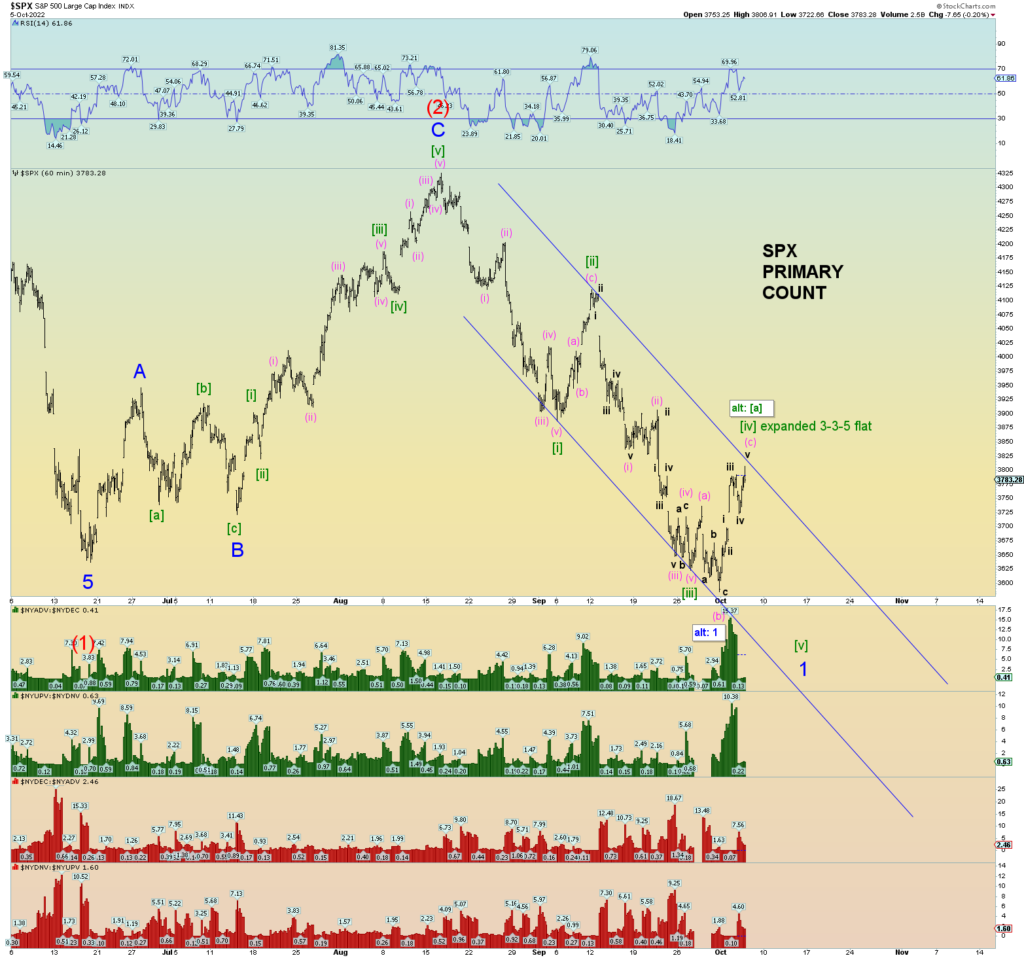

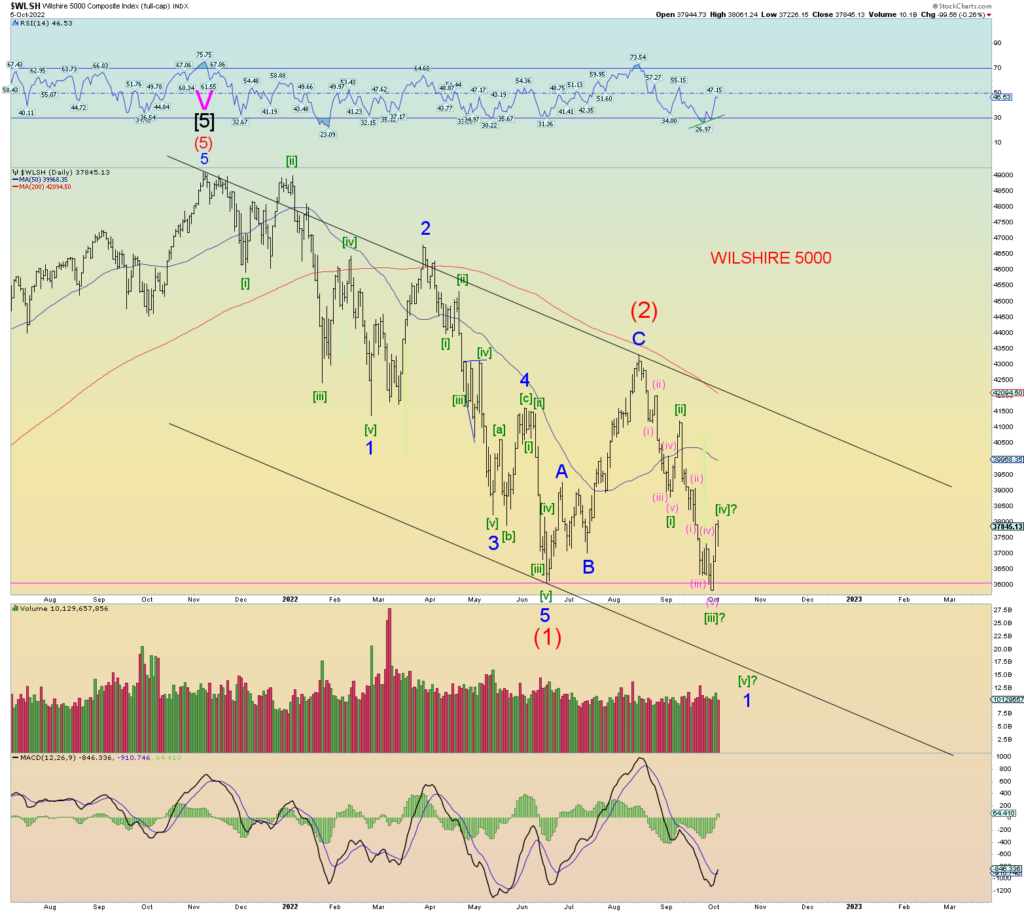

Well, the primary count looks about perfect as long as prices do not go much higher. Otherwise, we’ll have to consider the alternate counts presented in yesterday’s update.

I was sure the day would end positive but the last hour bearish price action that led to all three major indexes closing red for the day was perhaps telling.

Basically, a poke above 3800 resistance and then a slap down. Tomorrow we shall see how convicted people are (or the machines) to buy this market at these levels. My gut tells me if tomorrow is a relatively “flat” open, then selling will commence very hard not creating a mega-gap down.

Actually, in my bearish mind, any market open tomorrow presents a potential bearish outlook. Gap down, gap up, or flat. How’s that for a bearish outlook? LOL, I have the end of the world as we know it on my side.