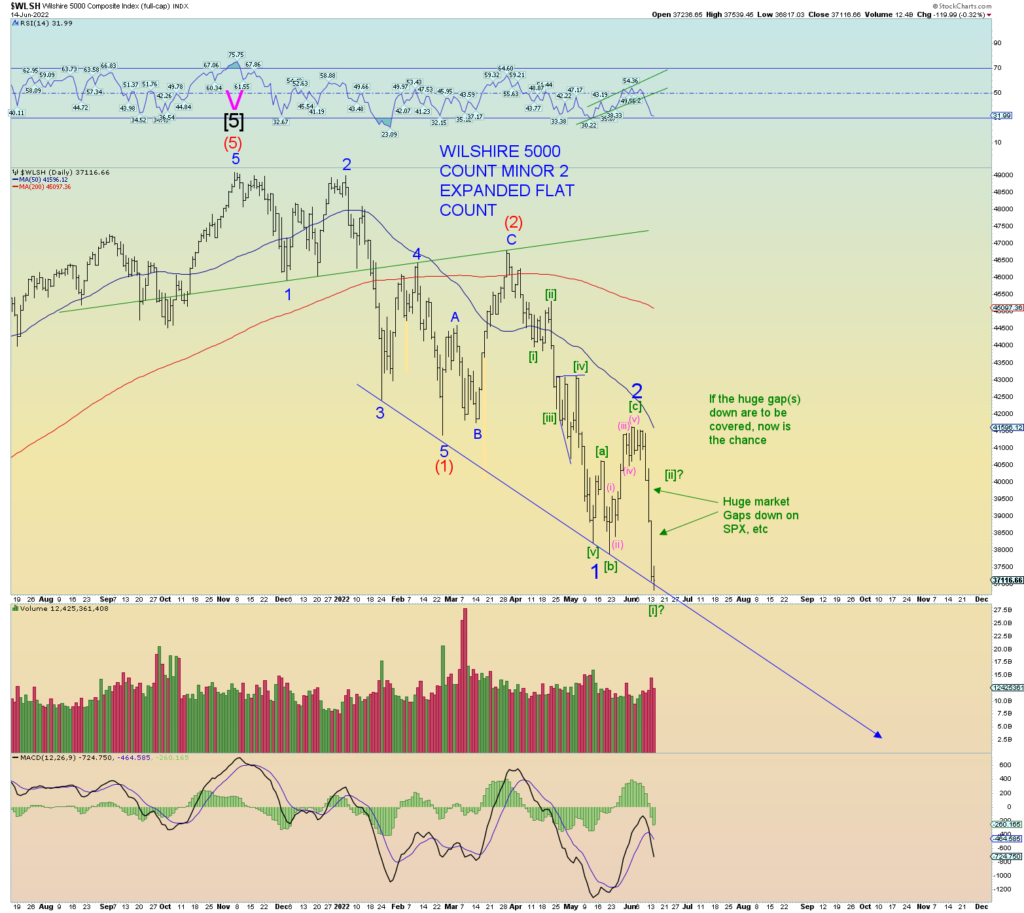

Tomorrow should be a volatile day. Expect a .75 rate hike at the minimum. The wave structure supports the idea of an aggressive rally as outlined yesterday. Today may have been the Minute [i] price low as the wave structure can count as “complete” for Minute [i] down as there exists a very adequate subwave squiggle count as shown. Minute [ii] would be the final hard bounce prior to the real panic plunge – perhaps a Fibonacci .618 of the peak of Minor 2.

The “job” of Minute [i] of Minor 3 of (3) down is/was to advance prices lower than 1 of (3) down. And in that regard, it has met the down sloping trendline. All indices seem to be in agreement on this.

As suggested yesterday, if there was ever a point in the wave structure in which the market “covers” the two huge recent gaps down, now is the time to do it. Simply put, the wave structure supports the notion of a volatile extreme short-covering rally. And the hedge funds are again playing yo-yo with the market always on the wrong side of things.

