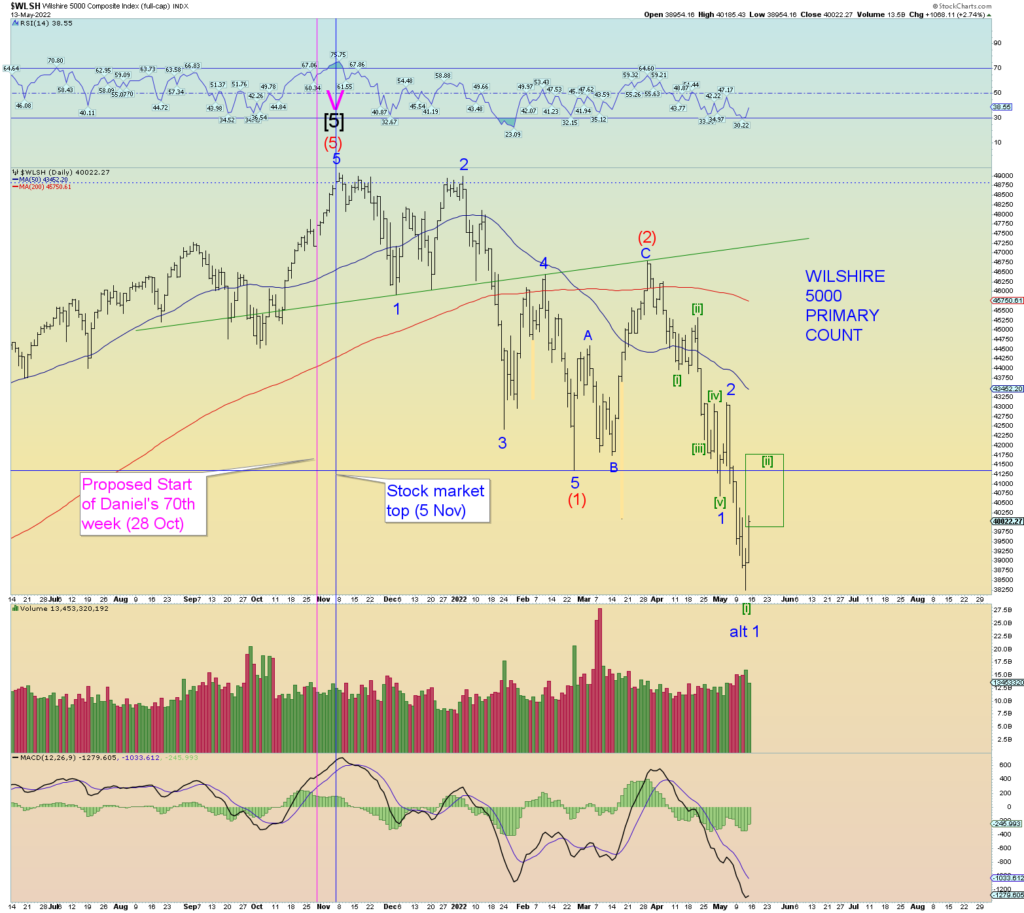

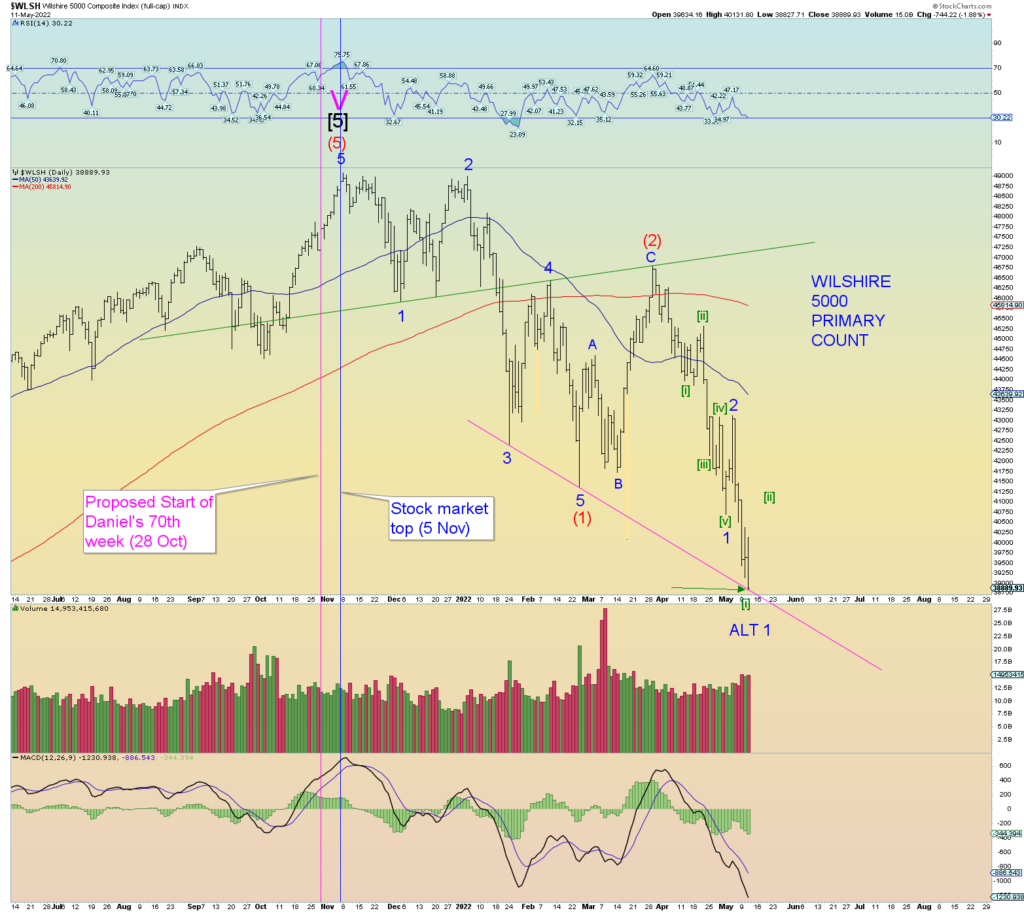

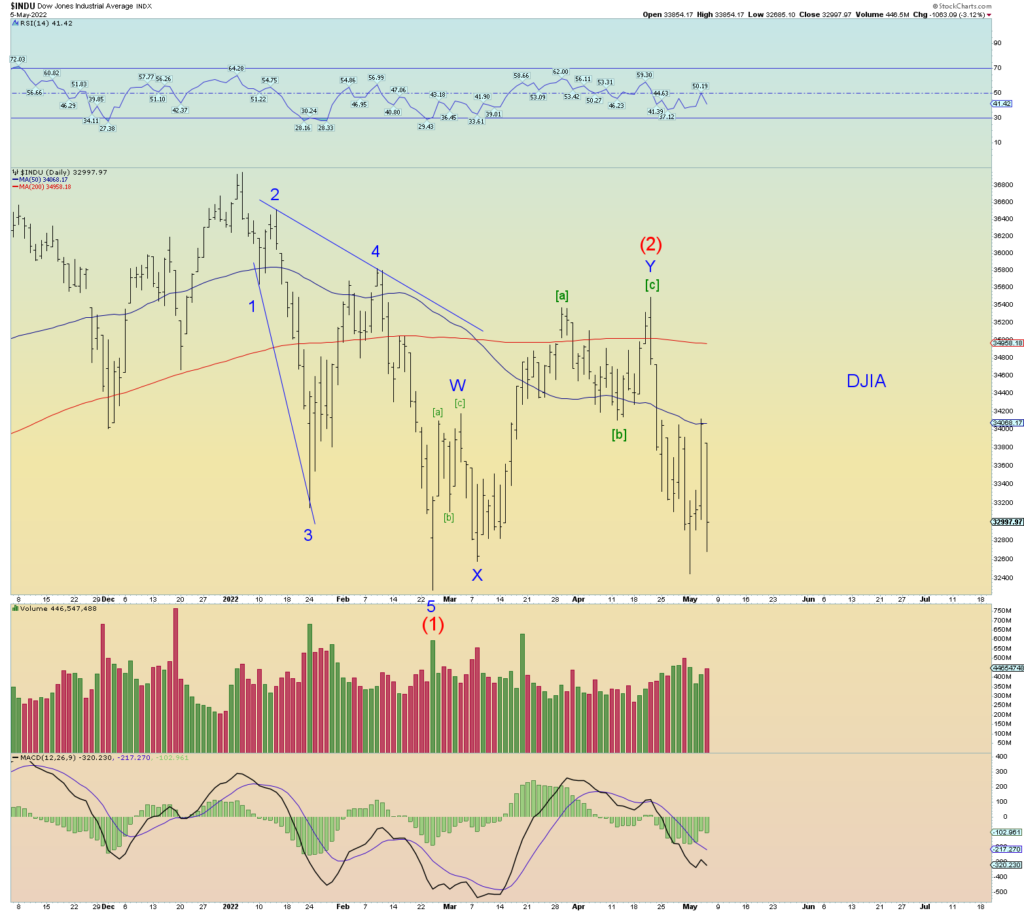

Well, we finally got the pop I was expecting to form what appears to be Minute [ii] of 3 of (3). Looking for further upside perhaps overlapping the price low of Minor 1 (blue dashed line)

Minute [ii] has met the minimum target retrace.

COMMENTARY

I sit back and laugh as I peruse the headlines day after day. People get all worked up. Believe me, when my heart was firmly set into the things of this world, I huffed and puffed and worried day after day and tried to “believe” in politicians and things of this world. What a waste of time and energy that was.

About 2 years ago, during the Covid run-up when they were denying Ivermectin and HCQ for Covid, I had woken to the truth of the evil that this world had become. Woken to the truth of secret societies, and satanic cults and the world of WEF, and the fact that they really did want us “normies” dead. And nothing has changed. If anything, the masks have come fully down and the globalists/satanists are coming after us hard and are pushing for global war hard.

They have begun the “takedown” of the global financial system, not that they could do anything about it anyways. It was more than ripe for a popping. The debt loads are so bloated any rise in interest rates would expose the Ponzi scheme for what it always was. The globalists know all this of course. They ain’t dummies. Now that they have squeezed every last corrupt penny of resources they could, they simply will let it all come crashing down. Again, they couldn’t stop it even if they wanted to.

Satan is on earth, and he knows he has but a little time. The push for war against Russia will eventually be a push for war against China. They are the 2 nations that have nuclear arsenals targeted against the western powers who are trying to implement Babylon global empire #7 to be ruled by the Antichrist.

