Well, the wave count went about as I expected last night but I did not see it being such one-sided strong market internals. It was a very solid 90%+ up day across the board in the NYSE to include volume and advancers versus decliners. This is a rare event to have a 90%+ up day in both categories.

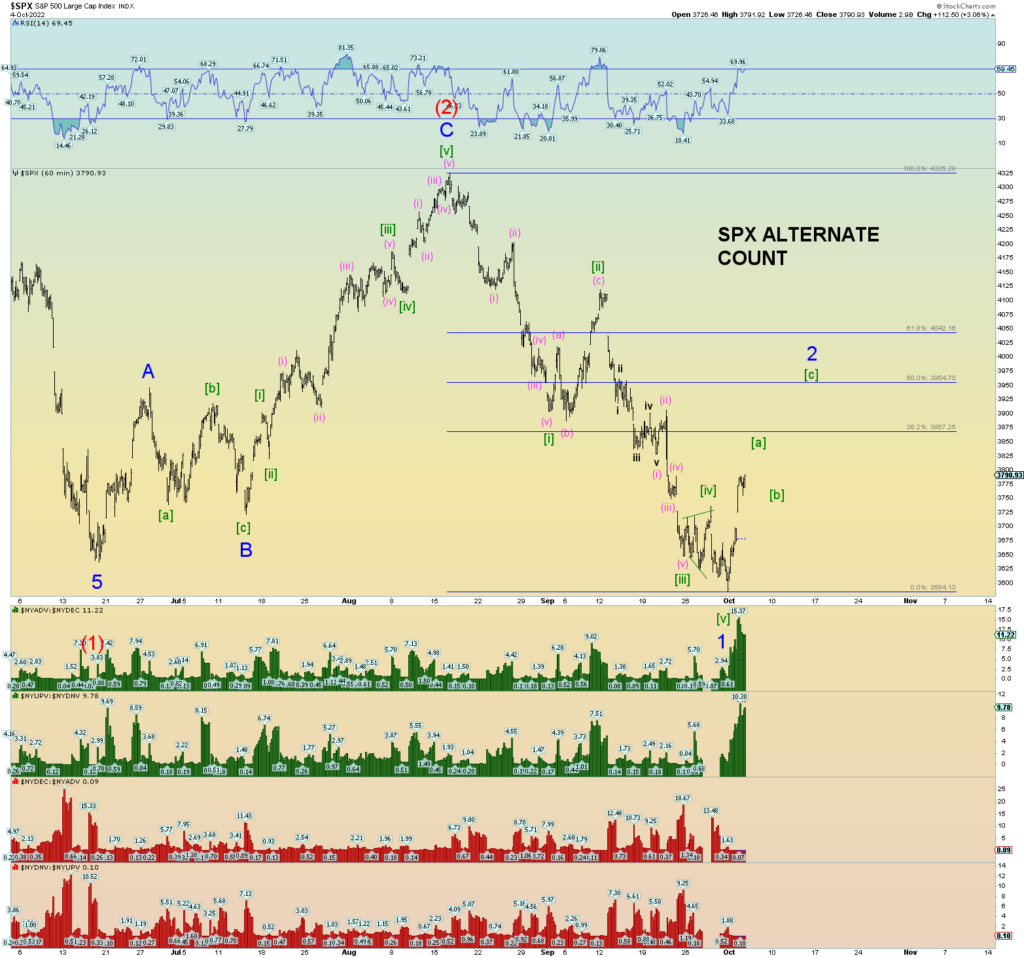

We have 3 counts to consider after today’s market action.

The first is the primary count of wave (c) of Minute [iv] 3-3-5 expanded flat and that a reversal down is coming very soon within a day or so. The key wave marker for this count is the price low of Minute [i]. Prices cannot go above that. If they did, we have an alternate count, see the second chart.

We have nice channeling still and a bit more room for upside to stay inside the down channel.

The top alternate is that Minor 1 actually finished at Friday’s low, the first subwave of Intermediate (3). This retrace ideally should stay below Fib 75% retrace (the upper gap just below [ii]) or else it would start to resemble our 2nd alternate count which is the third chart and I use the daily for that illustration. remember, I have been trying to determine if Minute [iii] or even Minor 1 has made its price low so it looks like a decent count.

