There are many possibilities with the overall wave structure. But the key point is that there is not yet a conclusive overall 5 wave pattern down on any index yet.

The next few charts show the thinking of potential counts. The first chart is the simplest using the Wilshire 5000. We had a wave 1 – 2 forming a “base channel”, then perhaps wave 3 forming an acceleration channel down, and now wave 4 in the process of a “backtest” of the base channel. Then another lower low would follow forming wave 5 of (1) down.

There are of course variations on the above. The next chart includes the alt [i] low and now the market is bouncing in alt [ii]. This is a much more aggressive count. Wave [ii] could very well overlap with Blur Minor 1.

And another view showing a more bearish view of red Intermediate (1) down and some slight internal count variations.

The S&P has its own thing going on as does the NASDAQ and INDU. I show the SPX. I could have given this a few variations, but you get the idea. I realize the wave degrees don’t match well with the Wilshire but ignore that for now the wave structure is what’s important at the moment. We can figure out the wave degrees once a solid structure has formed.

The bottom line is the market at some point requires a lower low to form a bear wave down.

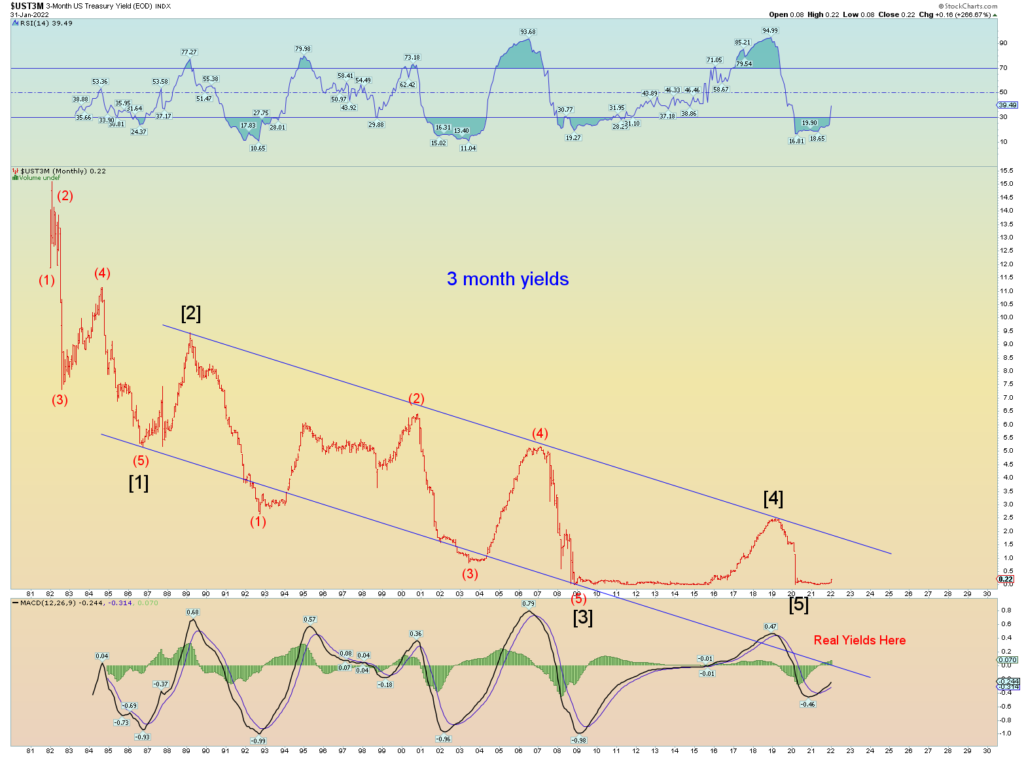

And the FED does not set the (market) interest rates, rather they follow the market. It’s pretty simple: when the 3-month Treasury and 6-month Treasury move (mainly the 3 month), the FED HAS to move with it. I don’t know all the intricate reasons why, but from a layman standpoint it makes perfect sense:

The FED cannot let the FED FUNDS rate differ widely from what the short-term lending market sets or you would have all kinds of perverse arbitrage and market distortions. The MASSIVE interest rate credit derivative swaps market wouldn’t work correctly. And for all intents and purposes, the 3-month treasury is probably the best indicator. If the 3-month rate is .25 or .30 or higher, you can bet the FED will follow and raise rates to keep matching it.

At this rate, I expect indeed the FED to raise rates in March unless these moves suddenly reverse sharply to near zero. Keep an eye on this chart and you will know better than all the gurus on what the FED will do next.

Higher interest rates will CRASH the entire PONZI scheme financial system and cause massive deflation. Oh, you’ll still be paying $18 for lb of ribeye steak (the little guy will get screwed) and $5 for a gallon of gas.

Inflation is not just a result of monetary policy. There is also supply and demand. And we all know they BROKE the supply side of things on purpose. So don’t confuse the two aspects of inflation/deflation. I used to blog about a deflationary collapse with inflationary consumer goods at the lower end. Both are possible.

So as the mom-and-pop stores go under some more, certain corporations will be huge losers. Lots of job losses. Governments and municipalities defaulting on debt. You get the picture.

For example, deflation might result in seeing the NFL (and NBA, NHL, MLB etc.) reduced from 30 teams to 24 (or whatever) due to financial losses eventually incurred when global unemployment skyrockets and the fan base dries up as corporations’ default and go bankrupt and people have no income to spend on overpriced sporting events. Yet if you DO go to the game, you’ll still pay $20 for a piss warm beer.

The whole thing is a time bomb and consumers are in credit card debt up to their ears. They will be the first to IMMEDIATELY feel the effect of higher interest rates. Banks will raise credit card rates THE SAME DAY the FED sets a higher FED funds rate.

The elite don’t care now that they own everything. So what if they lose billions? They’ll still claim the deed to your property and own the power of governments to threaten violence upon you to be removed or jailed or killed.

Why will this sucker reverse and head higher? Well, a 40+ year down channel has no more room to down channel any longer. This down channel IS the PONZI system. The PONZI needed lower and lower rates for the debt scheme to keep working. Now that we are out of “fools” to add to the Ponzi scheme, the jig is up. The elites know it. The FED knows it. This “plandemic” was all about control of the people for the coming financial system collapse.

Klaus Schwab really does want you eating bugs, living in a cement one-room apartment with no car, or better yet dead from a “vaccine”.

Massive warfare is coming once the worldwide Ponzi financial system collapses. My best guess for warfare is still a projection of June/July/August 2022….this year when the weather gets warmer. Wars always start in the Spring/summer.