At the end of yesterday’s post:

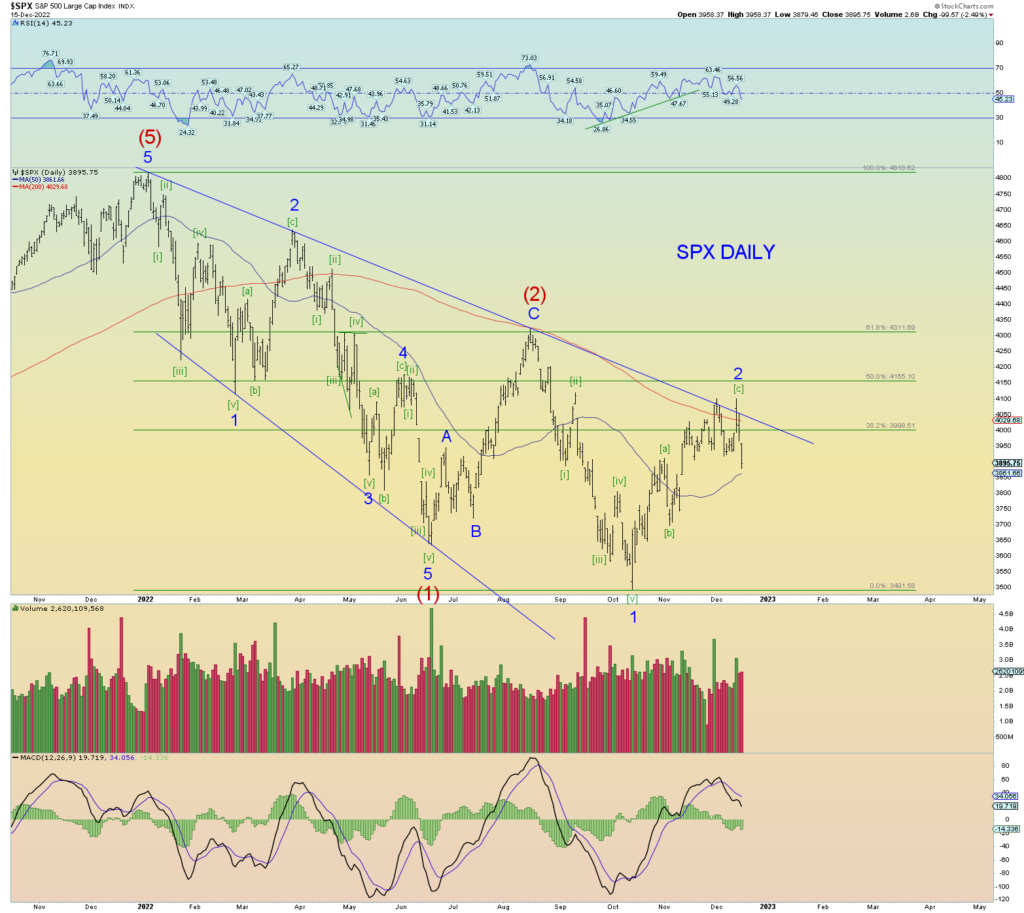

“…not quite ready to throw the towel in on the most bearish count of Minor 2 of (3) high, but prices need to turn down soon for it to be a reality.“

Well, we asked, and the market seems to have obliged. For now, at least. SPX 3900 was closed under which is more bearish than not. This would be considered the “kickoff” to Minor 3 of (3) down.

And finally, if this downdraft today turned out to be yet another whipsaw head fake, the bullish count alt. Whereby we would get a Christmas rally in low volume environment. The open chart gap on the SPX is still intact.