So be of good cheer! My best recommendation is to get right with Jesus Christ the only one who can and will deliver us. Don’t participate in the evil, and don’t retaliate or get caught up in wrongdoing for vengeance is the Lord’s. Unfortunately, Christians will have to endure the greatest tribulation (for them) in the history of the world before that great Day of the Lord comes. Even so, if we stay right by God, preach the Gospel, do not get caught up in committing evil and he’ll keep us protected.

THE COUNTS

As mentioned last night predicting bounces in the midst of a wave (3) down can be a fool’s affair. But again, selling wasn’t too bad today via the NYSE internal data. But still, prices bled lower. We can still imagine one final giant squeeze that is building up in the market prior to the real panic to come because the wave count supports this notion. For if that squeeze comes, you can better believe everyone will take full advantage and sell into it.

But really, the market is just as extremely leveraged on the way down as much as it was on the way up. It’s a dangerous market, as social mood worldwide is obviously deteriorating to the point where regular Americans have no problem calling for war not only against foreigners, they have no business making war against, but soon domestically also. Keep out of the streets, don’t fight against the wicked political system. Half the reprobates running this country I truly believe are possessed with literal devils. Biden for sure. Psaki, Harris, the faggot Buttedgehole is definitely a reprobate recruiter. Pelosi is a literal hag witch teeming with Beelzebub’s.

Trump is a degenerate also. He pushed and still pushes the death jabs. It is all a political theatre for the masses. If Trump was a real threat, he would have been killed. Like Epstein. Trump didn’t stop any of the globalist’s long-term plans, he merely became the initial reason to ramp up hatred against Russia.

Fear the Lord, and you will be right with God.

