Working a little bit lower today.

The market is getting quite ahead of the FED. It’s hilarious.

COVID MADNESS COMMENTARY

The vaccine “narrative” is slowly losing momentum worldwide. I had thought over a year ago that the obvious injuries and deaths from it would waken people up very quickly to the worldwide genocide that was occurring, but I was wrong. People were quick to bury their heads in the sand to deny the obvious. It’s like the stolen 2020 election. You’re an idiot if you 1) believe Biden won fair and square 2) the vaccine is “good” for humanity. But whatever. And if you think the Ponzi worldwide financial system will continue forever then you also probably are pro-vax and anti-Christian. An unthinking NPC.

THE COUNTS

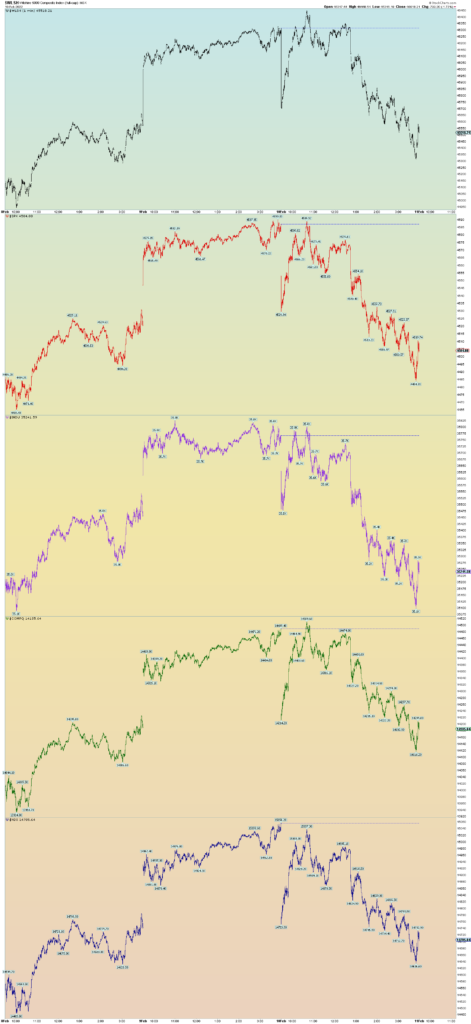

Big gap cover price moves today. First the SPX gap up from yesterday was covered in the down open and then a furious rally and the gap down was covered. And then steady selling which kind of tells the overall bearish outlook story. All the indices were in agreement.

New price low on the 30-year bond confirms the long-term impulse down wave pattern.

JUNK leading the way.

