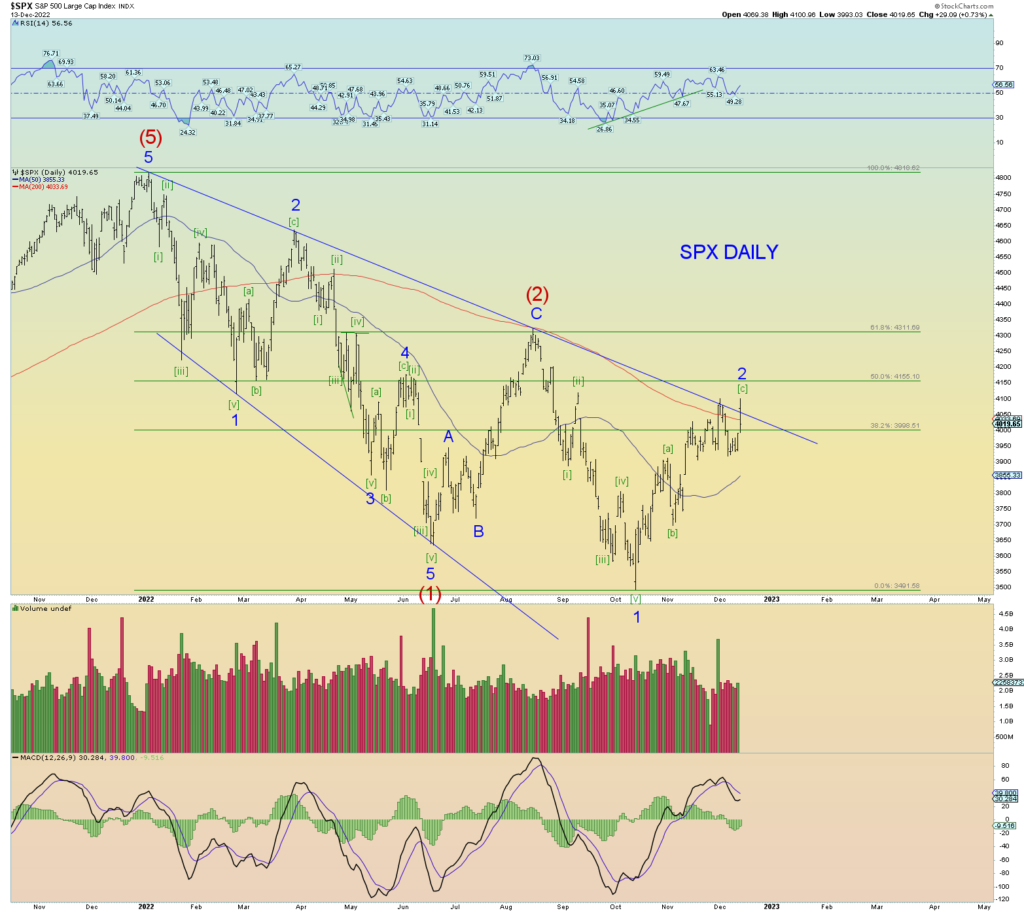

SPX made a technical new Minor 2 of (3) high today but the Wilshire 5000 did not.

Perhaps it’s just a matter of where [c] is not going to finish until it equals wave [a] at 4112 SPX or so. The primary count allows for another marginal push.

Prices trying to break above the downtrend line(s) on the SPX and Wilshire.

