJIA, and NASDAQ composite probably diverge and not make a new all-time high. In other words, today was the “kickoff day” of a significant wave 3 of 3 event upwards in the SPX. Practically a 90% up day all around. The wave count is such that the SPX has had a series of 1-2, [i]-[ii] upwards. Both the corrective wave 2 and [ii] are 3-3-5 “flats”.

The overall primary count would be thus:

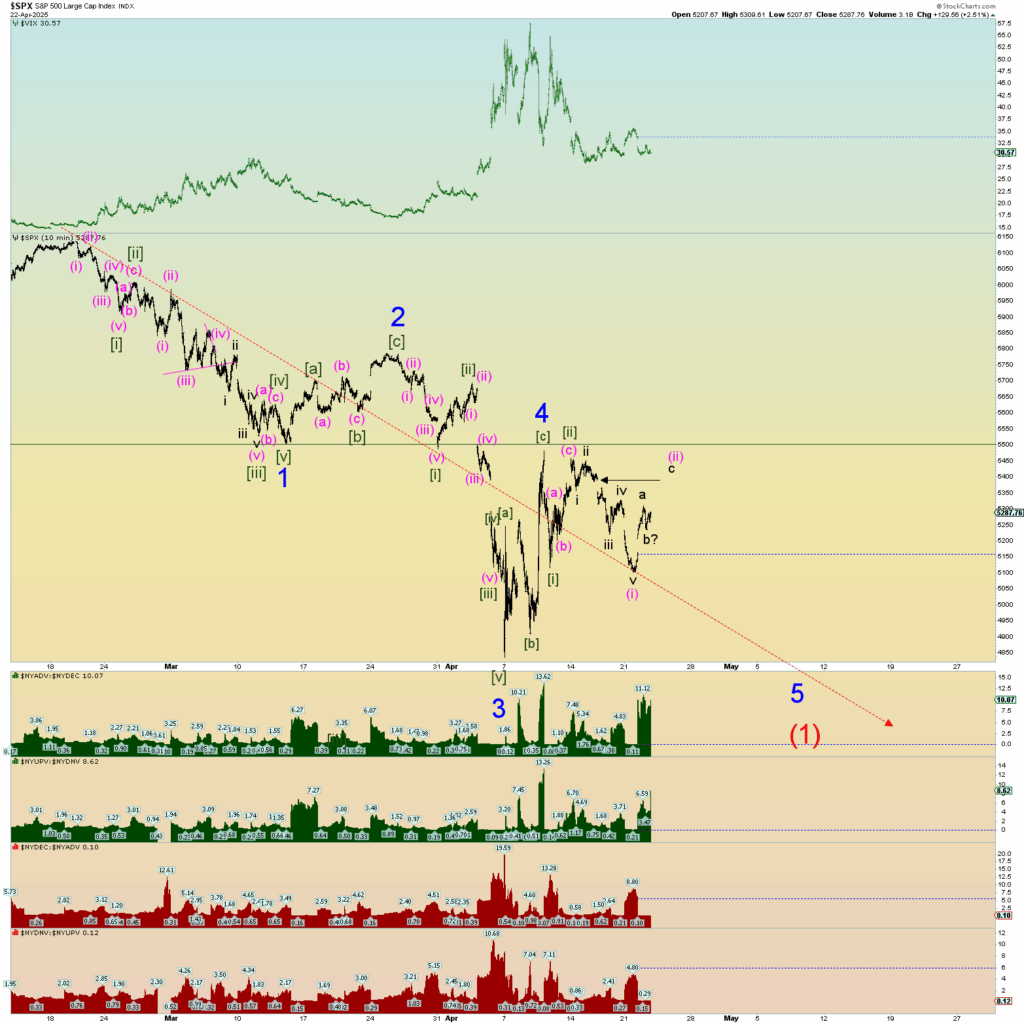

The alternative count is that the market is just going to keep fucking with us as much as possible and cover the very big open gap above in a wave (1)-(2), 1-2 DOWN and then collapse.

I wished I cared, but this massive trading range is just one bug jerk around so far for both sides.

Of course, the other count is wave 5 of (1) is just going to take its fucking time as much as possible to fuck with you and fuck you out of all sanity. That seems about right.

CONCLUSION:

I’ve presented the 3 top counts based on my feelings of today. I wanted to be bearish but about 4 dickheads from work swear the market is “over” that I thought to myself, these assholes are so bearish I should probably be bullish. And today’s internal numbers and the fact that a possible 1-2, [i]-[ii], double 3-3-5 flat pattern, back-to-back ended yesterday is noteworthy for the contrarian in me. One guy who didn’t even know what the Dow Jones or S&P 500 index was, emphatically told me the stock market is finished just deflated me to the point where I resign and might as well start counting to a new all-time high again.

When the plebes at work are paying attention to their 401Ks to the point of making proclamations about the stock market in which they don’t even understand that the S&P500 is an “index” and not a stock, then I resign to the possible wave count, that new all-time SPX highs are probably coming in the summer….I really hope I’m wrong.