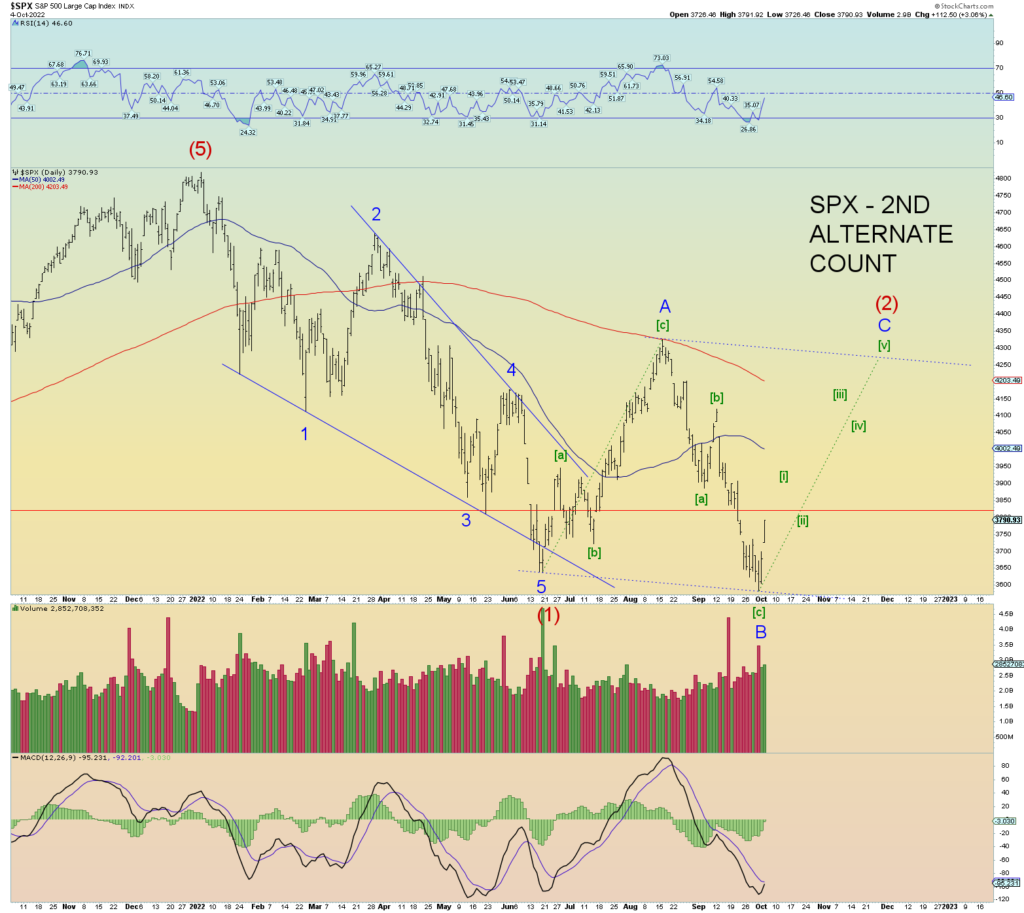

The third count is that Intermediate wave (2) traced three waves to “A”, then three waves down to “B” and this is now the “kickoff” rally to five waves for wave C of a 3-3-5 downward flat Intermediate wave (2) and the rally will likely take many weeks maybe even through Thanksgiving. This would probably be the most painful market pathing for the most players involved, and the strong follow-through today is very bullish.

However, there are many people wanting out of this market and social mood is deteriorating so further price gains through higher resistance levels would be a slog. The red horizontal line is really first resistance and prices are just coming up to it.

Remember, the market “bottomed” below 3600 Friday and the 2-day bounce to 3790 has relatively been “resistance free” so far. Higher price levels above from here things get more serious and that is why this is the 3rd count because we are charting the end times anyways and there exists considerable resistance layers for the market to get back to 4250ish….

But it’s been a very weird market and very turbulent. We could just as well have a 90% down day across the board tomorrow or Friday. Or a tactical nuke could go off…

The only thing that bums me out for the immediate bearish pathing is that headlines like Marketwatch still are very cautious even after the end of today. The contrarian in me says we go higher because I am so used to predicting doom and the opposite happens.

However, we have the end of the world thing going on, so we have that going for us.

Marketwatch is however correct. “This is not healthy” is very true. And those assclowns have to show a needle, yes they suck. yeah, there are a lot of people in pain from the “Covaids” shot.