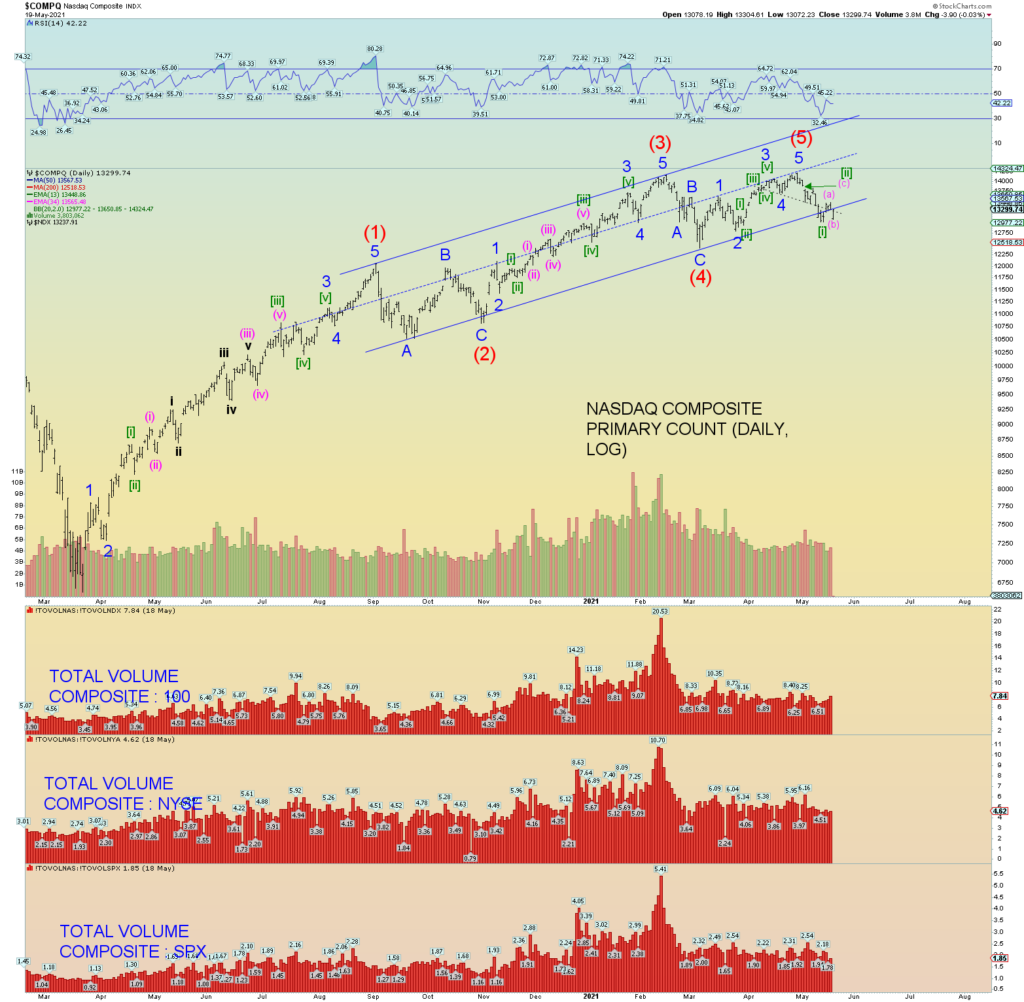

THE COUNTS

The markets had a solidly negative open, yet we have only 3 waves down from the May 14th peak of the Wilshire.

The Wilshire 5000 (and its close cousin SPX), the DJIA, and the NASDAQ Composite are all seemingly aligned. Each count has a Minute [i] low forming last week and the best count for each is that they are tracing a Minute [ii] 3-3-5 (3 waves, 3 waves, 5 waves) flat. This implies that tomorrow will be a big up day, maybe even a gap up opening to form wave (c) of [ii]. Wave (c) should take the form of a 5 wave move.

On the Wilshire, the 3-3-5 flat would be called an upward flat as the (b) wave is slightly elevated above the low instead of being level. Note that the ALT [ii] is still a solid count if the market makes a new lower low first thing tomorrow, then we will have had a small 5 waves down from where alt [ii] is currently marked.

In the DJIA, we would count Minute [ii] as an expanded flat since prices went lower today than the Minute [i] low. Target area is the open chart gap.

And thus the Composite is in the same potential count. Minute [ii] flat or a zigzag.

I’ll probably post some more later.