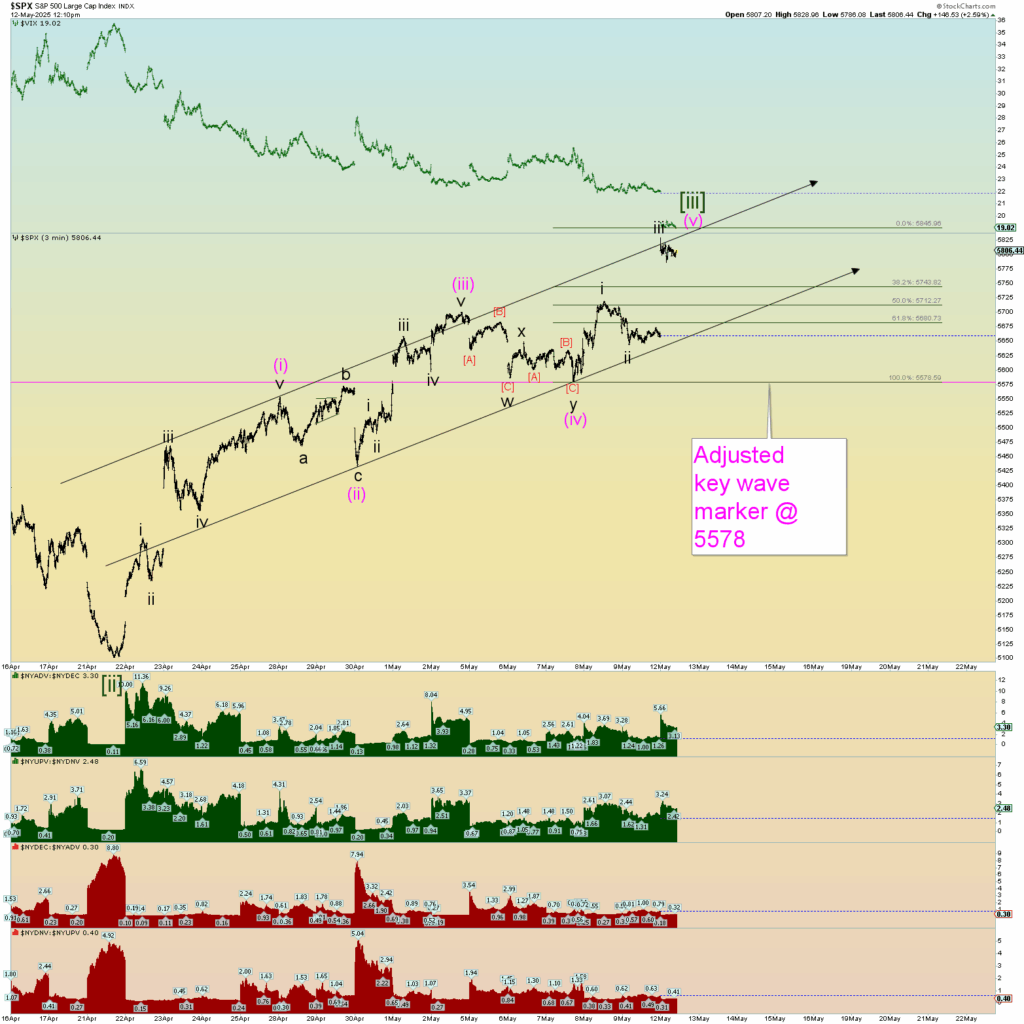

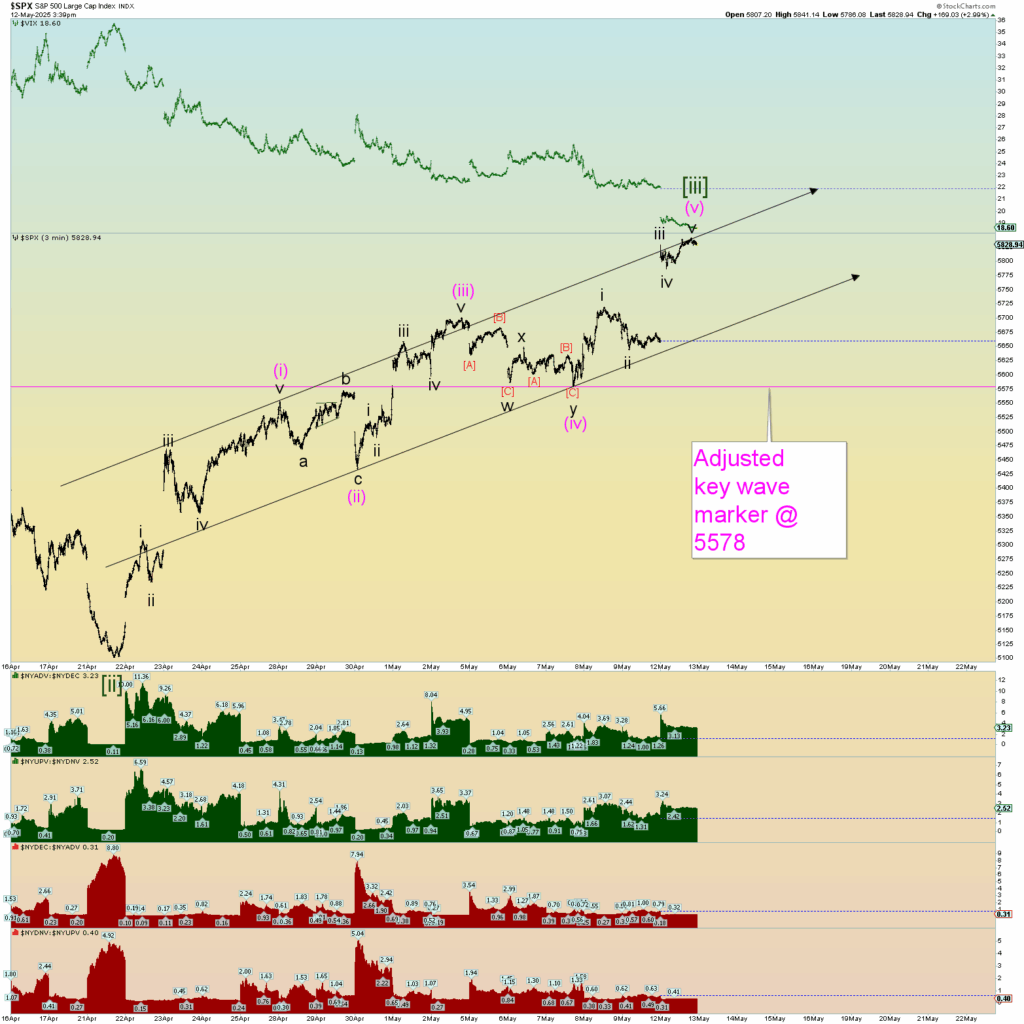

