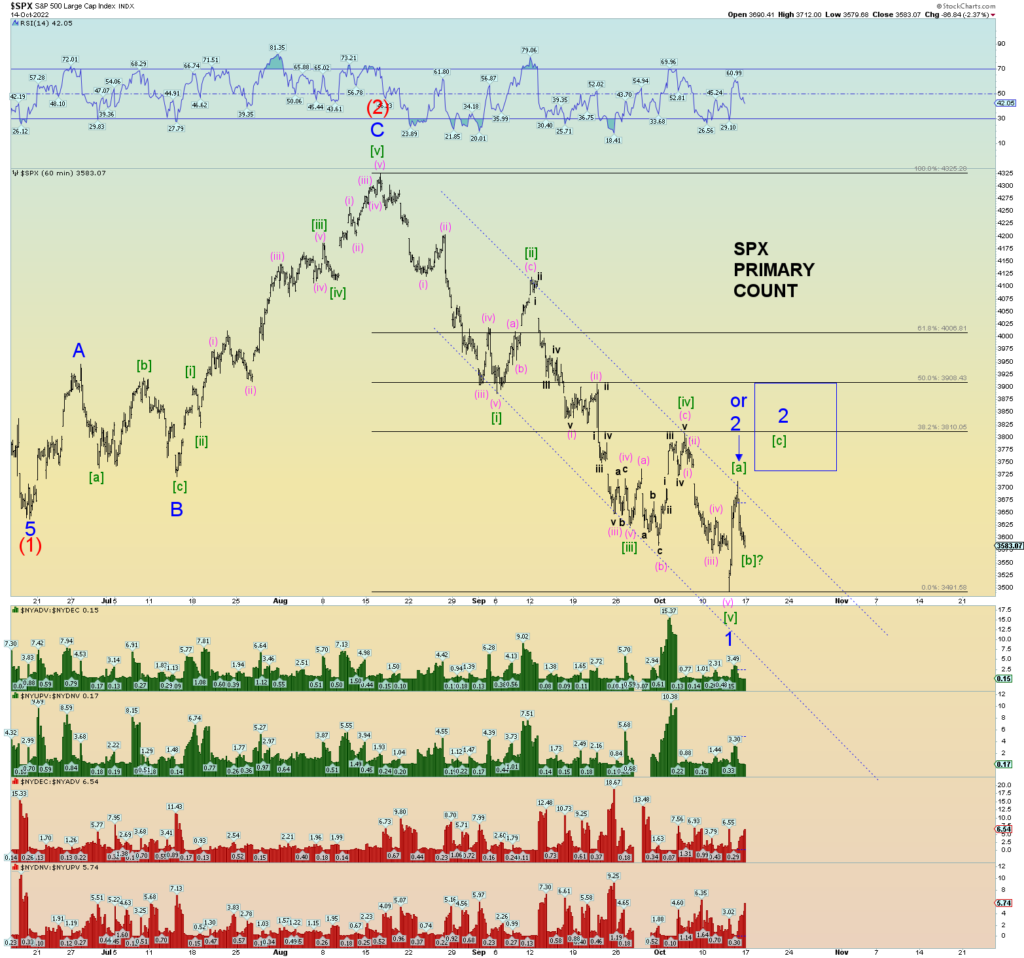

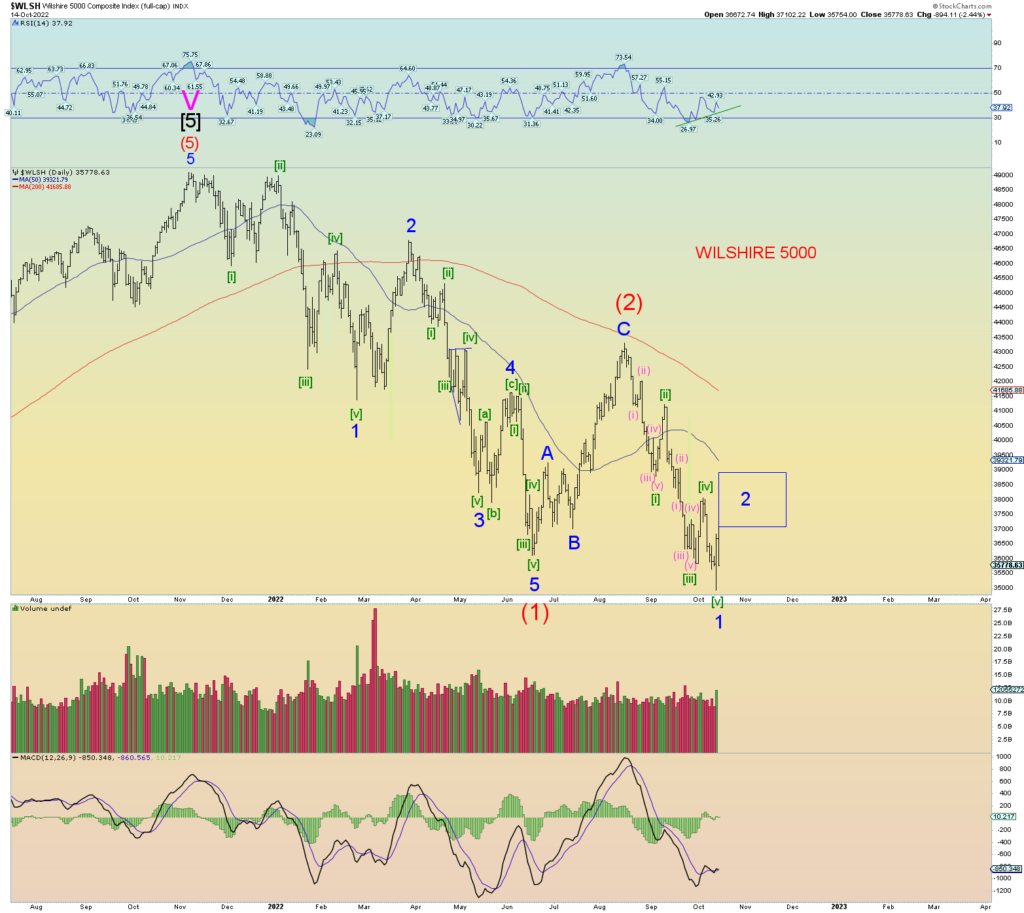

The market is trading very “heavy”. An outright crash is predicted based on the Elliott Wave count. How close or far away from that exact moment is why we count intraday squiggles, but the overall outlook points toward collapse.

We are only trying to guess the timing.

Lowered expectations for Minor 2. If it is Minor 2 that is…

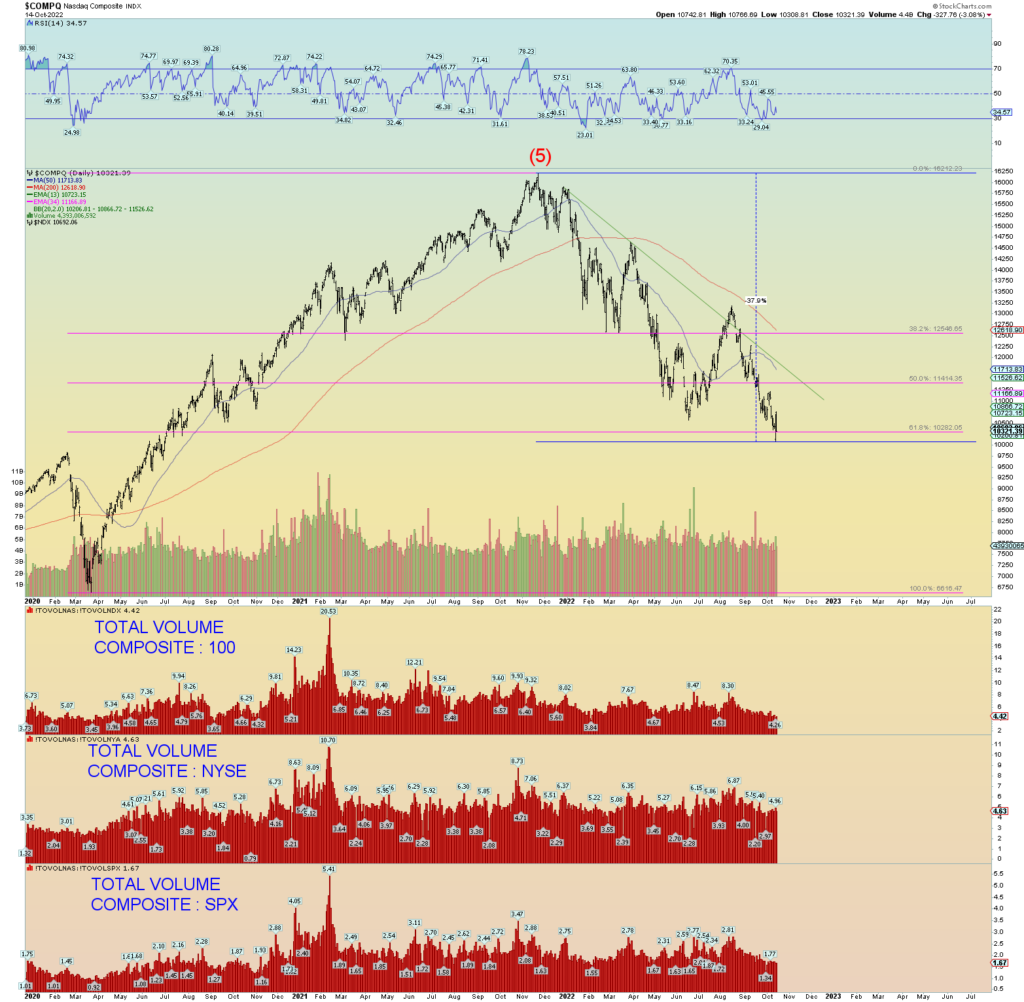

It’s amazing the “psychology” of the bear market so far. No one has yet to say, “the market has crashed”. Yet the Composite already shows a 62% retracement from the peak versus the 2020 low.

And a 38% drop from intraday peak. And yet the pundits would be correct. The market has yet to truly “panic”. Maybe it won’t because that is what everyone is waiting for. Perhaps we just keep grinding lower and lower.

The RSI is not oversold. Is that bullish? Or is that a sign that the market has plenty room to fall. I contend the latter of course. How we get there is a matter of squiggles.