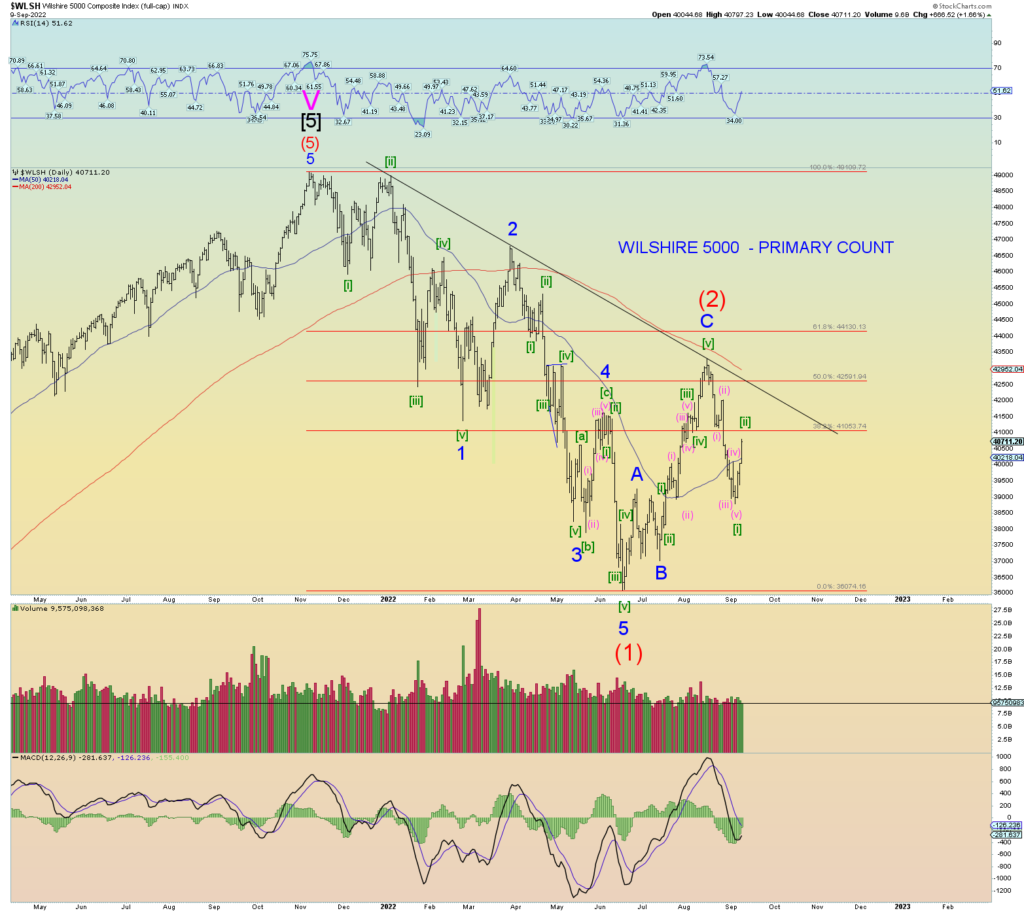

Total daily volume on the Wilshire 5000 was less than the previous 2 days. And the 6th or 7th lowest volume day of 2022. Still a big vacation week of the super-players. Monday, the gloves come off.

So, despite the gap and go open, real conviction in buying stocks is not yet super evident. At some point, a major world event (like a new war) over the weekend and market players will awake Monday to a down-limit situation. I’m not saying that will happen this weekend, but at some point, it seems inevitable.

Wave (c) = (a) of an (a)-(b) -(c) 5-3-5 zigzag corrective wave [ii] almost perfectly. Minute [ii] pink window box shows a wide range of possibilities. The minimum wave structure and price, however, has been met.

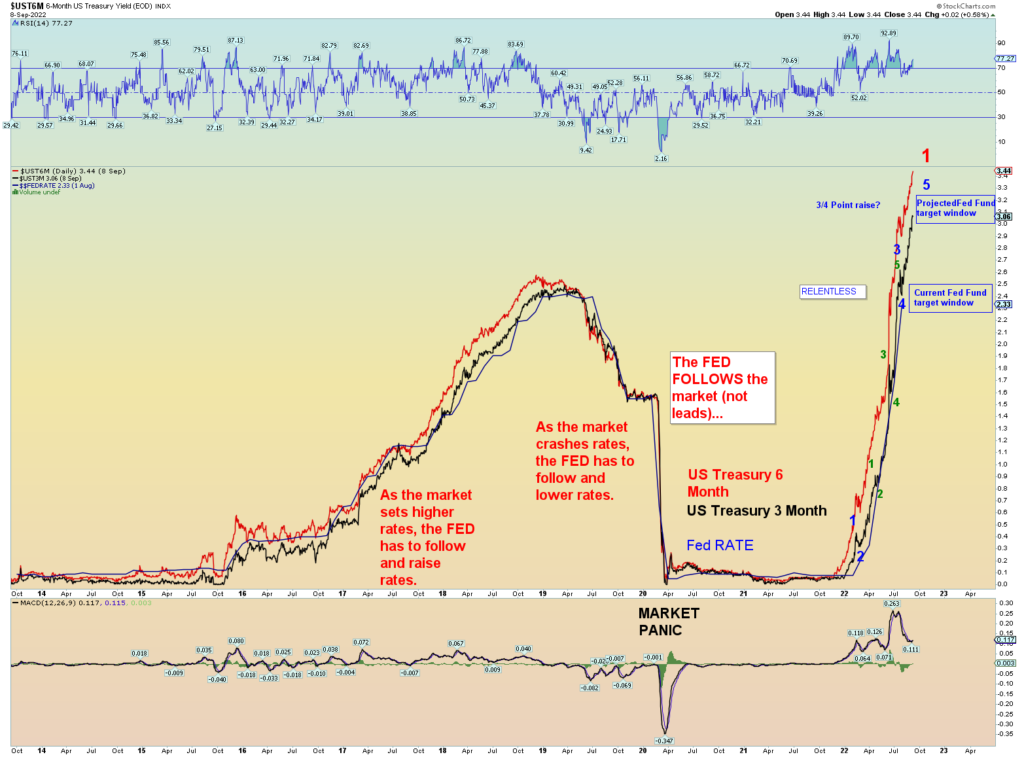

3/4-point hike is definitely on the table as of this moment. It won’t take much more to pop the global Ponzi once and for all.

The lowest volume week since the February 2020 top and I realize it was a holiday shortened 4-day trading week, but there have been other 4-day trading weeks in that time.