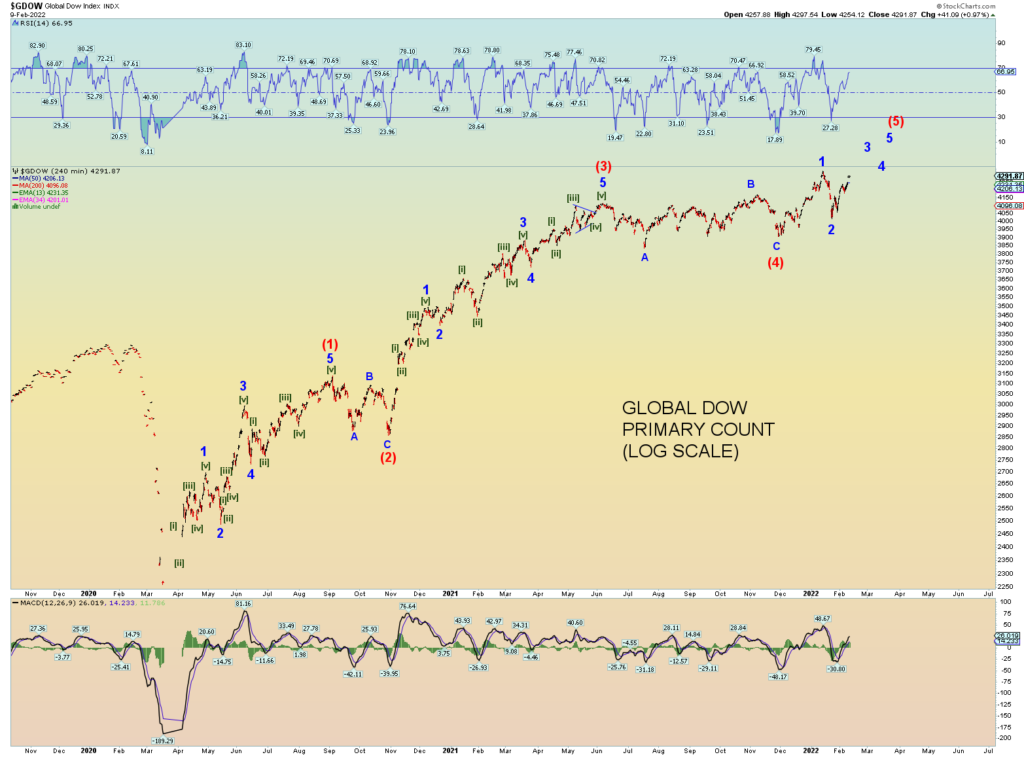

The 233-year Grand Supercycle wave will not rollover easy. But rolling over is still the best count.

The NYSE and Global DOW is well positioned to make a possible new high. The DJIA is not looking too bad either.

The NASDAQ Composite is still about 10% from its peak. The S&P500 would come close to making a new all-time high if we continue to chug upwards.

I would think any new high in the DOW and or NYSE would result in a fractured topping process whereas the Composite and Wilshire 5000 do not make a new high. The S&P 500 would probably make it.

I am projecting ahead obviously since today was internally a strong up day on the NYSE. However, the Wilshire 5000’s pattern says it all. Prices could be merely backtesting the broken neckline as was talked about a few posts ago. So, we shall see.

Last Thursday had what appears is a misprint on the Wilshire 5000. I don’t understand it, it happens every blue moon or so. The spike down I think is false.

Worldwide bond update. 30-year bond at horizontal support. Expect a move back to the long term trendline support.

10 Year price head and shoulder pattern broken. Downside target shown.

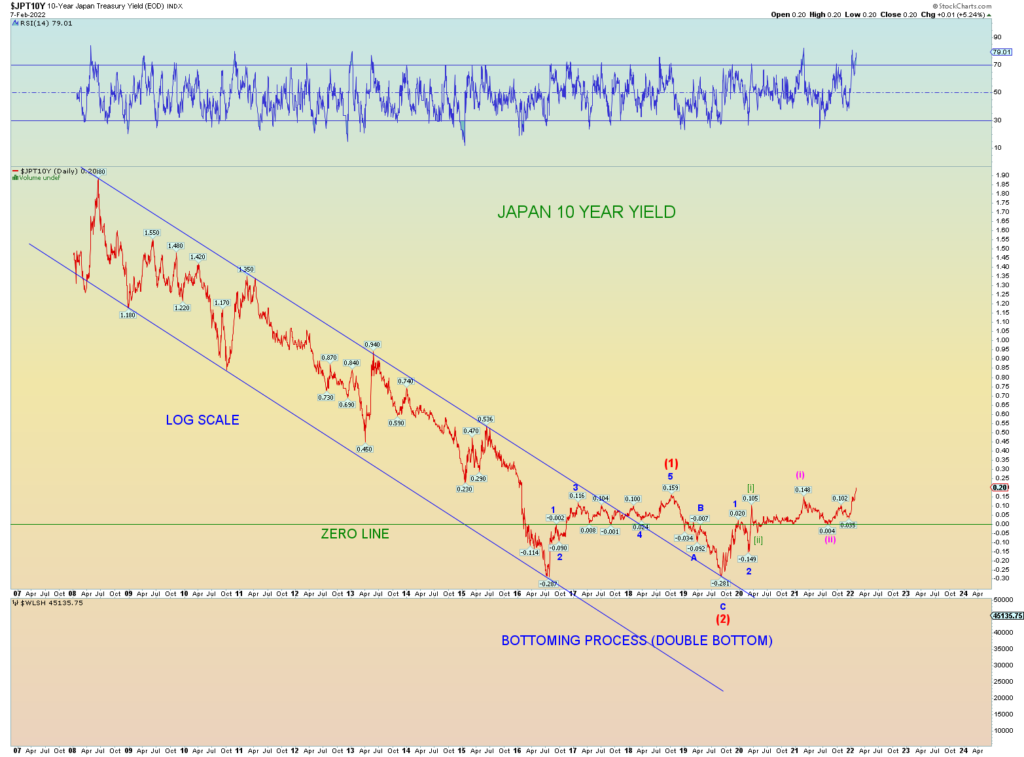

Japan. King of credit debt. Highest 10-year yield since 2015. This is not good. Remember all these channels of yields going lower correlate to massive amounts of debt issued. That is fine if the yields continued lower. But the world hit the bottom and reversed. Never in the history of mankind have we been in this financial time bomb situation before.