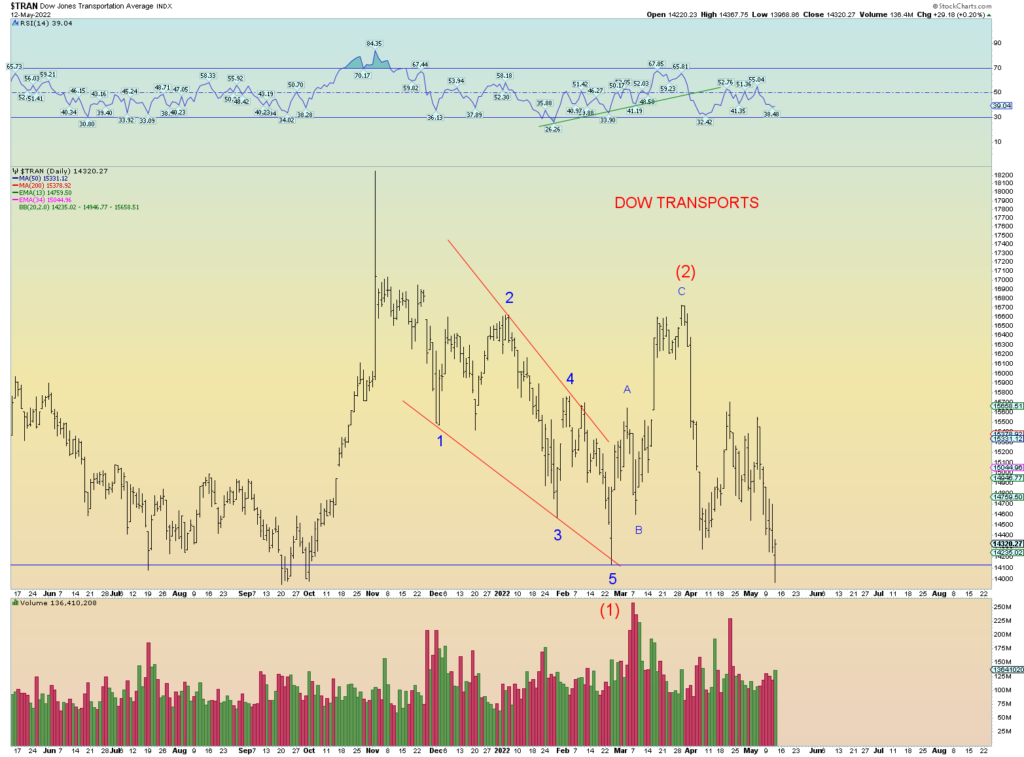

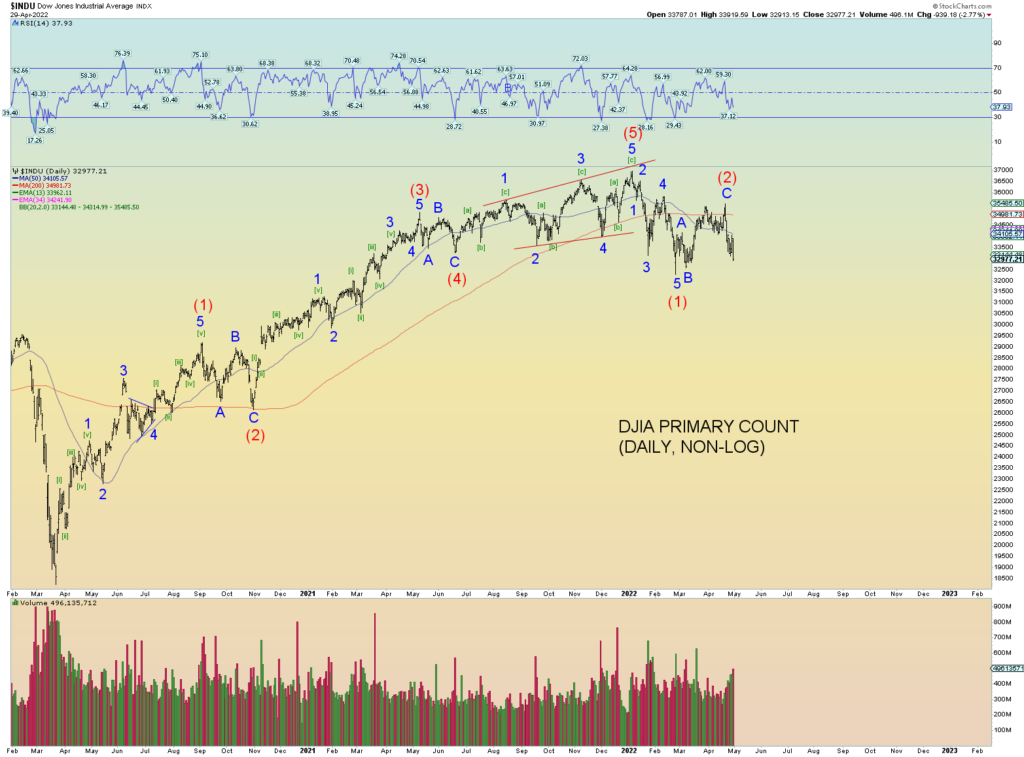

The DJTA finally broke lower confirming the bear market with the DJIA.

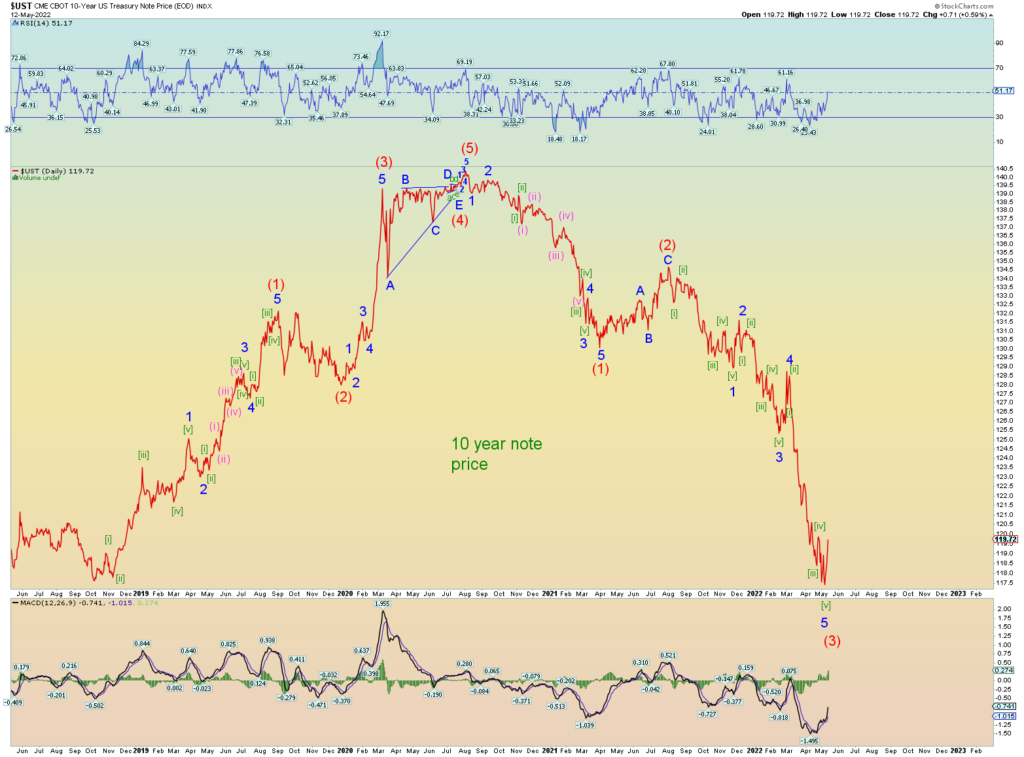

Bonds are due for a bid, the wave count supports it.