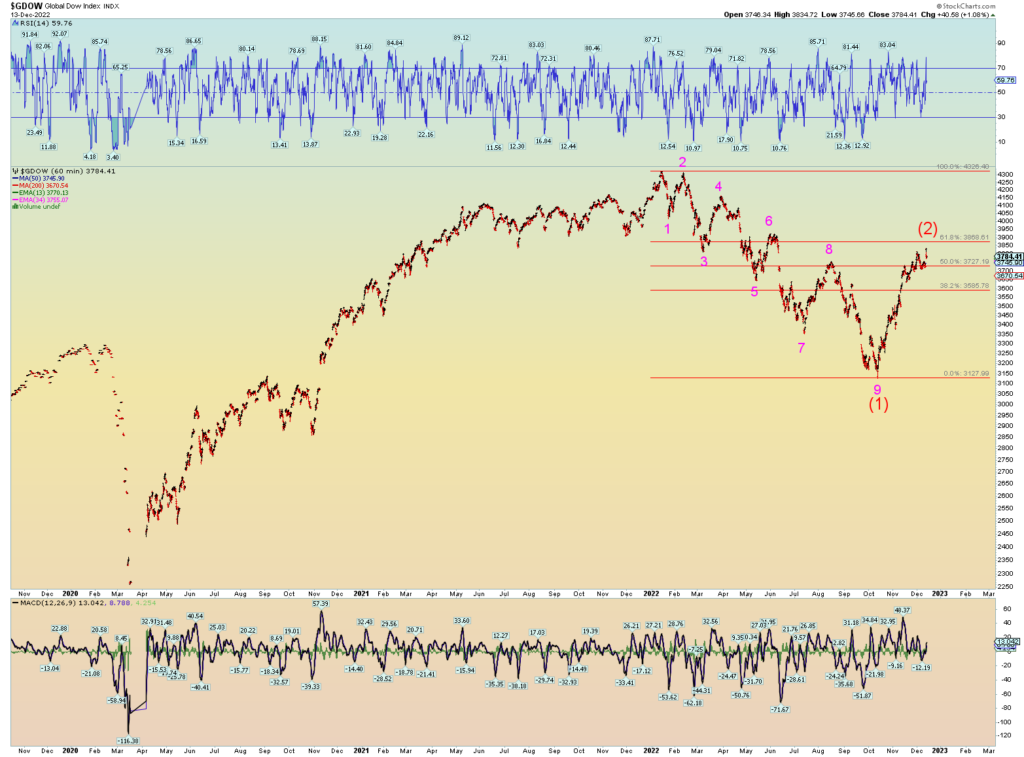

DOW theory divergence still in place.

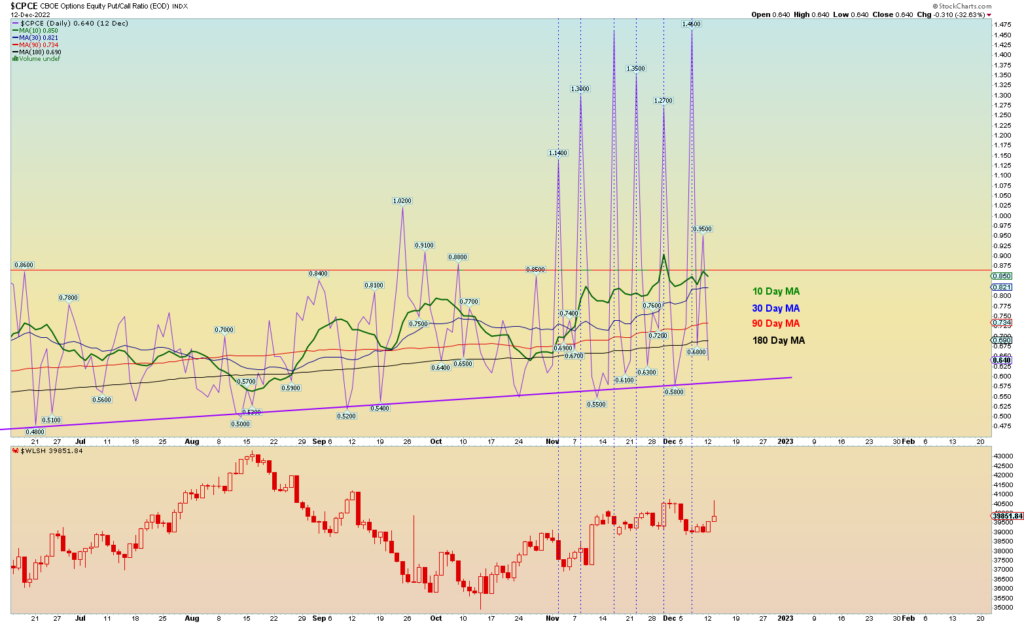

CPCE madness as of late. It looks like the results of a bunch of malfunctioning computer algorithms.

The top long-term alternate is that the October low in the Wilshire was Intermediate (1) low and that the market is in the middle of an Intermediate (2) retrace. If so, expect at least a 61.8% Fibonacci total price retrace and prices to go above “4” of (1).

Timewise we are looking for first quarter 2023. People get mad when I show this alt as if I am changing the primary count (I am not) but what can we say about the DJIA? It has rallied 21.5% off its October lows and today’s peak was a mere 6.15% from its absolute peak of early January. Even the Global DOW has rallied almost 61.8%.

But it’s a completely fractured market as the NASDAQ Composite is still a full 30% beneath its absolute all-time peak.

Overall, the CPCE as of late reflects the sentiment swinging from one extreme to another. Do people go all in short or all in long? Schizoid market. The primary count suggests it will fall apart in wave 3 of (3) down. The rallies on the DJIA and Global DOW seem very extended, and the wave count is more than satisfactory on the Wilshire 5000.