Yesterday’s CPCE data. 1.75 calls for every 1 put. This is of course deemed “normal”, but is it? Is it not a reflection of an extremely overleveraged market?

At the very least, to claim that people are still “too bearish” does not reflect in the actual data of what they do. Which is bullishness all the time, every time. Despite a 35% pullback in the Composite, there never was any real panic to speak of.

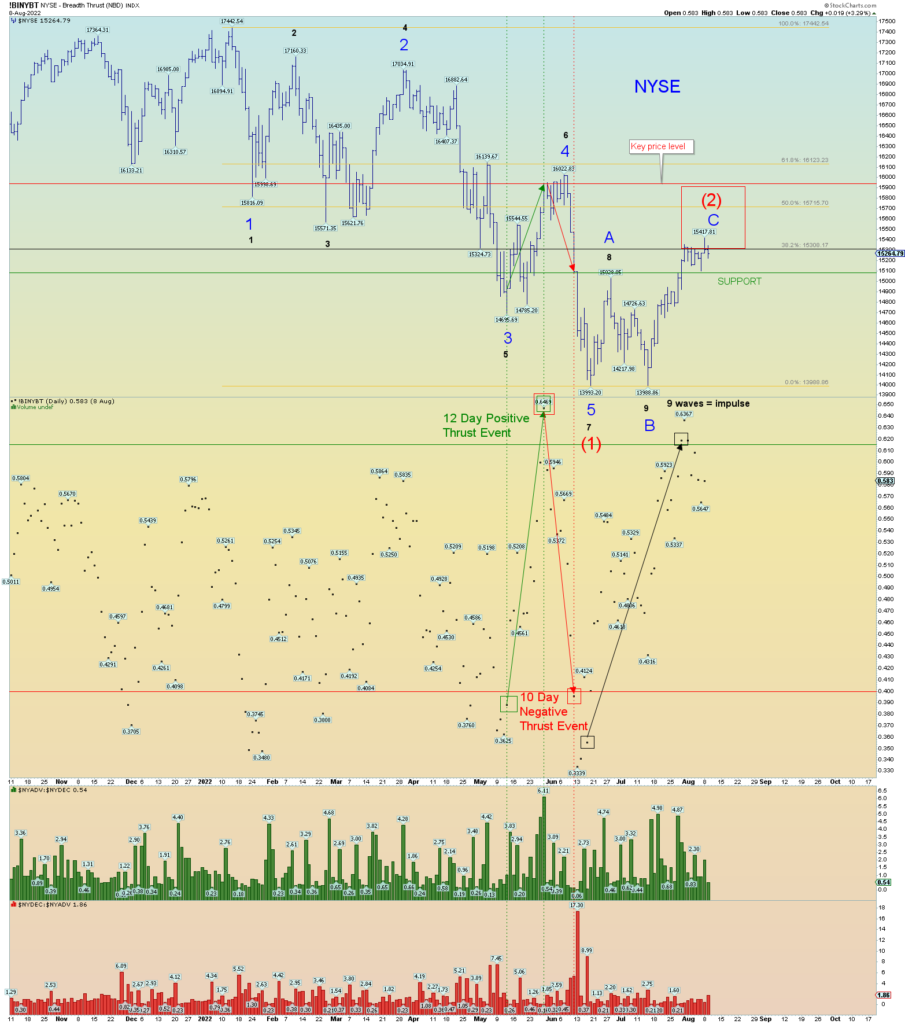

Primary count is that Minute [iv] is finally finishing up for good. Any price break of Minute [i] peak would be very bearish and indicate this wave structure as labeled is finished.

NYSE still struggling to get above things and make a move. This was predicted because of the previous negative Zweig Breadth thrust event as outlined by the red arrow down. I am very fascinated if this extremely bearish event will hold true in the long run. 8 days so far struggling with the 38.2% Fib retrace line.