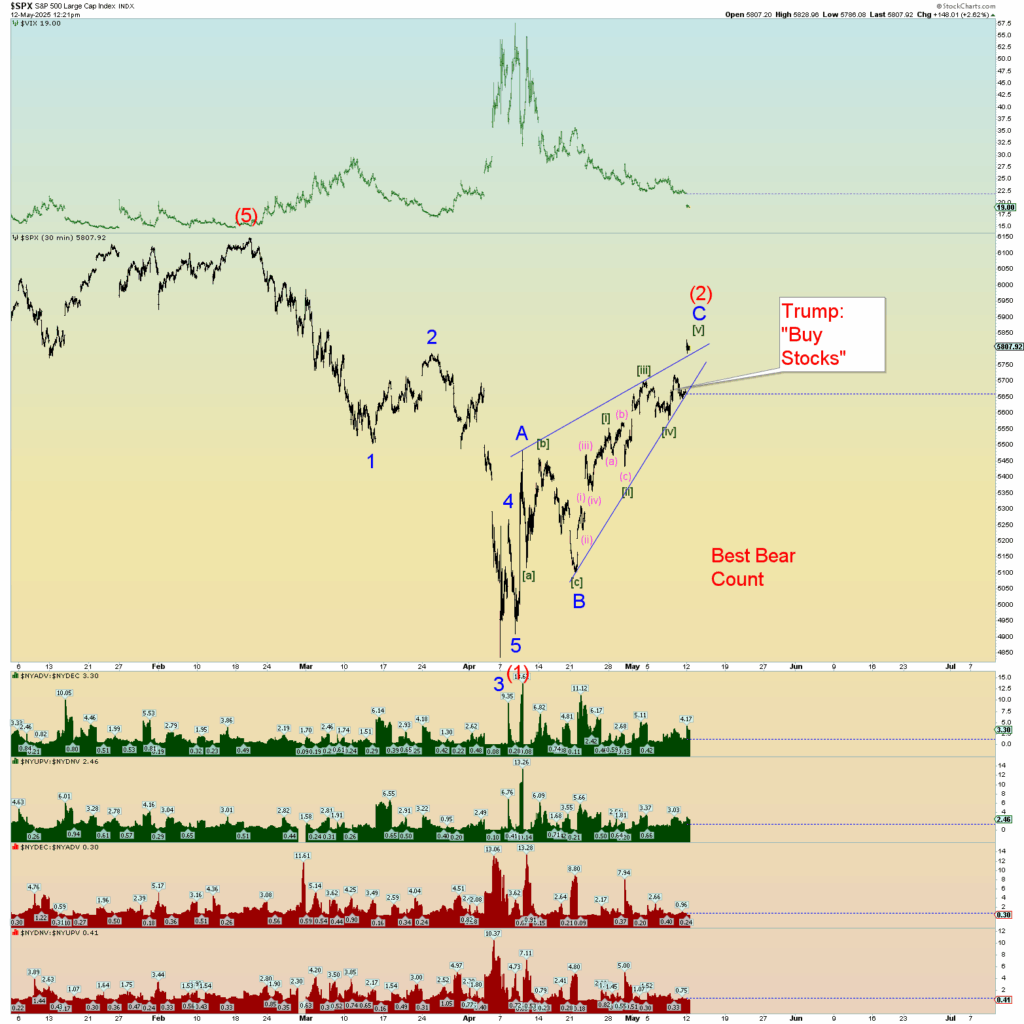

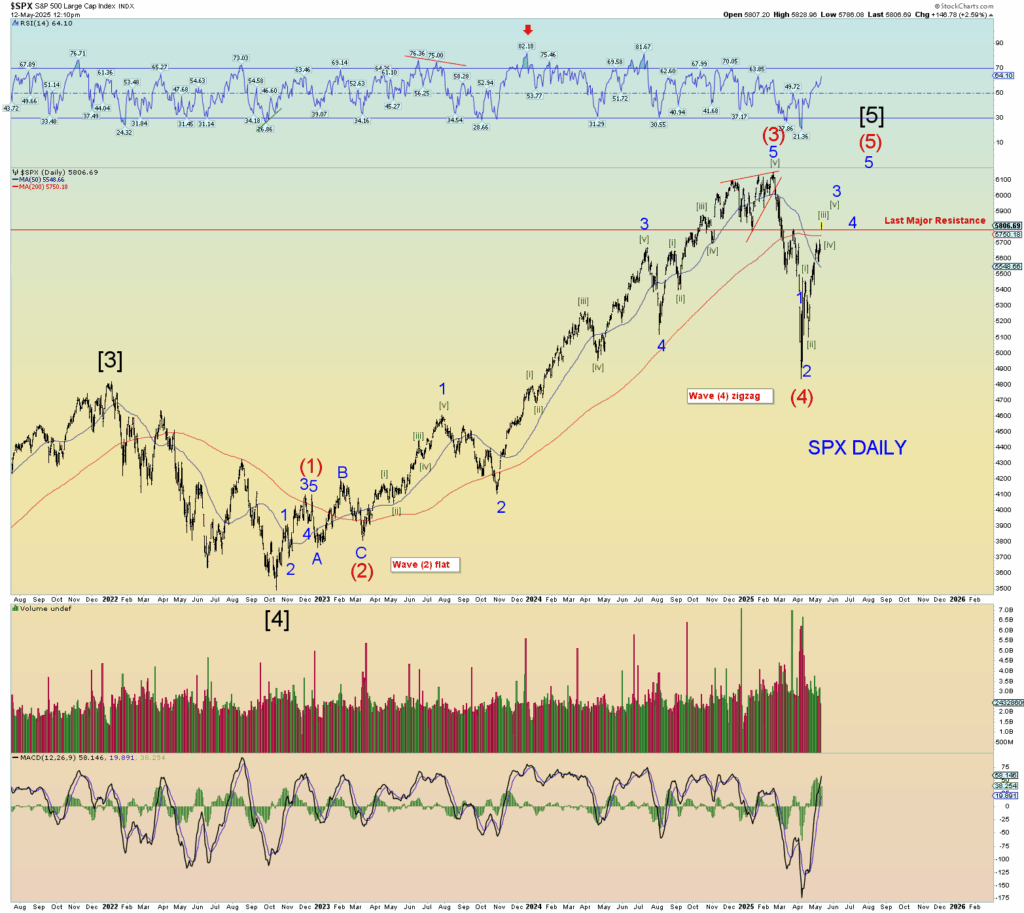

Again, if prices go above 5845, then the wave count I have labeled is not correct. Wave (iii) of [iii] cannot be the shortest wave. So far, the SPX has a 5841 high. So, we can still label it this way for now.

[Update 12:45 pm EST]