It’ll all blow up soon enough.

UK looks nicely impulsive upwards.

Don’t forget the Germans who also let their yields run negative. Duration risk is oh so dangerous here. Selling will beget more selling which will start a nasty feedback loop. The entire world is a debt bomb primed to explode. This will not be good for stocks.

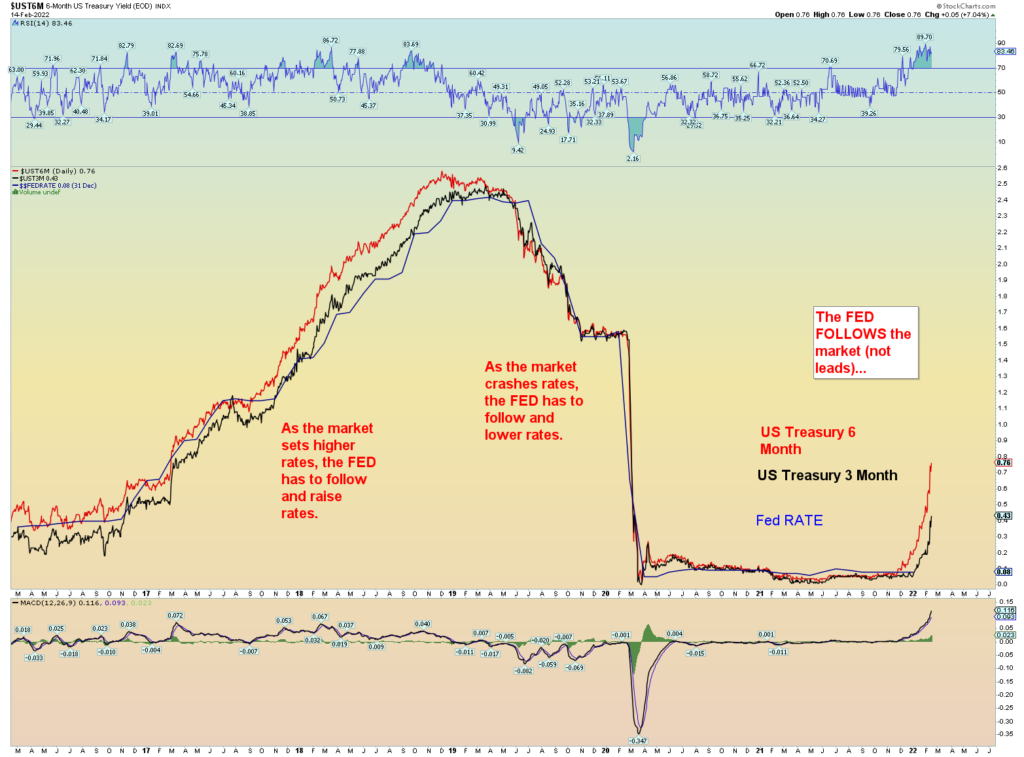

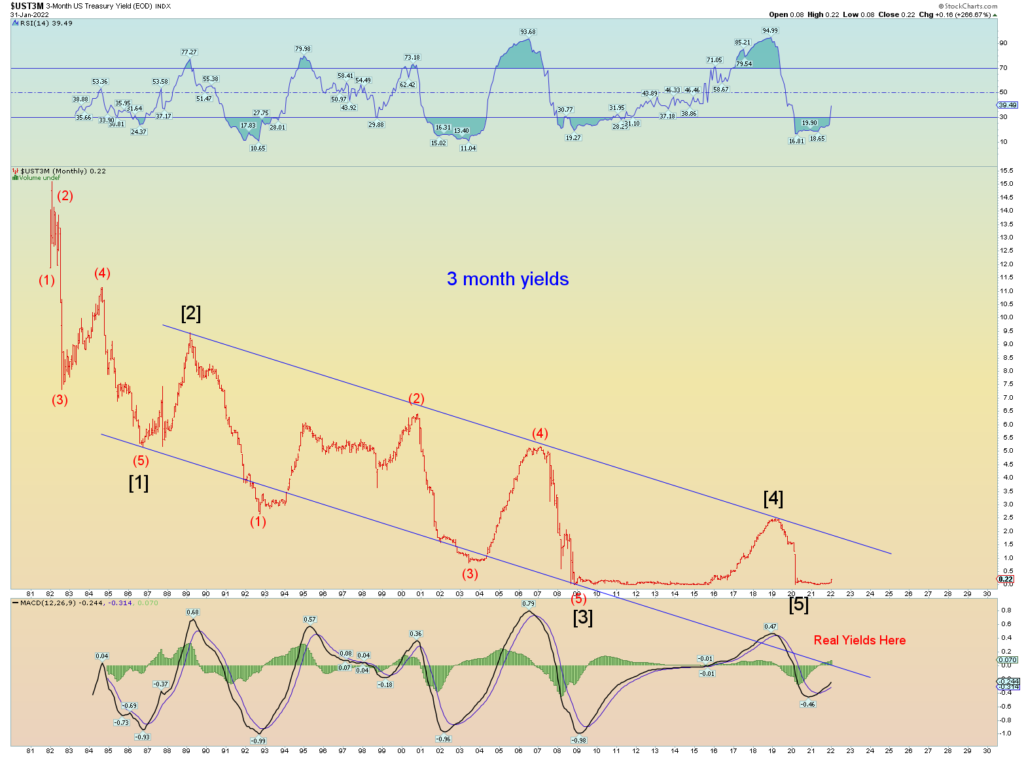

Rate raises are coming. The 3/6-month yield chart is running ahead of the FED and the FED has no choice but to play catch up. LOL, if the 3-month yield bursts toward .40 – .50 range and the 6 month considerably higher, the FED might actually raise it more than a quarter point…. wouldn’t that be a kick to the face for the stock market?

Look at that RSI momentum.

The Wilshire 5000’s primary bearish count has now whittled down to Minor 1 -2, Minute [i] – [ii] wave structure.

From a head and shoulders topping chart pattern – which broke the neckline and met its lower target as shown in previous week’s posts – we now have prices attempting a backtest of the broken neckline.

The short-term neckline pattern happens to align with the long-term upper channel line as shown on the weekly.

Therefore, the neckline “backtest” is not only of the head and shoulders topping chart pattern, but one could say the entire bull market upper channel line.

Zooming in on the weekly, prices are more or less at that upper channel. The upper channel line had provided support for the overextended wave (5) for well over a year. Prices fell violently through, and they need to regain this key trendline in order for the bull market to continue. It’s that simple.

If the neckline/channel line is rejected – which the primary count is that prices will be rejected – then an even more violent bear wave down in Minute [iii] of Minor 3 should occur. Basically, it would be a loss of support in search of the next support. And that is the key question. Where is next support other than the recent pivot price low of Minute [i] of 3 down (which should not prove to be very solid)?

15-minute squiggle count.

CONCLUSION

The chart wave patterns are simple. Prices need to regain the broken head and shoulders neckline – which is also the long-term upper bull channel line – in order for the bull market to continue. The primary count is that prices will not regain this key support line (now acting as key resistance). And thus, the next wave down – Minute [iii] of Minor 3 of Intermediate (1) – will commence. Within the next wave, downside internal market metrics should surpass “90% down days”. This would be the first key internal market metric that would help confirm the count.

The next few days/week should be very interesting.

The options are narrowing down about two main bearish counts on the Wilshire 5000, both are similar. The 3rd option is a new all-time high eventually takes place. But we have only just retraced a bit over 50% so far.

Backtest of the base channel.

Or we have a 1 – 2, [i] – [ii] situation. In this count, [ii] should ideally overlap in price within the prior wave 1’s price range.

If a 1 – 2, [i] – [ii] count, then a backtest of the long-term upper channel line will be a target.