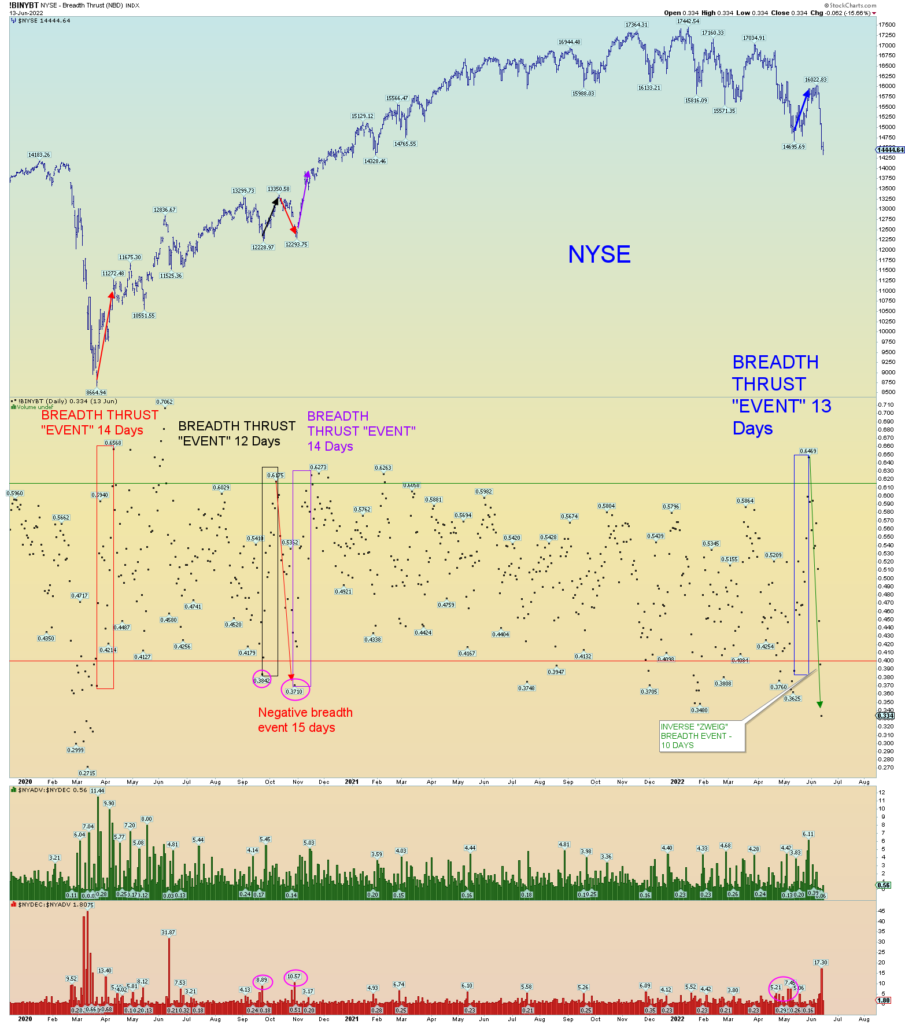

Yesterday’s NYSE breadth thrust data point. Again, this is a historic “inverse” breadth event not seen in 80 years. And yesterday was day 11 and buried the data point deep beneath the .40 line. This is the kind of data that cannot be ignored. It takes an opposite violent reaction to recover from such a negative event.

Not saying that it cannot happen, because, in effect that is exactly what happened Oct – Nov of 2020. However, the wave count does not support the notion that the market is “bottoming” at this time and going to all-time highs. In Oct/Nov 2020, the wave count DID allow and support the notion of a new all-time high since the 2020 plunge proved to be wave (E) of Primary wave [4] a huge expanding triangle.

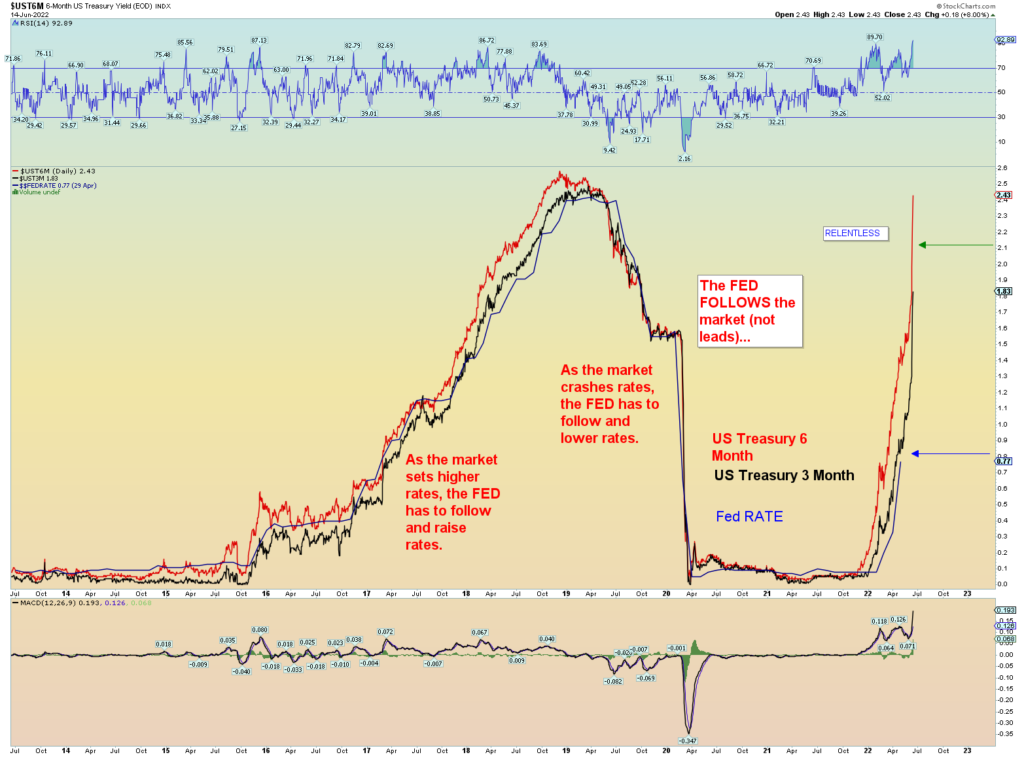

An updated 3- and 6-month yield chart. The Fed fund rate is now a solid 1 point behind the market. There is justification for a 1-point hike tomorrow. Again, based on squiggles, the market supports the notion of an aggressive stock market rally in Minute [ii] of 3 of (3). The last great short-covering rally before the massive worldwide panic.

Otherwise, an outright crash is also not out of the order of things being that if this is the end of the world as we know it, you can forget about “orderly” selling and covering massive gaps down. At some point it will all break and break for good.

We haven’t even begun to discuss the massive dislocations going on in the interest rate swaps “CDS”. And the poor consumer. Tapping their credit cards, spending their savings, and their prime rates are going to go up tomorrow at least another .75 %. The middle class is getting hammered but of course that was the plan all along.

I never say they are “stupid”. Joe Biden is not stupid; he is clearly possessed by a high-level demon(s). They are doing exactly Satan’s bidding.

Imagine if China attacks Taiwan in this current atmosphere? What do you think would happen to worldwide markets?