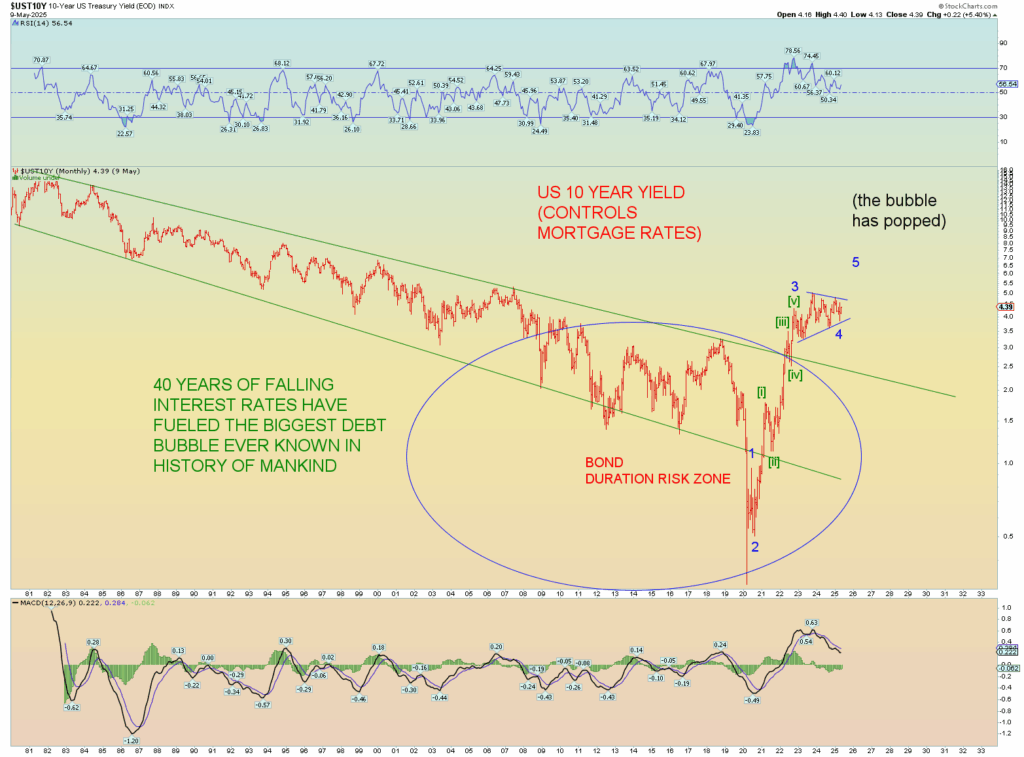

The pattern with the 10-year yields is a long-winded contracting triangle with breakout upside outlook. Today may be the beginning surge and then the talk will all be about interest and mortgage rates surging. Which is of course unsustainable for the economy, the consumer and our debt-laden governments at all levels.

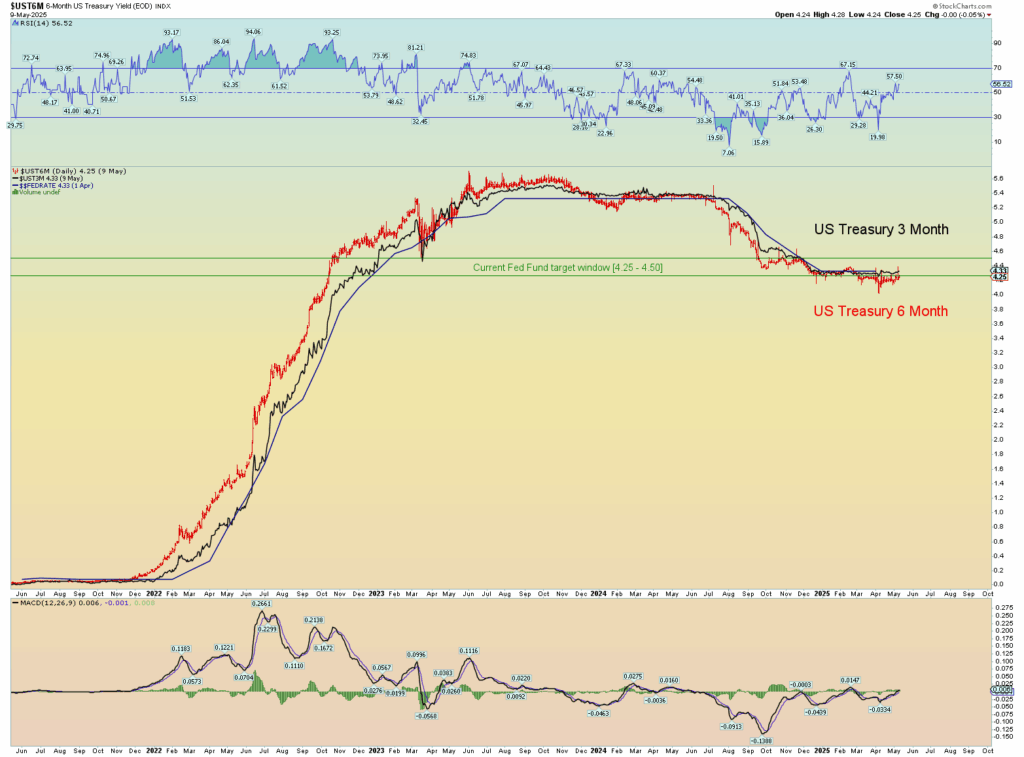

And the short-term rates are holding steady. Powell cannot lower rates if the market tells him not to. The FED must set the short-term rate to what the market signals (best seen through the lens of the combined 3- and 6-month yields) otherwise interest rate distortion occurs which would be bad for the Fed which after all, is a private bank.