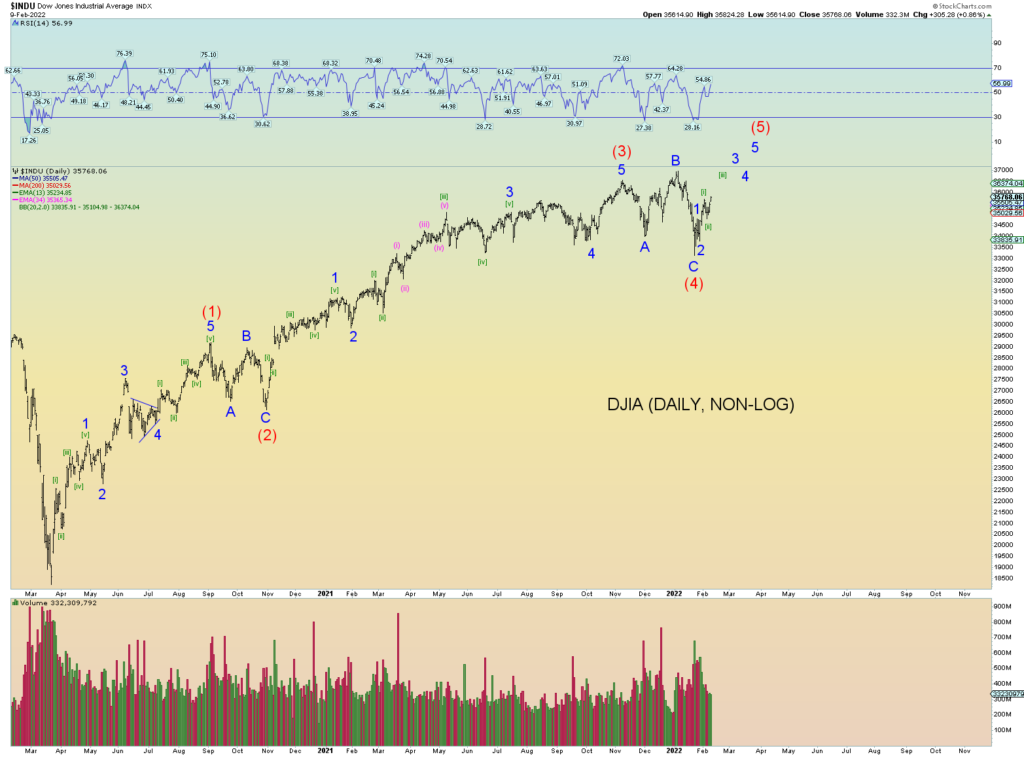

The bullish option count I mentioned is best shown using the DJIA as it has retraced almost a Fibonacci 61.8% from its peak. Again, I keep mentioning June 2022 is about when the world starts falling apart so maybe the market holds up a few more months as a result. We’ll see. But so far, we have not had a solid five wave down move and certainly internal market measures have not been extreme to the downside. We haven’t had a 90% downside volume day for instance. However, it’s not required.

There are many possibilities with the overall wave structure. But the key point is that there is not yet a conclusive overall 5 wave pattern down on any index yet.

The next few charts show the thinking of potential counts. The first chart is the simplest using the Wilshire 5000. We had a wave 1 – 2 forming a “base channel”, then perhaps wave 3 forming an acceleration channel down, and now wave 4 in the process of a “backtest” of the base channel. Then another lower low would follow forming wave 5 of (1) down.

There are of course variations on the above. The next chart includes the alt [i] low and now the market is bouncing in alt [ii]. This is a much more aggressive count. Wave [ii] could very well overlap with Blur Minor 1.

And another view showing a more bearish view of red Intermediate (1) down and some slight internal count variations.

The S&P has its own thing going on as does the NASDAQ and INDU. I show the SPX. I could have given this a few variations, but you get the idea. I realize the wave degrees don’t match well with the Wilshire but ignore that for now the wave structure is what’s important at the moment. We can figure out the wave degrees once a solid structure has formed.

The bottom line is the market at some point requires a lower low to form a bear wave down.