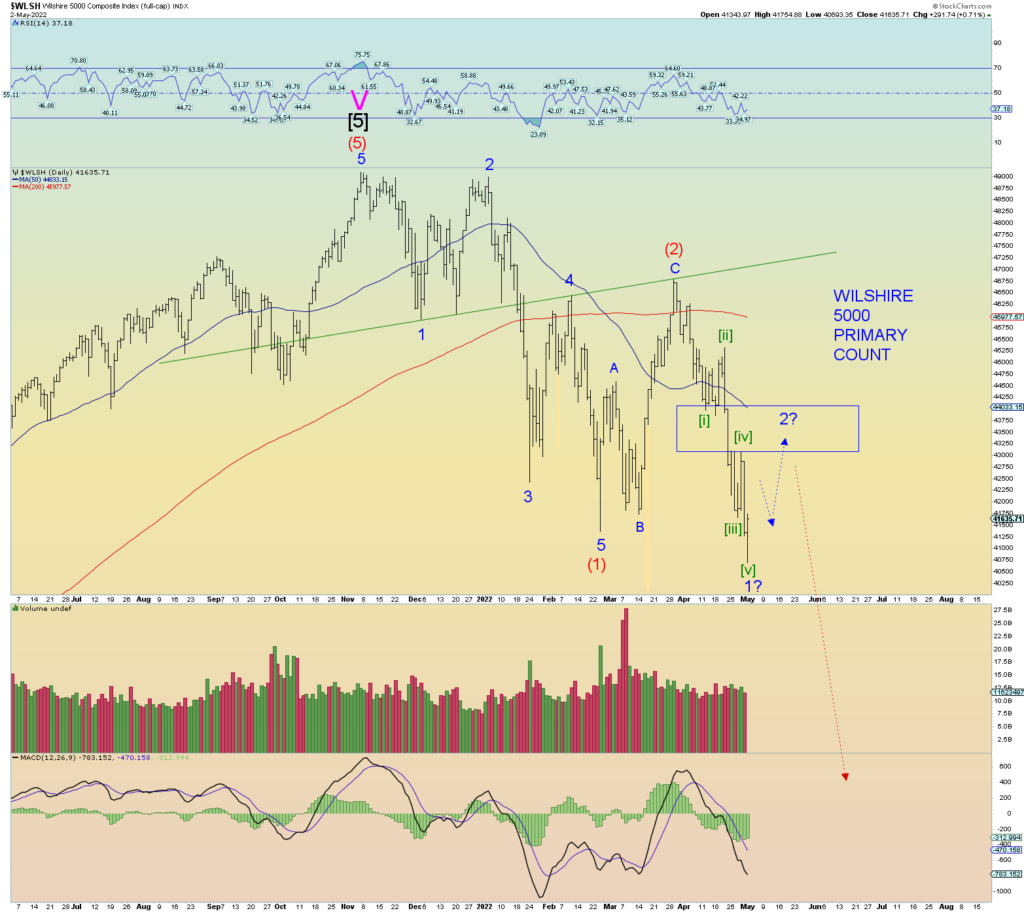

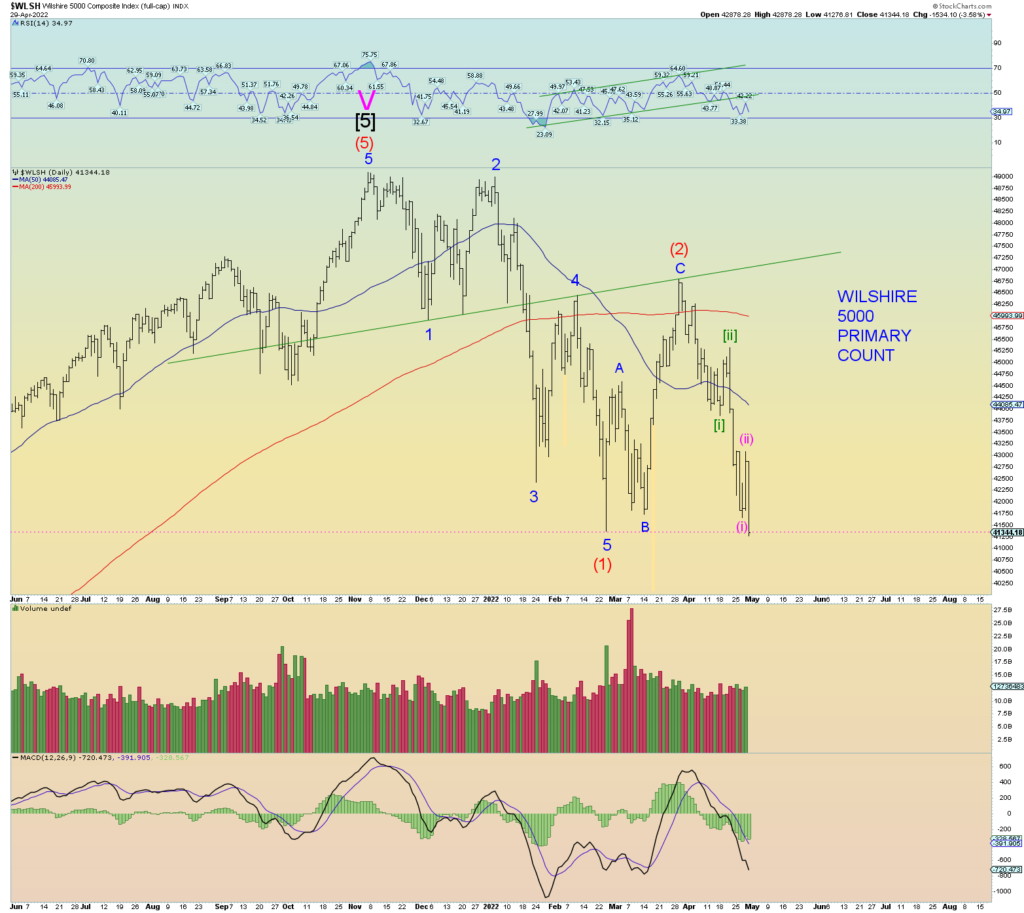

An important trendline was met today in both the Wilshire 5000 and Nasdaq Composite. Selling pressure has receded as measured by the NYSE internals despite the price drop to meet that trendline. Therefore, there is still room for a very healthy price bounce.

Perhaps I am overcomplicating the squiggles and today was merely the end of Minor blue 1. It is a possibility. But for now, we’ll still call it Minute [i] instead, the next wave degree lower.

The Wilshire 5000 is now officially in a “bear” market as prices have finished today more than 20% from peak. Trying to guess where and how hard the countertrend short-covering “rips” is a bit of a fool’s game I suppose. But the wave structure supports it.

The 10-minute chart is useful for the histrographs showing the NYSE selling pressure. Despite the new price low, the selling was not that bad as far as intensity.

This 5-minute chart shows the proposed wave structure since wave 2. It is a very satisfying 5 wave impulse structure.