[Update 12:25 pm EST]

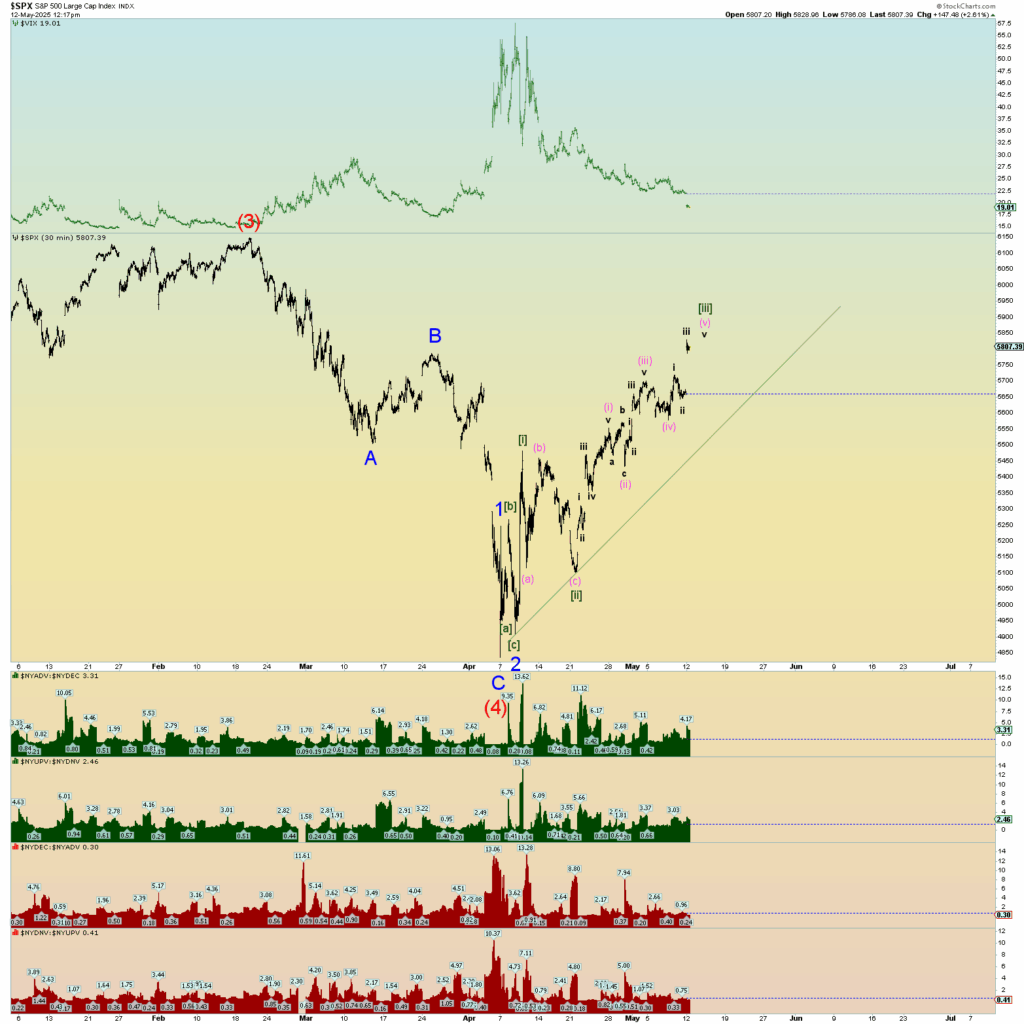

The market is making an interesting wedge pattern with “overthrow” at the top. Although this is not the primary count, I have to show it, nonetheless because if it is correct the collapse will be very, very swift back down through the bottom wedge line in total exhaustion. Today’s euphoric gap up and all is wonderful with the world is kind of overdone, don’t ya think?

So, the pattern is interesting but if no quick follow-through crashing through the downside, then it is not a true rising bearish wedge.

Prices gapped right over the last major resistance. I think prices will still struggle here and today’s massive gap up will close in Minute wave [iv] of 3.

Wave (iii) of [iii] cannot be the shortest wave. So, Minute [iii]’s top price must come in under about 5845. The adjusted key wave marker has been raised a bit from 5555 to 5578.