Last Thursday had what appears is a misprint on the Wilshire 5000. I don’t understand it, it happens every blue moon or so. The spike down I think is false.

Worldwide bond update. 30-year bond at horizontal support. Expect a move back to the long term trendline support.

10 Year price head and shoulder pattern broken. Downside target shown.

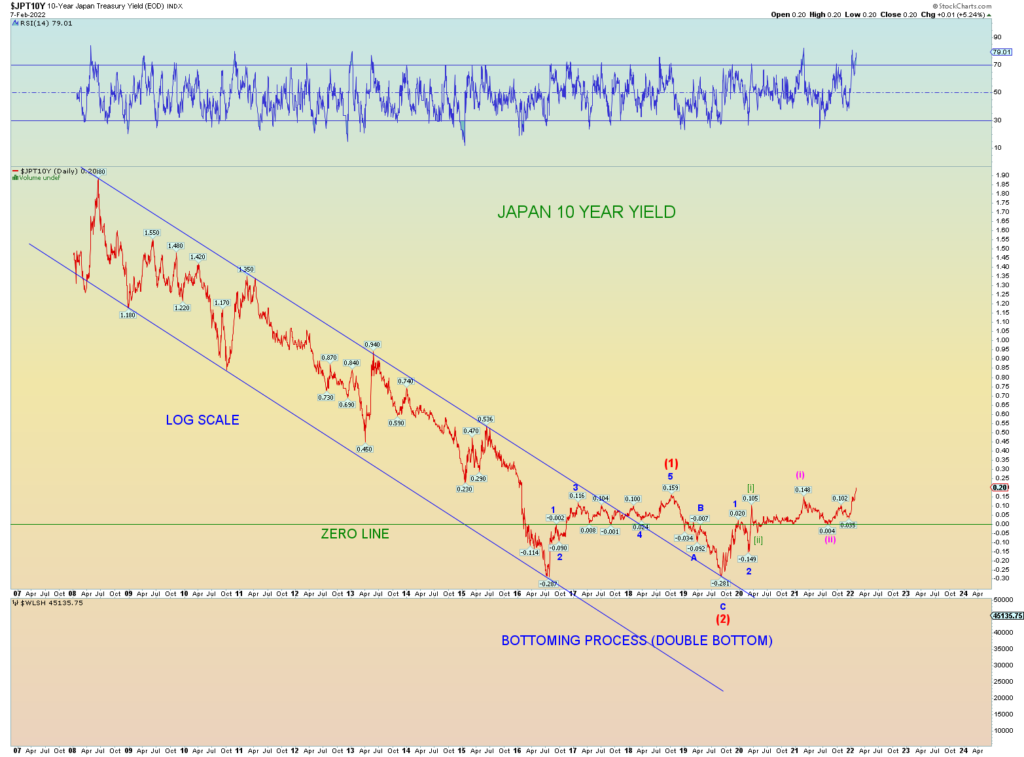

Japan. King of credit debt. Highest 10-year yield since 2015. This is not good. Remember all these channels of yields going lower correlate to massive amounts of debt issued. That is fine if the yields continued lower. But the world hit the bottom and reversed. Never in the history of mankind have we been in this financial time bomb situation before.

It’ll all blow up soon enough.

UK looks nicely impulsive upwards.

Don’t forget the Germans who also let their yields run negative. Duration risk is oh so dangerous here. Selling will beget more selling which will start a nasty feedback loop. The entire world is a debt bomb primed to explode. This will not be good for stocks.

Rate raises are coming. The 3/6-month yield chart is running ahead of the FED and the FED has no choice but to play catch up. LOL, if the 3-month yield bursts toward .40 – .50 range and the 6 month considerably higher, the FED might actually raise it more than a quarter point…. wouldn’t that be a kick to the face for the stock market?

Look at that RSI momentum.