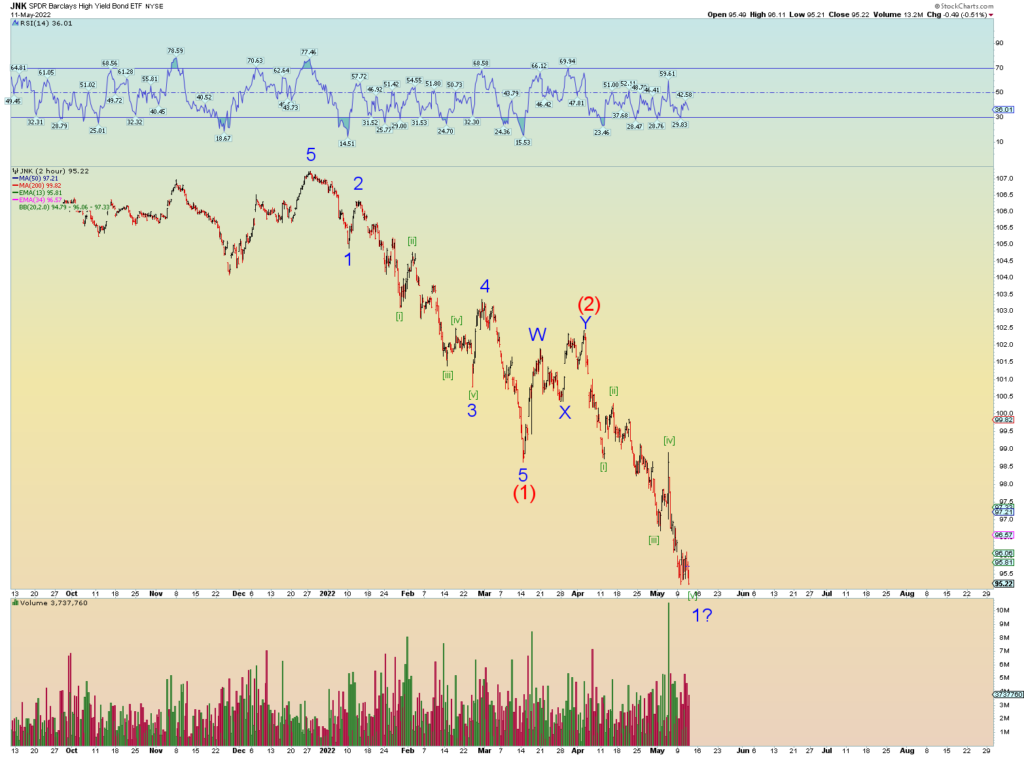

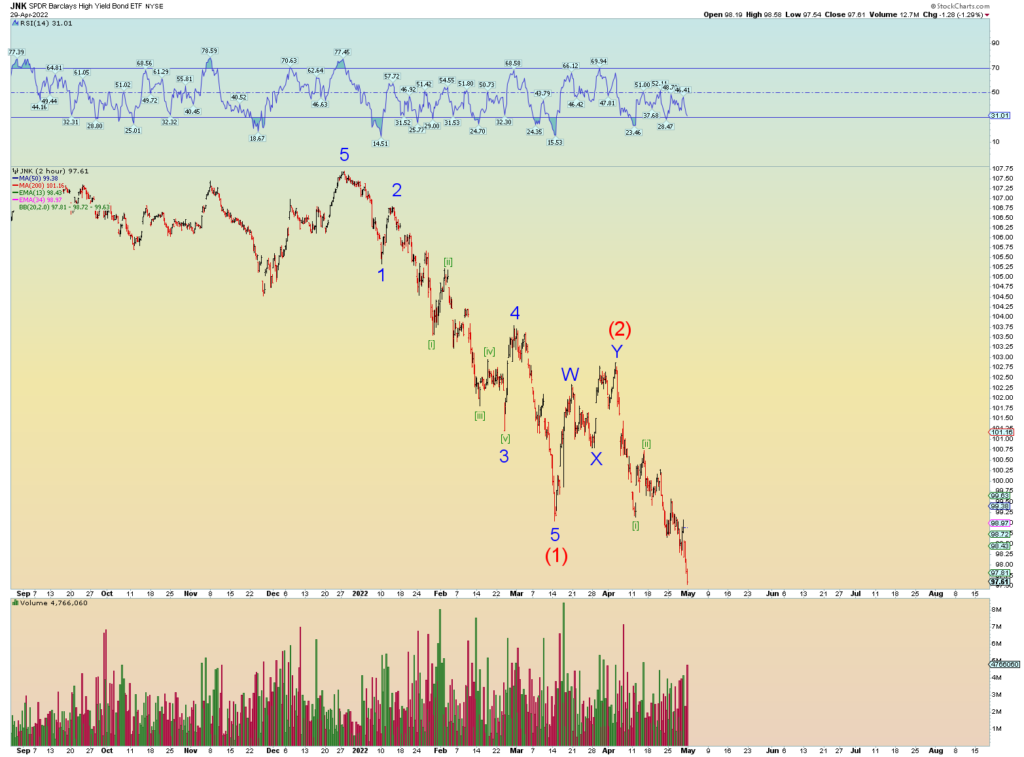

Junk possible count

The CPCE is still very tame considering the Wilshire 5000 is now down 20% from peak. There has been no true panic. And the wave structure supports this as the true panic does not come until a “third of a third” wave and below. That would be wave (iii) of [iii] of 3 of (3). We are not quite there yet.

The best count has today’s low as Minute [i] of 3 of (3). We have room for Minute [ii] bounce up. And then, Minute [iii] of 3 of (3) lower would be, in Elliott Wave theory, the harshest wave lower. The “third of a third”, in which the market “breaks” and panics to lower price ranges.

Still waiting for DJTA to make lower lows to confirm “DOW Theory” of lower prices to confirm the bear market lower.

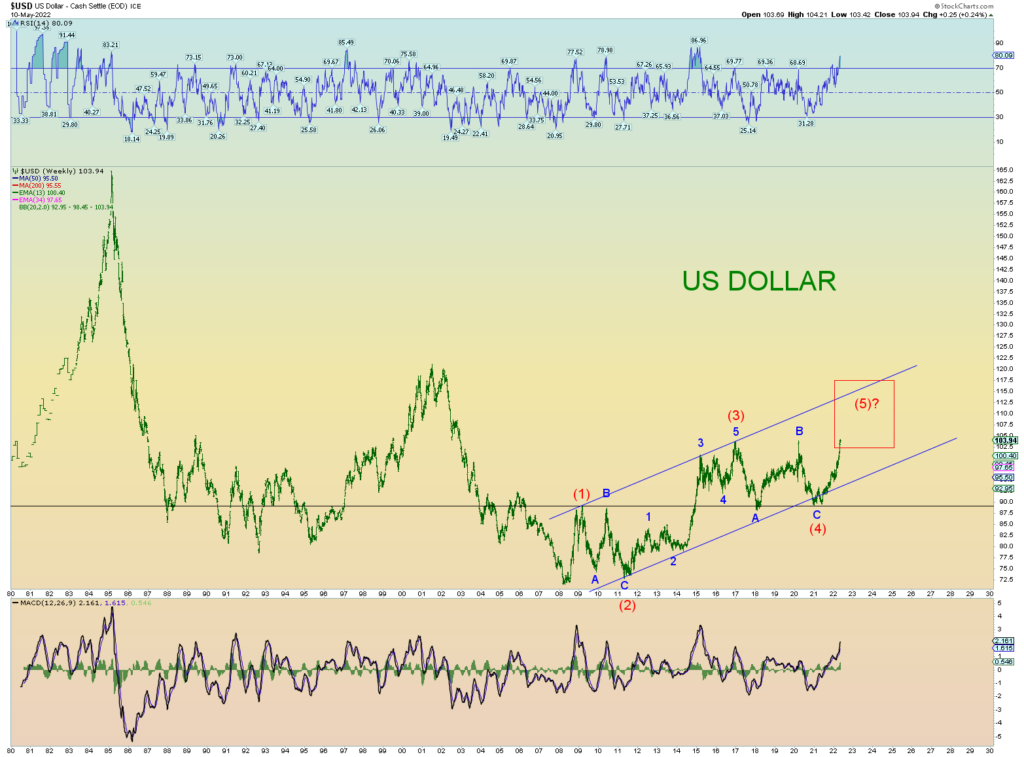

King Dollar for now.

COMMENTARY

The odds of Zelenskyy being the actual Antichrist is about 90%.

And Biden and his minions who are promoting this madness are clearly demonically possessed.

Does that make Putin a righteous person? Uh, no, he is just another pawn of Satan. Basically, Satan controls the entire chessboard of the world at this point in time. Satan and his devils have been kicked out of heaven and they know they have but a short time on this earth. And thus, the effort to consolidate the world into a New World Order, one world government is urgent business. Taking out the 2 nations that have their nuclear arsenals pointed at the western powers who are trying to implement the New World Order is biblical and obvious. Regime change of Russia (and soon to be China) is the goal.

Russia being #1 soon to be followed by China (and maybe their ally North Korea). The next biblical event is expanding global war and the next logical outcome is that the Western alliance provokes China to attack Taiwan. Well, to be truthful Satan is going to put it in the heart of Chinese leaders to attack Taiwan. And a global alliance will be formed against Russia/China and Zelenskyy voted leader of that alliance.

Just about ALL the western leaders, Europe and otherwise, have now travelled and paid homage and fealty to Zelenskyy. This weekend it was Jill Biden and Justin Trudeau.

Again, we are still waiting for Russia to win this war. Change my mind. Yeah, I’d gladly not yet go through the great tribulation. Please, change my mind.

