And if there was any doubt the Jewish fix is in, I’m laughing out loud. At this point you just have to. The NY Times Jewish propaganda fest for the masses has the Jewish King of Crypto still scheduled as a speaker:

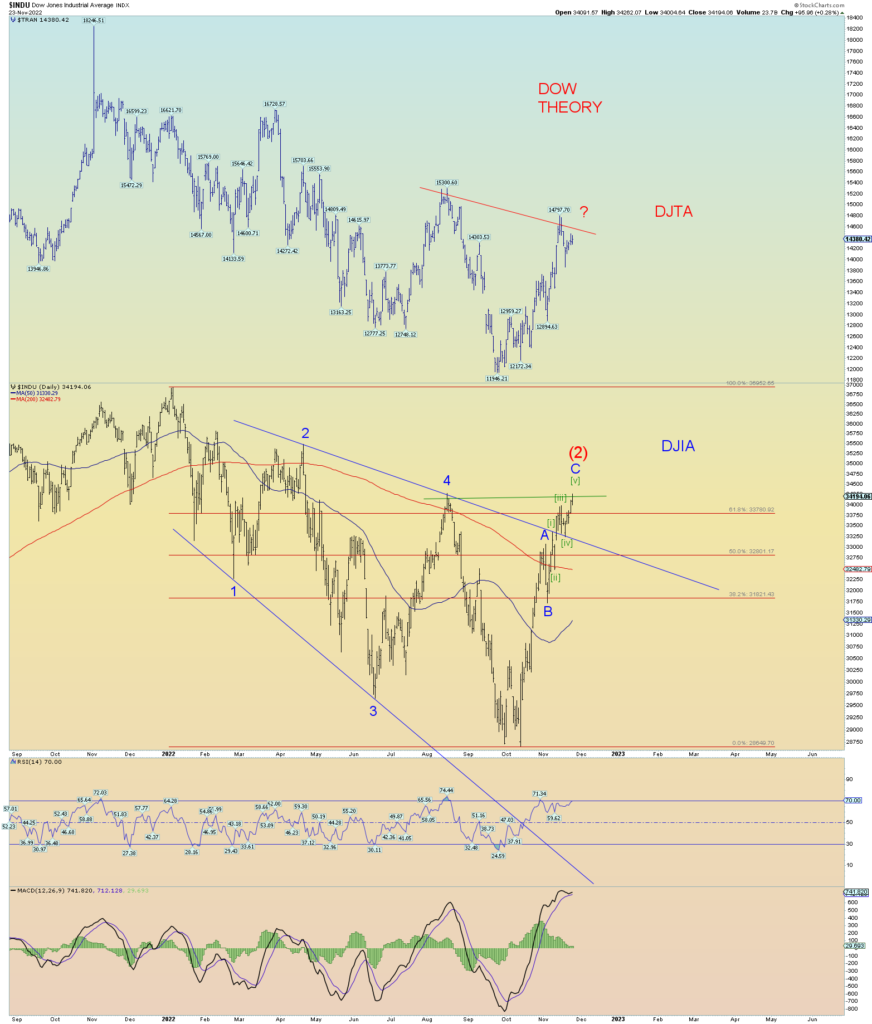

The DJIA closed at its highest since early April and is less than 8% from making a new all-time high. Yet the NASDAQ Composite is still some 30% beneath its all-time peak. The difference is remarkable.

DOW theory is in danger of triggering if the transports cannot follow the Industrials.

Yesterday’s CPCE data. A herky-jerky affair from one extreme to another.