And the FED does not set the (market) interest rates, rather they follow the market. It’s pretty simple: when the 3-month Treasury and 6-month Treasury move (mainly the 3 month), the FED HAS to move with it. I don’t know all the intricate reasons why, but from a layman standpoint it makes perfect sense:

The FED cannot let the FED FUNDS rate differ widely from what the short-term lending market sets or you would have all kinds of perverse arbitrage and market distortions. The MASSIVE interest rate credit derivative swaps market wouldn’t work correctly. And for all intents and purposes, the 3-month treasury is probably the best indicator. If the 3-month rate is .25 or .30 or higher, you can bet the FED will follow and raise rates to keep matching it.

At this rate, I expect indeed the FED to raise rates in March unless these moves suddenly reverse sharply to near zero. Keep an eye on this chart and you will know better than all the gurus on what the FED will do next.

Higher interest rates will CRASH the entire PONZI scheme financial system and cause massive deflation. Oh, you’ll still be paying $18 for lb of ribeye steak (the little guy will get screwed) and $5 for a gallon of gas.

Inflation is not just a result of monetary policy. There is also supply and demand. And we all know they BROKE the supply side of things on purpose. So don’t confuse the two aspects of inflation/deflation. I used to blog about a deflationary collapse with inflationary consumer goods at the lower end. Both are possible.

So as the mom-and-pop stores go under some more, certain corporations will be huge losers. Lots of job losses. Governments and municipalities defaulting on debt. You get the picture.

For example, deflation might result in seeing the NFL (and NBA, NHL, MLB etc.) reduced from 30 teams to 24 (or whatever) due to financial losses eventually incurred when global unemployment skyrockets and the fan base dries up as corporations’ default and go bankrupt and people have no income to spend on overpriced sporting events. Yet if you DO go to the game, you’ll still pay $20 for a piss warm beer.

The whole thing is a time bomb and consumers are in credit card debt up to their ears. They will be the first to IMMEDIATELY feel the effect of higher interest rates. Banks will raise credit card rates THE SAME DAY the FED sets a higher FED funds rate.

The elite don’t care now that they own everything. So what if they lose billions? They’ll still claim the deed to your property and own the power of governments to threaten violence upon you to be removed or jailed or killed.

Why will this sucker reverse and head higher? Well, a 40+ year down channel has no more room to down channel any longer. This down channel IS the PONZI system. The PONZI needed lower and lower rates for the debt scheme to keep working. Now that we are out of “fools” to add to the Ponzi scheme, the jig is up. The elites know it. The FED knows it. This “plandemic” was all about control of the people for the coming financial system collapse.

Klaus Schwab really does want you eating bugs, living in a cement one-room apartment with no car, or better yet dead from a “vaccine”.

Massive warfare is coming once the worldwide Ponzi financial system collapses. My best guess for warfare is still a projection of June/July/August 2022….this year when the weather gets warmer. Wars always start in the Spring/summer.

The primary count is that the market is working lower to form an overall initial impulse 5 wave count. The SPX is the best index for illustrative purposes. It has a very different starting peak than the Wilshire 5000.

Overall, for the Wilshire 5000, the bigger picture projected for the next few months is a collapse in prices. The theory is that if Intermediate red wave (5) was indeed an extended, ridiculous wave structure built on leverage and retail buying, the pattern predicts that a swift retrace of prices to beneath where wave (5) started would be the next wave structure (which has begun). This following chart shows that potential.

The green down channel represents the acceleration channel of a wave 3 down move. For now, I painted it wide to give the benefit of the doubt for the market as there may be a more violent bounce than so far has happened. Note how the collapse in March/April 2020 was also very steep and (even more) narrow. It is an example of how fast the market can move to the downside. I am not making any predictions for now other than we have to rely on the wave structures as it goes.

However, as I said, if the market was in an extended (5), expect a swift collapse in prices. It would be an approximate 33% down move from absolute peak for the first Intermediate wave (1) down. Wave (5) up was built exclusively on retail and extreme market leverage so extreme leverage works the same in reverse and usually way more deadly. Again, note the steep, fast 2020 collapse in prices which everyone has forgotten apparently. Therefore wave (1) down will basically be a retrace of wave (5) up and a little more for good measure. That’s the theory anyway.

I would expect JUNK to lose quite a bit also.