THE COUNTS

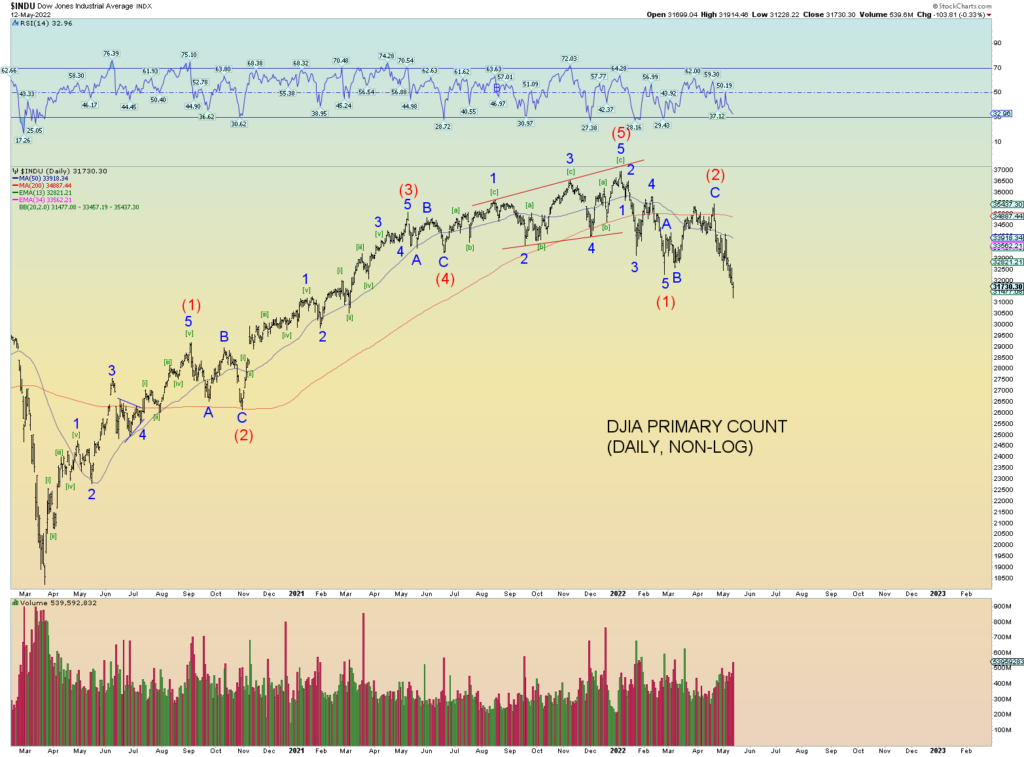

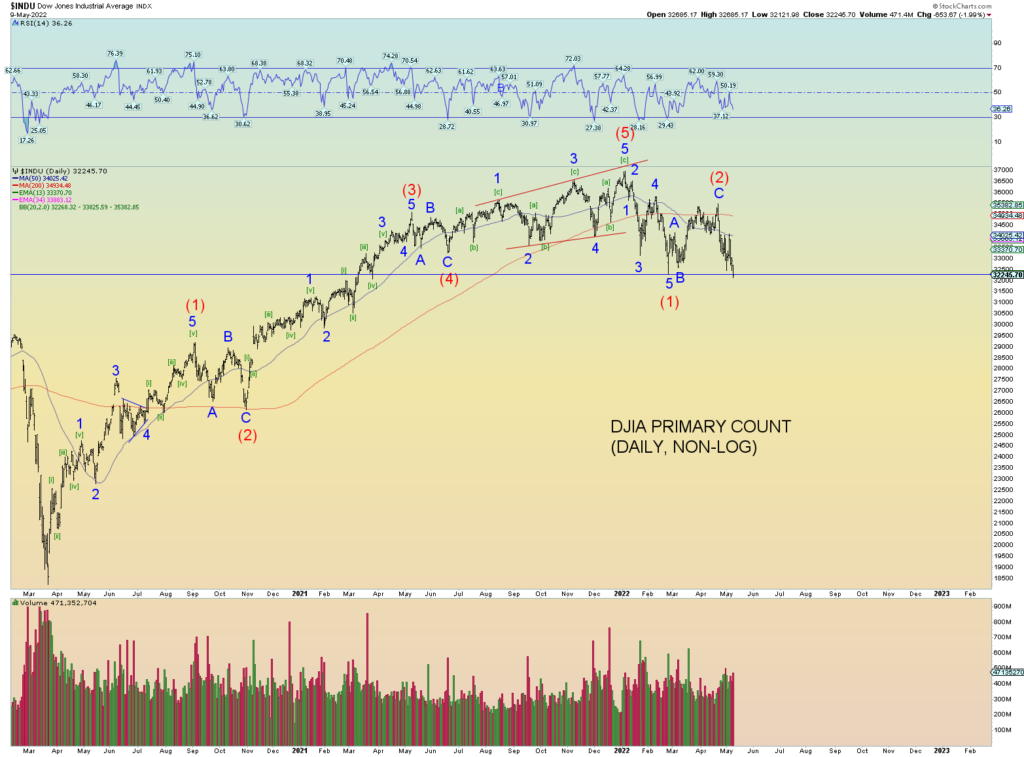

The DJIA broke lower finally confirming with the rest of the major indices.

From a wave standpoint, we are looking to confirm wave [i] of 3 of (3) lower. At some point wave [ii] will commence (which may be possibly sharply upward) and then the heart of a major crash wave [iii] of 3 of (3) down. That’s the primary count.

UPDATE:

Speaking of China, their stock market is in a precarious situation. A 17-year uptrend and you can believe if it is broken decisively to the downside, social mood will turn REAL ugly against the world.

US market, 5000 equities, on the verge of a bear market 20% down,

The NY Stock Exchange internal data is the worst selling since the November Wilshire 5000 high. This is a good clue that wave 3 of (3) down has kicked off in earnest.

Decliners vs advancers ended the day at 90.9% to the downside. Downside volume ended the day at 87.1%. Almost across-the-board 90% down day.

Primary count allows for a small pop tomorrow in (ii) and then prices should be taken lower than Minor wave 1. As Intermediate wave (3) unfolds, selling pressure and market internals should get very ugly indeed.

The downside leader – the NASDAQ Composite – advanced prices lower thereby maintaining its downside leadership position.

Another downside leader – junk debt – also broke lower in prices.

On the daily, we are not even near an oversold condition on the RSI. Technically the market is primed for a collapse.

The market’s “general” – the DJIA – has yet to submit to lower prices under (1). But the wave count suggests it will sooner or later.

The price move to yesterday’s peak has proven to be a three wave [a]-[b]-[c] structure and may consist all of Minor wave 2. If so, that portends a very quick and shallow Minor 2 peak and is a very bearish development.

Today’s market internals are increasing as downside pressure continues. This increasing pressure, if it peaks higher than what has come before in wave 1 of (3) down (as shown on the bottom red histographs using NYSE data), probably indicates that Minor 3 of (3) is just getting started in unfurling.

COMMENTARY

Clearly, the West’s push for more war continues. Pelosi appearing in Kiev is only meant to further provoke Russia. She received a “medal” from Zelensky. It is in reality a Baphomet medallion. A formal New World Order signal that the US Congress is “all in” for the worldwide evil plan being led by Satan himself behind the scenes.

Note the “Ukrainian Presidential Seal” on the medal above within a 6 pointed “Star of David” (Star of Remphan). The Baphomet symbol of the New World Order directly behind Zelensky:

Jesus Christ himself told us what to expect at the end of the world in The Book of Matthew chapter 24:

3 And as he sat upon the mount of Olives, the disciples came unto him privately, saying, Tell us, when shall these things be? and what shall be the sign of thy coming, and of the end of the world?

4 And Jesus answered and said unto them, Take heed that no man deceive you.

5 For many shall come in my name, saying, I am Christ; and shall deceive many.

6 And ye shall hear of wars and rumours of wars: see that ye be not troubled: for all these things must come to pass, but the end is not yet.

7 For nation shall rise against nation, and kingdom against kingdom: and there shall be famines, and pestilences, and earthquakes, in divers places.

8 All these are the beginning of sorrows.

We are well into the “rumours of war stage”. And when the second seal of Revelation is fully opened: Revelation Chapter 6:

3 And when he had opened the second seal, I heard the second beast say, Come and see.

4 And there went out another horse that was red: and power was given to him that sat thereon to take peace from the earth, and that they should kill one another: and there was given unto him a great sword.

“to take peace from the earth,”

I propose the second seal is not yet fully opened. It is in the process of being opened. The predicted “fully opened” is no later than September 2022 this year. We have a full four months of opening global war stages yet to go.

Again, if I am wrong, and the earth does not have an expanding global war this year, then we likely have not started Daniel’s 70th week. But if we do indeed get an expanding global war, then we must continue to watch for further signs.

Again, bible prophecy tells us the Antichrist will topple 3 global powers (likely nuclear armed) that are resisting the New World Order in one way or another. I propose that Russia is nation #1 out of the 3. I also theorize that China may be global nation #2 that must be subdued.

The United States, Revelation’s “Babylon” of the end times, will likely provoke China into attacking Taiwan and garnering worldwide anger against it. The same playbook we used against Russia via Ukraine. The world is already angered against China for Covid-19 (I’m not mad, it is all part of Satan’s end times lies anyways). And recall Nancy Pelosi had recently postponed a trip to Taiwan supposedly because of “Covid-19”.