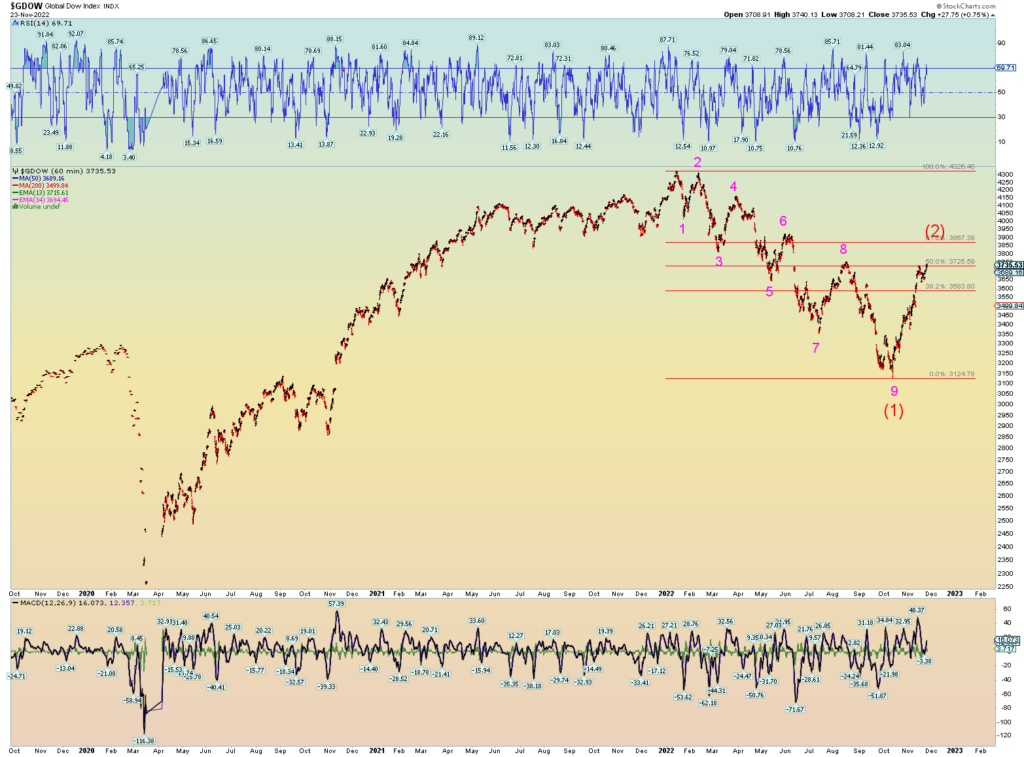

Global Dow:

A comparison of the Wilshire and SPX. New recovery Minor 2 high for the SPX but the Wilshire was unable to achieve the same. Sometimes the minor differences between these close cousin indices are a clue the trend is about to reverse.

And of course, the SPX is knocking on the bottom of the huge open chart gap. Note that wave [c] = [a] @ 4118.

And close to a key downtrend line and its 200 DMA

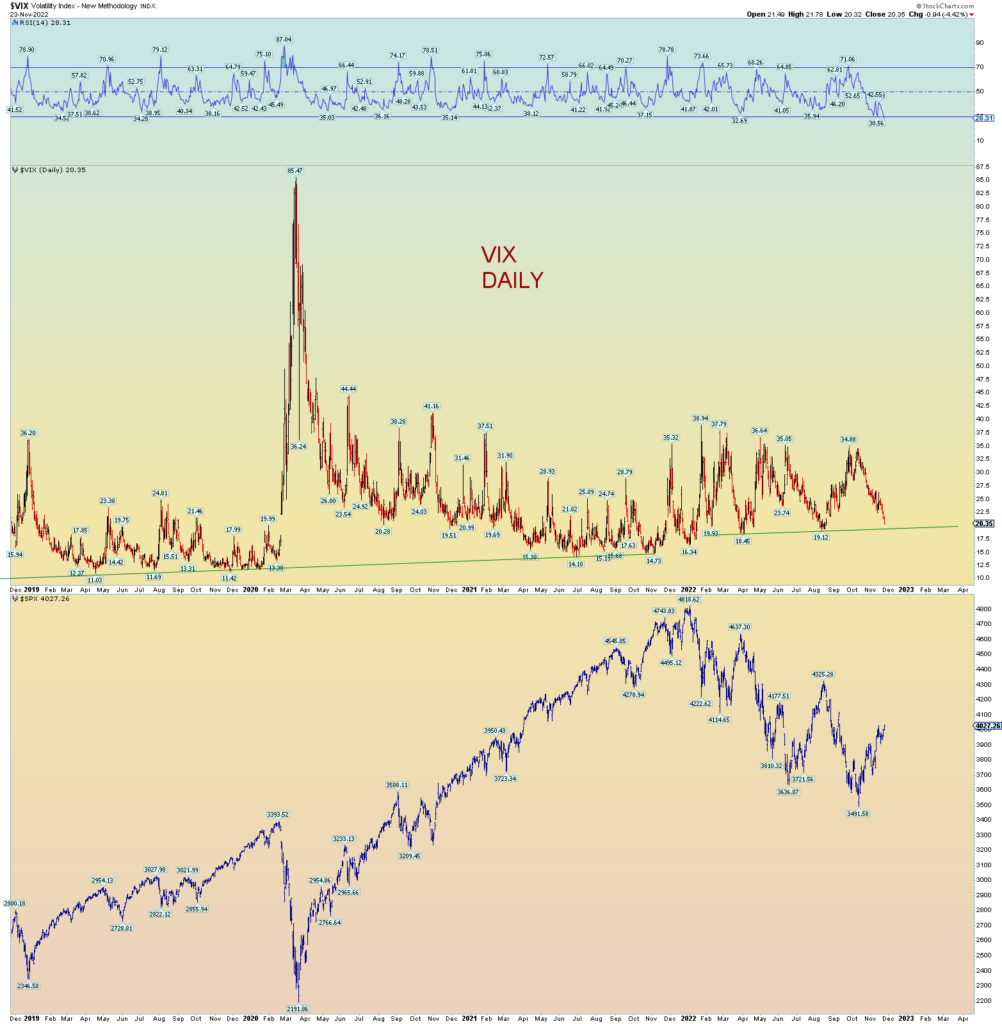

The VIX is reflecting the newborn complacency of the market. This is how the market works off oversold bearish sentiment conditions. Some 500+ points lower than in late March in the SPX, yet the VIX is trading about the same.