COMMENTARY

A reminder of what we are up against. NANO-MAN (deep nasal swab tech, radiation, injection tech, Borg assimilation) (bitchute.com) The vaccines are the primary bioweapon. Very good film recapping a lot of what we have learned over the past year. The thing that really stands out is the graphene hydroxide part. Razor blades in the bloodstream. “Transhumanism” is way overrated. Yet they really are injecting lethal, debilitating, infertility-producing poisons into billions, nonetheless. Killing and maiming is what they are good at.

But it’s not just the vaccines. They spray the skies with poisons. They poison the food supply for example when all cattle are injected with poison “vaccines” and other agents. And the water supplies have toxic chemicals such as fluoride. No wonder the global elites are mad the population of the earth just keeps growing anyway.

Is there one global cabal responsible for all these evils? I think we give too much credit. The world is a mess. Each individual will be judged by God in the end. If you are actively participating in truly evil deeds, you will be judged accordingly. Ultimately only through Jesus can anyone be saved. And he is surely coming back, hopefully within my lifetime.

If we are starting the great 7-year tribulation/wrath of God period, it requires world warfare. It requires a global financial system collapse. So far all is calm although the recent market disturbance may be the beginning of a far greater calamity to come that triggers global warfare. But at the moment, there is little warfare in the world compared to the amount of population on the earth. A collapsing global financial system might do the trick. Is that what they want? Like I said, we give the global cabal that runs the world too much credit.

The global elite are largely paranoid individuals. Sociopaths and psychopaths and none have a relationship with Jesus. In fact, I would speculate almost 100% are reprobates and have thoroughly rejected Jesus and can no longer be saved because God has rejected them as a result of them rejecting God. The sociopath global power banker doesn’t give a crap what the person running the top-secret geoengineering program is spraying into the skies. Klaus Schwab probably hates Hillary Clinton but nonetheless will use her like a cheap whore if it suits his agenda. Pfizer CEO Albert Bourla may only care about money for all I know. Or he could be a secret agent working for Mossad to bring about the Jewish “messiah” (Antichrist) to power so the Jews can rule the world finally. And who knows what sexual perversions Bill Gates has done over the last 20 years, maybe that’s all he wants and is his only motivation. And on and on it goes. Each individual doing his or her own part and they all have one thing in common: They are reprobates and they have rejected God and have signed on to the devil’s work for their own power and glory or for whatever perverted reason.

And reprobates tend to abuse minors or children for their sexual gratification. And reprobates would willingly have sex with an animal if push came to shove. And they have little regard for human life. Many have likely participated in devil cult worship and rituals. These are the people who run the world. The devil has bought and paid for their souls. It’s mostly a perverted sex cult as it always has been throughout the ages. Like I said, we give them too much credit for being “clever” and powerful and full of “plans”. But they have no power in the end even if they don’t realize it yet.

Really the only entity that knows the entire evil plan is the devil himself. (And of course, God). It is the devil trying to bring about a one world government, a one world currency, and a one world religion. These things need to happen and as you can see, a global power banker may have nothing in common with a global power religious cult leader or politician. Sure, their paths cross sooner or later. Each is doing the devil’s agenda. A warmongering 4-star general may go to war advancing the devil’s overall plan, but he is ignorant of what the bankers are doing or the secret societies performing blood rituals. Or they may intersect at many places or only some. It doesn’t matter. They all have their part to play. It is the devil who is orchestrating the overarching end game.

And in the end, the devil will turn on all as he hates humanity down to the last soul. Corruption and then destruction of the human spirit is his goal.

I had a point in this, but I am wandering in thoughts here. The bottom line is if you are saved to Jesus, you are mightier and wiser than all the global power elite combined. Never forget that. Thats why they fear you. That’s why they hate Jesus. Deep down their puny little minds somehow sense that is who will defeat them in the end. They don’t know it yet or can even comprehend it. As they have no spiritual discernment, they could read the Book of Revelation 100 times and not get any of it. They are completely ignorant of their roles in end times events as a result. Hard to believe, but true.

Again, we give them way too much credit.

THE COUNTS

From an SPX standpoint, it would be better if the market made a lower low forming wave [i] down proper.

A couple of count versions using the Wilshire. So far, this makes more sense as a wave (iv) than a wave [ii]. But I included both counts.