China has experienced a sharp social mood drop. Their stock market reflects this. However, it may be due for an extended relief rally.

Is Zelensky the Antichrist? And if he was, how would someone like him “conquer” – through warfare – 3 global nuclear-powered nations seeing that he is from Ukraine? Well, let’s use our imagination. Let’s suppose Zelensky is the Antichrist and he “defeats” Russia resulting in a regime change to one that is now onboard with eventually joining the “New World Order”. Or let’s suppose Putin is assassinated or forced out due to continued military attrition. (The U.S. is providing unlimited weaponry to Ukraine and undoubtably valuable satellite/signal intelligence that resulted in the sinking of the “Moscow” and other such targets.)

If the United States, then provokes China into war against Taiwan in a few months from now, the world would obviously have a big shit-show on its hands. The remaining global powers perhaps form a “new” global coalition and invite Zelensky to be its leader. At first it will seem to be purely a “propaganda” move for the world. Something as a show of “unity”. Let us even suppose that China starts to get bogged down on Taiwan and Zelensky actually goes to Taiwan to “lead” the global resistance against both Russia and China. By this time perhaps Russia is experiencing internal conflict due to Putin being either killed or deposed. And now that the “Ukrainian” front had stabilized (Russia in retreat) he becomes the de facto leader of the New World Order against Russia and China (and then a yet undetermined 3rd nuclear power).

China will have been defeated or forced into a “regime change”. I would further theorize that full blown internal civil war within mainland China is probably the goal of destabilization. Do you see how these kinds of scenarios can develop to elevate the Antichrist into a global position of power?

Am I saying that Zelensky is the Antichrist? The odds at this stage sit at about 35%. If he is the Antichrist, then he really is calling the global shots at this stage for the West. It certainly seems to be the case so far. If he is not the real Antichrist than he is a perfect “prototype”. An outsider NOT from the 10 global nuclear powers who manages to defeat world powers anyways. Of course, Ukraine hasn’t won anything just yet. We are merely speculating. I am sure the globalists don’t mind. Free speech while we still have it.

But, if this is the end of the world according to Revelation, it can be deduced that Ukraine will likely prevail against Russia one way or another.

But let us just leave the speculation there for now. There is so much more that would have to occur I’d rather not get ahead of things at the moment. These are the types of things for now we must watch for.

Ask yourself the following questions from a biblical perspective:

There is no need at the moment to ponder more scenarios than the above. And we’ll leave it at that. And yes, Zelensky is a reprobate war monger being used by the West to trigger Russian regime change. I despise him, and I am sure so does Jesus Christ.

OLD WHITE SHRIVELED SATAN WORSHIPPERS RUNNING OUT OF TIME

The West never liked Putin. He replaced the West’s favorite: Boris the drunkard Yeltsin and set back global plans for the New World Order by at least 20 years in their estimations. Hillary and Bill and Fauci and Klaus and Biden and Kerry and Gates and Buffett and Pelosi – and we could go on and on and yes Obama AND Trump – are getting old. All the Satan worshipping reprobates of the world who once wanted to start this Global NWO revolution back under Papa Bush simply don’t care anymore. They are desperate and all the Bohemian grove type Satanic sacrificial rituals have demented their minds. Satan promised them the world. They are old and evil and that makes them dangerous. They simply don’t care about keeping up appearances any longer. They are “getting on” with getting on the NWO.

They no longer care if you believe the lies or not. The bigger the lies the better. From the election in 2020, to Covid-19 and its murderous “vaccines”, to the blatant “geoengineer” spraying of the skies, to this sham war they started in Ukraine and the sham wars to come.

So, I laugh at those who fret over the things in this world. It is no longer worth saving (only individual souls are worth saving) and besides we never had the power to “save” the earth anyway. God is going to burn it all down anyway.

Pull your kids out of public schools. Don’t participate in the evil all around us. Be a good Christian and live the best you can. Separate yourself and be a role model for the world, a role model for Jesus. A light, a beacon to give glory to God. Look to things not of this world but the next. And most importantly spread the gospel of Jesus Christ because the hour is getting late, and we need to save as many as possible. Work toward heavenly rewards for surely all the earthly rewards mean nothing when it comes to eternity.

Everything is a distraction meant for the masses. Think Elon Musk is some kind of “hero” for buying Twitter? I laugh, this is the one guy who wants to hook you up to a machine and make you a robot. He is a NWO member through and through. It is all a controlled distraction for the masses. To give you hope. To keep you distracted and from finding the source of the real power that the Satanists fear: Jesus Christ. Oh, you can bet they hate him with a passion. How hard it must be for Bush Jr. to pretend he was a Christian all this time?

For that is the dividing line from here on out. If you’re a Christian, seek other true bible-believing Christians and disconnect from earthly things as much as possible and have your heart set on the next world to come led by the rod of iron, Jesus Christ. I am not suggesting living as a hermit. Do stay engaged and spread the Gospel of Jesus Christ is what matters. The world is succumbing to a great delusion and will further slip into madness (of crowds).

Orwell’s 1984 didn’t “predict” anything. It was a literal handbook for the NWO. He was certainly not a Christian and is burning in Hell as I type. 1984 was the year it was supposed to be implemented. The white, old, shriveled Satanists are almost 40 years overdue, and they are pissed off coming after humanity under the authority of Satan.

Revelation chapter 12:

12 Therefore rejoice, ye heavens, and ye that dwell in them. Woe to the inhabiters of the earth and of the sea! for the devil is come down unto you, having great wrath, because he knoweth that he hath but a short time.

