The dog days of August continue with the market oblivious to anything outside of its own momentum. Which is how waves work to begin with.

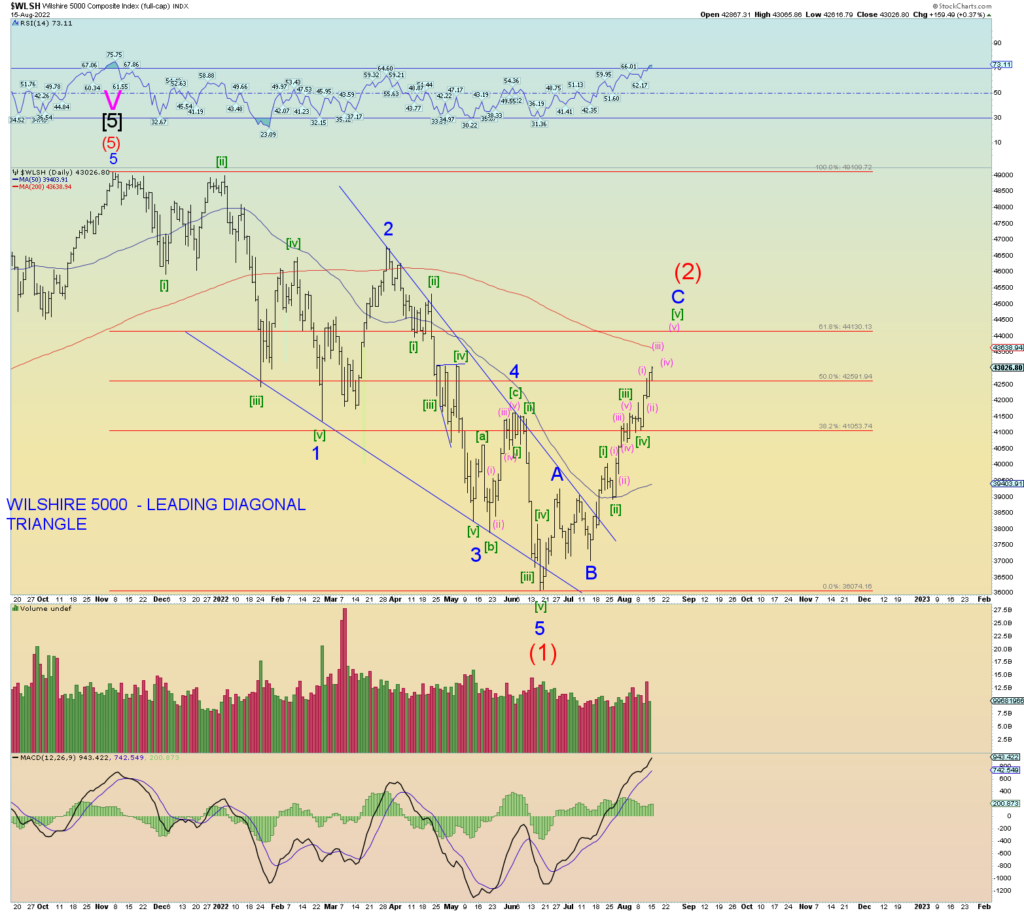

The squiggle count was slightly reconfigured to account better for the latest wave moves. It allows for wave [v] of C of (2) to advance as high as it needs and is not price constrained by making the third wave the “shortest”. This is on a smaller scale the count had at since the 2020 low… which is why the Wilshire is counted the way it is overall since March 2020.

The SPX closed the gap where prices “broke” away 3 times previously in late April/early May. We have a slight negative divergence with the VIX occurring today. Higher prices, but not lower VIX.

Coming up on the 200 DMA.

The weekly is very interesting. Let’s see if these trendlines mean anything.