THE COUNTS

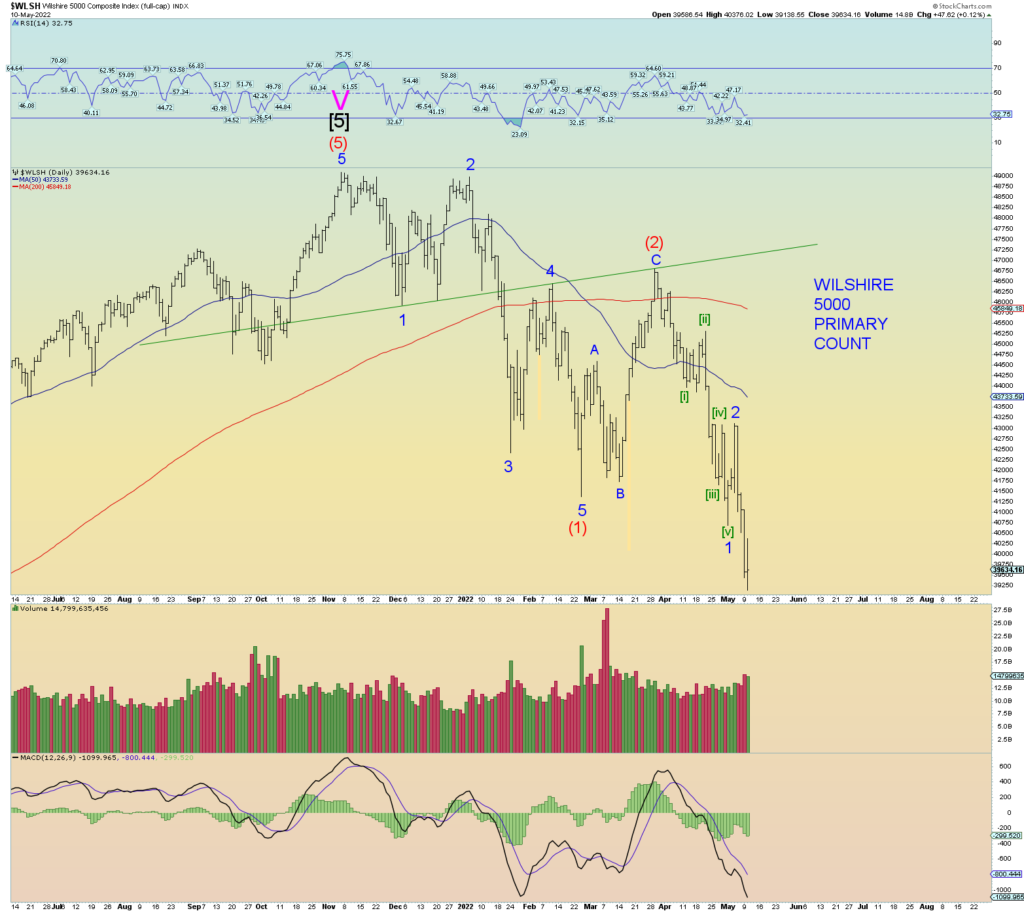

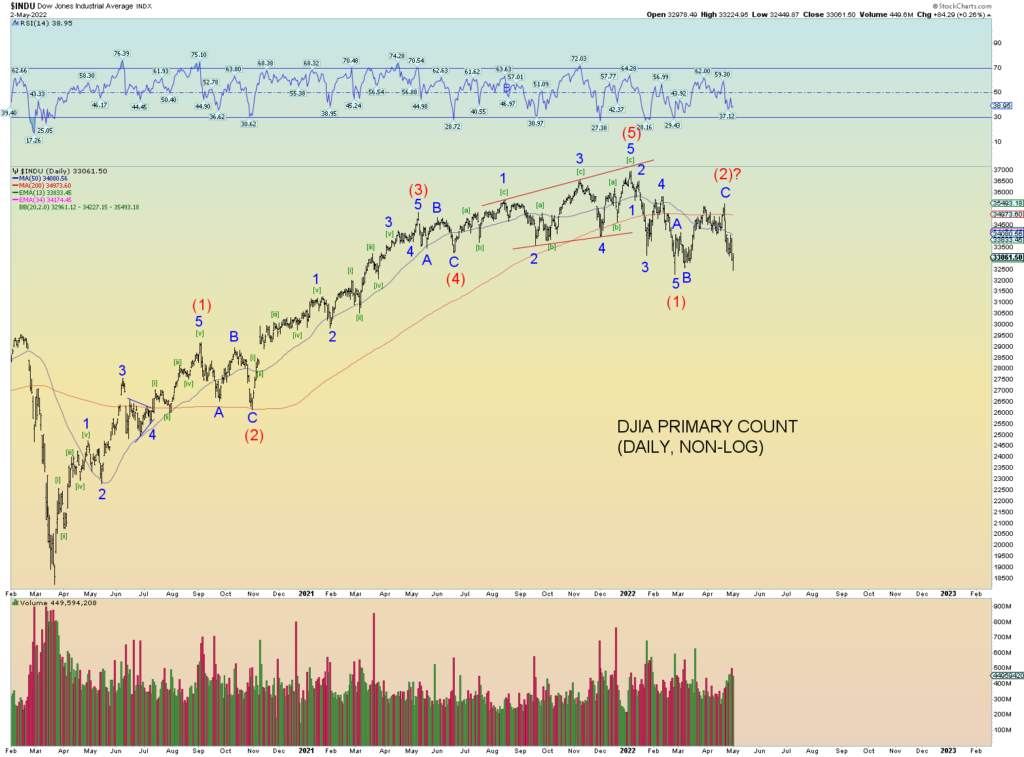

I’ll just be a contrarian here and suppose Minor 1 of (3) down ended at today’s low and perhaps we get a final shakeout of the bears in a wave 2 up. It does have that “bullish falling wedge” look.

The reason is we have a good 5 wave structure to today’s low. Therefore, let’s keep it simple for today.

If so, the blue box would be the wave 2 target area. About 50% of the recent decline since late March.

The goal of Minor 1 was to advance prices lower than (1) and it has achieved that so far in every index except the DJIA. Regardless of if this is Minor 2 or not, the real primary count is that wave (3) down will unfold sooner or later.

One reason is that the DJIA is non-confirming in making a lower low vs. the February 24th low. The generals have refused to give up the fight and may make one last charge up the hill.

However, if the DJIA breaks lower in prices under (1), then we have a confirmation of sorts between the DJIA, SPX, Wilshire 5000, Nasdaq, etc.

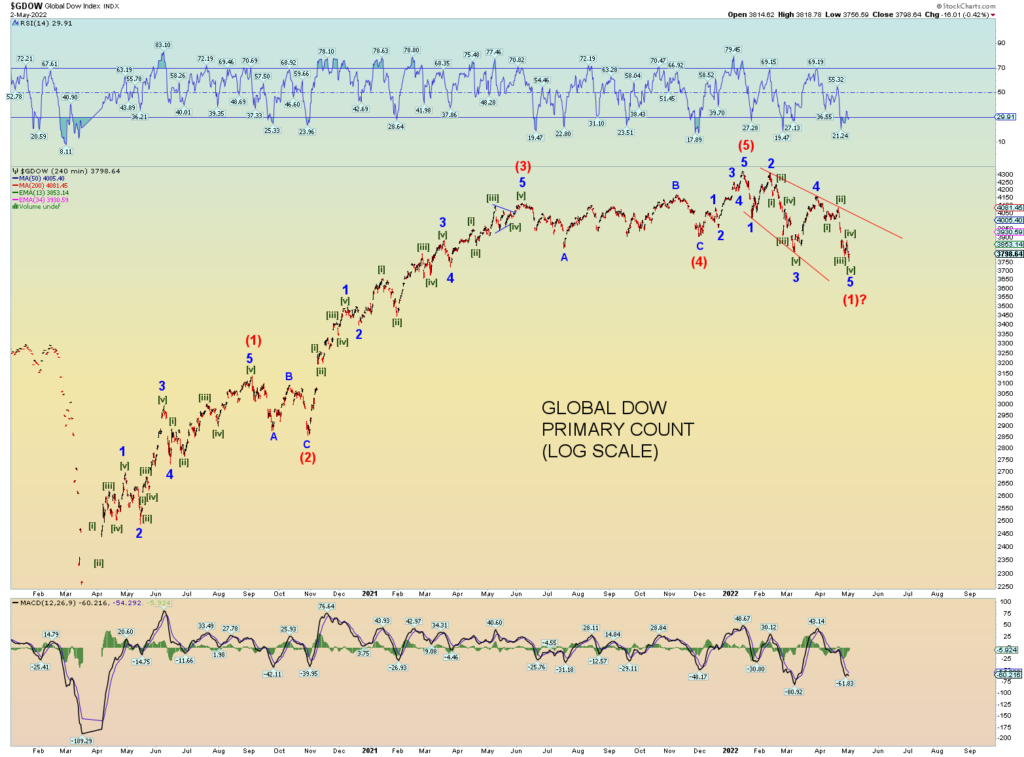

GDOW finally broke lower. Don’t really have a good count for this just yet.

I tend to agree with Karl Denninger here in that we are at war with Russia. It will escalate.

The waves are progressing nicely.

Now that prices have closed to a new market low, the blue downside line makes a nice target for Minor 1 or (3) down some several thousands of points lower.

The alternate count is that we are nearing the end of Minor 1 of (3) down. We’ll know soon enough I imagine of the market’s intentions. We have now a lower low than wave (1) which was a requirement for 1 of (3) down. There is nothing technical-wise or sentiment-wise to suggest that this count is correct. Hence an alternate count.